Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Strategy Overview: Asia Equity<br />

on <strong>the</strong>m. The fundamental checks are (1) whe<strong>the</strong>r asset price<br />

inflation will eventually start spilling over onto <strong>the</strong> CPI and (2) if<br />

<strong>the</strong>re is cost push inflation, especially from <strong>the</strong> labor market,<br />

raw materials and business costs, which will in turn compress<br />

margins. China's CPI and PPI continued to fall in August,<br />

suggesting <strong>the</strong>re is still no price pressure in China.<br />

Unemployment rate in Asia probably hasn't peaked yet. We<br />

look at <strong>the</strong> formation of bubble markets from three aspects:<br />

stock, property and credit markets. The conclusion is that<br />

<strong>the</strong>re may be premature signs of a bubble but not suggestive<br />

of an imminent burst.<br />

Stock market bubble<br />

A stock market bubble is a type of economic bubble taking<br />

place in stock markets when market participants drive stock<br />

prices above <strong>the</strong>ir value in relation to some measures of stock<br />

valuation.<br />

Valuations<br />

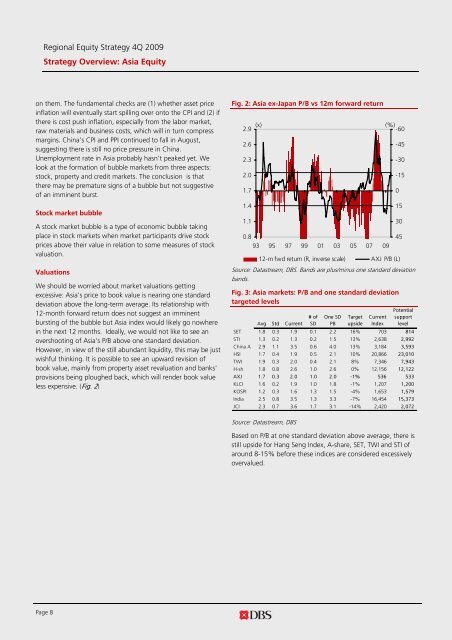

We should be worried about market valuations getting<br />

excessive: Asia's price to book value is nearing one standard<br />

deviation above <strong>the</strong> long-term average. Its relationship with<br />

12-month forward return does not suggest an imminent<br />

bursting of <strong>the</strong> bubble but Asia index would likely go nowhere<br />

in <strong>the</strong> next 12 months. Ideally, we would not like to see an<br />

overshooting of Asia's P/B above one standard deviation.<br />

However, in view of <strong>the</strong> still abundant liquidity, this may be just<br />

wishful thinking. It is possible to see an upward revision of<br />

book value, mainly from property asset revaluation and banks'<br />

provisions being ploughed back, which will render book value<br />

less expensive. (Fig. 2)<br />

Fig. 2: Asia ex-Japan P/B vs 12m forward return<br />

2.9<br />

2.6<br />

2.3<br />

2.0<br />

1.7<br />

1.4<br />

1.1<br />

(x) (%)<br />

-60<br />

0.8<br />

93 95 97 99 01 03 05 07 09<br />

12-m fwd return (R, inv erse scale) AXJ P/B (L)<br />

Source: Datastream, <strong>DBS</strong>. Bands are plus/minus one standard deviation<br />

bands.<br />

Fig. 3: Asia markets: P/B and one standard deviation<br />

targeted levels<br />

Avg Std Current<br />

# of<br />

SD<br />

One SD<br />

PB<br />

Target<br />

upside<br />

Current<br />

Index<br />

Potential<br />

support<br />

level<br />

SET 1.8 0.3 1.9 0.1 2.2 16% 703 814<br />

STI 1.3 0.2 1.3 0.2 1.5 13% 2,638 2,992<br />

China A 2.9 1.1 3.5 0.6 4.0 13% 3,184 3,593<br />

HSI 1.7 0.4 1.9 0.5 2.1 10% 20,866 23,010<br />

TWI 1.9 0.3 2.0 0.4 2.1 8% 7,346 7,943<br />

H-sh 1.8 0.8 2.6 1.0 2.6 0% 12,156 12,122<br />

AXJ 1.7 0.3 2.0 1.0 2.0 -1% 536 533<br />

KLCI 1.6 0.2 1.9 1.0 1.8 -1% 1,207 1,200<br />

KOSPI 1.2 0.3 1.6 1.3 1.5 -4% 1,653 1,579<br />

India 2.5 0.8 3.5 1.3 3.3 -7% 16,454 15,373<br />

JCI 2.3 0.7 3.6 1.7 3.1 -14% 2,420 2,072<br />

-45<br />

-30<br />

-15<br />

0<br />

15<br />

30<br />

45<br />

Source: Datastream, <strong>DBS</strong><br />

Based on P/B at one standard deviation above average, <strong>the</strong>re is<br />

still upside for Hang Seng Index, A-share, SET, TWI and STI of<br />

around 8-15% before <strong>the</strong>se indices are considered excessively<br />

overvalued.<br />

Page 8