NABARD BNB Termsheet - Rrfinance.com

NABARD BNB Termsheet - Rrfinance.com

NABARD BNB Termsheet - Rrfinance.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

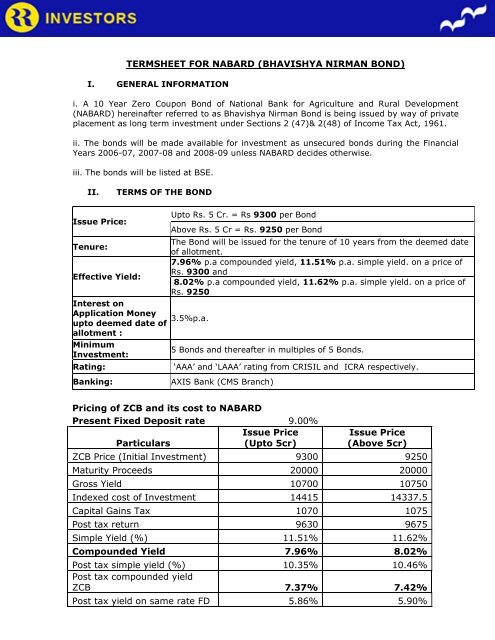

TERMSHEET FOR <strong>NABARD</strong> (BHAVISHYA NIRMAN BOND)<br />

I. GENERAL INFORMATION<br />

i. A 10 Year Zero Coupon Bond of National Bank for Agriculture and Rural Development<br />

(<strong>NABARD</strong>) hereinafter referred to as Bhavishya Nirman Bond is being issued by way of private<br />

placement as long term investment under Sections 2 (47)& 2(48) of In<strong>com</strong>e Tax Act, 1961.<br />

ii. The bonds will be made available for investment as unsecured bonds during the Financial<br />

Years 2006-07, 2007-08 and 2008-09 unless <strong>NABARD</strong> decides otherwise.<br />

iii. The bonds will be listed at BSE.<br />

II.<br />

TERMS OF THE BOND<br />

Issue Price:<br />

Upto Rs. 5 Cr. = Rs 9300 per Bond<br />

Above Rs. 5 Cr = Rs. 9250 per Bond<br />

The Bond will be issued for the tenure of 10 years from the deemed date<br />

Tenure:<br />

of allotment.<br />

7.96% p.a <strong>com</strong>pounded yield, 11.51% p.a. simple yield. on a price of<br />

Rs. 9300 and<br />

Effective Yield:<br />

8.02% p.a <strong>com</strong>pounded yield, 11.62% p.a. simple yield. on a price of<br />

Rs. 9250<br />

Interest on<br />

Application Money<br />

3.5%p.a.<br />

upto deemed date of<br />

allotment :<br />

Minimum<br />

Investment:<br />

Rating:<br />

Banking:<br />

5 Bonds and thereafter in multiples of 5 Bonds.<br />

‘AAA’ and ‘LAAA’ rating from CRISIL and ICRA respectively.<br />

AXIS Bank (CMS Branch)<br />

Pricing of ZCB and its cost to <strong>NABARD</strong><br />

Present Fixed Deposit rate 9.00%<br />

Issue Price<br />

Particulars<br />

(Upto 5cr)<br />

Issue Price<br />

(Above 5cr)<br />

ZCB Price (Initial Investment) 9300 9250<br />

Maturity Proceeds 20000 20000<br />

Gross Yield 10700 10750<br />

Indexed cost of Investment 14415 14337.5<br />

Capital Gains Tax 1070 1075<br />

Post tax return 9630 9675<br />

Simple Yield (%) 11.51% 11.62%<br />

Compounded Yield 7.96% 8.02%<br />

Post tax simple yield (%) 10.35% 10.46%<br />

Post tax <strong>com</strong>pounded yield<br />

ZCB 7.37% 7.42%<br />

Post tax yield on same rate FD 5.86% 5.90%

Note –<br />

• For each application amount above Rs 5 crores required approval from H.O.<br />

• RR - Arranger Code is NBA001, the same has to be used across all application<br />

forms.<br />

• Applications without arranger code stamp will not be considered for payment.