Therapy Class Review - Express Scripts

Therapy Class Review - Express Scripts

Therapy Class Review - Express Scripts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

<strong>Express</strong> <strong>Scripts</strong> 2007 Drug Trend Report

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

In this section of the Drug Trend Report, we evaluate trends for nine nonspecialty classes and seven<br />

specialty classes. For each featured class, we detail components of trend, key facts about the class,<br />

market-share trend over the past five years, important points to note, and pipeline and patent<br />

expiration information.<br />

NONSPECIALTY<br />

This year, we added shorter discussions for six nonspecialty classes that deserve notice due to unusual<br />

activity. While some of these classes to watch may have little impact on total spend, they all include one<br />

or more drugs that influence utilization or cost, or both.<br />

The top 20 nonspecialty therapy classes accounted for 75% of nonspecialty drug spend for 2007.<br />

Exhibit 22<br />

PMPY Cost and Cost per Prescription for Selected Nonspecialty <strong>Therapy</strong> <strong>Class</strong>es 2006 to 2007<br />

Ranked by 2007 PMPY Cost<br />

PMPY Cost<br />

Cost per Prescription<br />

2006 2007 % Change 2006 2007 % Change<br />

Antihyperlipidemics $ 91.53 $ 83.32 -9.0% $ 79.48 $ 67.32 -15.3%<br />

Gastrointestinals $ 62.50 $ 63.09 1.0% $100.38 $ 99.19 -1.2%<br />

Antidepressants $ 58.88 $ 56.91 -3.3% $ 62.08 $ 58.17 -6.3%<br />

Antidiabetics $ 42.67 $ 49.50 16.0% $ 65.23 $ 73.55 12.8%<br />

Antiasthmatics $ 40.65 $ 45.82 12.7% $ 83.65 $ 92.17 10.2%<br />

Antihypertensives $ 41.20 $ 45.19 9.7% $ 33.70 $ 35.73 6.0%<br />

Anticonvulsants $ 27.36 $ 31.88 16.6% $ 96.98 $105.82 9.1%<br />

Antivirals $ 18.56 $ 21.27 14.6% $214.50 $234.76 9.4%<br />

Hypnotics $ 12.62 $ 11.64 -7.7% $ 74.50 $ 61.81 -17.0%<br />

Others $366.79 $390.13 6.4% $ 42.16 $ 44.18 4.8%<br />

Total $762.76 $798.76 4.7% $ 53.25 $ 54.34 2.0%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

express scripts 2007 drug trend report 21

Antihyperlipidemics NONSPECIALTY RANK 1<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription -15.3% Cost PMPY: $83.32<br />

Price -2.0% # Rx PMPY: 1.24<br />

Units per Prescription -0.2% Prevalence of Use: 11.5%<br />

Brand/Generic Mix -9.1% Average Cost/Rx: $67.32<br />

Therapeutic Mix -4.7% # Rx/User/Year: 9.78<br />

Utilization 7.5%<br />

Prevalence 4.8%<br />

Intensity 2.5%<br />

New Drugs 0<br />

TOTAL -9.0%<br />

Antihyperlipidemics Market-Share Trend<br />

60%<br />

50%<br />

Generics $34.80<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Lipitor ® $90.07<br />

Vytorin ® $82.36<br />

Crestor ® $82.64<br />

Zetia ® $78.80<br />

TriCor ® $88.01<br />

• Generic market share for antihyperlipidemics rose from 9% in 2005 to nearly 40% in 2007.<br />

• Although utilization of antihyperlipidemics continues to increase, a full year’s use of multisource<br />

generics for Zocor ® decreased cost per prescription and drove overall trend into negative numbers.<br />

• Statins will remain the mainstay of treatment for high cholesterol.<br />

• The next statin scheduled to lose patent protection is Lipitor ® in 2010 (2011 if the patent<br />

is reinstated).<br />

• Niacin remains the only product to raise HDL cholesterol. Cordaptive , the combination<br />

of extended-release niacin and a flushing inhibitor, will compete with Niaspan ® in this market.<br />

• The antihyperlipidemics pipeline consists mainly of products that combine a statin with other therapies<br />

to target several types of high cholesterol with a single pill.<br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

Cordaptive <br />

niacin, extended release/<br />

laropiprant (MK-0524A)<br />

Pipeline 6/29/2008<br />

ABT-335 next-generation fenofibrate Pipeline 2008<br />

mipomersen Pipeline 2009<br />

MK-0524B Cordaptive /simvastatin Pipeline 2009<br />

22 express scripts 2007 drug trend report

Gastrointestinals NONSPECIALTY RANK 2<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription -1.2% Cost PMPY: $63.09<br />

Price 2.2% # Rx PMPY: 0.64<br />

Units per Prescription 0.7% Prevalence of Use: 8.5%<br />

Brand/Generic Mix -0.2% Average Cost/Rx: $99.19<br />

Therapeutic Mix -3.8% # Rx/User/Year: 6.85<br />

Utilization 2.2%<br />

Prevalence 1.1%<br />

Intensity 1.0%<br />

New Drugs 0<br />

TOTAL 1.0%<br />

Gastrointestinals Market-Share Trend<br />

45%<br />

Percent of Prescriptions<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Generics $39.32<br />

Nexium ® $145.36<br />

Prevacid ® $146.00<br />

Protonix ® $117.54<br />

AcipHex ® $150.39<br />

• Overall trend in the gastrointestinals class was relatively flat; increased use was offset by decreased<br />

cost per prescription.<br />

• Proton pump inhibitors (PPIs) will continue to dominate treatment for gastroesophageal reflux disease<br />

(GERD) into the next decade.<br />

• Generic Prilosec OTC ® became available during Q1 2008.<br />

• Although the Protonix ® patent is not due to expire until early 2011, generics for it were launched<br />

at risk (before litigation was resolved) in late December 2007. A trial date has yet to be scheduled.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

TAK-390MR dexlansoprazole Pipeline 10/28/2008<br />

Prevacid ® OTC lansoprazole Pipeline Q4 2009<br />

Prilosec OTC ® omeprazole Patent Expiration Q1 2008<br />

Prevacid ® lansoprazole Patent Expiration 11/10/2009<br />

express scripts 2007 drug trend report 23

Antidepressants NONSPECIALTY RANK 3<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription -6.3% Cost PMPY: $56.91<br />

Price 1.9% # Rx PMPY: 0.98<br />

Units per Prescription 1.0% Prevalence of Use: 10.8%<br />

Brand/Generic Mix -10.7% Average Cost/Rx: $58.17<br />

Therapeutic Mix 2.0% # Rx/User/Year: 8.49<br />

Utilization 3.1%<br />

Prevalence 1.0%<br />

Intensity 2.1%<br />

New Drugs 0<br />

TOTAL -3.3%<br />

Antidepressants Market-Share Trend<br />

70%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Generics $32.56<br />

Lexapro ® $77.02<br />

Effexor XR ® $131.63<br />

Cymbalta ® $129.91<br />

Wellbutrin XL ® $149.41<br />

• Overall trend for antidepressants was negative because more patients used generic antidepressants.<br />

Generics now dominate market share at more than 65%.<br />

• As serotonin-norepinephrine reuptake inhibitors (SNRIs) continue to get unique additional indications,<br />

they will take market share from generically available selective serotonin reuptake inhibitors (SSRIs).<br />

• Non-AB-rated generic tablets to Effexor XR ® could launch after the venlafaxine patent expires<br />

on June 13, 2008.<br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

BVF-033 bupropion salt Pipeline 4/23/2008<br />

amibegron Pipeline 2009<br />

saredutant Pipeline 2009<br />

Valdoxan ® agomelatine Pipeline 2009<br />

Paxil CR ® paroxetine, extended release Patent Expiration 10/1/2008<br />

Wellbutrin XL ®<br />

150mg<br />

bupropion, extended release Patent Expiration 2008<br />

24 express scripts 2007 drug trend report

Antidiabetics NONSPECIALTY RANK 4<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 12.8% Cost PMPY: $49.50<br />

Price 7.5% # Rx PMPY: 0.67<br />

Units per Prescription 0.5% Prevalence of Use: 4.4%<br />

Brand/Generic Mix -0.2% Average Cost/Rx: $73.55<br />

Therapeutic Mix 4.6% # Rx/User/Year: 13.97<br />

Utilization 2.3%<br />

Prevalence 4.2%<br />

Intensity -1.9%<br />

New Drugs 0.7%<br />

TOTAL 16.0%<br />

Antidiabetics Market-Share Trend<br />

60%<br />

50%<br />

Generics $22.48<br />

Percent of Prescriptions<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Actos ® $154.66<br />

Lantus ® $116.30<br />

Avandia ® $135.51<br />

Humalog ® $154.74<br />

Januvia ® $148.16<br />

Byetta ® $191.69<br />

• Overall trend for antidiabetics was up 16.5%, largely due to higher cost per prescription.<br />

• After reports of potential safety issues, utilization of Avandia ® dropped in late 2007.<br />

• Significant new generic opportunities are limited until early next decade.<br />

• Manufacturers developing inhaled insulins are re-evaluating market potential of their products after<br />

Exubera ® was withdrawn from the market due to disappointing sales.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

alogliptin Pipeline 11/4/2008<br />

Byetta ® LAR exenatide, long-acting Pipeline 2009<br />

liraglutide Pipeline 2009<br />

saxagliptin Pipeline 2009<br />

Precose ® acarbose Patent Expiration 2008<br />

Prandin ® repaglinide Patent Expiration 3/14/2009<br />

Glyset ® miglitol Patent Expiration 7/27/2009<br />

express scripts 2007 drug trend report 25

Antiasthmatics NONSPECIALTY RANK 5<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 10.2% Cost PMPY: $45.82<br />

Price 8.0% # Rx PMPY: 0.50<br />

Units per Prescription 0.1% Prevalence of Use: 8.1%<br />

Brand/Generic Mix -0.1% Average Cost/Rx: $92.17<br />

Therapeutic Mix 2.1% # Rx/User/Year: 5.61<br />

Utilization 2.2%<br />

Prevalence 0.8%<br />

Intensity 1.5%<br />

New Drugs 0.1%<br />

TOTAL 12.7%<br />

Antiasthmatics Market-Share Trend<br />

40%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Singulair ® $92.32<br />

Generics $22.98<br />

Advair Diskus ® $167.92<br />

ProAir ® HFA $34.12<br />

Spiriva ® $120.55<br />

Flovent ® HFA $106.65<br />

• With an 8% increase, inflation is the driver of overall trend for antiasthmatics. Generic albuterol<br />

metered-dose inhalers (MDIs) are being replaced by brand-name MDIs containing nondamaging<br />

hydrofluoroalkane propellants. Limited supplies of CFC-containing inhalers may still be available,<br />

but they cannot be sold in the U.S. after Dec. 31, 2008.<br />

• Advair Diskus ® and Singulair ® represent the majority of spend in the antiasthmatics class.<br />

• Complex inhaler devices and difficulty in determining equivalence of topically acting products<br />

will delay FDA approval of other generic asthma inhalers.<br />

• Moving into the next decade, once-daily long-acting beta agonists (LABA) and corticosteroid/LABA<br />

combinations may replace the current twice-daily products.<br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

ProAir ®<br />

Breathmatic albuterol HFA MDI Pipeline 2008<br />

Flutiform fluticasone/formoterol Pipeline 2009<br />

indacaterol Pipeline 2009<br />

Serevent ® salmeterol Patent Expiration 8/12/2008<br />

Advair Diskus ® fluticasone/salmeterol Patent Expiration 2008/2010<br />

26 express scripts 2007 drug trend report

Antihypertensives NONSPECIALTY RANK 6<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 6.0% Cost PMPY: $45.19<br />

Price 8.4% # Rx PMPY: 1.26<br />

Units per Prescription -0.4% Prevalence of Use: 11.5%<br />

Brand/Generic Mix -1.8% Average Cost/Rx: $35.73<br />

Therapeutic Mix 0 # Rx/User/Year: 9.99<br />

Utilization 2.9%<br />

Prevalence 3.3%<br />

Intensity -0.4%<br />

New Drugs 0.5%<br />

TOTAL 9.7%<br />

Antihypertensives Market-Share Trend<br />

70%<br />

Percent of Prescriptions<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Generics $17.53<br />

Diovan ® /Diovan HCT ® $63.49<br />

Cozaar ® /Hyzaar ® $61.01<br />

Benicar ® /Benicar HCT ® $54.55<br />

Altace ® $56.05<br />

Lotrel ® $87.51<br />

Avapro ® $53.87<br />

• Roughly two-thirds of trend for antihypertensives resulted from cost per prescription — primarily<br />

driven by inflation.<br />

• The first generics for lower strengths of Lotrel ® were launched at risk in May 2007. Litigation<br />

is delaying generics from additional manufacturers, as well as generics for higher strengths of Lotrel.<br />

• Generics to Altace ® capsules (but not Altace tablets) became available in late December 2007.<br />

• The patent for the last brand-only angiotensin-converting enzyme inhibitor, Aceon ® , expires in 2009,<br />

although challenges are pending.<br />

• Exforge ® and Azor are two new brand-name amlodipine/angiotensin receptor blocker combinations<br />

that entered the market in 2007. The availability of generic amlodipine likely will result in other<br />

combination products.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

Aceon ® perindopril Patent Expiration 11/10/2009<br />

express scripts 2007 drug trend report 27

Anticonvulsants NONSPECIALTY RANK 7<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 9.1% Cost PMPY: $31.88<br />

Price 6.6% # Rx PMPY: 0.30<br />

Units per Prescription -1.0% Prevalence of Use: 3.7%<br />

Brand/Generic Mix -0.7% Average Cost/Rx: $105.82<br />

Therapeutic Mix 4.1% # Rx/User/Year: 7.50<br />

Utilization 6.8%<br />

Prevalence 7.0%<br />

Intensity -0.1%<br />

New Drugs 0<br />

TOTAL 16.6%<br />

Anticonvulsants Market-Share Trend<br />

60%<br />

50%<br />

Generics $34.41<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

• At 16.6%, the anticonvulsants class had the largest increase in trend for 2007.<br />

• Cost per prescription increased due to both inflation and therapeutic mix.<br />

Topamax ® $221.80<br />

Lamictal ® $233.24<br />

Lyrica ® $127.24<br />

Depakote ® ER $135.05<br />

Depakote ® $147.37<br />

Keppra ® $247.06<br />

• Utilization also increased because anticonvulsants continue to be used off-label for a wide variety<br />

of conditions, including pain and migraines.<br />

• The significant generic opportunities in this class for 2008 include possible first-time generics to<br />

Lamictal ® , Keppra ® and Depakote ® /Depakote ® ER.<br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

lacosamide Pipeline 9/29/2008<br />

Keppra XR levetiracetam, extended release Pipeline 2008<br />

Lamictal XR lamotrigine, extended release Pipeline 2008<br />

Depakote ® /<br />

Depakote ® ER<br />

divalproex Patent Expiration 7/29/2008<br />

Keppra ® levetiracetam Patent Expiration 11/1/2008<br />

Lamictal ® lamotrigine Patent Expiration 2008<br />

Topamax ® topiramate Patent Expiration 3/26/2009<br />

28 express scripts 2007 drug trend report

Antivirals NONSPECIALTY RANK 10<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 9.4% Cost PMPY: $21.27<br />

Price 6.8% # Rx PMPY: 0.09<br />

Units per Prescription -0.1% Prevalence of Use: 2.6%<br />

Brand/Generic Mix -0.2% Average Cost/Rx: $234.76<br />

Therapeutic Mix 2.8% # Rx/User/Year: 3.14<br />

Utilization 4.5%<br />

Prevalence 2.1%<br />

Intensity 2.4%<br />

New Drugs 0.2%<br />

TOTAL 14.6%<br />

Antivirals Market-Share Trend<br />

Percent of Prescriptions<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Valtrex ® $167.36<br />

Generics $72.06<br />

Tamiflu ® $69.05<br />

Famvir ® $190.36<br />

Truvada ® $784.24<br />

Atripla ® $1,233.19<br />

• The two drugs that drove 2007 trend in the antivirals category were Valtrex ® , for treating herpes,<br />

and Atripla ® , a once-daily triple therapy for treating HIV.<br />

• Following a patent-litigation settlement, generics to Valtrex are expected to become available<br />

in December 2009.<br />

• Because the recent influenza seasons have been relatively mild, the use of Tamiflu ® and Relenza ®<br />

has not been as significant as in previous years.<br />

• In 2007, the market saw the introduction of two HIV drugs with novel mechanisms: Selzentry ® blocks<br />

HIV from entering healthy cells; Isentress ® blocks an important step in viral replication. Both are used<br />

in combination with other antivirals.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

vicriviroc Pipeline 2009<br />

Zerit ® stavudine Patent Expiration 12/24/2008<br />

Valtrex ® valacyclovir Patent Expiration 12/23/2009<br />

express scripts 2007 drug trend report 29

Hypnotics NONSPECIALTY RANK 21<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription -17.0% Cost PMPY: $11.64<br />

Price 19.2% # Rx PMPY: 0.19<br />

Units per Prescription -0.5% Prevalence of Use: 3.5%<br />

Brand/Generic Mix -31.2% Average Cost/Rx: $61.81<br />

Therapeutic Mix 1.6% # Rx/User/Year: 5.00<br />

Utilization 11.2%<br />

Prevalence 4.3%<br />

Intensity 6.6%<br />

New Drugs 0<br />

TOTAL -7.7%<br />

Hypnotics Market-Share Trend<br />

80%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Generics $20.61<br />

Ambien CR ® $95.82<br />

Ambien ® $107.15<br />

Lunesta ® $106.01<br />

Rozerem TM $82.58<br />

Sonata ® $98.23<br />

• Overall trend for hypnotics was negative due to the April 2007 launch of generics for Ambien ® .<br />

However, continued increase in utilization and double-digit growth in inflation dampened<br />

the full impact of the generics.<br />

• The receipt of a second approvable letter requesting further studies for indiplon could mark the<br />

end of its development.<br />

• Silenor (low-dose doxepin) is continuing in development for insomnia. Doxepin is already used<br />

for anxiety and depression.<br />

• The hypnotics class remains the leading class in direct-to-consumer spending.<br />

Brand Generic Pipeline or Patent Expiration Anticipated Availability<br />

indiplon Pipeline 2008<br />

Silenor doxepin Pipeline 2008<br />

eplivanserin Pipeline 2009<br />

Sonata ® zaleplon Patent Expiration 6/6/2008<br />

Ambien CR ® zolpidem, extended release Patent Expiration (exclusivity) 3/2/2009<br />

30 express scripts 2007 drug trend report

<strong>Class</strong>es to Watch<br />

Narcotic Analgesics NONSPECIALTY RANK 8<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 9.8% Cost PMPY: $27.00<br />

Utilization 4.5% # Rx PMPY: 0.63<br />

New Drugs 0 Prevalence of Use: 16.7%<br />

TOTAL 14.7% Average Cost/Rx: $43.03<br />

# Rx/User/Year: 3.43<br />

• Even though generics control the narcotic analgesics, inflation increased class trend.<br />

• Patent settlements are forcing a phaseout of generics for OxyContin ® , re-establishing brand-name<br />

OxyContin in the market, and contributing to inflation for both generics and brands.<br />

• Patients using narcotic analgesics are particularly susceptible to dose creep (increases in dosage<br />

to maintain response), which drives up utilization.<br />

Stimulants/Antiobesity Agents NONSPECIALTY RANK 11<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 6.9% Cost PMPY: $19.24<br />

Utilization 3.6% # Rx PMPY: 0.16<br />

New Drugs 0.9% Prevalence of Use: 2.1%<br />

TOTAL 11.7% Average Cost/Rx: $120.81<br />

# Rx/User/Year: 7.06<br />

• Trend in this category is driven by drugs, such as Adderall XR ® and Concerta ® , that are used for<br />

the treatment of attention deficit hyperactivity disorder.<br />

• Generic Adderall XR (mixed amphetamine salts) is expected to reach the market in April 2009,<br />

following a patent settlement.<br />

• FDA approval of the prescription antiobesity drug rimonabant (Acomplia ® in Europe; proposed name<br />

Zimulti ® in the U.S.) was delayed due to safety concerns.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Miscellaneous Endocrines NONSPECIALTY RANK 12<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 7.1% Cost PMPY: $18.33<br />

Utilization -3.4% # Rx PMPY: 0.23<br />

New Drugs 0 Prevalence of Use: 2.5%<br />

TOTAL 3.5% Average Cost/Rx: $78.83<br />

# Rx/User/Year: 8.25<br />

• Bisphosphonates — used to treat osteoporosis — dominate trend for the class.<br />

• Although utilization was down due to potential side effects publicized in 2007, three brand-name<br />

bisphosphonates made up nearly 75% of market share in the class.<br />

• The leading bisphosphonate, Fosamax ® , which has more than 40% of utilization, lost patent protection<br />

in February 2008. Its generic will impact trend for 2008.<br />

• Evista ® , a selective estrogen receptor modulator (SERM), which treats osteoporosis and breast cancer, may<br />

face competition in 2008 from Viviant and Fablyn ® , both under FDA review for treating osteoporosis.<br />

express scripts 2007 drug trend report 31

Antipsychotics NONSPECIALTY RANK 13<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 10.2% Cost PMPY: $16.67<br />

Utilization 3.6% # Rx PMPY: 0.09<br />

New Drugs 0.9% Prevalence of Use: 1.3%<br />

TOTAL 15.0% Average Cost/Rx: $190.07<br />

# Rx/User/Year: 6.13<br />

• Inflation is the main driver of trend for antipsychotics, but both utilization and new drugs contribute.<br />

• Although generics made up more than 26% of antipsychotics spend, the brand-name drugs Seroquel ® ,<br />

Risperdal ® and Abilify ® represented nearly 60% of 2007 market share.<br />

• On June 29, 2008, the main drug patent for Risperdal will expire — opening the potential for<br />

considerable savings in this class.<br />

• Asenapine and iloperidone, two new drugs for treating schizophrenia and bipolar disorder, are currently<br />

under FDA review.<br />

• New brands will continue to enter the market, providing treatment options for those not adequately<br />

controlled on current therapies.<br />

Miscellaneous Genitourinary NONSPECIALTY RANK 24<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 4.7% Cost PMPY: $8.45<br />

Utilization 13.5% # Rx PMPY: 0.12<br />

New Drugs 0 Prevalence of Use: 2.0%<br />

TOTAL 18.9% Average Cost/Rx: $68.43<br />

# Rx/User/Year: 5.64<br />

• The majority of spend in the miscellaneous genitourinary class is from the use of Flomax ® .<br />

Following a settlement, generics to Flomax are expected in March 2010.<br />

• Extensive direct-to-consumer advertising will continue to drive utilization for the class.<br />

Antiparkinson Agents NONSPECIALTY RANK 41<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 6.8% Cost PMPY: $4.34<br />

Utilization 15.7% # Rx PMPY: 0.05<br />

New Drugs 1.1% Prevalence of Use: 0.5%<br />

TOTAL 24.7% Average Cost/Rx: $87.22<br />

# Rx/User/Year: 8.26<br />

• Growth among the antiparkinson agents is driven largely by Requip ® and Mirapex ® . Although both<br />

are approved for treating Parkinson’s disease, their newer indications for treating restless legs<br />

syndrome have been publicized heavily in direct-to-consumer advertising.<br />

• The patent on Requip will expire May 19, 2008. As a follow-on, the manufacturer is developing<br />

once-daily Requip XL ® , which could be approved in 2008.<br />

32 express scripts 2007 drug trend report

SPECIALTY<br />

Utilization and cost have also been analyzed for leading specialty therapy classes. Components of<br />

trend and pipelines for potential products are reviewed for each of the classes listed below. In addition,<br />

information on orphan drugs has been included.<br />

Exhibit 23<br />

PMPY Cost and Cost per Prescription for Selected Specialty <strong>Therapy</strong> <strong>Class</strong>es 2006 to 2007<br />

Ranked by 2007 PMPY Cost<br />

Inflammatory<br />

Conditions<br />

Multiple<br />

Sclerosis<br />

PMPY Cost<br />

Cost per Prescription<br />

2006 2007 % Change 2006 2007 % Change<br />

$19.44 $22.96 18.1% $1,480.57 $1,547.97 4.6%<br />

$13.85 $16.02 15.7% $1,469.75 $1,647.00 12.1%<br />

Cancer $10.82 $12.96 19.7% $1,568.00 $1,816.38 15.8%<br />

Blood Cell $ 5.38 $ 4.86 -9.7% $1,581.82 $1,724.51 9.0%<br />

Deficiency<br />

Growth<br />

$ 4.35 $ 4.62 6.3% $2,524.33 $2,569.10 1.8%<br />

Hormone<br />

Deficiency<br />

Anticoagulants $ 3.57 $ 4.18 17.3% $ 848.81 $ 887.11 4.5%<br />

Hepatitis C $ 3.32 $ 3.34 0.6% $1,113.54 $1,174.31 5.5%<br />

Others $13.60 $15.78 16.1% $1,216.87 $1,340.40 10.2%<br />

Total $74.30 $84.73 14.0% $1,404.01 $1,519.15 8.2%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Orphan Drugs<br />

Increasingly, specialty-drug spend includes orphan drugs, a designation that may be unfamiliar to many<br />

plan sponsors. In short, orphan drugs treat conditions that affect relatively few patients.<br />

To meet the need for research on treatments for rare diseases, the Orphan Drug Act was passed in 1983.<br />

Generally, this legislation supports pharmaceutical companies that develop products to treat conditions<br />

affecting fewer than 200,000 Americans. Benefits for the manufacturers of orphan drugs include:<br />

• Tax incentives for clinical research<br />

• Grant funding to subsidize costs of clinical trials<br />

• Seven years of marketing exclusivity after approval<br />

Since the act was passed, nearly 300 1 orphan drugs and biologics have been approved. Many of them<br />

treat conditions that previously had no medications available. Information on how orphan drugs affected<br />

<strong>Express</strong> <strong>Scripts</strong>’ specialty-drug trend in 2007 is included at the end of this section.<br />

1<br />

Haffner ME. Adopting orphan drugs — two dozen years of treating rare diseases. N Engl J Med. 2006;354(5):445-447.<br />

express scripts 2007 drug trend report 33

Inflammatory Conditions SPECIALTY RANK 1<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 4.6% Cost PMPY: $22.96<br />

Price 5.2% # Rx PMPY: 0.0148<br />

Units per Prescription -1.5% Prevalence of Use: 0.18%<br />

Brand/Generic Mix 0 Average Cost/Rx: $1,547.97<br />

Therapeutic Mix 0.9% # Rx/User/Year: 8.17<br />

Utilization 13.0%<br />

Prevalence 14.8%<br />

Intensity -1.6%<br />

New Drugs 0<br />

TOTAL 18.1%<br />

Inflammatory Conditions Market-Share Trend<br />

90%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Enbrel ® $1,515.31<br />

Humira ® $1,585.81<br />

Raptiva ® $1,614.23<br />

Remicade ® $2,603.30<br />

• Expanded indications and earlier use of tumor necrosis factor (TNF) inhibitors such as Enbrel ® ,<br />

Humira ® and Remicade ® to treat rheumatoid arthritis (RA) continue to drive trend growth for this class.<br />

• Actemra ® , LymphoStat-B ® and ustekinumab are biologic drugs with novel mechanisms that may be<br />

approved in 2008 for RA, lupus and psoriasis, respectively.<br />

• Cimzia ® and golimumab are long-acting TNF inhibitors given monthly by subcutaneous (SQ) injection,<br />

as compared to more frequent dosing for current TNF inhibitors.<br />

• LymphoStat-B is among several drugs expected to enter the lupus market by the end of the decade.<br />

Rituxan ® , currently approved for non-Hodgkin’s lymphoma and RA, is also likely to receive an expanded<br />

indication for lupus.<br />

Inflammatory Conditions Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

Actemra ® tocilizumab IV infusion RA 2008<br />

Cimzia ® certolizumab SQ Crohn’s disease, RA 2008<br />

LymphoStat-B ® belimumab IV infusion Lupus, RA 2008<br />

ustekinumab SQ Psoriasis 2008<br />

34 express scripts 2007 drug trend report

Multiple Sclerosis SPECIALTY RANK 2<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 12.1% Cost PMPY: $16.02<br />

Price 12.4% # Rx PMPY: 0.0097<br />

Units per Prescription -0.5% Prevalence of Use: 0.10%<br />

Brand/Generic Mix 0 Average Cost/Rx: $1,647.00<br />

Therapeutic Mix 0.2% # Rx/User/Year: 9.53<br />

Utilization 3.2%<br />

Prevalence 3.1%<br />

Intensity 0.1%<br />

New Drugs 0<br />

TOTAL 15.7%<br />

Multiple Sclerosis Market-Share Trend<br />

Percent of Prescriptions<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Avonex ® $1,567.28<br />

Copaxone ® $1,647.12<br />

Rebif ® $1,711.54<br />

Betaseron ® $1,717.05<br />

Tysabri ® $2,262.59<br />

H.P. Acthar ® $11,040.59<br />

• With the cost per prescription increasing 12.1% in 2007, inflation continues to be the key driver<br />

of trend for drugs to treat multiple sclerosis (MS).<br />

• H.P. Acthar ® Gel, an intramuscular medication sometimes used to treat acute exacerbations<br />

of MS, experienced a significant price increase in 2007.<br />

• Current MS therapies are injected, but several oral drugs, including Fampridine-SR, fingolimod,<br />

Mylinax and Panaclar , may reach the market in the next few years.<br />

• Rituxan ® and Zenapax ® , which are already on the market for other indications, are being evaluated<br />

for use in the treatment of MS. Both require IV infusion.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Multiple Sclerosis Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

Mylinax cladribine Oral MS 2008<br />

Panaclar <br />

Fampridine-SR<br />

BG-12<br />

(dimethyl fumarate)<br />

fampridine<br />

(4-aminopyridine)<br />

sustained-release<br />

Oral MS 2008<br />

Oral MS 2009<br />

fingolimod Oral MS 2009<br />

express scripts 2007 drug trend report 35

Cancer SPECIALTY RANK 3<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 15.8% Cost PMPY: $12.96<br />

Price 14.1% # Rx PMPY: 0.0071<br />

Units per Prescription -4.8% Prevalence of Use: 0.17%<br />

Brand/Generic Mix -0.1% Average Cost/Rx: $1,816.38<br />

Therapeutic Mix 6.6% # Rx/User/Year: 4.17<br />

Utilization 0.9%<br />

Prevalence 1.2%<br />

Intensity -0.3%<br />

New Drugs 2.8%<br />

TOTAL 19.7%<br />

Cancer Market-Share Trend<br />

30%<br />

25%<br />

Lupron Depot ® $792.48<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Xeloda ® $1,200.66<br />

Gleevec ® $3,109.45<br />

Temodar ® $2,070.55<br />

leuprolide $235.76<br />

Tarceva ® $2,975.65<br />

Thalomid ® $4,742.66<br />

• Although the introduction of new drugs did not affect trend in most therapy classes, it represented<br />

2.8% of trend for the cancer therapy class. Tykerb ® , an oral breast cancer drug approved in<br />

March 2007, had the biggest impact.<br />

• Targeted therapies, such as the oral tyrosine kinase inhibitor vatalanib and the monoclonal antibodies<br />

galiximab and ofatumumab, are expected to play an increasingly important role in the treatment of<br />

various cancer types.<br />

• While many of the cancer drugs in the pipeline require IV infusion, approximately 25% of cancer<br />

therapies in development are oral. Infused cancer therapies are typically billed under the medical<br />

benefit since they are administered in a physician’s office; however, these oral cancer medications,<br />

which can frequently be taken in a patient’s home, are expected to have an increasingly important<br />

impact on the prescription-drug benefit.<br />

Cancer Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

HuMax-CD20 ® ofatumumab IV infusion Chronic lymphocytic<br />

leukemia (CLL)<br />

Onconase ® ranpirnase IV infusion Mesothelioma 2008<br />

2008<br />

phenoxodiol Oral Prostate cancer 2008<br />

Treanda ® bendamustine IV infusion CLL 2008<br />

36 express scripts 2007 drug trend report

Blood Cell Deficiency SPECIALTY RANK 4<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 9.0% Cost PMPY: $4.86<br />

Price 1.4% # Rx PMPY: 0.0028<br />

Units per Prescription -3.8% Prevalence of Use: 0.06%<br />

Brand/Generic Mix 0 Average Cost/Rx: $1,724.51<br />

Therapeutic Mix 11.8% # Rx/User/Year: 4.51<br />

Utilization -17.1%<br />

Prevalence -13.2%<br />

Intensity -4.5%<br />

New Drugs 0<br />

TOTAL -9.7%<br />

Blood Cell Deficiency Market-Share Trend<br />

60%<br />

50%<br />

Procrit ® $1,131.10<br />

Percent of Prescriptions<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Aranesp ® $1,405.73<br />

Neupogen ® $2,347.92<br />

Neulasta ® $3,817.31<br />

Epogen ® $1,075.90<br />

Leukine ® $3,172.38<br />

• Safety concerns associated with the use of erythropoiesis-stimulating agents — Aranesp ® , Epogen ®<br />

and Procrit ® — caused a decrease in utilization of these anemia medications.<br />

• In early 2008, the liquid form of Leukine ® was withdrawn from the market due to reports of adverse<br />

reactions. The lyophilized (freeze-dried) formulation is still available, and market share should not<br />

be impacted significantly.<br />

• Two novel therapies, Nplate and Promacta ® , may be approved in 2008 for idiopathic thrombocytopenic<br />

purpura (ITP), a bleeding disorder related to low platelet counts.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Blood Cell Deficiency Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

ferumoxytol IV infusion Anemia 2008<br />

Mozobil plerixafor SQ Stem cell<br />

mobilization<br />

Nplate romiplostim IV infusion and SQ ITP 2008<br />

Promacta ® eltrombopag Oral ITP 2008<br />

2008<br />

express scripts 2007 drug trend report 37

Growth Hormone Deficiency SPECIALTY RANK 5<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 1.8% Cost PMPY: $4.62<br />

Price 7.0% # Rx PMPY: 0.0018<br />

Units per Prescription 1.5% Prevalence of Use: 0.02%<br />

Brand/Generic Mix 0 Average Cost/Rx: $2,569.10<br />

Therapeutic Mix -6.3% # Rx/User/Year: 8.23<br />

Utilization 4.4%<br />

Prevalence 6.6%<br />

Intensity -2.1%<br />

New Drugs 0<br />

TOTAL 6.3%<br />

Growth Hormone Deficiency Market-Share Trend<br />

35%<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Humatrope ® $2,287.87<br />

Nutropin AQ ® $2,766.52<br />

Genotropin ® $2,314.26<br />

Norditropin ® /NordiFlex ® $2,493.48<br />

Saizen ® $2,436.36<br />

Nutropin ® $3,245.12<br />

• Omnitrope growth hormone was launched in the U.S. in early 2007. The FDA has been careful to point<br />

out that Omnitrope is not a generic biologic, but rather a follow-on protein product. Even at an average<br />

cost of less than $500 per prescription, Omnitrope has not gained appreciable market share in the U.S.<br />

An easier-to-use pen form approved in February 2008 may increase its acceptance.<br />

• Accretropin is a recombinant human growth hormone being developed for treating short stature in<br />

children with growth hormone deficiency and girls with Turner’s syndrome.<br />

• Tesamorelin is an analog of the growth hormone-releasing factor that induces growth hormone.<br />

It is being studied for the treatment of HIV-related lipodystrophy.<br />

Growth Hormone Deficiency Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

Accretropin <br />

recombinant<br />

human growth<br />

hormone<br />

tesamorelin<br />

(TH-9507)<br />

SQ<br />

SQ<br />

Growth hormone<br />

deficiency<br />

HIV-related<br />

lipodystrophy<br />

ALTU-238 SQ Growth hormone<br />

deficiency<br />

2008<br />

2008<br />

2009<br />

38 express scripts 2007 drug trend report

Anticoagulants SPECIALTY RANK 6<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 4.5% Cost PMPY: $4.18<br />

Price 5.9% # Rx PMPY: 0.0047<br />

Units per Prescription -2.9% Prevalence of Use: 0.25%<br />

Brand/Generic Mix 0 Average Cost/Rx: $887.11<br />

Therapeutic Mix 1.6% # Rx/User/Year: 1.85<br />

Utilization 12.2%<br />

Prevalence 14.5%<br />

Intensity -2.0%<br />

New Drugs 0<br />

TOTAL 17.3%<br />

Anticoagulants Market-Share Trend<br />

Percent of Prescriptions<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

Lovenox ® $874.71<br />

Arixtra ® $1,296.39<br />

Fragmin ® $805.79<br />

Innohep ® $1,147.85<br />

• Anticoagulants had the greatest trend increase in specialty-drug use — primarily due to shifts in<br />

payment from the medical benefit to the prescription-drug benefit.<br />

• ATryn ® is an infused anticoagulant that will be administered during major surgical procedures to<br />

patients with hereditary antithrombin deficiency.<br />

• Recent data showing increased bleeding in patients taking idraparinux may delay its approval.<br />

Idraparinux is an SQ anticoagulant in development for treating blood clots in the legs and lungs.<br />

Its once-weekly dosing differentiates it from current products that need more frequent dosing.<br />

• Generic alternatives to Lovenox ® may enter the market in 2009, pending approval and resolution<br />

of patent litigation.<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Anticoagulants Pipeline<br />

ATryn ®<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

antithrombin III,<br />

recombinant<br />

Anticoagulants Patent Expiration<br />

IV infusion Anticoagulant 2008<br />

idraparinux SQ Anticoagulant 2008<br />

Drug Generic Indication Anticipated Generic Availability<br />

Lovenox ® enoxaparin Anticoagulant 2009<br />

express scripts 2007 drug trend report 39

Hepatitis C SPECIALTY RANK 7<br />

COMPONENTS OF TREND 2006 TO 2007 KEY FACTS 2007<br />

Cost per Prescription 5.5% Cost PMPY: $3.34<br />

Price 2.4% # Rx PMPY: 0.0028<br />

Units per Prescription 2.1% Prevalence of Use: 0.03%<br />

Brand/Generic Mix -0.6% Average Cost/Rx: $1,174.31<br />

Therapeutic Mix 1.6% # Rx/User/Year: 10.20<br />

Utilization -4.6%<br />

Prevalence -8.6%<br />

Intensity 4.3%<br />

New Drugs 0<br />

TOTAL 0.6%<br />

Hepatitis C Market-Share Trend<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Percent of Prescriptions<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

2003<br />

2004 2005 2006<br />

2007<br />

ribavirin $558.51<br />

Pegasys ® $1,651.60<br />

PegIntron TM $1,614.85<br />

RibaPak ® $851.02<br />

Infergen ® $1,985.02<br />

Ribasphere ® $528.82<br />

Copegus ® $1,106.96<br />

Rebetol ® $1,214.99<br />

• New treatment options in development for hepatitis C include several oral products. At least initially,<br />

many of the oral drugs will be used in combination with ribavirin, or with ribavirin and pegylated<br />

interferon together.<br />

• Albuferon ® is a long-acting interferon that may be dosed once every two weeks or possibly once<br />

monthly, as compared to weekly dosing with the currently available interferons.<br />

• The next big class of drugs that shows promise for hepatitis C is the oral protease inhibitors, including<br />

boceprevir and telaprevir.<br />

Hepatitis C Pipeline<br />

Brand Generic Route of Administration Proposed Use Anticipated Availability<br />

Albuferon ®<br />

albumininterferon<br />

alpha 2b<br />

SQ Hepatitis C 2010<br />

boceprevir Oral Hepatitis C 2010<br />

celgosivir Oral Hepatitis C 2010<br />

telaprevir Oral Hepatitis C 2011<br />

40 express scripts 2007 drug trend report

Orphan Drugs<br />

By definition, rare (orphan) conditions affect small groups of patients. Diseases with names as familiar<br />

as cystic fibrosis and sickle-cell anemia, and as unfamiliar as acromegaly, are all considered rare.<br />

Collectively, an estimated 25 million Americans have one of the more than 6,000 rare conditions that<br />

have been identified by the National Institutes of Health 2 . Many of them are long-term, serious and at<br />

least partially genetic.<br />

New rare diseases are being discovered, advances in genetics are making rare conditions more likely to<br />

be diagnosed, and the number of orphan medications available to treat them is growing. Therefore, rare<br />

diseases and orphan drugs will continue to receive an increasing amount of attention in the coming years.<br />

Orphan designations are granted to specific indications for drugs. Many medications with orphan<br />

indications for chronic conditions may cost hundreds of thousands of dollars per year. According to<br />

<strong>Express</strong> <strong>Scripts</strong> data, annual costs for Cerezyme ® , for example, can exceed $200,000 per year. Cerezyme<br />

is indicated for Gaucher’s disease, an inherited enzyme deficiency that must be treated for life.<br />

A single prescription drug may have both non-orphan and orphan approvals. One example is H.P. Acthar ® ,<br />

which is used to treat several rare conditions, including acute flare-ups of MS. It also has an off-label<br />

orphan designation for the treatment of infantile spasms. In August 2007, the manufacturer of this drug<br />

increased its wholesale price from $2,062 per vial to more than $29,000 per vial, increasing the average<br />

cost per prescription to $11,041.<br />

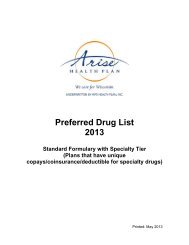

According to an analysis of <strong>Express</strong> <strong>Scripts</strong> data, drugs with orphan indications make up slightly more<br />

than one-third of specialty drugs, but contribute a disproportionate part (71.3%) to specialty-drug<br />

spend. Additionally, as shown in Exhibit 24, orphan drugs cost more than twice as much as non-orphan<br />

medications on a PMPY basis.<br />

Exhibit 24<br />

Specialty-Drug Trend by Orphan Status<br />

$70<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

PMPY<br />

$60<br />

$50<br />

$40<br />

$30<br />

$20<br />

$60.43<br />

$10<br />

$24.29<br />

$ 0<br />

Non-Orphan Drugs<br />

Orphan Drugs<br />

Source: 2008 <strong>Express</strong> <strong>Scripts</strong> analysis<br />

2<br />

National Organization for Rare Disorders. What is a rare disorder? Last modified August 28, 2007.<br />

Available at: www.rarediseases.org/info/about.html. Accessed March 24, 2008.<br />

express scripts 2007 drug trend report 41

In the U.S., rare diseases generally have patient populations of fewer than 200,000. Although the diseases<br />

they treat may be obscure, orphan drugs are often well-known. One example is Gleevec ® , approved as an<br />

orphan for relatively rare cancers and blood diseases.<br />

Treatments for conditions affecting more than 200,000 U.S. citizens may also be orphan drugs if their<br />

sales are not anticipated to offset the costs involved in making them. For instance, even though MS<br />

affects an estimated 400,000 Americans, some MS medications, such as Avonex ® and Betaseron ® ,<br />

have orphan-drug status because of their high development and manufacturing costs.<br />

The use of orphan drugs is expected to grow over the next few years. Some of the orphan drugs being<br />

developed are listed in Exhibit 25.<br />

Exhibit 25<br />

Selected Orphan Drugs in Development<br />

<strong>Therapy</strong> <strong>Class</strong> <strong>Review</strong><br />

Brand (Generic) Condition Description Risk Factors Prevalence<br />

Cinryze <br />

(C1-inhibitor)<br />

Firazyr ® (icatibant)<br />

Rhucin ® (ecallantide/<br />

DX-88 rhC1INH)<br />

Hereditary<br />

angioedema<br />

(HAE)<br />

Attacks of swelling in the<br />

face, feet, gastrointestinal<br />

tract, hands, throat or<br />

other parts of the body<br />

Genetics 6,000 to 10,000 3<br />

Kiacta (eprodisate)<br />

Xiaflex (clostridial<br />

collagenase for<br />

injection)<br />

Amyloid A<br />

amyloidosis<br />

(AA amyloidosis,<br />

Secondary<br />

amyloidosis)<br />

Dupuytren’s<br />

contracture<br />

Deposits of amyloid<br />

proteins in body tissues<br />

and organs disrupt<br />

normal functioning<br />

Thickening and shortening<br />

of the skin on the hand<br />

pulls the fingers<br />

towards the palm<br />

Male,<br />

age over 40 years,<br />

chronic inflammatory,<br />

infectious or<br />

malignant conditions<br />

Male,<br />

age over 65 years,<br />

Caucasian ancestry<br />

1,275 to 3,000<br />

new cases<br />

per year 4<br />

Up to 30% of<br />

high-risk groups 5<br />

3<br />

HAE overview. United States Hereditary Angioedema Association. No date given. Available at:<br />

http://www.haea.org/hae_overview_for_physicians.php. Accessed Jan. 31, 2008.<br />

4<br />

Falk RH, Comenzo RL, Skinner M. The systemic amyloidoses. N Engl J Med. 1997;337(13):898-909.<br />

5<br />

Brown AN, Gilkeson GS. Fibrosing diseases: Diabetic stiff hand syndrome, Dupuytren’s contracture, palmar and plantar<br />

fasciitis, retroperitoneal fibrosis, and Peyronie’s disease. In: Koopman WJ, Moreland LW, eds., Arthritis and Allied Conditions:<br />

A Textbook of Rheumatology, 15th ed., vol. 2. Philadelphia: Lippincott Williams & Wilkins; 2005:2093-2108.<br />

42 express scripts 2007 drug trend report