Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Left Brain Right B - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity Strategy 4Q 2009<br />

Country Assessment<br />

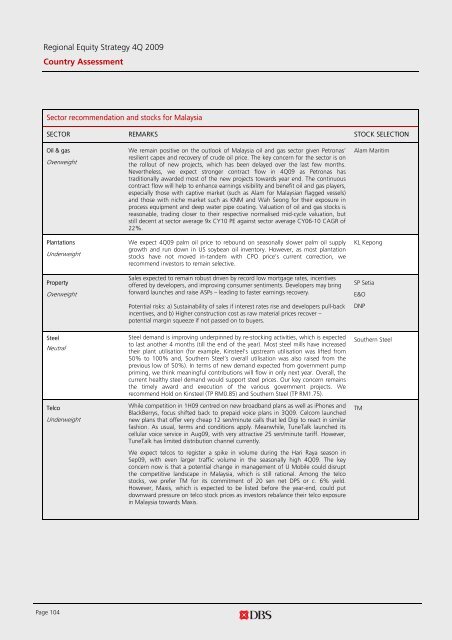

Sector recommendation and stocks for Malaysia<br />

SECTOR REMARKS STOCK SELECTION<br />

Oil & gas<br />

Overweight<br />

Plantations<br />

Underweight<br />

Property<br />

Overweight<br />

Steel<br />

Neutral<br />

Telco<br />

Underweight<br />

We remain positive on <strong>the</strong> outlook of Malaysia oil and gas sector given Petronas’<br />

resilient capex and recovery of crude oil price. The key concern for <strong>the</strong> sector is on<br />

<strong>the</strong> rollout of new projects, which has been delayed over <strong>the</strong> last few months.<br />

Never<strong>the</strong>less, we expect stronger contract flow in 4Q09 as Petronas has<br />

traditionally awarded most of <strong>the</strong> new projects towards year end. The continuous<br />

contract flow will help to enhance earnings visibility and benefit oil and gas players,<br />

especially those with captive market (such as Alam for Malaysian flagged vessels)<br />

and those with niche market such as KNM and Wah Seong for <strong>the</strong>ir exposure in<br />

process equipment and deep water pipe coating. Valuation of oil and gas stocks is<br />

reasonable, trading closer to <strong>the</strong>ir respective normalised mid-cycle valuation, but<br />

still decent at sector average 9x CY10 PE against sector average CY06-10 CAGR of<br />

22%.<br />

We expect 4Q09 palm oil price to rebound on seasonally slower palm oil supply<br />

growth and run down in US soybean oil inventory. However, as most plantation<br />

stocks have not moved in-tandem with CPO price’s current correction, we<br />

recommend investors to remain selective.<br />

Sales expected to remain robust driven by record low mortgage rates, incentives<br />

offered by developers, and improving consumer sentiments. Developers may bring<br />

forward launches and raise ASPs – leading to faster earnings recovery.<br />

Potential risks: a) Sustainability of sales if interest rates rise and developers pull-back<br />

incentives, and b) Higher construction cost as raw material prices recover –<br />

potential margin squeeze if not passed on to buyers.<br />

Steel demand is improving underpinned by re-stocking activities, which is expected<br />

to last ano<strong>the</strong>r 4 months (till <strong>the</strong> end of <strong>the</strong> year). Most steel mills have increased<br />

<strong>the</strong>ir plant utilisation (for example, Kinsteel's upstream utilisation was lifted from<br />

50% to 100% and, Sou<strong>the</strong>rn Steel’s overall utilisation was also raised from <strong>the</strong><br />

previous low of 50%). In terms of new demand expected from government pump<br />

priming, we think meaningful contributions will flow in only next year. Overall, <strong>the</strong><br />

current healthy steel demand would support steel prices. Our key concern remains<br />

<strong>the</strong> timely award and execution of <strong>the</strong> various government projects. We<br />

recommend Hold on Kinsteel (TP RM0.85) and Sou<strong>the</strong>rn Steel (TP RM1.75).<br />

While competition in 1H09 centred on new broadband plans as well as iPhones and<br />

BlackBerrys, focus shifted back to prepaid voice plans in 3Q09. Celcom launched<br />

new plans that offer very cheap 12 sen/minute calls that led Digi to react in similar<br />

fashion. As usual, terms and conditions apply. Meanwhile, TuneTalk launched its<br />

cellular voice service in Aug09, with very attractive 25 sen/minute tariff. However,<br />

TuneTalk has limited distribution channel currently.<br />

We expect telcos to register a spike in volume during <strong>the</strong> Hari Raya season in<br />

Sep09, with even larger traffic volume in <strong>the</strong> seasonally high 4Q09. The key<br />

concern now is that a potential change in management of U Mobile could disrupt<br />

<strong>the</strong> competitive landscape in Malaysia, which is still rational. Among <strong>the</strong> telco<br />

stocks, we prefer TM for its commitment of 20 sen net DPS or c. 6% yield.<br />

However, Maxis, which is expected to be listed before <strong>the</strong> year-end, could put<br />

downward pressure on telco stock prices as investors rebalance <strong>the</strong>ir telco exposure<br />

in Malaysia towards Maxis.<br />

Alam Maritim<br />

KL Kepong<br />

SP Setia<br />

E&O<br />

DNP<br />

Sou<strong>the</strong>rn Steel<br />

TM<br />

Page 104