Full Annual Report - Inchcape

Full Annual Report - Inchcape

Full Annual Report - Inchcape

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section<br />

Three<br />

Financial<br />

statements<br />

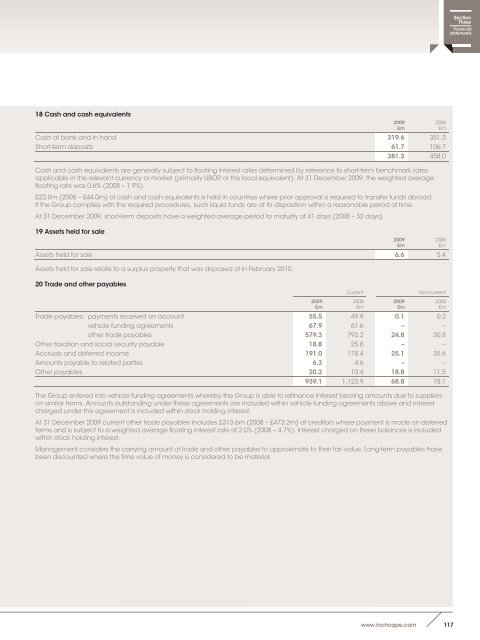

18 Cash and cash equivalents<br />

Cash at bank and in hand 319.6 351.3<br />

Short-term deposits 61.7 106.7<br />

2009<br />

£m<br />

2008<br />

£m<br />

381.3 458.0<br />

Cash and cash equivalents are generally subject to floating interest rates determined by reference to short-term benchmark rates<br />

applicable in the relevant currency or market (primarily LIBOR or the local equivalent). At 31 December 2009, the weighted average<br />

floating rate was 0.6% (2008 – 1.9%).<br />

£22.0m (2008 – £44.0m) of cash and cash equivalents is held in countries where prior approval is required to transfer funds abroad.<br />

If the Group complies with the required procedures, such liquid funds are at its disposition within a reasonable period of time.<br />

At 31 December 2009, short-term deposits have a weighted average period to maturity of 41 days (2008 – 32 days).<br />

19 Assets held for sale<br />

Assets held for sale 6.6 5.4<br />

Assets held for sale relate to a surplus property that was disposed of in February 2010.<br />

20 Trade and other payables<br />

2009<br />

£m<br />

Current<br />

2008<br />

£m<br />

2009<br />

£m<br />

2009<br />

£m<br />

2008<br />

£m<br />

Non-current<br />

2008<br />

£m<br />

Trade payables: payments received on account 55.5 49.9 0.1 0.2<br />

vehicle funding agreements 67.9 61.6 – –<br />

other trade payables 579.3 793.2 24.8 30.8<br />

Other taxation and social security payable 18.8 25.8 – –<br />

Accruals and deferred income 191.0 178.4 25.1 35.6<br />

Amounts payable to related parties 6.3 4.6 – –<br />

Other payables 20.3 10.4 18.8 11.5<br />

939.1 1,123.9 68.8 78.1<br />

The Group entered into vehicle funding agreements whereby the Group is able to refinance interest bearing amounts due to suppliers<br />

on similar terms. Amounts outstanding under these agreements are included within vehicle funding agreements above and interest<br />

charged under this agreement is included within stock holding interest.<br />

At 31 December 2009 current other trade payables includes £313.6m (2008 – £473.2m) of creditors where payment is made on deferred<br />

terms and is subject to a weighted average floating interest rate of 2.0% (2008 – 4.7%). Interest charged on these balances is included<br />

within stock holding interest.<br />

Management considers the carrying amount of trade and other payables to approximate to their fair value. Long-term payables have<br />

been discounted where the time value of money is considered to be material.<br />

www.inchcape.com 117