Application Form for claiming Dependent Parent or ... - ç¨ åå±

Application Form for claiming Dependent Parent or ... - ç¨ åå±

Application Form for claiming Dependent Parent or ... - ç¨ åå±

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

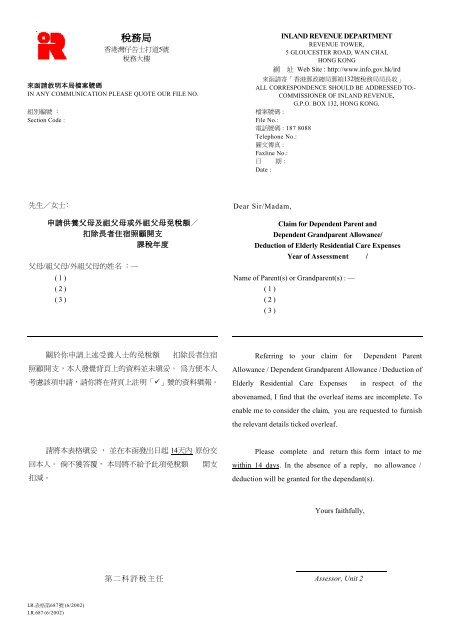

稅 務 局<br />

ਉᤜӒثѓԚᄐ5<br />

໔௭ѕፔ<br />

來 函 請 敘 明 本 局 檔 案 號 碼<br />

IN ANY COMMUNICATION PLEASE QUOTE OUR FILE NO.<br />

ഴؑᎳ ʚ<br />

Section Code :<br />

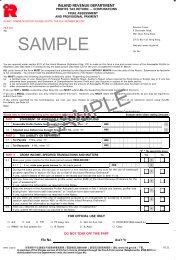

INLAND REVENUE DEPARTMENT<br />

REVENUE TOWER,<br />

5 GLOUCESTER ROAD, WAN CHAI,<br />

HONG KONG<br />

ሻ ؿ Web Site : http://www.info.gov.hk/ird<br />

ˉ֯ᏮబˈਉཡङᘔٝཡᎣ132໔௭ٝٝܤܐ<br />

ALL CORRESPONDENCE SHOULD BE ADDRESSED TO:<br />

COMMISSIONER OF INLAND REVENUE,<br />

G.P.O. BOX 132, HONG KONG.<br />

ᖾૂ᎘ :<br />

File No.:<br />

ᄽჩ᎘ : 187 8088<br />

Telephone No.:<br />

ᅹҮྚଟ :<br />

Faxline No.:<br />

Ҳ ๚ :<br />

Date :<br />

գԳ̯іѓʥ<br />

申 請 供 養 父 母 及 祖 父 母 或 外 祖 父 母 免 稅 額 ̯<br />

扣 除 長 者 住 宿 照 顧 開 支<br />

課 稅 年 度<br />

ռݩ࠱ӀԦ/ଲӀԦ/ԆଲӀԦ —ʚ<br />

( 1 )<br />

( 2 )<br />

( 3 )<br />

Dear Sir/Madam,<br />

Claim <strong>f<strong>or</strong></strong> <strong>Dependent</strong> <strong>Parent</strong> and <br />

<strong>Dependent</strong> Grandparent Allowance/<br />

Deduction of Elderly Residential Care Expenses<br />

Year of Assessment /<br />

Name of <strong>Parent</strong>(s) <strong>or</strong> Grandparent(s) : —<br />

( 1 )<br />

( 2 )<br />

( 3 )<br />

໔ᜰ؍࠱ԹᏮт৪ܹᑆгѓߍែ<br />

၃ིҭʔԡгহт࠱ჷ܀Ԣ࿄ٔʖ<br />

మװࡃை֬<br />

Referring to your claim <strong>f<strong>or</strong></strong> <strong>Dependent</strong> <strong>Parent</strong><br />

ॡұԡг<br />

ჷ࿄෴ʖ࠱9ˉˈߔጞრྈԹᏮʔᏮలևহт༯ו<br />

Allowance / <strong>Dependent</strong> Grandparent Allowance / Deduction of<br />

Elderly Residential Care Expenses<br />

in respect of the<br />

abovenamed, I find that the overleaf items are incomplete. To<br />

enable me to consider the claim, you are requested to furnish<br />

the relevant details ticked overleaf.<br />

Ꮾలԡ࿄ٔ ʔ ӠҲܤևԡ܀ 14Қ҃ ՝Ռ<br />

փԡгʖ ਣѬᗧʔ ԡٝలѬѲּྈ؍໔ᜰ ིҭ<br />

֬ງʖ<br />

Please complete and return this <strong>f<strong>or</strong></strong>m intact to me<br />

within 14 days. In the absence of a reply, no allowance /<br />

deduction will be granted <strong>f<strong>or</strong></strong> the dependant(s).<br />

Yours faithfully,<br />

ണвঝ༱໔ӌ՚ Assess<strong>or</strong>, Unit 2<br />

I.R.ണ687 (6/2002)<br />

I.R.687 (6/2002)

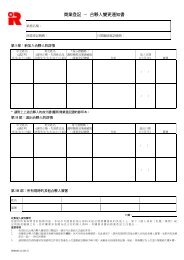

ʚ໔௭ٝٝ ী<br />

To : The Commissioner of Inland Revenue<br />

ਉཡङᘔٝཡᎣ132<br />

G.P.O. Box 132, Hong Kong.<br />

ᅹҮྚଟ<br />

Faxline No. : 2877 1232<br />

ᖾૂ᎘ ʚ<br />

File No. : _________________________________<br />

ԹᏮᑆӀԦ0ଲӀԦ0<br />

Claim <strong>f<strong>or</strong></strong> <strong>Dependent</strong> <strong>Parent</strong> / Grandparent Allowance <strong>or</strong> Deduction of Elderly Residential Care Expenses<br />

మ၃ིҭװࡃ໔ᜰި֬ை؍ԆଲӀԦ<br />

/ Ᏸ໔֣࣫<br />

Year of Assessment /<br />

ണ1ܹᑆг<br />

Dependant 1<br />

ണ2ܹᑆг<br />

Dependant 2<br />

ണ3ܹᑆг<br />

Dependant 3<br />

(1) ܹᑆгݩռ(ᏮԴԥဒ࿄ጊ)<br />

Full name of dependant ( Please Use Block Letters)<br />

(2) ܹᑆг࠱ਉ۪҉ឞ᎘<br />

Dependant’ s H.K. Identity Card No. ( ) ( ) ( )<br />

(3) ܹᑆгӠԳҲ๚ (ӽ࿄ጊҴ՝җ֣՝); ܹ֕ᑆгևԡ֣࣫҃Ѭ۩<br />

60ဣՍᏮ࿄ጊണ 7 ྈ<br />

Date of birth of dependant (enter month and year only); if the<br />

dependant was less than 60 years old during the year, please also<br />

complete item 7 below<br />

Ҵ<br />

Month<br />

֣<br />

Year<br />

Ҵ<br />

Month<br />

֣<br />

Year<br />

Ҵ<br />

Month<br />

֣<br />

Year<br />

ែ࠱ቖԡгިԡг (4)<br />

Relationship with me / my spouse<br />

ӀԦ<br />

parent<br />

ଲӀԦި<br />

ԆଲӀԦ<br />

grandparent<br />

ӀԦ<br />

parent<br />

ଲӀԦި<br />

ԆଲӀԦ<br />

grandparent<br />

ӀԦ<br />

parent<br />

ଲӀԦި<br />

ԆଲӀԦ<br />

grandparent<br />

請 填 寫 第 (5) 或 第 (6) 其 中 一 項<br />

Complete EITHER Item (5) OR Item (6)<br />

(5)<br />

(i) ӑӠм۩ངԴʖ܀זװᑆгևԡ֣࣫҃එᡛቖԡгյܹ<br />

(࠼6ਡҴʔᏮߍҟװյ)<br />

The dependant resided with me continuously during the year<br />

without paying full cost. (Leave blank if residing period was less<br />

than 6 months)<br />

դ֣ ҟ6ਡҴן<br />

װյ<br />

װյ<br />

<strong>f<strong>or</strong></strong> full <strong>f<strong>or</strong></strong> at least<br />

year 6 months<br />

դ֣ ҟ6ਡҴן<br />

װյ<br />

װյ<br />

<strong>f<strong>or</strong></strong> full<br />

year<br />

<strong>f<strong>or</strong></strong> at least<br />

6 months<br />

դ֣ ҟ6ਡҴן<br />

װյ<br />

װյ<br />

<strong>f<strong>or</strong></strong> full<br />

year<br />

<strong>f<strong>or</strong></strong> at least<br />

6 months<br />

$12,000ߍևԡ֣࣫҃ѲܹᑆгѬҟ࠱ԡгިԡг (ii)<br />

(1998 / 99֣࣫Ӑॡ $1,200) ᕒԳ॒ངʖ࠱<br />

I / my spouse contributed not less than $12,000 in money during<br />

the year ($1,200 pri<strong>or</strong> to year of assessment 1998 / 99) towards<br />

the dependant’ s maintenance.<br />

ढ<br />

Yes<br />

ء<br />

No<br />

ढ<br />

Yes No<br />

ढ ء<br />

Yes<br />

ء<br />

No<br />

(6) (i) ռሠה֜࠱װݺᑆгܹ<br />

Name of the residential care home at which the dependant resided<br />

(ii) ҭི࠱הևԡ֣࣫҃ެҭӑт৪֜࠱ԡгިԡг<br />

ᜰ (Է՚гѓިᒲᇌӑᙫ࠱ፇᜰʔѬᖨৠሩև҃)<br />

Amount of expenses paid by me / my spouse to the above<br />

residential care home during the year (excluding any amount<br />

subsequently reimbursed by any person <strong>or</strong> <strong>or</strong>ganization)<br />

$ $ $<br />

(7) ्ཀʖྞތᑆгևԡֶ֣࣫҃ჷԹङܹ<br />

The dependant was eligible to claim an allowance under the<br />

Government’ s Disability Allowance Scheme during the year.<br />

ढ<br />

Yes<br />

ء<br />

No<br />

ढ<br />

Yes<br />

ء<br />

No<br />

ढ<br />

Yes<br />

ء<br />

No<br />

Ꮾևᐞၝ࠼҃ӣтˈ 9 ˉ<br />

9!in the appropriate box<br />

ᡆ᎔ᆔൽʖفჷ࠱ʔӐтެ෴ެ࠵ฉԡгެߔᘢ<br />

I declare that to the best of my knowledge and belief, all the above statements are true and c<strong>or</strong>rect.<br />

႟<br />

Signature ʚ<br />

Ҳ๚<br />

Dateʚ . Name ʚ<br />

ռݩ<br />

.<br />

.<br />

I.R.ണ687 (6/2002)<br />

I.R.687 (6/2002)