Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Strategy Overview: Asia Equity<br />

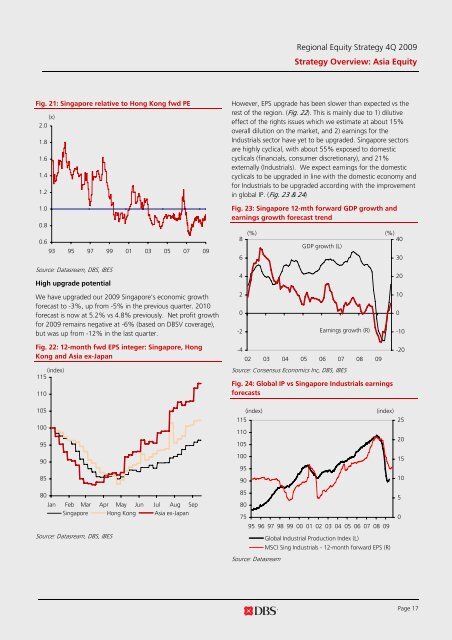

Fig. 21: Singapore relative to Hong Kong fwd PE<br />

(x)<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

93 95 97 99 01 03 05 07 09<br />

However, EPS upgrade has been slower than expected vs <strong>the</strong><br />

rest of <strong>the</strong> region. (Fig. 22). This is mainly due to 1) dilutive<br />

effect of <strong>the</strong> rights issues which we estimate at about 15%<br />

overall dilution on <strong>the</strong> market, and 2) earnings for <strong>the</strong><br />

Industrials sector have yet to be upgraded. Singapore sectors<br />

are highly cyclical, with about 55% exposed to domestic<br />

cyclicals (financials, consumer discretionary), and 21%<br />

externally (Industrials). We expect earnings for <strong>the</strong> domestic<br />

cyclicals to be upgraded in line with <strong>the</strong> domestic economy and<br />

for Industrials to be upgraded according with <strong>the</strong> improvement<br />

in global IP. (Fig. 23 & 24)<br />

Fig. 23: Singapore 12-mth forward GDP growth and<br />

earnings growth forecast trend<br />

8<br />

6<br />

(%) (%)<br />

40<br />

GDP growth (L)<br />

30<br />

Source: Datasream, <strong>DBS</strong>, IBES<br />

High upgrade potential<br />

4<br />

20<br />

We have upgraded our 2009 Singapore's economic growth<br />

forecast to -3%, up from -5% in <strong>the</strong> previous quarter. 2010<br />

forecast is now at 5.2% vs 4.8% previously. Net profit growth<br />

for 2009 remains negative at -6% (based on <strong>DBS</strong>V coverage),<br />

but was up from -12% in <strong>the</strong> last quarter.<br />

2<br />

0<br />

-2<br />

Earnings growth (R)<br />

10<br />

0<br />

-10<br />

Fig. 22: 12-month fwd EPS integer: Singapore, Hong<br />

Kong and Asia ex-Japan<br />

(index)<br />

115<br />

110<br />

-4<br />

02 03 04 05 06 07 08 09<br />

Source: Consensus Economics Inc, <strong>DBS</strong>, IBES<br />

Fig. 24: Global IP vs Singapore Industrials earnings<br />

forecasts<br />

-20<br />

105<br />

100<br />

95<br />

(index)<br />

115<br />

110<br />

105<br />

(index)<br />

25<br />

20<br />

90<br />

85<br />

100<br />

95<br />

90<br />

15<br />

10<br />

80<br />

Jan Feb Mar Apr May Jun Jul Aug Sep<br />

Singapore Hong Kong Asia ex-Japan<br />

Source: Datasream, <strong>DBS</strong>, IBES<br />

85<br />

80<br />

75<br />

95 96 97 98 99 00 01 02 03 04 05 06 07 08 09<br />

Global Industrial Production Index (L)<br />

MSCI Sing Industrials - 12-month forward EPS (R)<br />

Source: Datasream<br />

5<br />

0<br />

Page 17