KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ... KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

Commercial-in-Confidence KI Traveller’s Levy Impact Assessment electing not to visit in 2011 and 51,840 over the period 2011 to 2019. The relatively larger drop in visitor numbers means that lost tourism expenditure on KI is larger in this scenario, with $2.06 million lost in 2011. TABLE 4.6: OPTION 3A MODELLING RESULTS Variable 2011 impact 2011-2019 impact Required levy rate $10.23 Change in visitor numbers -5,530 -51,840 Domestic overnight visitors -2,840 -26,220 International overnight visitors -940 -9,510 Day visitors -1,750 -16,120 Change in resident trips 0 0 Change in tourism expenditure ($real) -$2.06m -$19.21m Levy revenue ($real) $1.80m $17.04m OPTION 3B: A FLAT PER PASSENGER CHARGE EXCLUDING RESIDENTS AND CHILDREN Options 2 and 3A demonstrate the outcome if children, and then residents are excluded from the levy, however each of these is in isolation. When both are excluded, the levy rate required to generate the revenue target rises to $11.34. Consistent with the results in Option 2 and 3A, the number of visitors lost and change in tourism expenditure is lower when children are excluded. This arises because the exemption for children reduces the burden on families, so larger travel parties are less dissuaded. Foregone tourism expenditure in this case is estimated at $2.03 million in 2011. TABLE 4.7: OPTION 3B MODELLING RESULTS Variable 2011 impact 2011-2019 impact Required levy rate $11.34 Change in visitor numbers -5,480 -51,450 Domestic overnight visitors -2,770 -25,540 International overnight visitors -1,010 -10,150 Day visitors -1,710 -15,770 Change in resident trips 0 0 Change in tourism expenditure ($real) -$2.03m -$18.95m Levy revenue ($real) $1.80m $17.07m OPTION 4: A FLAT-PER NIGHT CHARGE, EXCLUDING RESIDENTS For a given revenue target, a per-night levy has quite different effects compared with a perperson levy, most significantly in relation to the distribution of the economic burden. In particular, the impacts on day visitors are markedly less, as the required levy rate of $2.99 per day has a much smaller proportional impact compared with the per-trip levy of $8 - $11. The burden on international visitors is also reduced as the average length of stay of 2.7 29

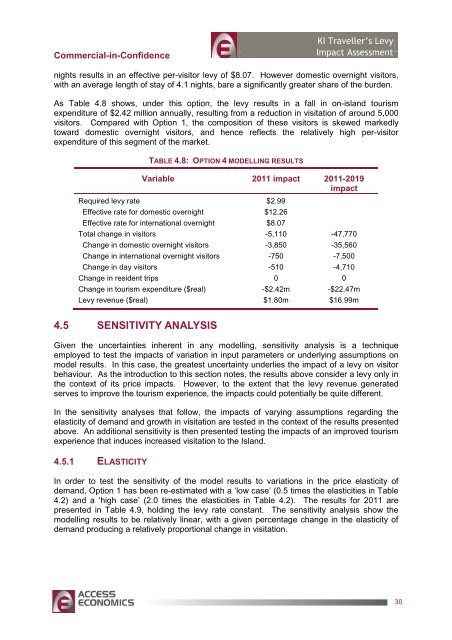

Commercial-in-Confidence KI Traveller’s Levy Impact Assessment nights results in an effective per-visitor levy of $8.07. However domestic overnight visitors, with an average length of stay of 4.1 nights, bare a significantly greater share of the burden. As Table 4.8 shows, under this option, the levy results in a fall in on-island tourism expenditure of $2.42 million annually, resulting from a reduction in visitation of around 5,000 visitors. Compared with Option 1, the composition of these visitors is skewed markedly toward domestic overnight visitors, and hence reflects the relatively high per-visitor expenditure of this segment of the market. TABLE 4.8: OPTION 4 MODELLING RESULTS Variable 2011 impact 2011-2019 impact Required levy rate $2.99 Effective rate for domestic overnight $12.26 Effective rate for international overnight $8.07 Total change in visitors -5,110 -47,770 Change in domestic overnight visitors -3,850 -35,560 Change in international overnight visitors -750 -7,500 Change in day visitors -510 -4,710 Change in resident trips 0 0 Change in tourism expenditure ($real) -$2.42m -$22.47m Levy revenue ($real) $1.80m $16.99m 4.5 SENSITIVITY ANALYSIS Given the uncertainties inherent in any modelling, sensitivity analysis is a technique employed to test the impacts of variation in input parameters or underlying assumptions on model results. In this case, the greatest uncertainty underlies the impact of a levy on visitor behaviour. As the introduction to this section notes, the results above consider a levy only in the context of its price impacts. However, to the extent that the levy revenue generated serves to improve the tourism experience, the impacts could potentially be quite different. In the sensitivity analyses that follow, the impacts of varying assumptions regarding the elasticity of demand and growth in visitation are tested in the context of the results presented above. An additional sensitivity is then presented testing the impacts of an improved tourism experience that induces increased visitation to the Island. 4.5.1 ELASTICITY In order to test the sensitivity of the model results to variations in the price elasticity of demand, Option 1 has been re-estimated with a ‘low case’ (0.5 times the elasticities in Table 4.2) and a ‘high case’ (2.0 times the elasticities in Table 4.2). The results for 2011 are presented in Table 4.9, holding the levy rate constant. The sensitivity analysis show the modelling results to be relatively linear, with a given percentage change in the elasticity of demand producing a relatively proportional change in visitation. 30

- Page 1 and 2: Commercial-in-Confidence 28 July 20

- Page 3 and 4: Commercial-in-Confidence KI Travell

- Page 5 and 6: Commercial-in-Confidence KI Travell

- Page 7 and 8: Commercial-in-Confidence KI Travell

- Page 9 and 10: Commercial-in-Confidence KI Travell

- Page 11 and 12: Commercial-in-Confidence KI Travell

- Page 13 and 14: Commercial-in-Confidence KI Travell

- Page 15 and 16: Commercial-in-Confidence KI Travell

- Page 17 and 18: Commercial-in-Confidence KI Travell

- Page 19 and 20: Commercial-in-Confidence KI Travell

- Page 21 and 22: Commercial-in-Confidence KI Travell

- Page 23 and 24: Commercial-in-Confidence KI Travell

- Page 25 and 26: Commercial-in-Confidence KI Travell

- Page 27 and 28: Commercial-in-Confidence KI Travell

- Page 29 and 30: Commercial-in-Confidence KI Travell

- Page 31: Commercial-in-Confidence KI Travell

- Page 35 and 36: Commercial-in-Confidence KI Travell

- Page 37 and 38: Commercial-in-Confidence KI Travell

- Page 39 and 40: Commercial-in-Confidence KI Travell

- Page 41 and 42: Commercial-in-Confidence KI Travell

- Page 43 and 44: Commercial-in-Confidence KI Travell

- Page 45 and 46: Commercial-in-Confidence KI Travell

- Page 47 and 48: Commercial-in-Confidence KI Travell

- Page 49 and 50: Commercial-in-Confidence KI Travell

Commercial-in-Confidence<br />

<strong>KI</strong> Traveller’s <strong>Levy</strong><br />

<strong>Impact</strong> <strong>Assessment</strong><br />

nights results in an effective per-visitor levy of $8.07. However domestic overnight visitors,<br />

with an average length of stay of 4.1 nights, bare a significantly greater share of the burden.<br />

As Table 4.8 shows, under this option, the levy results in a fall in on-island tourism<br />

expenditure of $2.42 million annually, resulting from a reduction in visitation of around 5,000<br />

visitors. Compared with Option 1, the composition of these visitors is skewed markedly<br />

toward domestic overnight visitors, and hence reflects the relatively high per-visitor<br />

expenditure of this segment of the market.<br />

TABLE 4.8: OPTION 4 MODELLING RESULTS<br />

Variable 2011 impact 2011-2019<br />

impact<br />

Required levy rate $2.99<br />

Effective rate for domestic overnight $12.26<br />

Effective rate for international overnight $8.07<br />

Total change in visitors -5,110 -47,770<br />

Change in domestic overnight visitors -3,850 -35,560<br />

Change in international overnight visitors -750 -7,500<br />

Change in day visitors -510 -4,710<br />

Change in resident trips 0 0<br />

Change in tourism expenditure ($real) -$2.42m -$22.47m<br />

<strong>Levy</strong> revenue ($real) $1.80m $16.99m<br />

4.5 SENSITIVITY ANALYSIS<br />

Given the uncertainties inherent in any modelling, sensitivity analysis is a technique<br />

employed to test the impacts of variation in input parameters or underlying assumptions on<br />

model results. In this case, the greatest uncertainty underlies the impact of a levy on visitor<br />

behaviour. As the introduction to this section notes, the results above consider a levy only in<br />

the context of its price impacts. However, to the extent that the levy revenue generated<br />

serves to improve the tourism experience, the impacts could potentially be quite different.<br />

In the sensitivity analyses that follow, the impacts of varying assumptions regarding the<br />

elasticity of demand and growth in visitation are tested in the context of the results presented<br />

above. An additional sensitivity is then presented testing the impacts of an improved tourism<br />

experience that induces increased visitation to the <strong>Island</strong>.<br />

4.5.1 ELASTICITY<br />

In order to test the sensitivity of the model results to variations in the price elasticity of<br />

demand, Option 1 has been re-estimated with a ‘low case’ (0.5 times the elasticities in Table<br />

4.2) and a ‘high case’ (2.0 times the elasticities in Table 4.2). The results for 2011 are<br />

presented in Table 4.9, holding the levy rate constant. The sensitivity analysis show the<br />

modelling results to be relatively linear, with a given percentage change in the elasticity of<br />

demand producing a relatively proportional change in visitation.<br />

30