Dixons Group plc - The Dixons Stores Group Image Server

Dixons Group plc - The Dixons Stores Group Image Server

Dixons Group plc - The Dixons Stores Group Image Server

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Interim statement 2000/2001

Adding value<br />

Our business is about adding value: shareholder value, customer value, brand value.<br />

We add value to our businesses by continual innovation in the creation of new brands and concepts, by<br />

being the first with the latest, most exciting new technologies at the best prices, by offering expert<br />

comprehensive service, by continually improving the efficiency of our operations and by selecting the best<br />

sites for our stores, the best manufacturers for our products and the best staff.<br />

Contents<br />

Financial highlights 1<br />

Chairman’s statement 2<br />

Consolidated profit and loss account 6<br />

Statement of total recognised gains and losses 7<br />

Consolidated balance sheet 8<br />

Consolidated cash flow statement 9<br />

Notes to the interim financial report 10<br />

Retail sales analysis and store data 18<br />

General information 19

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 1<br />

Financial<br />

highlights<br />

• <strong>Group</strong> turnover (excluding Freeserve) increased by 27% to £2.2 billion (1999/00 £1.7 billion), up 4 % like for like<br />

• Underlying operating profit (before exceptional items and Freeserve losses) £93.1 million (£77.8 million), an increase of<br />

20%, largely reflecting a strong performance from the new international businesses<br />

• Underlying profit before tax (before exceptional items and Freeserve losses) £90.8 million (1999/00 £92.5 million)<br />

• Interim dividend of 1.25 pence per ordinary share (1.05 pence), an increase of 19 %<br />

• International operations in 12 countries contributed around 25% of operating profits<br />

• Shortly after the half-year end, a recommended offer for Freeserve by Wanadoo was announced. As at 8 January 2001,<br />

this values <strong>Dixons</strong> shareholding in Freeserve at over £880 million<br />

• Retail sales for 8 weeks to 6 January 2001 up 19%; 6% like for like

2 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Chairman’s<br />

Statement<br />

Results and dividends<br />

<strong>Group</strong> turnover (excluding Freeserve) for the 28<br />

weeks ended 11 November 2000 increased by<br />

27% to £2.2 billion (1999/00 £1.7 billion),<br />

reflecting continued strong growth in the UK<br />

and the inclusion of our recently acquired<br />

international retail businesses. Like for like<br />

sales across the <strong>Group</strong> were ahead 4%.<br />

Underlying operating profit (before exceptional<br />

items and Freeserve losses) grew by 20% to<br />

£93.1 million (£77.8 million). Interest payable,<br />

excluding Freeserve, was £2.3 million against<br />

interest receivable of £14.7 million in the first<br />

half of 1999/00. <strong>The</strong> reduction resulted<br />

principally from the acquisition for cash of<br />

Elkjøp and Ei System, and the return of<br />

approximately £160 million to shareholders in<br />

the second half of last year.<br />

Underlying profit before tax (before exceptional<br />

items and Freeserve losses) for the first half was<br />

£90.8 million (£92.5 million). Adjusted diluted<br />

earnings per ordinary share were 3.4 pence<br />

(3.5 pence).<br />

Including Freeserve and exceptional items,<br />

profit before tax was £51.9 million, compared to<br />

£299.4 million in the prior year. <strong>The</strong> prior year<br />

figure reflects an exceptional profit of £219<br />

million recognised on the flotation of Freeserve.<br />

In the current year, the net exceptional charge<br />

of £2.1 million comprises a charge of £9.7<br />

million relating to the restructuring of the<br />

<strong>Group</strong>’s store portfolio and service operations,<br />

partially offset by a credit of £7.6 million on the<br />

issue of additional shares by Freeserve.<br />

<strong>The</strong> directors have declared an interim dividend<br />

of 1.25 pence per ordinary share (1.05 pence),<br />

an increase of 19%, payable on 5 March 2001<br />

to shareholders registered on 2 February 2001.<br />

UK retail<br />

<strong>The</strong> UK Retail division made an operating profit<br />

before exceptional items of £74.2 million<br />

(£73.5 million), an increase of 1%. Total sales in<br />

the period increased by 11% to £1,845 million<br />

(£1,656 million), with like for like sales 2.3%<br />

higher than in the first 28 weeks of 1999/00.<br />

Underlying gross margins continued at a similar<br />

level to the second half of last year, although<br />

this, as anticipated, represented a year on year<br />

decline of 1.3 percentage points of gross<br />

margin. <strong>The</strong> division improved cost to sales<br />

ratios by a further 0.9 percentage points,

thereby offsetting most of the margin pressure<br />

and providing an increase in profit against<br />

demanding comparatives.<br />

<strong>The</strong> markets in which the UK Retail division<br />

operates grew in value by 2%, with some of our<br />

markets slowing in autumn, reflecting weaker<br />

consumer confidence following the petrol crisis<br />

and floods. <strong>The</strong> brown goods market was<br />

strong, with growth in new technologies, such<br />

as widescreen TV and DVD being partially offset<br />

by a further decline in the games market ahead<br />

of the launch of the new generation of games<br />

consoles. <strong>The</strong> PC market was weaker,<br />

although those for laptop and portable PCs<br />

grew. <strong>The</strong> domestic appliance market grew<br />

slightly. <strong>The</strong> mobile phone market continued to<br />

expand against strong sales last year. <strong>The</strong> UK<br />

Retail division gained further market share, with<br />

all brands recording increases.<br />

<strong>Dixons</strong> sales, at £378 million (£361 million),<br />

were up 5% overall and 2% like for like. Good<br />

sales growth was achieved in laptop PCs and<br />

digital cameras and camcorders, although the<br />

games market had another difficult period<br />

ahead of the launch of PlayStation 2. Sixty-one<br />

stores were converted to the new <strong>Dixons</strong> 21<br />

concept, which facilitates self-selection of lower<br />

ticket products, thereby releasing sales staff to<br />

help customers purchasing more complex, new<br />

technology products. This new format has<br />

proved successful, providing both improved<br />

sales and better cost ratios. Further<br />

conversions are planned. Three new stores<br />

were opened in the period and a further 3 were<br />

re-sited. Thirteen smaller stores were either<br />

closed or converted to <strong>The</strong> Link.<br />

Currys sales were £705 million (£685 million), an<br />

increase of 3% in total, although 2% lower on a<br />

like for like basis. Six new Currys Marketplace<br />

stores were opened, offering greater selfservice<br />

on smaller ticket items, with increased<br />

availability of take-away stock. This concept is<br />

being further developed and many of its<br />

features are being incorporated into existing<br />

stores. In total, 15 stores were opened or resited,<br />

including the UK’s largest electrical<br />

superstore of 55,000 square feet near<br />

Birmingham.<br />

<strong>The</strong> period saw the introduction of a number of<br />

other changes at Currys. New advertising that<br />

emphasised that Currys was ‘Britain’s Biggest<br />

for Low Prices’ was introduced. This was<br />

reinforced by a team of independent<br />

researchers checking Currys prices against<br />

competitors on a weekly basis and by a<br />

programme of aggressive price promotions on<br />

a wide range of products.<strong>The</strong> changes being<br />

made to Currys have been positive. Although<br />

somewhat disruptive in the short-term, they will<br />

provide long-term benefits.<br />

PC World sales grew by 22% to £546 million.<br />

Like for like sales increased by 5%. Despite a<br />

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 3<br />

4% decline in the PC market, PCs increased<br />

their proportion of total sales. In addition to<br />

providing the latest PC technology at market<br />

beating prices, PC World continues to offer an<br />

unrivalled range of products and level of service.<br />

PC Clinics, which provide a 7-day a week PC<br />

repair and upgrade service, were introduced<br />

into all stores. Among its services, PC<br />

Healthcheck, which checks and optimises the<br />

performance of the customer’s computer, has<br />

proved particularly popular. In addition to many<br />

other problems found, computer viruses have<br />

been discovered and treated on 25% of PCs<br />

receiving a Healthcheck.<br />

Ten new PC World Superstores were opened in<br />

the first half, bringing the total number of stores<br />

to 91. A further six stores are expected to open<br />

in the second half of this financial year.<br />

PC World Business continued to achieve strong<br />

growth in a difficult business market with sales<br />

up 44% at £77 million (including internet sales).<br />

In the second half of this financial year, PC<br />

World Business will relocate its head office to a<br />

purpose built site near Manchester. It will also<br />

implement new enterprise-wide systems. This<br />

investment will provide a sound base for future<br />

growth and allow the PC World brand to attain<br />

clear leadership in the small and medium sized<br />

business sector, matching its position in the<br />

consumer market.

4 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

<strong>The</strong> Link had a very strong period, gaining<br />

market share in an expanding mobile phone<br />

market. Sales were £177 million (£125 million),<br />

an increase of 41% in total and 18 % on a like<br />

for like basis. This sales growth reflects an<br />

increase of 60% in mobile connections, being<br />

partially offset by declining prices in a highly<br />

competitive market. Penetration of mobile<br />

phones in the UK is now estimated to be in<br />

excess of 65%. Increasingly this market’s<br />

performance will be dependent on new<br />

handset designs and the introduction of new<br />

technology, which should increase the use of<br />

mobiles for data communication. <strong>The</strong> Link, as<br />

the UK’s leading mobile communication<br />

specialist, is in a strong position to capitalise on<br />

these developments.<br />

Twenty-six new stores were opened in the<br />

period, taking the total to 244. <strong>The</strong> new store<br />

openings included eight stores converted from<br />

<strong>Dixons</strong> and Currys High Street fascias.<br />

International retail<br />

<strong>The</strong> International Retail division achieved an<br />

operating profit of £15.7 million (loss £0.4<br />

million) on sales of £283 million. Like for like<br />

sales were ahead by 18%.<br />

<strong>The</strong> increase in profit was largely attributable to<br />

the inclusion of our Nordic business, Elkjøp,<br />

which was acquired on 29 November 1999.<br />

Elkjøp’s sales in the first half were £250 million,<br />

representing an increase of 20% on a like for<br />

like basis. Elkjøp opened an additional seven<br />

stores, including four more in Sweden and a<br />

further two stores in Finland. During the period<br />

Elkjøp completed the planned sale of Snehvide,<br />

its Danish chain of 33 high street white goods<br />

stores. This will allow Elkjøp to concentrate on<br />

expanding its superstore operations in<br />

Denmark.<br />

Elkjøp is a fast growing retailer with significant<br />

potential for further expansion. A number of<br />

store openings are planned over the next few<br />

years, which will reinforce its market leadership<br />

across the Nordic region.<br />

In Spain, Ei System retail operations also<br />

achieved good growth with like for like sales<br />

ahead by 17%. Sales benefited from an<br />

expansion in product range and more effective<br />

marketing. Shortly after the end of the halfyear,<br />

three of the Madrid stores were refitted<br />

leading to strong sales growth. A number of<br />

new, larger out of town stores are planned in<br />

the next financial year.<br />

Sales in the Republic of Ireland grew by 24% to<br />

£20 million. Like for like sales growth of 4%<br />

was affected by the opening of new stores<br />

within the catchment of the existing store base.<br />

A further two stores are planned to open in the<br />

second half of the current financial year with<br />

further openings thereafter, particularly in<br />

markets outside Dublin.<br />

Internet services<br />

<strong>The</strong> <strong>Group</strong>’s Internet Services division<br />

comprises Freeserve and the electronic<br />

commerce activities of our retail brands.<br />

Freeserve has established itself as the UK’s<br />

leading internet brand. An operating loss of £27<br />

million was consolidated in the <strong>Group</strong>’s results,<br />

on turnover up 319% at £30 million. <strong>The</strong><br />

number of active registered users grew to over<br />

2 million, who in aggregate spent 7.8 billion<br />

minutes on-line in the first 28 weeks of the<br />

financial year.<br />

On 6 December 2000, it was announced that<br />

<strong>Dixons</strong> had reached agreement with the boards<br />

of Wanadoo S.A., a subsidiary of France<br />

Telecom, and Freeserve on the terms of a<br />

recommended share exchange offer for<br />

Freeserve. <strong>The</strong> offer of 0.225 of a New<br />

Wanadoo Share for each Freeserve share<br />

values <strong>Dixons</strong> shareholding as at 8 January<br />

2001 at over £880 million. Pursuant to this<br />

offer, the Board of <strong>Dixons</strong> <strong>Group</strong> has<br />

undertaken to accept the Wanadoo offer in<br />

relation to the <strong>Group</strong>’s shareholding in<br />

Freeserve, conditional on the approval of<br />

shareholders at an Extraordinary General<br />

Meeting to be held on 11 January 2001.<br />

Freeserve was launched by the <strong>Group</strong> in<br />

September 1998 with a total investment of<br />

£240,000. <strong>The</strong> value realised from Wanadoo’s<br />

offer, together with £120 million previously

ealised from the sale of shares in Freeserve<br />

represents significant shareholder value<br />

creation. While the <strong>Group</strong> anticipates remaining<br />

a long-term shareholder in Wanadoo, the<br />

transaction provides the <strong>Group</strong> with significant<br />

flexibility over its investment and enables the<br />

<strong>Group</strong> to focus resources on further expansion<br />

of its retail businesses.<br />

Turnover from the <strong>Group</strong>’s e-commerce<br />

activities increased by over 600% to £10.8<br />

million . <strong>The</strong> strongest growth came from PC<br />

World Business’ e-commerce operations, with<br />

sales increasing by 852% to £5.8 million,<br />

underlining the particular attraction of electronic<br />

commerce to the business-to-business market.<br />

As expected, losses from the Internet Services<br />

division (excluding Freeserve) increased to £4.4<br />

million (£1.6 million), reflecting significant pre<br />

start-up costs relating to new internet<br />

operations for Currys, <strong>The</strong> Link and PC City, a<br />

new venture in France. Fully transactional web<br />

sites for these brands, backed up by<br />

sophisticated end-to-end product, customer<br />

management and fulfilment systems, were<br />

launched in December. <strong>The</strong> PC City website will<br />

be complemented by PC superstores in<br />

France, the first of which is expected to open in<br />

the second half of the next financial year.<br />

<strong>The</strong> <strong>Group</strong>’s e-commerce operations allow our<br />

customers to shop or browse on the internet in<br />

addition to being able to purchase through<br />

stores or mail order. Experience to date<br />

reinforces our conviction that multi-channel<br />

retailing is the most cost effective business<br />

model and provides the strongest customer<br />

proposition. We believe that our offering and<br />

infrastructure will enable the <strong>Group</strong> to become<br />

the market leader in on-line retailing as it is<br />

through the traditional channels.<br />

In September, the <strong>Group</strong> sold @jakarta, a<br />

games specialist, to gameplay <strong>plc</strong>, in return for<br />

an initial 12.5% shareholding. Gameplay is one<br />

of Europe’s leading gaming companies selling<br />

games software and multi-player gaming on the<br />

internet, interactive TV and mobile phones.<br />

European property<br />

<strong>The</strong> European Property division had another<br />

strong period with operating profits increasing<br />

by 21% to £7.6 million (£6.3 million) on sales of<br />

£35 million (£39 million). Operating assets<br />

employed were £50.4 million (£61.1 million).<br />

Good progress has been made in Belgium,<br />

France and Luxembourg, where Codic’s<br />

business is now concentrated and where a<br />

number of new projects are planned. <strong>The</strong><br />

division continued to manage the level of<br />

property stock tightly in order to limit risk.<br />

Financial position<br />

At the end of the period, the <strong>Group</strong> had net<br />

funds of £30 million. Excluding amounts held<br />

under trust to fund extended warranty liabilities<br />

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 5<br />

and funds held by Freeserve, net borrowings<br />

were £359 million (net funds of £403 million).<br />

<strong>The</strong> reduced level of funds reflects the<br />

acquisition for cash of Elkjøp and Ei System<br />

together with the return to shareholders of<br />

approximately £160 million of cash in the<br />

second half of the last financial year. <strong>The</strong> <strong>Group</strong><br />

continues to invest in expansion and<br />

enhancement of its store portfolio, systems and<br />

support infrastructure with capital expenditure<br />

in the current financial year expected to be in<br />

excess of £200 million.<br />

Christmas trading<br />

In the eight weeks ending 6 January 2001,<br />

<strong>Group</strong> retail sales increased in total by 19% and<br />

by 6% on a like for like basis. Our international<br />

businesses continued to perform well. In the<br />

UK, sales of mobile phones and digital products<br />

grew strongly. <strong>The</strong> year on year gross margin<br />

decline experienced in the first half narrowed<br />

significantly over the Christmas period. Gross<br />

margins in the UK Retail division were slightly<br />

lower than last year. We anticipate another<br />

satisfactory year.<br />

Sir Stanley Kalms<br />

Chairman<br />

10 January 2001

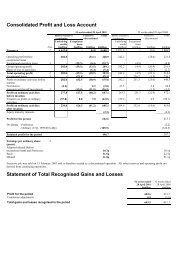

6 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Consolidated Profit and Loss Account<br />

28 weeks ended 11 November 2000<br />

28 weeks ended 13 November 1999<br />

52 weeks<br />

ended<br />

Before Freeserve<br />

Before Freeserve<br />

29 April<br />

2000<br />

Underlying Exceptional Underlying Exceptional<br />

results items Freeserve Total results items Freeserve Total Total<br />

Note £million £million £million £million £million £million £million £million £million<br />

Turnover 2 2,174.0 - 30.2 2,204.2 1,713.5 - 7.2 1,720.7 3,889.9<br />

Continuing operations 93.1 - (23.2) 69.9 77.8 - (10.0) 67.8 221.8<br />

Exceptional operating items - (9.7) (0.4) (10.1) - (4.9) - (4.9) (4.9)<br />

<strong>Group</strong> operating profit 93.1 (9.7) (23.6) 59.8 77.8 (4.9) (10.0) 62.9 216.9<br />

Share of loss of associates - - (3.3) (3.3) - - - - (2.7)<br />

Total operating profit 2 93.1 (9.7) (26.9) 56.5 77.8 (4.9) (10.0) 62.9 214.2<br />

Exceptional items 3 - 7.6 - 7.6 - 224.0 (3.6) 220.4 234.3<br />

Profit on ordinary activities before<br />

interest 93.1 (2.1) (26.9) 64.1 77.8 219.1 (13.6) 283.3 448.5<br />

Net interest 4 (2.3) - 1.6 (0.7) 14.7 - 1.4 16.1 24.9<br />

Amounts written off investments - - (11.5) (11.5) - - - - (1.3)<br />

Profit on ordinary activities<br />

before taxation 90.8 (2.1) (36.8) 51.9 92.5 219.1 (12.2) 299.4 472.1<br />

Taxation on profit on ordinary activities 5 (20.2) 1.9 6.3 (12.0) (22.1) 0.7 2.5 (18.9) (54.1)<br />

Profit on ordinary activities<br />

after taxation 70.6 (0.2) (30.5) 39.9 70.4 219.8 (9.7) 280.5 418.0<br />

Equity minority interests 1.4 (1.5) (4.3)<br />

Profit for the period 41.3 279.0 413.7<br />

Dividends - Preference 6 - (2.2) (2.2)<br />

Dividends - Ordinary 6 (24.1) (56.6) (124.3)<br />

Retained profit for the period 17.2 220.2 287.2<br />

Earnings per ordinary share<br />

(pence) 7<br />

Adjusted diluted (before exceptional 3.4p 3.5p 10.1p<br />

items and Freeserve)<br />

Basic 2.2p 15.7p 22.5p<br />

Diluted 2.1p 14.2p 21.1p

Statement of Total Recognised Gains and Losses<br />

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 7<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

£million £million £million<br />

Profit for the period 41.3 279.0 413.7<br />

Translation adjustments 1.3 (0.2) (2.6)<br />

Total gains and losses recognised in the period 42.6 278.8 411.1

8 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Consolidated Balance Sheet<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

Note £million £million £million<br />

Fixed assets<br />

Intangible assets 463.1 3.4 443.3<br />

Tangible assets 550.2 387.1 501.0<br />

Investments 94.7 14.6 85.8<br />

1,108.0 405.1 1,030.1<br />

Current assets<br />

Stocks 8 795.7 609.9 512.5<br />

Debtors 398.1 292.0 358.3<br />

Investments 672.1 864.9 788.8<br />

Cash at bank and in hand 61.8 185.1 103.9<br />

1,927.7 1,951.9 1,763.5<br />

Creditors - due within one year<br />

Borrowing (97.6) (46.7) (68.8)<br />

Other creditors (991.7) (873.4) (878.4)<br />

(1,089.3) (920.1) (947.2)<br />

Net current assets 838.4 1,031.8 816.3<br />

Total assets less current liabilities 1,946.4 1,436.9 1,846.4<br />

Creditors - due after more than one year<br />

Borrowing (606.0) (199.3) (556.9)<br />

Other creditors (249.5) (182.4) (233.8)<br />

(855.5) (381.7) (790.7)<br />

Provisions for liabilities and charges (44.2) (34.7) (36.5)<br />

2 1,046.7 1,020.5 1,019.2<br />

Equity shareholders’ funds 9 1,003.4 986.0 977.0<br />

Equity minority interests 43.3 34.5 42.2<br />

1,046.7 1,020.5 1,019.2

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 9<br />

Consolidated Cash Flow Statement<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

Note £million £million £million<br />

Net cash (outflow)/inflow from operating activities 11 (33.0) 140.9 422.5<br />

Returns on investments and servicing of finance<br />

Interest received 39.7 24.4 53.2<br />

Interest paid (41.1) (1.8) (31.7)<br />

Preference dividends paid 1- (2.2) (4.4)<br />

(1.4) 20.4 17.1<br />

Taxation paid (9.7) (1.0) (24.5)<br />

Capital expenditure and financial investment<br />

Purchase of fixed asset investments (9.1) (13.0) (28.5)<br />

Purchase of tangible assets (109.7) (64.6) (200.5)<br />

Sale of tangible assets 0.1 10.1 25.5<br />

Loans to related undertakings 1- 1- (0.2)<br />

(118.7) (67.5) (203.7)<br />

Acquisitions and disposals<br />

Cash consideration for acquisitions (1.9) (2.2) (467.0)<br />

Net cash acquired with subsidiaries 1- 0.1 1.5<br />

Cash consideration for partial sales of subsidiaries 3 7.6 242.2 251.7<br />

Cash consideration for acquisition of associates 0.2 1- (9.5)<br />

5.9 240.1 (223.3)<br />

Equity dividends paid (67.8) (53.4) (107.7)<br />

Net cash (outflow)/inflow before management of liquid resources<br />

and financing (224.7) 279.5 (119.6)<br />

Management of liquid resources<br />

Decrease/(increase) in current asset investments 117.6 (117.7) (44.5)<br />

Financing<br />

Issue of ordinary share capital 7.9 11.1 15.2<br />

Return of capital to shareholders 1- 1- (121.1)<br />

(Decrease)/increase in debt due within one year (42.9) (1.8) 28.9<br />

Increase/(decrease) in debt due after more than one year 28.4 (3.3) 337.8<br />

(6.6) 6.0 260.8<br />

(Decrease)/increase in cash in the period 12 (113.7) 167.8 96.7

10 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Notes to the Interim Financial Report<br />

1 Basis of preparation<br />

<strong>The</strong> interim financial report has been prepared using accounting policies consistent with those set out in the financial statements for the 52 weeks ended 29 April 2000.<br />

<strong>The</strong> interim financial report does not constitute statutory accounts within the meaning of section 240 of the Companies Act 1985. It is unaudited but has been reviewed by the<br />

auditors. <strong>The</strong>ir report is on page 17.<br />

<strong>The</strong> financial information for the 52 weeks ended 29 April 2000 has been extracted from the financial statements for that period. Those statements, which contain an unqualified<br />

auditors’ report, have been delivered to the Registrar of Companies.<br />

<strong>The</strong> Interim Statement for the 28 weeks ended 11 November 2000 was approved by the directors on 10 January 2001.<br />

2 Segmental analysis of turnover and operating profit<br />

28 weeks 2000/01 28 weeks 1999/00 52 weeks 1999/00<br />

Operating Operating Operating<br />

Turnover profit Turnover profit Turnover profit<br />

£million £million £million £million £million £million<br />

UK Retail - base 1,845.4 74.2 1,655.8 73.5 3,552.7 226.9<br />

- exceptional 1- (9.7) 1- (4.9) 1- (4.9)<br />

International Retail 283.2 15.7 16.3 (0.4) 244.4 10.4<br />

Internet Services - base 41.0 (30.9) 10.8 (11.6) 30.6 (28.3)<br />

- exceptional 1- (0.4) 1- 1- 1- 1-<br />

European Property 35.3 7.6 38.6 6.3 63.8 10.1<br />

Intra group (0.7) 1- (0.8) 1- (1.6) 1-<br />

2,204.2 56.5 1,720.7 62.9 3,889.9 214.2<br />

Segmental analysis of net assets<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

£million £million £million<br />

UK Retail 457.4 286.8 256.3<br />

International Retail - base 173.3 8.4 178.0<br />

International Retail - goodwill 426.9 1- 405.5<br />

Internet Services 55.2 10.4 18.7<br />

European Property 50.4 61.1 50.1<br />

Net operating assets 1,163.2 366.7 908.6<br />

Net non-operating liabilities (146.8) (150.2) (156.4)<br />

Net funds 30.3 804.0 267.0<br />

Net assets 1,046.7 1,020.5 1,019.2

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 11<br />

2 Segmental analysis (continued)<br />

All turnover and operating profit are derived from continuing operations.<br />

Net non-operating liabilities comprise dividends payable, corporation tax, overseas taxation and deferred taxation balances and other non-operating assets and liabilities.<br />

Net funds include cash and investments of £337.9 million (13 November 1999 £304.0 million, 29 April 2000 £279.3 million) held under trust to fund extended warranty liabilities.<br />

Excluding amounts held under trust to fund extended warranty liabilities and Freeserve funds, net borrowing was £358.8 million (13 November 1999 net funds £402.8 million,<br />

29 April 2000 net borrowing £75.8 million).<br />

3 Exceptional items<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

Included within operating profit:<br />

Restructuring of store portfolio and service operations (9.7) 1- 1-<br />

Expenses incurred by Freeserve with respect to potential sale (0.4) 1- 1-<br />

Year 2000 costs 1- (1.6) (1.6)<br />

Integration of prior years’ acquisitions 1- (3.3) (3.3)<br />

(10.1) (4.9) (4.9)<br />

Exceptional items<br />

Exceptional profit on partial sales<br />

- Freeserve <strong>plc</strong> 7.6 220.4 238.3<br />

- Partial sale of <strong>The</strong> Link <strong>Stores</strong> in 1996/97 1- 1- 7.5<br />

7.6 220.4 245.8<br />

Exceptional costs of the corporate restructuring 1- 1- (11.5)<br />

7.6 220.4 234.3<br />

<strong>The</strong> provision for restructuring the store portfolio and service operations comprises disposal costs of stores and redundancy costs of service engineers.<br />

Consolidated net gains in the period arose on deemed disposals in respect of shares issued by Freeserve <strong>plc</strong> to Energis <strong>plc</strong> as part of the Subscription Agreement entered into in<br />

July 1999, and on shares issued by Freeserve <strong>plc</strong> in respect of its acquisition of Intracus Limited. Exceptional profit on partial sale in 1999/00 arose largely as a result of the initial<br />

public offering of a minority interest in Freeserve <strong>plc</strong>.

12 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Notes to the Interim Financial Report (continued)<br />

4 Net interest<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

Interest receivable and similar income 32.1 26.4 54.5<br />

Interest payable on bank loans, overdrafts and other loans repayable within<br />

five years (33.2) (10.6) (30.4)<br />

(1.1) 15.8 24.1<br />

Interest capitalised 0.4 0.3 0.8<br />

(0.7) 16.1 24.9<br />

5 Taxation on profit on ordinary activities<br />

<strong>The</strong> taxation charge on profit on ordinary activities before Freeserve and exceptional items is based on the estimated effective rate of taxation of 22.2% for the 52 weeks ending<br />

28 April 2001. Taxation on exceptional items comprises an estimated taxation credit of £1.9 million on the provision for restructuring the store portfolio and service operations.<br />

<strong>The</strong> taxation credit in respect of Freeserve comprises losses available for surrender within the <strong>Group</strong>.<br />

6 Dividends<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

Special interim of 1.875 pence paid in 1999/00 - 36.3 36.2<br />

Interim of 1.25 pence proposed (1999/00 1.05 pence) 24.1 20.3 20.3<br />

Final for 1999/00 of 3.55 pence paid - - 67.8<br />

Ordinary dividends paid and proposed 24.1 56.6 124.3<br />

Preference dividends paid - 2.2 2.2<br />

24.1 58.8 126.5<br />

As a result of the conversion of the Preference shares into ordinary shares the Preference dividend paid on 31 July 1999 was the final such payment. For ordinary dividends<br />

declared before 8 March 2000, the dividend per share has been restated to reflect the notional four for one share split effective at that date.

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 13<br />

7 Earnings per ordinary share<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

Profit for the period 41.3 279.0 413.7<br />

Preference dividends 1- (2.2) (2.2)<br />

Basic earnings 41.3 276.8 411.5<br />

Preference dividends 1- 2.2 2.2<br />

Diluted earnings 41.3 279.0 413.7<br />

Freeserve results, net of taxation 30.5 9.7 18.6<br />

Freeserve minority interest (7.0) (0.7) (2.5)<br />

Exceptional items, net of taxation 0.2 (219.8) (232.0)<br />

Adjusted diluted earnings (before exceptional items and Freeserve) 65.0 68.2 197.8<br />

Million Million Million<br />

Basic weighted average number of shares 1,911.1 1,759.2 1,829.6<br />

Convertible Preference shares 1- 168.8 96.6<br />

Employee share options and incentive schemes 28.9 39.2 39.1<br />

Diluted weighted average number of shares 1,940.0 1,967.2 1,965.3<br />

Pence Pence Pence<br />

Basic earnings per ordinary share 2.2 15.7 22.5<br />

Diluted earnings per ordinary share 2.1 14.2 21.1<br />

Exceptional items, net of taxation 1- (11.2) (11.8)<br />

Freeserve results, net of taxation and minority interests 1.3 0.5 0.8<br />

Adjusted diluted earnings per ordinary share 3.4 3.5 10.1<br />

Diluted earnings per ordinary share are calculated on the assumption that applicable outstanding share options were exercised on the first day of the period or the date of grant if<br />

later.<br />

<strong>The</strong> calculation of the weighted average number of shares has been made on the basis that the notional four for one share split effective from 8 March 2000 was in existence<br />

throughout the current and prior periods.

14 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Notes to the Interim Financial Report (continued)<br />

8 Stocks<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

£million £million £million<br />

Finished goods and goods for resale 756.3 565.6 470.6<br />

Properties held for development or resale 39.4 44.3 41.9<br />

795.7 609.9 512.5<br />

9 Shareholders’ funds<br />

Ordinary Share Capital Profit<br />

share premium Capital Merger reduction and loss<br />

capital account reserve reserve reserve account Total<br />

£million £million £million £million £million £million £million<br />

At 29 April 2000 47.7 50.2 121.2 (386.1) 425.5 718.5 977.0<br />

Retained profit 1- 1- 1- 1- 1- 17.2 17.2<br />

Translation adjustments 1- 1- 1- 1- 1- 1.3 1.3<br />

Transfer to capital reserve 1- 1- 7.6 1- 1- (7.6) 1-<br />

Ordinary shares issued:<br />

Share options - employees 0.2 7.7 1- 1- 1- 1- 7.9<br />

- employee trusts 1- 6.9 1- 1- 1- (6.9) 1-<br />

At 11 November 2000 47.9 64.8 128.8 (386.1) 425.5 722.5 1,003.4<br />

10 Reconciliation of movements in shareholders’ funds<br />

11 November 13 November 29 April<br />

2000 1999 2000<br />

£million £million £million<br />

Opening shareholders’ funds 977.0 754.9 754.9<br />

Profit for the period 41.3 279.0 413.7<br />

Dividends - Preference 1- (2.2) (2.2)<br />

- Ordinary (24.1) (56.6) (124.3)<br />

17.2 220.2 287.2<br />

Other recognised gains and losses relating to the period 1.3 (0.2) (2.6)<br />

Return of capital to shareholders 1- 1- (121.1)<br />

Ordinary shares issued:<br />

Share options 7.9 11.1 15.2<br />

On acquisitions 1- 1- 43.4<br />

Net additions to shareholders’ funds 26.4 231.1 222.1<br />

Closing shareholders’ funds 1,003.4 986.0 977.0

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 15<br />

11 Net cash (outflow)/inflow from operating activities<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

Operating profit 56.5 62.9 214.2<br />

Provisions for exceptional operating items 10.1 4.9 4.9<br />

Utilisation of provisions for exceptional costs (0.8) (5.4) (9.2)<br />

Depreciation 46.4 40.3 81.8<br />

Loss on disposal of fixed assets 3.8 1- (4.2)<br />

Amortisation of goodwill 1.8 0.2 0.9<br />

Amortisation of own shares 0.3 0.2 1.5<br />

Shares retained in lieu of income tax liability 1- 1- (0.5)<br />

Increase in stocks (278.4) (183.5) (18.1)<br />

Increase in debtors (50.7) (3.8) (0.9)<br />

Increase in creditors 178.0 225.1 152.1<br />

(33.0) 140.9 422.5<br />

12 Reconciliation of net cash flow to movement in net funds<br />

28 weeks 28 weeks 52 weeks<br />

2000/01 1999/00 1999/00<br />

£million £million £million<br />

(Decrease)/increase in cash in the period (113.7) 167.8 96.7<br />

(Decrease)/increase in current asset investments (117.6) 117.7 44.5<br />

Decrease/(increase) in debt due within one year 42.9 1.8 (28.9)<br />

(Increase)/decrease in debt due after more than one year (28.4) 3.3 (337.8)<br />

(Decrease)/increase in net funds resulting from cash movements (216.8) 290.6 (225.5)<br />

Loans acquired with subsidiaries 1- 1- (46.0)<br />

Other adjustments (0.1) 1.2 (0.3)<br />

Translation adjustments (19.8) 0.3 26.9<br />

Movement in net funds in the period (236.7) 292.1 (244.9)<br />

Opening net funds 267.0 511.9 511.9<br />

Closing net funds 30.3 804.0 267.0

16 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

Notes to the Interim Financial Report (continued)<br />

13 Analysis of movement in net funds<br />

29 April Other Translation 11 November<br />

2000 Cash flow adjustments adjustments 2000<br />

£million £million £million £million £million<br />

Cash at bank and in hand 103.9 (42.7) 1- 0.6 61.8<br />

Overdrafts (15.0) (71.0) 1- (0.6) (86.6)<br />

(113.7)<br />

Current asset investments 788.8 (117.6) 1- 0.9 672.1<br />

Debt due within one year (53.8) 42.9 1- (0.1) (11.0)<br />

Debt due after more than one year (556.9) (28.4) (0.1) (20.6) (606.0)<br />

Net funds 267.0 (216.8) (0.1) (19.8) 30.3<br />

14 Post balance sheet event<br />

On 6 December 2000, the boards of Freeserve <strong>plc</strong>, Wanadoo S.A. and <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> announced that they had reached agreement on the terms of a recommended share<br />

exchange offer by Wanadoo for the entire issued and to be issued ordinary share capital of Freeserve <strong>plc</strong>. <strong>The</strong> offer will be made on the basis of 0.225 of a Wanadoo share for<br />

each Freeserve share. As at 8 January 2001, this values the <strong>Group</strong>’s holding in Freeserve at over £880 million. <strong>The</strong> <strong>Group</strong> is seeking the approval of <strong>Dixons</strong> shareholders at an<br />

Extraordinary General Meeting to be held on 11 January 2001.

Independent Review Report by the Auditors<br />

To <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 17<br />

Introduction<br />

We have been instructed by the company to review the financial information set out on pages 6 to 16 and we have read the other information contained in the interim report and<br />

considered whether it contains any apparent misstatements or material inconsistencies with the financial information.<br />

Directors’ responsibilities<br />

<strong>The</strong> interim report, including the financial information contained therein, is the responsibility of, and has been approved by the directors. <strong>The</strong> Listing Rules of the UK Listing<br />

Authority require that the accounting policies and presentation applied to the interim figures should be consistent with those applied in preparing the preceding annual accounts<br />

except where any changes, and the reasons for them, are disclosed.<br />

Review work performed<br />

We conducted our review in accordance with guidance contained in Bulletin 1999/4 issued by the Auditing Practices Board. A review consists principally of making enquiries of<br />

group management and applying analytical procedures to the financial information and underlying financial data and based thereon, assessing whether the accounting policies<br />

and presentation have been consistently applied unless otherwise disclosed. A review excludes audit procedures such as tests of controls and verification of assets, liabilities<br />

and transactions. It is substantially less in scope than an audit performed in accordance with Auditing Standards and therefore provides a lower level of assurance than an audit.<br />

Accordingly, we do not express an audit opinion on the financial information.<br />

Review conclusion<br />

On the basis of our review we are not aware of any material modifications that should be made to the financial information as presented for the 28 weeks ended 11 November<br />

2000.<br />

Hill House<br />

Deloitte & Touche<br />

1 Little New Street Chartered Accountants<br />

London EC4A 3TR 10 January 2001

18 <strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong><br />

28 weeks 28 weeks<br />

ended<br />

ended<br />

11 November 13 November Like for<br />

2000 1999 Change like change<br />

Retail Sales Analysis<br />

£million £million % %<br />

UK Retail<br />

<strong>Dixons</strong> 378.4 360.8 5% 2%<br />

Currys 705.2 685.0 3% -2%<br />

PC World 546.1 448.3 22% 5%<br />

<strong>The</strong> Link 176.5 125.3 41% 18%<br />

Other 39.2 36.4 8% -..<br />

International Retail<br />

Nordic region 250.1 1- -... 20%<br />

Spain and Portugal 13.0 1- -... 17%<br />

Republic of Ireland 20.1 16.3 24% 4%<br />

2,128.6 1,672.1 27% 4%<br />

Retail Store Data<br />

Number of stores<br />

Sales area<br />

11 November Change since 11 November Change since<br />

2000 29 April 2000 2000 29 April 2000<br />

000 sq.ft. 000 sq. ft.<br />

UK Retail<br />

<strong>Dixons</strong> 346 1(10) 869 (14)<br />

Currys - Superstores 277 6. 3,413 162.<br />

- High Street 122 (10) 217 (19)<br />

PC World 91 10. 1,589 133.<br />

<strong>The</strong> Link 244 26. 222 28.<br />

International Retail<br />

Nordic Region➀ - Norway 88 -. 629 -.<br />

- Sweden 18 4. 394 76.<br />

- Denmark 14 (32)➁ 193 (75)<br />

- Finland 4 2. 101 50.<br />

- Iceland 1 -. 17 -.<br />

Spain and Portugal 12 -. .80 -.<br />

Republic of Ireland 9 1. 112 21.<br />

1,226 (3) 7,836 362.<br />

Notes<br />

1 Store numbers for Norway, Sweden and Iceland include franchise stores<br />

➁ During the period Snehvide, a high street white goods chain, was sold

<strong>Dixons</strong> <strong>Group</strong> <strong>plc</strong> 19<br />

General Information<br />

Registrars and transfer office<br />

Capita IRG <strong>plc</strong><br />

Balfour House<br />

390/398 High Road<br />

Ilford<br />

Essex IG1 1NQ<br />

Tel: 0208 639 2000<br />

Stockbrokers<br />

Cazenove & Co.<br />

Registered office<br />

Maylands Avenue<br />

Hemel Hempstead<br />

Hertfordshire HP2 7TG<br />

Registered No. 3847921<br />

Share dealing service<br />

Cazenove & Co. operates a postal share<br />

dealing service for private investors who wish<br />

to buy or sell the Company’s shares. Details<br />

are available from Cazenove & Co.<br />

Tel: 0207 606 1768.<br />

Internet<br />

<strong>The</strong> Annual Report and other information is<br />

available through the Internet on:<br />

http://www.dixons-group-<strong>plc</strong>.co.uk<br />

Dividend Reinvestment Plan<br />

Details of the <strong>Group</strong>’s Dividend Reinvestment<br />

Plan are available from the Registrars.<br />

Dividend mandate<br />

Shareholders who wish dividends to be paid<br />

directly into a bank or building society account<br />

should contact the Registrars for a dividend<br />

mandate form. This method of payment<br />

reduces the risk of delay or loss of dividend<br />

cheques in the post and ensures the account<br />

is credited on the dividend payment date.<br />

Individual savings account<br />

A corporate ISA is available for investors<br />

wishing to take advantage of preferential tax<br />

treatment in relation to their shareholdings.<br />

Details are available from Brewin Dolphin Bell<br />

Lawrie Limited. Telephone 0131 225 2566 and<br />

ask for the <strong>Dixons</strong> <strong>Group</strong> helpline.<br />

ADR depositary<br />

<strong>The</strong> Company’s ordinary shares are available<br />

in the form of American Depositary Receipts<br />

(ADRs). <strong>The</strong> Company’s depositary is Bank of<br />

New York. Tel: 001 212 815 2051 (from the<br />

United States of America 888-BNY-ADRS tollfree).<br />

Financial calendar<br />

Interim ordinary dividend record date<br />

2 February 2001<br />

Payment of interim ordinary dividend<br />

5 March 2001<br />

2000/2001 preliminary results announcement<br />

July 2001<br />

2000/2001 annual report publication<br />

August 2001<br />

Annual general meeting<br />

5 September 2001<br />

Payment of 2000/2001 final dividend<br />

October 2001

Thank you<br />

for shopping<br />

with us