Innovation in the UK Retail Sector - Nesta

Innovation in the UK Retail Sector - Nesta

Innovation in the UK Retail Sector - Nesta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

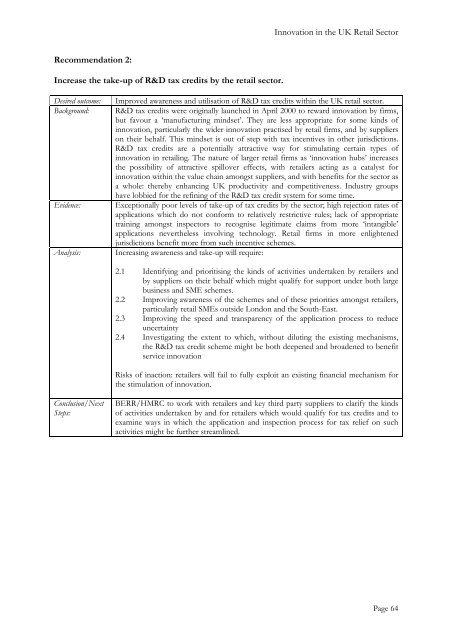

Recommendation 2:<br />

Increase <strong>the</strong> take-up of R&D tax credits by <strong>the</strong> retail sector.<br />

<strong>Innovation</strong> <strong>in</strong> <strong>the</strong> <strong>UK</strong> <strong>Retail</strong> <strong>Sector</strong><br />

Desired outcome: Improved awareness and utilisation of R&D tax credits with<strong>in</strong> <strong>the</strong> <strong>UK</strong> retail sector.<br />

Background: R&D tax credits were orig<strong>in</strong>ally launched <strong>in</strong> April 2000 to reward <strong>in</strong>novation by firms,<br />

but favour a ‘manufactur<strong>in</strong>g m<strong>in</strong>dset’. They are less appropriate for some k<strong>in</strong>ds of<br />

<strong>in</strong>novation, particularly <strong>the</strong> wider <strong>in</strong>novation practised by retail firms, and by suppliers<br />

on <strong>the</strong>ir behalf. This m<strong>in</strong>dset is out of step with tax <strong>in</strong>centives <strong>in</strong> o<strong>the</strong>r jurisdictions.<br />

R&D tax credits are a potentially attractive way for stimulat<strong>in</strong>g certa<strong>in</strong> types of<br />

<strong>in</strong>novation <strong>in</strong> retail<strong>in</strong>g. The nature of larger retail firms as ‘<strong>in</strong>novation hubs’ <strong>in</strong>creases<br />

<strong>the</strong> possibility of attractive spillover effects, with retailers act<strong>in</strong>g as a catalyst for<br />

<strong>in</strong>novation with<strong>in</strong> <strong>the</strong> value cha<strong>in</strong> amongst suppliers, and with benefits for <strong>the</strong> sector as<br />

a whole: <strong>the</strong>reby enhanc<strong>in</strong>g <strong>UK</strong> productivity and competitiveness. Industry groups<br />

have lobbied for <strong>the</strong> ref<strong>in</strong><strong>in</strong>g of <strong>the</strong> R&D tax credit system for some time.<br />

Evidence: Exceptionally poor levels of take-up of tax credits by <strong>the</strong> sector; high rejection rates of<br />

applications which do not conform to relatively restrictive rules; lack of appropriate<br />

tra<strong>in</strong><strong>in</strong>g amongst <strong>in</strong>spectors to recognise legitimate claims from more ‘<strong>in</strong>tangible’<br />

applications never<strong>the</strong>less <strong>in</strong>volv<strong>in</strong>g technology. <strong>Retail</strong> firms <strong>in</strong> more enlightened<br />

jurisdictions benefit more from such <strong>in</strong>centive schemes.<br />

Analysis: Increas<strong>in</strong>g awareness and take-up will require:<br />

Conclusion/Next<br />

Steps:<br />

2.1 Identify<strong>in</strong>g and prioritis<strong>in</strong>g <strong>the</strong> k<strong>in</strong>ds of activities undertaken by retailers and<br />

by suppliers on <strong>the</strong>ir behalf which might qualify for support under both large<br />

bus<strong>in</strong>ess and SME schemes.<br />

2.2 Improv<strong>in</strong>g awareness of <strong>the</strong> schemes and of <strong>the</strong>se priorities amongst retailers,<br />

particularly retail SMEs outside London and <strong>the</strong> South-East.<br />

2.3 Improv<strong>in</strong>g <strong>the</strong> speed and transparency of <strong>the</strong> application process to reduce<br />

uncerta<strong>in</strong>ty<br />

2.4 Investigat<strong>in</strong>g <strong>the</strong> extent to which, without dilut<strong>in</strong>g <strong>the</strong> exist<strong>in</strong>g mechanisms,<br />

<strong>the</strong> R&D tax credit scheme might be both deepened and broadened to benefit<br />

service <strong>in</strong>novation<br />

Risks of <strong>in</strong>action: retailers will fail to fully exploit an exist<strong>in</strong>g f<strong>in</strong>ancial mechanism for<br />

<strong>the</strong> stimulation of <strong>in</strong>novation.<br />

BERR/HMRC to work with retailers and key third party suppliers to clarify <strong>the</strong> k<strong>in</strong>ds<br />

of activities undertaken by and for retailers which would qualify for tax credits and to<br />

exam<strong>in</strong>e ways <strong>in</strong> which <strong>the</strong> application and <strong>in</strong>spection process for tax relief on such<br />

activities might be fur<strong>the</strong>r streaml<strong>in</strong>ed.<br />

Page 64