Lesson Plan 7: Your SLOPE and Your Future Lifestyle ... - Bridges

Lesson Plan 7: Your SLOPE and Your Future Lifestyle ... - Bridges

Lesson Plan 7: Your SLOPE and Your Future Lifestyle ... - Bridges

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Lesson</strong> <strong>Plan</strong> 7: <strong>Your</strong> <strong>SLOPE</strong> <strong>and</strong> <strong>Your</strong> <strong>Future</strong> <strong>Lifestyle</strong><br />

Core www.cfnc.org Area:<br />

Financial <strong>Plan</strong>ning<br />

Total Time:<br />

50 minutes.<br />

Target Grades:<br />

Appropriate for 11-12, Recommended for grade 12<br />

Suggested Timeline:<br />

Grade 12: Winter Semester<br />

ASCA Correlation<br />

(Which of the ASCA St<strong>and</strong>ards does this lesson address?)<br />

A-A A-B A-C C-A C-B C-C PS-A PS-B PS-C<br />

X X X X X X X<br />

<strong>Lesson</strong> Objectives<br />

(What will students know <strong>and</strong> be able to do when the lesson is complete?)<br />

By the end of the lesson, students will underst<strong>and</strong> what the total cost of their student loans could<br />

be, what they will cost per month, <strong>and</strong> how those payments will impact their overall future lifestyle.<br />

Materials Needed<br />

(What materials are needed to deliver this lesson?)<br />

Reserve computer lab or computer cart<br />

<strong>Your</strong> <strong>SLOPE</strong> <strong>and</strong> <strong>Your</strong> <strong>Future</strong> <strong>Lifestyle</strong> worksheet<br />

Advance Preparation<br />

(What does the instructor need to do in advance in order to be prepared to deliver this lesson?<br />

How much time is required for advance prep?)<br />

Print <strong>Your</strong> <strong>SLOPE</strong> <strong>and</strong> <strong>Your</strong> <strong>Future</strong> <strong>Lifestyle</strong> worksheet– 10 min<br />

Activator (Typically 5-10 minutes)<br />

(How will you tap into the learners’ background knowledge <strong>and</strong> help them view the lesson as<br />

relevant?)<br />

Demonstrate the importance of financial aid planning <strong>and</strong> budgeting by discussing the following<br />

points:<br />

Once you finish your education, you will have to repay all of your student loans<br />

The interest on your student loans increases the amount that you will have to pay<br />

<br />

<br />

<strong>Your</strong> monthly payment will have an impact on your future lifestyle<br />

The Student Loans Over Projected Earnings (<strong>SLOPE</strong>) calculator will help you to evaluate<br />

whether or not you will be able to afford the loans that you are considering taking out<br />

www.cfnc.org will:<br />

Help students to evaluate their <strong>SLOPE</strong><br />

Assist students in developing a budget <strong>and</strong> prioritizing expenses in their future life<br />

Save student work<br />

1

Core Learning Strategies/<strong>Lesson</strong> Activities (Typically 30-40 minutes)<br />

(How will you facilitate the learning of knowledge/skills using adult learning strategies? How will<br />

you provide for skill practice? How will you differentiate learning, as appropriate, for different roles,<br />

skill levels, <strong>and</strong> experience?)<br />

Session # Step # Responsibility Action Steps<br />

1 1 School<br />

counselor<br />

Focus on today’s work:<br />

1. Distributes the <strong>Your</strong> <strong>SLOPE</strong> <strong>and</strong> <strong>Your</strong> <strong>Future</strong><br />

<strong>Lifestyle</strong> worksheet<br />

2. Asks Students to sign into www.cfnc.org<br />

<strong>and</strong> click on the Financial Aid <strong>Plan</strong>ning Tab, then on<br />

Financial Aid Calculators<br />

2 Student Completes the <strong>SLOPE</strong> calculator<br />

Answers the related questions on the<br />

worksheet<br />

3 Counselor Assists students with the worksheet as<br />

needed<br />

4 Student Completes reflection question, “When<br />

planning your financial budget for your future<br />

lifestyle, you have to take into account both<br />

your needs <strong>and</strong> your wants. What are some<br />

things that you want – a large house, a boat,<br />

<strong>and</strong> designer clothes? What would you be<br />

willing to compromise on to ensure your own<br />

financial fitness?’ in the <strong>Your</strong> Journal section<br />

of the <strong>Your</strong> Portfolio tab of www.cfnc.org<br />

(This question is also located on the student<br />

worksheet)<br />

5 Student Saves the worksheet in a paper portfolio or<br />

attaches an electronic copy to their<br />

www.cfnc.org Portfolio<br />

(chart from RI School Counselor Association’s Toolkits, found at www.rischoolcounselor.org)<br />

Summarizer/Informal Assessment (Typically 5-10 minutes)<br />

(How will you engage learners in processing <strong>and</strong> summarizing what they learned? How will you<br />

know that the objective has been achieved?)<br />

Complete reflection in Portfolio of www.cfnc.org<br />

Attach worksheet to portfolio or save in a paper portfolio.<br />

Discuss what students have learned<br />

Follow-Up<br />

(What additional learning could occur during the year? When?)<br />

Student, parents <strong>and</strong> counselor will review information during financial aid planning<br />

Students can complete the activity suggested the in the article ‘Sort Out <strong>Your</strong> Values’ in the<br />

Financial Aid <strong>Plan</strong>ning Tab of www.cfnc.org (Financial Fitness section).<br />

What’s <strong>Your</strong> <strong>SLOPE</strong>?<br />

2

Part 1:<br />

1. Log into www.cfnc.org<br />

2. Click on the Financial Aid <strong>Plan</strong>ning Tab, then click on Financial Aid Calculators<br />

3. Click on the Student Loans Over Projected Earnings (<strong>SLOPE</strong>) Calculator<br />

4. Read the information provided, then click Start the <strong>SLOPE</strong> Calculator<br />

5. Fill out all of the information with your best information or best guesses. If you have already<br />

received your financial aid packages, take you information from there. If you have not<br />

received your financial aid packages, list loan amounts that you hope to receive based on<br />

the cost of the school that you hope to attend.<br />

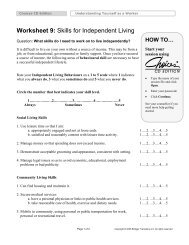

Part II: Answer the following questions about your potential loans:<br />

1. What is your Total Loan Balance?<br />

2. What is your Total Loan Monthly Payment?<br />

3. What is your Total Interest Paid?<br />

4. What is the total amount that you will pay if you take out these loans?<br />

5. What is your <strong>SLOPE</strong> (remember, 8% or less is a safe <strong>SLOPE</strong>)?<br />

6. Are you comfortable with this loan amount?<br />

Part III: <strong>Your</strong> <strong>Future</strong> <strong>Lifestyle</strong> – Fill out all of the information on the future lifestyle page. You may<br />

need to explore a few web sites or ask your teacher or counselor to suggest the average cost of<br />

some items. Once you’ve filled out this page, answer the following questions about the potential<br />

future lifestyle that you have described:<br />

7. What is your Net Income?<br />

8. What will your Total Fixed Expenses be?<br />

9. What will your Total Variable Expenses be?<br />

10. Look at your Financial Summary. After you subtract your Fixed <strong>and</strong> Variable Expenses<br />

from your Net Income, how much money remains (<strong>Your</strong> Total Net Income)?<br />

11. If you do not have any money remaining (or you’re in debt at the end of the month) what<br />

could you cut out?<br />

Reflection: In your portfolio journal (or on the back of this page), reflect on the following question:<br />

When planning your financial budget for your future lifestyle, you have to take into account both<br />

your needs <strong>and</strong> your wants. What are some things that you want – a large house, a boat, <strong>and</strong><br />

designer clothes? What would you be willing to compromise on to ensure your own financial<br />

fitness?<br />

3