Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Strategy Overview: Asia Equity<br />

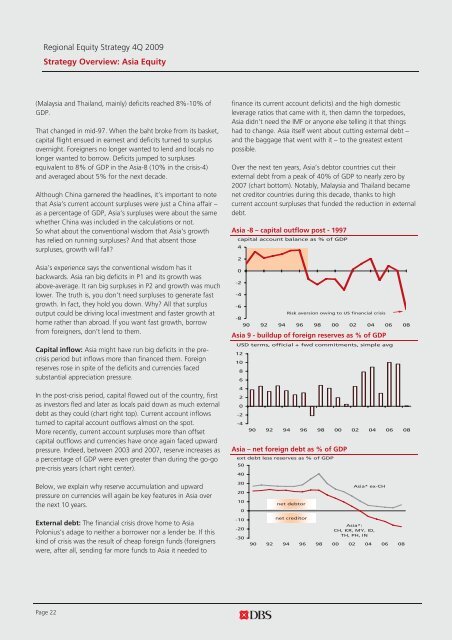

(Malaysia and Thailand, mainly) deficits reached 8%-10% of<br />

GDP.<br />

That changed in mid-97. When <strong>the</strong> baht broke from its basket,<br />

capital flight ensued in earnest and deficits turned to surplus<br />

overnight. Foreigners no longer wanted to lend and locals no<br />

longer wanted to borrow. Deficits jumped to surpluses<br />

equivalent to 8% of GDP in <strong>the</strong> Asia-8 (10% in <strong>the</strong> crisis-4)<br />

and averaged about 5% for <strong>the</strong> next decade.<br />

Although China garnered <strong>the</strong> headlines, it’s important to note<br />

that Asia’s current account surpluses were just a China affair –<br />

as a percentage of GDP, Asia’s surpluses were about <strong>the</strong> same<br />

whe<strong>the</strong>r China was included in <strong>the</strong> calculations or not.<br />

So what about <strong>the</strong> conventional wisdom that Asia’s growth<br />

has relied on running surpluses? And that absent those<br />

surpluses, growth will fall?<br />

Asia’s experience says <strong>the</strong> conventional wisdom has it<br />

backwards. Asia ran big deficits in P1 and its growth was<br />

above-average. It ran big surpluses in P2 and growth was much<br />

lower. The truth is, you don’t need surpluses to generate fast<br />

growth. In fact, <strong>the</strong>y hold you down. Why? All that surplus<br />

output could be driving local investment and faster growth at<br />

home ra<strong>the</strong>r than abroad. If you want fast growth, borrow<br />

from foreigners, don’t lend to <strong>the</strong>m.<br />

Capital inflow: Asia might have run big deficits in <strong>the</strong> precrisis<br />

period but inflows more than financed <strong>the</strong>m. Foreign<br />

reserves rose in spite of <strong>the</strong> deficits and currencies faced<br />

substantial appreciation pressure.<br />

In <strong>the</strong> post-crisis period, capital flowed out of <strong>the</strong> country, first<br />

as investors fled and later as locals paid down as much external<br />

debt as <strong>the</strong>y could (chart right top). Current account inflows<br />

turned to capital account outflows almost on <strong>the</strong> spot.<br />

More recently, current account surpluses more than offset<br />

capital outflows and currencies have once again faced upward<br />

pressure. Indeed, between 2003 and 2007, reserve increases as<br />

a percentage of GDP were even greater than during <strong>the</strong> go-go<br />

pre-crisis years (chart right center).<br />

finance its current account deficits) and <strong>the</strong> high domestic<br />

leverage ratios that came with it, <strong>the</strong>n damn <strong>the</strong> torpedoes,<br />

Asia didn’t need <strong>the</strong> IMF or anyone else telling it that things<br />

had to change. Asia itself went about cutting external debt –<br />

and <strong>the</strong> baggage that went with it – to <strong>the</strong> greatest extent<br />

possible.<br />

Over <strong>the</strong> next ten years, Asia’s debtor countries cut <strong>the</strong>ir<br />

external debt from a peak of 40% of GDP to nearly zero by<br />

2007 (chart bottom). Notably, Malaysia and Thailand became<br />

net creditor countries during this decade, thanks to high<br />

current account surpluses that funded <strong>the</strong> reduction in external<br />

debt.<br />

Asia -8 – capital outflow post - 1997<br />

capital account balance as % of GDP<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

Risk aversion owing to US financial crisis<br />

90 92 94 96 98 00 02 04 06 08<br />

Asia 9 - buildup of foreign reserves as % of GDP<br />

USD terms, official + fwd commitments, simple avg<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

90 92 94 96 98 00 02 04 06 08<br />

Asia – net foreign debt as % of GDP<br />

ext debt less reserves as % of GDP<br />

50<br />

40<br />

Below, we explain why reserve accumulation and upward<br />

pressure on currencies will again be key features in Asia over<br />

<strong>the</strong> next 10 years.<br />

External debt: The financial crisis drove home to Asia<br />

Polonius’s adage to nei<strong>the</strong>r a borrower nor a lender be. If this<br />

kind of crisis was <strong>the</strong> result of cheap foreign funds (foreigners<br />

were, after all, sending far more funds to Asia it needed to<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

net debtor<br />

net creditor<br />

Asia* ex-CH<br />

Asia*:<br />

CH, KR, MY, ID,<br />

TH, PH, IN<br />

90 92 94 96 98 00 02 04 06 08<br />

Page 22