Full Annual Report - Inchcape

Full Annual Report - Inchcape

Full Annual Report - Inchcape

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the accounts continued<br />

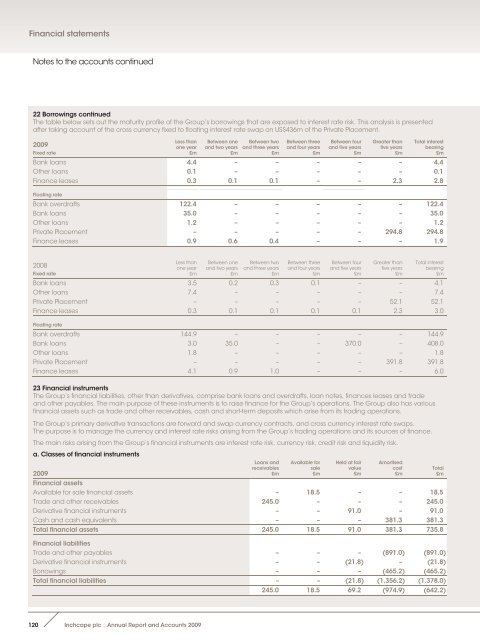

22 Borrowings continued<br />

The table below sets out the maturity profile of the Group’s borrowings that are exposed to interest rate risk. This analysis is presented<br />

after taking account of the cross currency fixed to floating interest rate swap on US$436m of the Private Placement.<br />

2009<br />

Fixed rate<br />

Less than<br />

one year<br />

£m<br />

Between one<br />

and two years<br />

£m<br />

Between two<br />

and three years<br />

£m<br />

Between three<br />

and four years<br />

£m<br />

Between four<br />

and five years<br />

£m<br />

Greater than<br />

five years<br />

£m<br />

Total interest<br />

bearing<br />

£m<br />

Bank loans 4.4 – – – – – 4.4<br />

Other loans 0.1 – – – – – 0.1<br />

Finance leases 0.3 0.1 0.1 – – 2.3 2.8<br />

Floating rate<br />

Bank overdrafts 122.4 – – – – – 122.4<br />

Bank loans 35.0 – – – – – 35.0<br />

Other loans 1.2 – – – – – 1.2<br />

Private Placement – – – – – 294.8 294.8<br />

Finance leases 0.9 0.6 0.4 – – – 1.9<br />

2008<br />

Fixed rate<br />

Less than<br />

one year<br />

£m<br />

Between one<br />

and two years<br />

£m<br />

Between two<br />

and three years<br />

£m<br />

Between three<br />

and four years<br />

£m<br />

Between four<br />

and five years<br />

£m<br />

Greater than<br />

five years<br />

£m<br />

Total interest<br />

bearing<br />

£m<br />

Bank loans 3.5 0.2 0.3 0.1 – – 4.1<br />

Other loans 7.4 – – – – – 7.4<br />

Private Placement – – – – – 52.1 52.1<br />

Finance leases 0.3 0.1 0.1 0.1 0.1 2.3 3.0<br />

Floating rate<br />

Bank overdrafts 144.9 – – – – – 144.9<br />

Bank loans 3.0 35.0 – – 370.0 – 408.0<br />

Other loans 1.8 – – – – – 1.8<br />

Private Placement – – – – – 391.8 391.8<br />

Finance leases 4.1 0.9 1.0 – – – 6.0<br />

23 Financial instruments<br />

The Group’s financial liabilities, other than derivatives, comprise bank loans and overdrafts, loan notes, finances leases and trade<br />

and other payables. The main purpose of these instruments is to raise finance for the Group’s operations. The Group also has various<br />

financial assets such as trade and other receivables, cash and short-term deposits which arise from its trading operations.<br />

The Group’s primary derivative transactions are forward and swap currency contracts, and cross currency interest rate swaps.<br />

The purpose is to manage the currency and interest rate risks arising from the Group’s trading operations and its sources of finance.<br />

The main risks arising from the Group’s financial instruments are interest rate risk, currency risk, credit risk and liquidity risk.<br />

a. Classes of financial instruments<br />

2009<br />

Loans and<br />

receivables<br />

£m<br />

Available for<br />

sale<br />

£m<br />

Held at fair<br />

value<br />

£m<br />

Amortised<br />

cost<br />

£m<br />

Financial assets<br />

Available for sale financial assets – 18.5 – – 18.5<br />

Trade and other receivables 245.0 – – – 245.0<br />

Derivative financial instruments – – 91.0 – 91.0<br />

Cash and cash equivalents – – – 381.3 381.3<br />

Total financial assets 245.0 18.5 91.0 381.3 735.8<br />

Financial liabilities<br />

Trade and other payables – – – (891.0) (891.0)<br />

Derivative financial instruments – – (21.8) – (21.8)<br />

Borrowings – – – (465.2) (465.2)<br />

Total financial liabilities – – (21.8) (1,356.2) (1,378.0)<br />

245.0 18.5 69.2 (974.9) (642.2)<br />

Total<br />

£m<br />

120<br />

<strong>Inchcape</strong> plc ¦ <strong>Annual</strong> <strong>Report</strong> and Accounts 2009