KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

KI Traveller's Levy Economic Impact Assessment - Kangaroo Island ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Commercial-in-Confidence<br />

<strong>KI</strong> Traveller’s <strong>Levy</strong><br />

<strong>Impact</strong> <strong>Assessment</strong><br />

estimated at $1.87 million annually. In this scenario, changes to resident behaviour are also<br />

observed, with a reduction in trips by residents of 1,690 in 2011.<br />

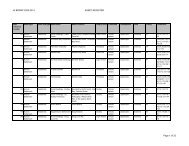

TABLE 4.4: OPTION 1 MODELLING RESULTS<br />

Variable 2011 impact 2011-2019<br />

impact<br />

Required levy rate $8.55<br />

Change in visitor numbers -4,620 -43,330<br />

Domestic overnight visitors -2,370 -21,910<br />

International overnight visitors -790 -7.950<br />

Day visitors -1,460 -13,470<br />

Change in resident trips -1,690 -15,460<br />

Change in tourism expenditure ($real) -$1.87m -$17.45m<br />

<strong>Levy</strong> revenue ($real) $1.80m $16.96m<br />

OPTION 2: A FLAT PER-PASSENGER CHARGE EXCLUDING CHILDREN<br />

Excluding children from the levy narrows the base of travellers upon whom the charge is<br />

levied. Children are estimated to represent around 9% of all visitors to <strong>Kangaroo</strong> <strong>Island</strong> and<br />

6% of residents. If this group is exempted then one of two alternative approaches must be<br />

adopted: either a smaller amount of revenue is collected, or the value of the levy must<br />

increase to achieve a given revenue target. The modelling adopts the latter (Table 4.5).<br />

TABLE 4.5: OPTION 2 MODELLING RESULTS<br />

Variable 2011 impact 2011-2019<br />

impact<br />

Required levy rate $9.41<br />

Change in visitor numbers -4,550 -42,700<br />

Domestic overnight visitors -2,300 -21,190<br />

International overnight visitors -840 -8,420<br />

Day visitors -1,420 -13,080<br />

Change in resident trips -1,740 -16,000<br />

Change in tourism expenditure ($real) -$1.84m -$17.16m<br />

<strong>Levy</strong> revenue ($real) $1.80m $16.97m<br />

When children are exempt, the required levy rate rises to $9.41, reflecting the lower number<br />

of visitors paying the levy (193,320 compared with 210,332 when children are included).<br />

Despite the higher levy, fewer visitor trips are lost, with a reduction of 4,550 visits in 2011,<br />

and 42,700 over the period 2011 to 2019. Although the levy is higher on a per-adult basis,<br />

excluding children reduces the burden on families (e.g. a family of four pays $18.82<br />

compared with $34.20 under Option 1).<br />

OPTION 3A: A FLAT PER PASSENGER CHARGE EXCLUDING RESIDENTS<br />

Excluding residents from the levy necessitates a higher levy rate to achieve a given revenue<br />

target –$10.23 when children are included. Consequently, with the burden placed solely on<br />

visitors, the impacts on tourist numbers is greater, with an estimated 5,530 potential visitors<br />

28