Appendix 4E - First State Investments

Appendix 4E - First State Investments

Appendix 4E - First State Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CPA<br />

CPA<br />

CONTENTS<br />

– Results for announcement<br />

<br />

– ASX announcement<br />

– Additional information<br />

– Financial Report<br />

<br />

ARSN 086 029 736<br />

<br />

<br />

<br />

Our approach

Commonwealth Property Office Fund (ABN 65 976 185 490)<br />

<strong>Appendix</strong> <strong>4E</strong> - Results for announcement to the market<br />

For the year ended 30 June 2013<br />

12 months to<br />

30-Jun-13 30-Jun-12<br />

Variance<br />

$m $m $m %<br />

2.1 Revenue from ordinary activities (excluding investment property and associates revaluations) 354.6 335.9 18.7<br />

Investment property revaluations - 91.7 (91.7)<br />

Share of associates' revaluations (2.0) 21.4 (23.4)<br />

Total revenue from ordinary activities 352.6 449.0 (96.4) (21.5)<br />

Expenses from ordinary activities (excluding investment property and derivatives revaluations) 166.7 153.7 13.0<br />

Investment property revaluations 38.1 - 38.1<br />

Financial derivatives revaluations 2.4 38.9 (36.5)<br />

Total expenses from ordinary activities 207.2 192.6 14.6 7.6<br />

2.2 Profit from ordinary activities after tax 145.4 256.4 (111.0) (43.3)<br />

2.3 Net profit 145.4 256.4 (111.0) (43.3)<br />

Distribution per unit<br />

Cents 1 Record date<br />

Payment<br />

date<br />

2.4/2.5 Interim 3.20 31-Dec-12 28-Feb-13<br />

Final 3.35 28-Jun-13 28-Aug-13<br />

Total 6.55<br />

2.6<br />

For explanation of figures in 2.1 to 2.4 refer to the attached documents: ASX announcement, Additional information and Financial Report.<br />

Share of net profits 2<br />

Ownership Interest 12 months to 12 months to<br />

30-Jun-13 30-Jun-12 30-Jun-13 30-Jun-12<br />

Details of associates % % $m $m<br />

11 Associates<br />

Kent Street Trust 3 - 50.0 3.2 5.5<br />

Grosvenor Place Holdings Trust 50.0 50.0 11.8 31.1<br />

Site 6 Homebush Bay Trust 50.0 50.0 3.2 5.1<br />

Site 7 Homebush Bay Trust 50.0 50.0 3.9 6.6<br />

PIF Managed Property Pty Limited 50.0 50.0 - -<br />

Grosvenor Place Pty Limited 25.0 25.0 - -<br />

Other information required under ASX Listing Rule 4.3A<br />

Page<br />

<strong>State</strong>ment of comprehensive income (Rule 4.3A Item No. 3) 11<br />

<strong>State</strong>ment of financial position (Rule 4.3A Item No. 4) 12<br />

<strong>State</strong>ment of cashflows (Rule 4.3A Item No. 5) 13<br />

<strong>State</strong>ment of changes in equity (Rule 4.3A Item No. 6) 14<br />

Distributions (Rule 4.3A Item No. 7) Above, 30<br />

Distribution reinvestment plans (Rule 4.3A Item No. 8)<br />

N/A<br />

Net tangible assets per security (Rule 4.3A Item No. 9) 56<br />

Details of entities over which control has been gained or lost during the year<br />

(Rule 4.3A Item No. 10) Above, 34<br />

Details of associates (Rule 4.3A Item No. 11) Above, 34<br />

Other significant information (Rule 4.3A Item No. 12)<br />

Summary of significant accounting policies 15<br />

Events occurring after the reporting date 55<br />

Foreign entities (Rule 4.3A Item No. 13)<br />

N/A<br />

Commentary on results (Rule 4.3A Item No. 14)<br />

ASX Announcement - Annual Results<br />

The information presented above is based upon the audited Financial Report for 30 June 2013. Refer to page 58 - Independent auditor's report.<br />

Michelle Brady Date: 20 August 2013<br />

Company Secretary<br />

Notes<br />

1 The franked amount per unit for the year ended 30 June 2013 is 0.0072 cents. Details of the full-year tax components of distributions will be provided in the Annual Tax<br />

<strong>State</strong>ments which will be sent to unitholders on 28 August 2013.<br />

2 Includes investment property valuation gains/(losses).<br />

3 On 10 April 2013, the Fund purchased the remaining 50% of the units in the Kent Street Trust. The Fund's 100% interest in the Kent Street Trust represents control.<br />

As such the Fund gained control over the Kent Street Trust from 10 April 2013. The Kent Street Trust is consolidated from this date.

Responsible Entity:<br />

Commonwealth Managed <strong>Investments</strong> Limited<br />

ABN 33 084 098 180<br />

AFSL 235384<br />

Colonial <strong>First</strong> <strong>State</strong> Property Limited<br />

ABN 20 085 313 926<br />

Manager of Commonwealth Property Office Fund<br />

Registered Address:<br />

Ground Floor, Tower 1, 201 Sussex Street<br />

Sydney NSW 2000 Australia<br />

Principal Office of the Manager:<br />

Level 4, Tower 1, 201 Sussex Street<br />

Sydney NSW 2000 Australia<br />

Telephone: 02 9303 3500<br />

Facsimile: 02 9303 3622<br />

20 August 2013<br />

COMMONWEALTH PROPERTY OFFICE FUND (CPA)<br />

Annual results for the 12 months ended 30 June 2013<br />

Commonwealth Property Office Fund (CPA or the ‘Fund’) has met the challenges of a difficult office market<br />

environment to deliver investors a distribution of 6.55 cents per unit for the year ended 30 June 2013, a 7.6%<br />

increase on the prior year.<br />

Angus McNaughton, Managing Director, Property, Colonial <strong>First</strong> <strong>State</strong> Global Asset Management, said: “While<br />

the Australian office markets continued to face a number of obstacles, with weak business confidence and<br />

soft tenant demand contributing to higher vacancy, CPA has delivered another creditable full-year result.”<br />

Charles Moore, CPA Fund Manager, said: “Our commitment to optimising the performance of our portfolio of<br />

quality Australian office assets to deliver long-term sustainable returns to investors has resulted in another<br />

positive outcome for our unitholders. CPA ended the year with an improved portfolio quality, a strong and<br />

flexible balance sheet, and an increase in distributions being declared.”<br />

Key operating highlights for the year included:<br />

net profit of $145.4 million compared to $256.4 million in the prior year, decreasing 43.3%<br />

predominantly due to reduced valuation increases and some valuation losses<br />

Funds From Operations (FFO) 1 increasing 3.1% to $207.0 million, up from $200.8 million in the prior<br />

year 2<br />

distribution of 6.55 cents per unit for the full year, which was up 7.6% on the prior year and reflected a<br />

74.3% payout ratio of FFO<br />

net property income growth of 5.1% and like-for-like 3 property income growth of 2.0%<br />

net tangible asset backing (NTA) per unit declining slightly to $1.15, from $1.16 at 30 June 2012<br />

total assets of $3.8 billion increasing marginally from $3.7 billion in the prior year<br />

restructuring $665 million of debt including $210 million in medium term note issuances<br />

maintaining a conservative gearing position of 25.2% 4 , up from 24.0% at 30 June 2012<br />

preserving a low weighted average cost of debt at 5.6%<br />

securing a solid occupancy level of 96.2% 5 with the successful leasing or renewal of 69,860 sqm of<br />

space, resulting in a weighted average lease expiry profile (by income) of 4.3 years 6<br />

achieving an average 4.1% increase in rents following the completion of rent reviews over 652,355 sqm<br />

of space (82.6% of the portfolio)<br />

acquiring a further 25% interest in 201 Kent Street, Sydney for $77.3 million excluding transaction costs<br />

1<br />

From 1 July 2012, FFO replaced Distributable Income. FFO is a key earnings measure used by management to assess the operating<br />

performance of the Fund. FFO equals net profit excluding: fair value adjustments from investment properties, associates and<br />

derivatives; straight-lining revenue; the movement in fair value of unrealised performance fees; non-cash convertible notes interest<br />

expense; the amortisation of fit-out incentives, cash incentives and leasing commissions and adjustments for other items.<br />

2 30 June 2012 has been restated to reflect the adoption of FFO on 1 July 2012 which resulted in the Fund adding back amortisation of fitout<br />

incentives, cash incentives and leasing commissions totalling $18.5 million to the net profit for the year ended 30 June 2012, to<br />

enable a like-for-like comparison to be made.<br />

3 Net property income and like-for-like net property income are unaudited, non-IFRS financial information and are not key earnings<br />

measures of the Fund. They are used by management to monitor the performance of the property portfolio. Please refer to <strong>Appendix</strong> 3<br />

for the calculation of net property income and like-for-like net property income.<br />

4 Gearing equals borrowings as a proportion of total assets. For this calculation, total assets exclude the fair value of derivatives and<br />

borrowings is the amount drawn down as per Note 11 of the Financial Report, adjusted for the fair value of cross currency swaps.<br />

5 By income.<br />

6 Excluding 5 Martin Place, Sydney (withdrawn for development).

selling 45 Pirie Street, Adelaide for $87.0 million (excluding transaction costs), Site 4B at Sydney<br />

Olympic Park and an option over 8 Exhibition Street, Melbourne, in line with our asset recycling<br />

strategy<br />

commencing construction on the jointly-owned office development at 5 Martin Place, Sydney,<br />

following law firm Ashurst committing to lease 44% of the project (by office area)<br />

<br />

<br />

<br />

completing the 145 Ann Street development project in Brisbane<br />

being ranked first globally in the 2012 Global Real Estate Sustainability Benchmark Survey and the<br />

Carbon Disclosure Project for Australia and New Zealand, in addition to being the overall winner of the<br />

2012 Best Practices Awards in the Mature Markets category from the Asia Pacific Real Estate<br />

Association (APREA), and<br />

achieving our long-term target of a portfolio weighted average NABERS Energy rating of 4.5-stars<br />

(excluding GreenPower).<br />

The Fund will pay an annual distribution of $153.7 million compared to $144.2 million for the prior year. The<br />

distribution, which equates to 6.55 cents per unit and a payout ratio of 74.3% of FFO, is in line with the Fund’s<br />

policy of distributing 70% to 80% of FFO, or the Fund’s taxable income, whichever is greater for any financial<br />

period. The distribution will be paid on 28 August 2013.<br />

For more information on CPA’s performance during the period, refer to the <strong>Appendix</strong> <strong>4E</strong> which was released<br />

today and can be found on CPA’s website, cfsgam.com.au/cpa<br />

Financial results<br />

CPA’s net profit for the financial year ended 30 June 2013 was $145.4 million, compared to $256.4 million for<br />

the previous year. The profit included a net loss on investment properties and associates valuations of<br />

$40.1 million 7 (compared to a $113.1 million net gain for the previous year), and a net loss on the fair value of<br />

derivatives of $2.4 million (compared to a net loss of $38.9 million for the previous year).<br />

FFO increased 3.1% to $207.0 million, up from $200.8 million in the prior year.<br />

Total net property income was up 5.1% to $255.9 million due to additional income received from the<br />

acquisitions of 10 Eagle Street, Brisbane and a further 25% of 201 Kent Street, Sydney, as well as the<br />

completion of 145 Ann Street, Brisbane, which was partially offset by sales in the prior year. On a like-for-like<br />

basis, net property income was up 2.0%.<br />

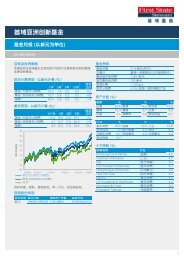

Investment performance<br />

The Fund delivered a strong total return 8 of 15.5% for the 2013 financial year, albeit below the S&P/ASX 200<br />

Property Accumulation Index (the ‘Index’).<br />

Over the five and 10-year periods, the Fund outperformed the Index by 4.1 and 3.3 percentage points per<br />

annum respectively, and underperformed over the one and three year periods.<br />

The performance fee entitlement is calculated every six months and is capped at 0.15% of the Fund’s gross<br />

asset value for each six-month period with any over/underperformance carried forward. In accordance with<br />

the Fund’s Constitution, the fee is paid only when there is a period of absolute positive performance; otherwise<br />

it is accrued until such a period occurs.<br />

The Fund changed its performance fee benchmark 9 at the beginning of the year to the S&P ASX 200 Property<br />

Accumulation Index, excluding CPA. This benchmark contains a larger number of entities with which to better<br />

compare CPA’s performance.<br />

The Fund underperformed the benchmark by 9.9 and 1.5 percentage points to 31 December 2012 and<br />

30 June 2013 respectively. Combined with prior period underperformance, the Manager was not entitled to a<br />

performance fee. Accrued underperformance of 22.6% will be carried over to the next reporting period in<br />

accordance with the performance fee formula.<br />

Further details of the performance fee are detailed in Note 14(d)(ii) of the Financial Report.<br />

7 Including net gains or losses on asset sales.<br />

8 Total return comprises unit price performance and distribution income yield.<br />

9 The performance fee benchmark (‘benchmark’) for the period was the S&P/ASX 200 Property Accumulation Index customised to<br />

remove the effect of CPA on the benchmark. A 20-day volume weighted average price (VWAP) is applied to both the CPA index and<br />

the benchmark. Prior to 1 July 2012, the benchmark was the S&P ASX 200 Commercial Accumulation Index.<br />

2

Transactions<br />

CPA has not wavered from its long-held strategy of actively managing a portfolio of quality Australian office<br />

assets to optimise performance. Recycling capital continues to be a key component of our strategy. In the<br />

period, we sold a non-core development site at Sydney Olympic Park and an option over 8 Exhibition Street,<br />

Melbourne, as well as a mature office building at 45 Pirie Street, Adelaide. Proceeds of $92.9 million from<br />

these transactions will be initially applied to pay down debt and provide balance sheet flexibility.<br />

In April 2013, we acquired a further 25% interest in the Sydney CBD office building at 201 Kent Street for<br />

$77.3 million, taking our ownership in this property to 50%. The transaction was accretive to earnings and<br />

provides CPA with greater exposure to an outstanding A-grade office building with high occupancy of 98.4% 10 .<br />

This transaction, along with better than anticipated leasing outcomes across the portfolio and a marginally<br />

higher payout ratio, were key contributors to the Fund’s stronger distribution outcome for the year.<br />

Capital management<br />

Despite lingering global economic concerns, credit market conditions improved throughout the year as interest<br />

rates reduced and demand from corporate bond investors put downward pressure on margins.<br />

Mr Moore said: “Over the past year we have seen further liquidity in capital markets and strengthening<br />

demand for quality borrowers, with margins continuing to compress.”<br />

During the year, the Manager:<br />

issued $185 million of 7-year MTNs at a 5.25% coupon<br />

issued $25 million of 10-year MTNs at a 5.75% coupon<br />

extended a $300 million bank debt facility for 26 months<br />

repaid $83 million of US Private Placement notes, and<br />

cancelled a $155 million short-term bank debt facility.<br />

At year end, CPA had $345.0 million 11 of undrawn debt facilities and the gearing level was 25.2%, up from<br />

24.0% at 30 June 2012, with borrowings of $948.9 million 12 . The weighted average debt maturity was<br />

3.9 years and the weighted average interest rate (including line fees and margins) remained competitive at<br />

5.6%. The Fund’s debt was 95.9% hedged. On hedged debt, the weighted average maturity was 4.0 years<br />

and the weighted average interest rate on hedged debt was 5.1% (including convertible notes and fixed-rate<br />

medium term notes and excluding line fees and margins).<br />

Portfolio update<br />

Total assets at 30 June 2013 were $3.8 billion, increasing marginally from $3.7 billion at 30 June 2012.<br />

At 30 June 2013, the Fund’s portfolio consisted of 25 properties, located in major office markets across<br />

Australia, with 46.3% of the portfolio (by value) in Sydney and 30.0% in Melbourne. The majority of assets are<br />

occupied by blue chip tenants with low risk profiles. The top 15 tenants contribute 51.7% of the Fund’s<br />

income.<br />

Leasing<br />

During the year, 69,860 sqm in new and renewed leases were successfully negotiated, maintaining a solid<br />

occupancy level of 96.2% (by income) across the portfolio. Leasing and renewal activity has contributed to the<br />

portfolio’s long weighted average lease expiry profile, or WALE (by income), of 4.3 years at 30 June 2013<br />

(4.9 years at 30 June 2012). See <strong>Appendix</strong> 1 for further details.<br />

Major lease deals for the year included:<br />

Ashurst underpinning the start of construction on 5 Martin Place, Sydney, with a 13,871 sqm precommitment,<br />

and<br />

AON Corporation renewing for a 10-year period at 201 Kent Street, Sydney, for 10,964 sqm of space.<br />

10 By income.<br />

11 This has been reduced by the $100 million of short term notes on issue.<br />

12<br />

Borrowings is the amount of debt drawn as per Note 11 of the Financial Report, equal to $931.9 million, adjusted for the $17 million<br />

liability value of cross currency swaps.<br />

3

In addition, we have agreed terms over an additional 44,477 sqm of space, including:<br />

Confidential terms being agreed for a new 12-year lease over 15,000 sqm of office space and CBA<br />

renewing 3,660 sqm of retail space for 10-years at 385 Bourke Street, Melbourne<br />

BNP Paribas agreeing to a new 10-year lease over 5,397 sqm of space at 60 Castlereagh Street,<br />

Sydney, and<br />

Two tenants agreeing to separate lease agreements at 108 North Terrace, Adelaide for seven and<br />

five-year terms respectively across 10,805 sqm of space.<br />

Rental reviews<br />

Rental reviews over 652,355 sqm of tenanted space (82.6% of the portfolio) were undertaken during the year<br />

(see <strong>Appendix</strong> 2 for further details), achieving an average rental increase of 4.1%. Of the space reviewed,<br />

93% was subject to fixed rental increases with the remainder reviewed to market.<br />

In the 2014 financial year, 606,546 sqm (76.7% of the portfolio) is subject to review, with 93% of the area<br />

subject to fixed reviews at an average increase of 4.5% 13 and the remainder to be reviewed to market.<br />

Asset valuations<br />

The Fund’s annual asset valuation program was this year reflective of the challenging conditions present in<br />

Australian office markets. While asset values remained largely static over the 12-month period, two significant<br />

upcoming lease expiries at 10 Shelley Street, Sydney, and 385 Bourke Street, Melbourne, along with the<br />

Finlay Crisp Centre in Canberra which was impacted by poor market fundamentals, were key drivers of a<br />

$40.1 million unrealised net loss on investment properties and associates valuations.<br />

The weighted average capitalisation rate of the portfolio softened marginally from 7.5% at 30 June 2012 to<br />

7.6% at 30 June 2013.<br />

Mr Moore said: “We are encouraged by solid transaction activity levels in the market. However we expect<br />

valuations to be predominantly driven by the strength of asset cash flows rather than any tightening in<br />

valuation metrics.”<br />

Development underway<br />

5 Martin Place, Sydney<br />

Construction of the jointly-owned 5 Martin Place development is well underway with completion expected in<br />

early 2015. Main contract works on the $215 million project (CPA share) commenced upon securing law firm<br />

Ashurst for over 44% of the office area.<br />

On completion in early 2015, the existing historic building will be transformed and integrated into a new<br />

structure to form a 31,280 sqm office building with floor plates ranging from 1,100 sqm to 2,400 sqm.<br />

The historic banking chamber will also be transformed into 2,580 sqm of retail space fronting Pitt Street.<br />

The project will target a 5-star Green Star rating, a 5-star NABERS Energy rating and a 5-star NABERS Water<br />

rating.<br />

Estimated cost (CPA share)^<br />

CPA cost to complete<br />

$215 million<br />

$153 million<br />

Target year-one yield ~7%*<br />

Target internal rate of return >10%<br />

Office NLA on completion<br />

Retail GLA on completion<br />

31,280 sqm<br />

2,580 sqm<br />

^This represents CPA’s 50% interest including land, construction costs, incentives, leasing fees and an allowance for finance costs.<br />

* On a fully-leased basis on completion.<br />

13 Average rental increase for the year to 30 June 2014 is based on all fixed rent reviews.<br />

4

Major refurbishment projects underway<br />

385 Bourke Street, Melbourne<br />

The centrally located Melbourne CBD property at 385 Bourke Street is to undergo a major refurbishment<br />

project to reposition this asset in the market. The $64 million project 14 will involve the complete refurbishment<br />

of 15 levels or 18,000 sqm of office space into modern A-grade office accommodation, the extension and<br />

refurbishment of the ground floor office foyer as well as the reconfiguration and refurbishment of the Galleria<br />

retail space. Upon completion, this asset will provide quality office space in the heart of Melbourne’s CBD at<br />

rentals comparable to Docklands.<br />

Works are expected to commence in September 2013, with completion in August 2014.<br />

180 Lonsdale Street, Melbourne<br />

This asset will be extensively refurbished with works to commence in August 2013 and completion targeted<br />

for April 2014. Works are estimated to cost $17 million 14 (representing CPA’s 50% interest) and will involve<br />

the refurbishment of 10 office levels over 18,000 sqm and will incorporate a foyer upgrade. Featuring large<br />

floor plates, abundant natural light, quality services and amenities, and competitive rents, this A-grade asset is<br />

well positioned to attract quality tenants.<br />

108 North Terrace, Adelaide<br />

In conjunction with the successful leasing up of 10,805 sqm of office space in this A-grade building, at least<br />

five floors of this building will be extensively refurbished. The $27 million program 14 will commence in<br />

December 2013 and is expected to be completed in June 2015.<br />

Responsible property investment<br />

Mr Moore said: “CPA continues to demonstrate leadership among office property owners and managers in the<br />

field of responsible property investment. Our efforts have again garnered the Fund outstanding global<br />

recognition.”<br />

During the period, CPA was ranked number one:<br />

globally in the Global Real Estate Sustainability Benchmark (GRESB)<br />

in the Australian and New Zealand Carbon Disclosure Project (CDP), and<br />

in the Asia Pacific Real Estate Association’s awards for best practice in the Mature Markets category.<br />

The Fund was also again included in the FTSE4Good, DJSI World, DJSI Asia Pacific and the Australian SAM<br />

Sustainability Index (AuSSI) indices, and has been a member of DJSI since 2003.<br />

At a portfolio level, we achieved our long-term target of reaching a 4.5-star weighted portfolio NABERS<br />

Energy rating, and our portfolio now carries a weighted average 3.7-star NABERS Water rating.<br />

Since July 2007, we have avoided $12.0 million in energy costs, $0.5 million in water costs and $0.5 million in<br />

waste costs 15 . Our office buildings:<br />

are 40.8% more energy efficient 16<br />

are 27.5% more water efficient 16<br />

have 41.1% lower emissions intensity 16 , and<br />

have achieved 67% waste diversion 17 from landfill.<br />

Mr Moore said: “This year we engaged with our stakeholders to identify environmental, social and governance<br />

(ESG) issues that are material to them. By identifying our stakeholders’ level of interest and engagement<br />

compared to CPA on a range of ESG matters, we have been able to prioritise these into our business model.”<br />

Comprehensive detail in relation to the Fund’s approach to responsible property investment can be found on<br />

CPA’s website cfsgam.com.au/cpa<br />

14<br />

Includes construction costs, incentives and leasing fees.<br />

15<br />

Since FY11.<br />

16 Since FY07.<br />

17 For FY13, includes those properties where CPA has operational control over the waste and recycling program.<br />

5

Internalisation proposal<br />

On 24 July 2013, the Commonwealth Managed <strong>Investments</strong> Limited (CMIL) Board announced it had received<br />

a highly conditional, indicative and incomplete proposal from Commonwealth Bank of Australia to internalise<br />

the management of CPA.<br />

The CMIL Board has established an Independent Board Committee (IBC) of independent Directors, being<br />

Chairman Richard Haddock AM, Nancy Milne OAM and James Kropp, to consider the proposal.<br />

Mr Haddock said: “The Board of CMIL can give no assurance that the proposal or any other proposal will<br />

proceed. It is also noted that the approval of CPA unitholders would be required.”<br />

“The IBC has engaged independent advisers to assist in its consideration of the proposal and will update the<br />

market when it is in a position to do so,” Mr Haddock said.<br />

Outlook<br />

Mr Moore said: “Notwithstanding a very solid 2013 financial year performance, we remain cautious about the<br />

year ahead. While signs are emerging that the global economic environment is improving, this is yet to<br />

translate into business confidence which, upon its return, will drive stronger office leasing demand in many of<br />

the major Australian office markets. We are, however, encouraged by some positive economic indicators such<br />

as rising global stock markets, a lower Australian dollar and stabilising business confidence.<br />

“In the short term, the CPA portfolio does have some leasing challenges, particularly in Melbourne. Within<br />

this context, we will target a distribution for the 2014 financial year at the mid-point of 70% to 80% of FFO and<br />

consequently provide full-year distribution guidance of 6.55 cents 18 per unit,” Mr Moore concluded.<br />

ENDS<br />

For further information please contact:<br />

Charles Moore<br />

Angus McNaughton<br />

Fund Manager<br />

Managing Director, Property<br />

Commonwealth Property Office Fund<br />

Colonial <strong>First</strong> <strong>State</strong> Global Asset Management<br />

Phone: +61 2 9303 3438 Phone: +61 2 9303 3765<br />

Email: chmoore@colonialfirststate.com.au<br />

Email: amcnaughton@colonialfirststate.com.au<br />

Investor and media contacts:<br />

Penny Berger<br />

Mathew Chandler<br />

Head of Investor Relations and Communications Investor Relations and Communications Manager<br />

Colonial <strong>First</strong> <strong>State</strong> Global Asset Management Colonial <strong>First</strong> <strong>State</strong> Global Asset Management<br />

Phone: +61 2 9303 3516 or +61 402 079 955 Phone: +61 2 9303 3484 or +61 407 009 687<br />

Email: pberger@colonialfirststate.com.au<br />

Email: mathewchandler@colonialfirststate.com.au<br />

About Commonwealth Property Office Fund<br />

CPA is an office sector-specific Australian Real Estate Investment Trust (A-REIT) which invests in prime<br />

quality office property located in central business districts and major suburban markets across Australia. The<br />

Fund is managed by entities within CFSGAM Property on behalf of more than 22,000 investors from<br />

20 countries. At 30 June 2013, the Fund comprised 25 assets with a total asset value of $3.8 billion.<br />

About CFSGAM Property<br />

CFSGAM Property is the specialist property division of Colonial <strong>First</strong> <strong>State</strong> Global Asset Management, and is<br />

one of the largest real estate fund managers in Australia with $17 billion in funds under management.<br />

CFSGAM Property offers a fully integrated real estate investment platform including investment management,<br />

asset management, development management, origination and execution. CFSGAM Property manages a<br />

suite of wholesale investment products, as well as three listed real estate investment trusts in Australia and<br />

New Zealand.<br />

18<br />

Assuming no performance fees are payable for the full 12-month period, the Fund’s taxable income is no more than 6.55 cents per unit<br />

and there is no unforeseen material deterioration in existing economic conditions. Guidance is based upon the current operating<br />

model. Refer to Note 20 of the Financial Report for details concerning potential changes to this operating model, which may impact<br />

upon future distributions.<br />

6

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 1 - Major leasing activity (over 500 sqm)<br />

For the year ended 30 June 2013<br />

Property Tenant Level / suite<br />

Area<br />

sqm<br />

Lease<br />

commence<br />

-ment<br />

New South Wales<br />

201 Miller Street, North Sydney Nestle 21-22 1,099 1-Nov-12 6.0 530 Net Annual 4% increases<br />

201 Miller Street, North Sydney Nestle 9 669 1-Nov-12 6.0 471 Net Annual 4% increases<br />

201 Miller Street, North Sydney Nestle 4 668 1-Nov-12 6.0 430 Net Annual 4% increases<br />

201Kent Street, Sydney Aon Corporation Part level 5 & 26, 27-34 10,964 3-Jul-12 10.0 620 Net Annual 3.75% increases with market review at year 4<br />

201 Kent Street, Sydney Bacardi Lion Level 8 560 1-Oct-13 1.0 655 Net NA<br />

225 George Street, Sydney Barclays 42 1,672 1-Jul-13 3.0 1,225 Gross Annual 4% increases<br />

225 George Street, Sydney Itochu Part level 31 986 1-Mar-13 8.0 1,235 Gross Annual 4% increases<br />

225 George Street, Sydney Colliers Part level 21 838 1-Oct-12 3.1 750 Gross Annual 4% increases<br />

225 George Street, Sydney Sumitomo Part level 33 780 22-Aug-13 7.0 1,220 Gross Annual 4% increases<br />

5 Martin Place, Sydney Ashurst 5-11 13,871 1-Mar-15 10.1 NA Net NA<br />

56 Pitt Street, Sydney NEHTA Part level 21, 25 1,240 1-Sep-12 3.0 841 Gross Annual 4.25% increases<br />

56 Pitt Street, Sydney Infigen Energy 22 823 1-May-13 5.0 830 Gross Annual 4% increases<br />

56 Pitt Street, Sydney Lynas Services 701 780 1-Mar-13 5.0 750 Gross Annual 4% increases<br />

56 Pitt Street, Sydney Philip Services 901 779 15-Mar-13 5.0 700 Gross Annual 4% increases<br />

56 Pitt Street, Sydney Insurance Council of Australia 401 778 21-Nov-13 5.0 690 Gross Annual 4% increases<br />

60 Castlereagh Street, Sydney Centric Services Level 9-10 2,247 1-Jan-13 7.0 638 Net Annual 4% increases<br />

60 Castlereagh Street, Sydney Shaw Stockbroking Part level 15, 16 1,800 1-Nov-12 6.5 875 Gross Annual 4% increases<br />

Victoria<br />

2 Southbank Boulevard, Melbourne Vanguard <strong>Investments</strong> Part level 36, 33 - 34 3,439 30-Jun-13 7.0 500 Net Annual 3.0% increases in years 1-3, 4.0% increases thereafter<br />

2 Southbank Boulevard, Melbourne Acciona Energy 12 1,804 1-Sep-12 7.0 430 Net Annual 4% increases<br />

Queensland<br />

10 Eagle Street, Brisbane Adani Mining 25 954 25-Sep-12 7.0 686 Gross Annual 4% increases<br />

South Australia<br />

11 Waymouth Street, Adelaide SA Water 12, 15 3,192 1-Nov-12 10.0 515 Net Annual 3.5% increases with market review at year 6<br />

45 Pirie Street, Adelaide SA Government 16 1,115 1-Mar-12 5.4 465 Gross Annual 3.5% increases<br />

45 Pirie Street, Adelaide AAPT Part level 1 641 1-Jul-13 5.0 450 Net Annual 4% increases<br />

Term<br />

years<br />

New<br />

rent<br />

$/sqm<br />

Rent<br />

type<br />

net/gross<br />

Rent<br />

review<br />

structure<br />

*100% ownership basis

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 2 - Major rent reviews (over 500 sqm)<br />

For the year ended 30 June 2013<br />

Property Tenant Level / suite<br />

Australian Capital Territory<br />

Finlay Crisp Centre - Nara House, Canberra ACT Government Whole building 7,506 1-Jul-12 Fixed 400 416 Gross 4.0%<br />

New South Wales<br />

10 Shelley Street, Sydney KPMG Part ground, 2-15 26,261 1-Feb-13 Fixed 681 721 Net 5.9%<br />

10 Shelley Street, Sydney KPMG 1 1,461 1-Feb-13 Fixed 607 637 Net 5.0%<br />

101 George Street Paramatta Commonwealth Bank of Australia 3-11 17,625 9-Nov-12 Fixed 450 468 Gross 4.0%<br />

150 George Street, Paramatta Commonwealth Bank of Australia Whole building 21,964 23-Nov-12 Fixed 339 352 Net 3.8%<br />

175 Pitt Street, Sydney Federal Government 2-5 4,142 1-Jul-12 Fixed 520 541 Net 4.0%<br />

175 Pitt Street, Sydney Kemp Strang Part level 17, 14-16 3,854 1-Jul-12 Fixed 564 587 Net 4.0%<br />

175 Pitt Street, Sydney Federal Government 19-21 3,137 1-Apr-13 Fixed 646 672 Net 4.0%<br />

175 Pitt Street, Sydney Employers Mutual Management Part level 11, 12-13 2,576 1-Jan-13 Fixed 567 589 Net 4.0%<br />

175 Pitt Street, Sydney Bendigo & Adelaide Bank Mezzanine - 1 2,453 1-Jan-13 Fixed 536 557 Net 4.0%<br />

175 Pitt Street, Sydney Tax Institute of Australia 10 987 1-Apr-13 Fixed 570 593 Net 4.0%<br />

175 Pitt Street, Sydney <strong>State</strong> Super 9 946 1-Sep-12 Fixed 540 562 Net 4.0%<br />

175 Pitt Street, Sydney Cushman and Wakefield Part level 18 689 1-Dec-12 Fixed 620 645 Net 4.0%<br />

175 Pitt Street, Sydney (retail) Fitness <strong>First</strong> Basement 1,410 3-Sep-12 Fixed 633 659 Gross 4.0%<br />

2 Dawn Fraser Ave, Sydney Olympic Park Commonwealth Bank of Australia Part ground, 1-7 18,803 23-Dec-12 Fixed 322 332 Net 3.3%<br />

2 Dawn Fraser Ave, Sydney Olympic Park Commonwealth Bank of Australia Part ground 957 23-Dec-12 Fixed 539 557 Gross 3.3%<br />

201 Miller Street, North Sydney Gallagher Bassett 5-8, 12-13 3,998 1-May-13 Fixed 437 454 Net 4.0%<br />

201 Miller Street, North Sydney Wipro 17 665 1-Jan-13 Fixed 519 540 Net 4.0%<br />

201 Miller Street, North Sydney McAffee 20 665 1-Feb-13 Fixed 503 523 Net 4.0%<br />

201 Miller Street, North Sydney McAffee 19 665 1-Feb-13 Fixed 498 517 Net 4.0%<br />

201 Miller Street, North Sydney Jobpac 1 659 1-Aug-12 Fixed 420 437 Net 4.0%<br />

201 Kent Street, Sydney ARUP 9,10 3,482 1-Oct-12 Fixed 543 566 Net 4.3%<br />

201 Kent Street, Sydney KBR 12,13 3,482 1-Jun-13 Fixed 583 609 Net 4.5%<br />

201 Kent Street, Sydney Austrade 22,23 2,650 1-May-13 Fixed 573 593 Net 3.5%<br />

201 Kent Street, Sydney Soul Pattinson Telecommunications L14 1,741 1-Mar-13 Fixed 573 596 Net 4.0%<br />

201 Kent Street, Sydney Lend Lease 15 1,698 1-Nov-12 Fixed 602 631 Net 4.7%<br />

201 Kent Street, Sydney Bupa Care Services 19 1,325 1-Jul-12 Fixed 584 607 Net 4.0%<br />

201 Kent Street, Sydney I-Med Network 24 1,325 1-Jan-13 Market (with ratchet) 600 625 Net 4.2%<br />

201 Kent Street, Sydney NSW Electoral Commission 25 1,325 1-Dec-12 Market (without ratchet) 608 633 Net 4.1%<br />

201 Kent Street, Sydney Aberdeen Asset Management Part level 6 1,021 1-Apr-13 Fixed 530 551 Gross 4.0%<br />

201 Kent Street, Sydney White Energy Company Part level 20 828 1-Oct-12 Fixed 607 630 Net 3.7%<br />

201 Kent Street, Sydney Adconian Part level 11 692 1-Feb-13 Fixed 550 573 Net 4.3%<br />

201 Kent Street, Sydney Lachlan Partners Part level 18 619 15-May-13 Fixed 612 636 Net 4.0%<br />

201 Kent Street, Sydney 18201 Kent Street Part level 18 590 1-Mar-13 Fixed 615 641 Net 4.3%<br />

201 Kent Street, Sydney Plus Fitness Part level 2 588 1-Dec-12 Fixed 158 164 Gross 4.0%<br />

201 Kent Street, Sydney Barcardi Lion 8 560 1-Oct-12 Fixed 625 655 Net 4.7%<br />

201 Kent Street, Sydney NSW Government Part level 21 507 1-Dec-12 Market (without ratchet) 588 620 Net 5.5%<br />

225 George Street, Sydney Deloitte 1 - 11,14,15 22,120 1-Dec-12 Fixed 910 950 Gross 4.4%<br />

Area<br />

sqm<br />

Review<br />

date<br />

Review<br />

type<br />

Passing<br />

rent<br />

$/sqm<br />

New<br />

rent<br />

$/sqm<br />

Rent<br />

type<br />

net/gross<br />

Variance<br />

%<br />

* 100% ownership basis

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 2 - Major rent reviews (over 500 sqm)<br />

For the year ended 30 June 2013<br />

Property Tenant Level / suite<br />

225 George Street, Sydney Ashurst 35-42 13,793 1-Jul-12 Fixed 990 1,032 Gross 4.3%<br />

225 George Street, Sydney Norton Rose 16-20 9,163 1-Jan-13 Fixed 1,034 1,076 Gross 4.0%<br />

225 George Street, Sydney Blackrock 43-44 3,992 1-Aug-12 Fixed 1,117 1,162 Gross 4.0%<br />

225 George Street, Sydney McCann RNH Grd - 6 3,959 1-Sep-12 Fixed 365 386 Gross 5.8%<br />

225 George Street, Sydney Ethereal 13 1,916 1-Jul-12 Fixed 884 920 Gross 4.1%<br />

225 George Street, Sydney RGA 23 1,878 1-Jul-12 Fixed 746 780 Gross 4.7%<br />

225 George Street, Sydney Barclays Bank Part level 42 1,672 1-Aug-12 Fixed 1,149 1,195 Gross 4.0%<br />

225 George Street, Sydney Man <strong>Investments</strong> Part level 21 753 1-Mar-13 Fixed 925 962 Gross 4.0%<br />

34-36 George Street Burwood Rail Corporation NSW Part ground, 2, 3 7,241 1-Nov-12 Fixed 300 311 Net 3.5%<br />

36 George Street Burwood Rail Corporation NSW Part ground, 1, 4 6,127 1-Nov-12 Fixed 315 328 Net 4.0%<br />

36 George Street Burwood Hewlett-Packard 4 3,092 10-Oct-12 Fixed 316 329 Net 4.0%<br />

4 Dawn Fraser Ave, Sydney Olympic Park Commonwealth Bank of Australia Part ground, 1-7 13,515 22-Aug-12 Fixed 322 332 Net 3.3%<br />

4 Dawn Fraser Ave, Sydney Olympic Park Commonwealth Bank of Australia Part ground 798 22-Aug-12 Fixed 539 557 Net 3.3%<br />

56 Pitt Street, Sydney The Donnington Group 15 824 1-Jul-12 Fixed 779 810 Gross 4.0%<br />

56 Pitt Street, Sydney Insurance Council of Australia 4 778 21-Nov-12 Fixed 685 716 Gross 4.5%<br />

56 Pitt Street, Sydney Transocean Part level 5 584 1-Sep-12 Fixed 660 686 Gross 4.0%<br />

56 Pitt Street, Sydney QIC Part Level 12 523 1-May-13 Fixed 738 768 Gross 4.0%<br />

60 Castlereagh Street, Sydney Banque Nationale De Paris 2, 4-8 8,675 1-Jul-12 Market (without ratchet) 375 398 Net 6.2%<br />

60 Castlereagh Street, Sydney Pitcher Partners 3 1,678 1-Mar-13 Fixed 677 705 Gross 4.0%<br />

60 Castlereagh Street, Sydney Balmain NB Commercial Managers 14 1,191 14-Feb-13 Fixed 815 848 Gross 4.0%<br />

60 Castlereagh Street, Sydney RMB Australia 13 1,190 1-Apr-13 Fixed 947 990 Gross 4.5%<br />

60 Castlereagh Street, Sydney Goodman International 18 1,189 1-Dec-12 Fixed 850 882 Gross 3.8%<br />

60 Castlereagh Street, Sydney Birdanco Nominees 12 1,171 1-Apr-13 Fixed 850 882 Gross 3.8%<br />

60 Castlereagh Street, Sydney Verandah Bar Ground level Elizabeth St 785 1-Oct-12 CPI 808 826 Gross 2.2%<br />

60 Castlereagh Street, Sydney Jones Lang LaSalle Part level 1 584 31-Oct-12 Fixed 720 749 Gross 4.0%<br />

60 Castlereagh Street, Sydney Birdanco Nominees Part level 19 571 1-Apr-13 Fixed 893 927 Gross 3.8%<br />

South Australia<br />

11 Waymouth Street, Adelaide SA Government 2-8 10,960 1-Feb-13 Fixed 456 474 Gross 4.0%<br />

11 Waymouth Street, Adelaide Australian Bureau of Statistics 9-11 4,581 1-Feb-13 Fixed 482 499 Gross 3.5%<br />

11 Waymouth Street, Adelaide ANZ 20, 21 2,928 1-Feb-13 Fixed 439 455 Net 3.5%<br />

11 Waymouth Street, Adelaide Deloitte 16,17 2,904 1-Feb-13 Fixed 421 437 Net 3.8%<br />

11 Waymouth Street, Adelaide SA Government 18 1,611 1-Feb-13 Fixed 433 449 Net 3.8%<br />

11 Waymouth Street, Adelaide Federal Government 13 1,391 1-Feb-13 Fixed 505 525 Gross 4.0%<br />

11 Waymouth Street, Adelaide ANZ Part level 19 716 1-Feb-13 Fixed 445 461 Net 3.5%<br />

11 Waymouth Street, Adelaide WSP Buildings 19 709 1-Feb-13 Fixed 427 444 Net 4.0%<br />

11 Waymouth Street, Adelaide Woods Bagot Part level 14 677 1-Feb-13 Fixed 438 456 Net 4.0%<br />

11 Waymouth Street, Adelaide Federal Government Part level 14 643 1-Feb-13 Fixed 535 557 Gross 4.0%<br />

45 Pirie Street, Adelaide SA Government Part ground, 2-11,14,17 13,957 1-Sep-12 Market (with ratchet) 419 465 Gross 11.0%<br />

45 Pirie Street, Adelaide AAPT Part level 1 641 1-Jul-12 Fixed 416 433 Gross 4.0%<br />

45 Pirie Street, Adelaide JBWere Part level 13 523 1-May-13 Fixed 520 541 Gross 4.0%<br />

Area<br />

sqm<br />

Review<br />

date<br />

Review<br />

type<br />

Passing<br />

rent<br />

$/sqm<br />

New<br />

rent<br />

$/sqm<br />

Rent<br />

type<br />

net/gross<br />

Variance<br />

%<br />

* 100% ownership basis

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 2 - Major rent reviews (over 500 sqm)<br />

For the year ended 30 June 2013<br />

Property Tenant Level / suite<br />

Victoria<br />

180 Lonsdale Street, Melbourne Telstra 10-16 13,040 15-Jul-12 Fixed 388 403 Net 3.8%<br />

180 Lonsdale Street, Melbourne BHP Billiton 23-28 10,768 6-Oct-12 Fixed 372 387 Net 4.0%<br />

180 Lonsdale Street, Melbourne National Australia Bank 19-22 7,171 6-Oct-12 Fixed 372 387 Net 4.0%<br />

180 Lonsdale Street, Melbourne GHD 7-9 5,670 1-Apr-13 Fixed 362 375 Net 3.5%<br />

180 Lonsdale Street, Melbourne Accenture 17, 18 3,597 1-Nov-12 Fixed 399 417 Net 4.5%<br />

2 Southbank Boulevard, Melbourne PricewaterhouseCoopers 15-27 22,968 10-Jun-13 Fixed 428 443 Net 3.4%<br />

2 Southbank Boulevard, Melbourne SPI Powernet 30-32 5,800 1-Sep-12 Fixed 436 452 Net 3.5%<br />

2 Southbank Boulevard, Melbourne PMP Part level 10,11,12 3,881 4-Jul-12 Fixed 408 422 Net 3.3%<br />

2 Southbank Boulevard, Melbourne HJ Heinz 8,9, part level 10 3,509 1-Sep-12 Fixed 411 425 Net 3.5%<br />

2 Southbank Boulevard, Melbourne Microsoft 5-7 3,185 1-Nov-12 Fixed 327 338 Net 3.5%<br />

2 Southbank Boulevard, Melbourne Vanguard <strong>Investments</strong> 33, 34 2,928 30-Jun-13 Fixed 447 500 Net 11.9%<br />

2 Southbank Boulevard, Melbourne SPI Powernet 29 1,893 1-Oct-12 Fixed 440 456 Net 3.7%<br />

2 Southbank Boulevard, Melbourne Australand 14 1,806 10-Jun-13 Fixed 432 448 Net 3.5%<br />

2 Southbank Boulevard, Melbourne Antares Requisites Part level 28 1,401 1-Nov-12 Fixed 440 456 Net 3.4%<br />

2 Southbank Boulevard, Melbourne Kaplan Part level 4 1,045 1-Aug-12 Fixed 377 392 Net 4.0%<br />

2 Southbank Boulevard, Melbourne Morrows Part level 13 817 10-Jun-13 Fixed 435 449 Net 3.4%<br />

2 Southbank Boulevard, Melbourne Genesis Fitness Club 3 683 20-Jun-13 Fixed 375 388 Gross 3.5%<br />

2 Southbank Boulevard, Melbourne HJ Heinz Part level 10 639 1-Sep-12 Fixed 424 438 Net 3.5%<br />

2 Southbank Boulevard, Melbourne LEK Consulting Part level 35 547 8-Jun-13 Fixed 460 475 Net 3.4%<br />

2 Southbank Boulevard, Melbourne Vanguard <strong>Investments</strong> Part level 36 511 30-Jun-13 Fixed 460 500 Net 8.6%<br />

222 Lonsdale Street, Melbourne Telstra Whole building 18,429 2-Jul-12 Fixed 357 369 Net 3.5%<br />

385 Bourke Street, Melbourne TRUenergy 28-34 9,303 1-Dec-12 Fixed 395 411 Net 4.0%<br />

385 Bourke Street, Melbourne Commonwealth Bank of Australia 2, 6-11 8,160 19-Apr-13 Fixed 319 331 Net 3.8%<br />

385 Bourke Street, Melbourne Commonwealth Bank of Australia Part level 1, 12-16 7,627 19-Apr-13 Fixed 344 357 Net 3.8%<br />

385 Bourke Street, Melbourne Commonwealth Bank of Australia 4,5 2,407 19-Apr-13 Fixed 338 350 Net 3.8%<br />

385 Bourke Street, Melbourne Commonwealth Bank of Australia Lower ground 1,968 19-Apr-13 Fixed 74 76 Net 3.8%<br />

385 Bourke Street, Melbourne Halcrow Pacific 40 1,397 14-Mar-13 Fixed 442 460 Net 4.0%<br />

385 Bourke Street, Melbourne Herbert Geer 19-21, 23 4,065 1-Oct-12 Fixed 385 400 Net 3.7%<br />

385 Bourke Street, Melbourne IRESS 17-18 2,511 1-Jul-12 Fixed 390 404 Net 3.5%<br />

385 Bourke Street, Melbourne Hunt & Hunt Part level 26, 25 1,740 1-Jan-13 Fixed 402 418 Net 4.0%<br />

385 Bourke Street, Melbourne Robert Walters 41 1,389 1-Dec-12 Fixed 460 477 Net 3.8%<br />

385 Bourke Street, Melbourne FIS Australasia 27 1,287 1-Oct-12 Market 398 425 Net 6.9%<br />

385 Bourke Street, Melbourne Piper Alderman 24 1,284 1-Jul-12 Fixed 384 398 Net 3.8%<br />

385 Bourke Street, Melbourne Herbert Geer 22 1,283 1-Oct-12 Fixed 413 429 Net 3.7%<br />

385 Bourke Street, Melbourne Regus Part level 39 977 1-Dec-12 Fixed 465 484 Net 4.0%<br />

385 Bourke Street, Melbourne IRESS Part level 26 832 1-Sep-12 Fixed 397 413 Net 4.3%<br />

655 Collins Street, Melbourne Fairfax Whole building 16,620 9-Dec-12 CPI 377 384 Net 1.8%<br />

750 Collins Street, Melbourne AMP Part level 2, 4-10 37,029 1-Dec-12 Fixed 402 416 Net 3.5%<br />

750 Collins Street, Melbourne Penguin Child Care Part level 1 1,031 1-Dec-12 Fixed 445 461 Net 3.5%<br />

Area<br />

sqm<br />

Review<br />

date<br />

Review<br />

type<br />

Passing<br />

rent<br />

$/sqm<br />

New<br />

rent<br />

$/sqm<br />

Rent<br />

type<br />

net/gross<br />

Variance<br />

%<br />

* 100% ownership basis

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 2 - Major rent reviews (over 500 sqm)<br />

For the year ended 30 June 2013<br />

Property Tenant Level / suite<br />

Western Australia<br />

58 Mounts Bay Road, Perth Clough Projects 6-15 15,692 3-Jun-13 Fixed 683 713 Net 4.5%<br />

58 Mounts Bay Road, Perth Cape Bouvard 19 1,571 3-Jun-13 Fixed 551 579 Net 5.0%<br />

58 Mounts Bay Road, Perth North West Shelf Shipping 16 1,571 3-Jun-13 Fixed 634 666 Net 5.0%<br />

58 Mounts Bay Road, Perth Euroz Securities 18 1,570 2-Jul-12 Fixed 549 573 Net 4.5%<br />

58 Mounts Bay Road, Perth Perdaman Part level 17 774 3-Jun-13 Fixed 696 721 Net 3.5%<br />

58 Mounts Bay Road, Perth CPA Australia Part level 17 772 3-Jun-13 Fixed 691 722 Net 4.5%<br />

Queensland<br />

10 Eagle Street, Brisbane Adani Mining 25, 30 1,908 1-Feb-13 Fixed 686 742 Gross 8.2%<br />

10 Eagle Street, Brisbane BDO Services 5-6 1,818 1-Oct-12 Market (with ratchet) 703 738 Gross 5.0%<br />

10 Eagle Street, Brisbane Talisman Australasia Part level 22, 21 1,470 1-Jun-13 Fixed 703 731 Gross 4.0%<br />

10 Eagle Street, Brisbane Bow Energy 26 954 29-Oct-12 Fixed 660 686 Gross 4.0%<br />

10 Eagle Street, Brisbane Ord Minnett Limited 31 954 1-Mar-13 Fixed 665 692 Gross 4.0%<br />

10 Eagle Street, Brisbane Knight Frank 11 911 1-Jun-13 Fixed 474 493 Gross 4.0%<br />

10 Eagle Street, Brisbane Moore Stephens Queensland 12 911 1-Mar-13 Fixed 666 692 Gross 4.0%<br />

10 Eagle Street, Brisbane Rider Levett Bucknall QLD 13 911 1-Oct-12 Fixed 640 666 Gross 4.0%<br />

10 Eagle Street, Brisbane Arrow Energy 3 909 1-Oct-12 Market (with ratchet) 899 944 Gross 5.0%<br />

10 Eagle Street, Brisbane BDO Services 4 909 1-Oct-12 Market (with ratchet) 899 944 Gross 5.0%<br />

10 Eagle Street, Brisbane QIC 2 909 1-Oct-12 Market (with ratchet) 899 944 Gross 5.0%<br />

10 Eagle Street, Brisbane Willis Australia Limited 1 819 15-Dec-12 Fixed 627 652 Gross 4.0%<br />

10 Eagle Street, Brisbane CPA Australia Part level 29 795 1-Sep-12 Market (without ratchet) 900 810 Gross (10.0%)<br />

10 Eagle Street, Brisbane McConaghy Property Services Part level 24 780 1-Apr-13 Fixed 670 697 Gross 4.0%<br />

10 Eagle Street, Brisbane Idemitsu Australia Resources Part level 28 688 1-Mar-13 Fixed 844 880 Gross 4.3%<br />

10 Eagle Street, Brisbane Adani Mining Part level 19 515 1-Jul-12 Fixed 676 703 Gross 4.0%<br />

Area<br />

sqm<br />

Review<br />

date<br />

Review<br />

type<br />

Passing<br />

rent<br />

$/sqm<br />

New<br />

rent<br />

$/sqm<br />

Rent<br />

type<br />

net/gross<br />

Variance<br />

%<br />

* 100% ownership basis

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> 3 - Calculation of net property income and like-for-like net property income<br />

For the year ended<br />

30-Jun-13 30-Jun-12 Change<br />

$m $m %<br />

Extracted from Consolidated <strong>State</strong>ment of Comprehensive Income in the Financial Report<br />

Rental and other property income 327.8 306.1 7.1<br />

Share of net profits from associates before fair value adjustments 24.1 26.9 (10.4)<br />

Rates, taxes and other outgoings (77.7) (75.9)<br />

Repairs and maintenance (12.2) (8.1) 6.6<br />

Bad and doubtful debts expense (0.1) (0.4)<br />

261.9 248.6<br />

Adjustments:<br />

- straight-lining revenue 1 (6.0) (5.2)<br />

Net property income 255.9 243.4 5.1<br />

Like-for-like adjustments:<br />

Net property income from development-affected properties 2 (11.3) (0.9)<br />

Net property income adjustment for changes in ownership of properties 3 (25.8) (28.0)<br />

Like-for-like net property income 218.8 214.5 2.0<br />

1. Refer to Note 2 of the Financial Report for further detail.<br />

2. Properties have been excluded from the like-for-like calculation where income has been significantly affected by development in<br />

either year. Properties excluded are 145 Ann Street Brisbane and 5 Martin Place , Sydney.<br />

3. Properties have been excluded from the like-for-like calculation where there was a change in ownership in either year. Properties<br />

excluded are: 201 Kent Street, Sydney; 10 Eagle Street, Brisbane; 45 Pirie Street, Adelaide; 1 and 5 Mill Street; Perth; 197 St Georges<br />

Terrace, Perth and 259 George Street, Sydney.

Commonwealth Property Office Fund<br />

Key occupancy statistics by property<br />

As at 30 June 2013<br />

Weighted Average<br />

Leases expiring<br />

Over/<br />

Occupancy average passing rent<br />

by<br />

(Under)<br />

by income lease expiry (occupied<br />

30-Jun-14<br />

by income office) 1 renting<br />

by income 2<br />

Property<br />

% years $/sqm % %<br />

Australian Capital Territory<br />

Finlay Crisp Centre, Canberra 100.0 4.1 403 n.a 0.0<br />

New South Wales<br />

60 Castlereagh Street, Sydney 91.4 3.5 752 (5.3) 38.7<br />

2 and 4 Dawn Fraser Avenue, Sydney Olympic Park 100.0 4.7 332 (9.4) 8.2<br />

36 George Street, Burwood 100.0 4.1 434 (2.3) 22.3<br />

101 George Street, Parramatta 100.0 3.4 483 0.6 0.4<br />

150 George Street, Parramatta 100.0 2.3 460 2.1 0.0<br />

225 George Street, Sydney 84.3 5.2 1,022 (4.9) 16.1<br />

201 Kent Street, Sydney 96.9 4.0 712 1.2 18.4<br />

14 Lee Street, Sydney 100.0 2.2 487 (14.7) 0.0<br />

5 Martin Place, Sydney currently under development<br />

201 Miller Street, North Sydney 92.3 3.0 598 0.2 12.5<br />

56 Pitt Street, Sydney 84.2 2.3 806 3.8 31.1<br />

175 Pitt Street, Sydney (excl. retail) 98.6 5.8 739 2.9 1.4<br />

10 Shelley Street, Sydney 100.0 2.5 878 20.5 0.5<br />

Queensland<br />

145 Ann Street, Brisbane 3 100.0 8.3 649 (1.2) 0.0<br />

10 Eagle Street, Brisbane 85.4 3.1 741 5.4 17.1<br />

South Australia<br />

108 North Terrace, Adelaide 100.0 0.6 546 10.0 100.0<br />

11 Waymouth Street, Adelaide 97.7 3.7 520 2.6 2.7<br />

Victoria<br />

385 Bourke Street, Melbourne (excl. Galleria) 100.0 3.5 527 (4.2) 32.2<br />

655 Collins Street, Melbourne 100.0 16.3 493 (4.6) 0.0<br />

750 Collins Street, Melbourne 100.0 6.1 520 0.1 2.1<br />

180-222 Lonsdale Street, Melbourne 4 100.0 2.6 506 (6.9) 60.9<br />

2 Southbank Boulevard, Melbourne 99.1 3.3 585 (3.9) 3.9<br />

Western Australia<br />

46 Colin Street, West Perth 100.0 4.2 713 3.9 0.0<br />

58 Mounts Bay Road, Perth 100.0 8.2 856 (1.5) 0.0<br />

Total portfolio average 96.2 4.3 594 (0.7) 17.7<br />

Key<br />

1. Represents base rent plus recoveries, including increases over base years.<br />

2. Includes vacancies and holdovers and represents leases expiring in the 12 months to 30 June 2014.<br />

3. The development of 145 Ann Street, Brisbane completed in November 2012.<br />

4. Office component only.

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> <strong>4E</strong> - Net property income (NPI)<br />

For the year ended 30 June 2013<br />

NPI components for 12 months to 30 June 2013 ($m) NPI components for 12 months to 30 June 2012 ($m)<br />

Rent free<br />

incentives<br />

amortisation<br />

Fit-out<br />

amortisation<br />

Cash<br />

incentives<br />

amortisation<br />

Leasing<br />

commissions<br />

amortisation NPI (pre amortisation)<br />

Rent free incentives<br />

amortisation<br />

NPI (pre amortisation)<br />

Total NPI variance<br />

Property Total NPI Total NPI $m %<br />

Australian Capital Territory<br />

Finlay Crisp Centre, Canberra^ 10.0 0.7 0.2 - 0.3 8.8 9.8 0.7 0.3 - 0.2 8.6 0.2 2.5<br />

Fit-out<br />

amortisation<br />

Cash incentives<br />

amortisation<br />

Leasing<br />

commissions<br />

amortisation<br />

New South Wales<br />

60 Castlereagh Street, Sydney^ 14.6 0.5 1.0 - 0.2 12.9 14.2 0.3 1.0 - 0.2 12.6 0.3 2.3<br />

36 George Street, Burwood^ 5.1 0.6 0.3 - 0.2 4.1 6.7 2.3 0.4 - 0.1 3.9 0.1 2.9<br />

101 George Street, Parramatta^ 7.5 0.1 1.7 - 0.0 5.6 7.6 0.1 1.7 - 0.0 5.8 (0.2) (3.2)<br />

150 George Street, Parramatta^ 9.0 0.0 1.3 - 0.1 7.6 9.0 - 1.3 - 0.1 7.6 0.0 0.0<br />

259 George Street, Sydney 1 0.0 - - - - 0.0 9.2 (0.1) 1.5 - 0.1 7.7 (7.7) n.a.<br />

201 Kent Street, Sydney 2 2.5 0.2 0.2 0.0 0.0 2.1 - - 0.0 - - - 2.1 n.a.<br />

14 Lee Street, Sydney^ 5.9 - 0.1 - 0.0 5.7 5.2 - 0.1 - 0.0 5.1 0.6 12.4<br />

5 Martin Place, Sydney 3 0.1 - - - - 0.1 0.9 - 0.0 - - 0.9 (0.8) n.a.<br />

201 Miller Street, North Sydney^ 5.1 0.1 0.3 - 0.2 4.6 5.0 0.1 0.3 - 0.1 4.6 0.1 1.3<br />

56 Pitt Street, Sydney^ 9.9 0.2 0.7 0.0 0.2 8.7 11.7 0.2 0.9 - 0.3 10.4 (1.7) (16.2)<br />

175 Pitt Street, Sydney^ 16.4 0.7 3.4 0.0 0.4 12.0 13.0 0.5 2.9 - 0.4 9.2 2.8 30.5<br />

10 Shelley Street, Sydney^ 12.1 - 0.0 - 0.0 12.1 11.9 - 0.0 - 0.0 11.9 0.2 2.0<br />

Queensland<br />

145 Ann Street, Brisbane 4 11.4 0.0 0.2 - - 11.2 - - 0.0 - - - 11.2 n.a.<br />

10 Eagle Street, Brisbane 5 14.9 0.1 0.1 - 0.0 14.6 0.4 - 0.0 - - 0.4 14.3 n.a.<br />

South Australia<br />

108 North Terrace, Adelaide^ 8.4 - - - - 8.4 8.0 - 0.0 - - 8.0 0.5 5.9<br />

45 Pirie Street, Adelaide 6 6.8 0.3 0.6 - 0.1 5.8 7.0 0.1 0.6 - 0.1 6.1 (0.4) (5.8)<br />

11 Waymouth Street, Adelaide^ 11.8 0.0 (0.0) - 0.0 11.8 12.7 0.0 0.0 - 0.0 12.7 (0.9) (7.3)<br />

Victoria<br />

385 Bourke Street, Melbourne^ 26.1 0.1 2.4 - 0.5 23.0 26.0 0.1 2.3 - 0.4 23.2 (0.1) (0.6)<br />

655 Collins Street, Melbourne^ 6.9 - - - - 6.9 6.6 - 0.0 - - 6.6 0.4 5.5<br />

750 Collins Street, Melbourne^ 18.4 (0.0) 0.1 - (0.1) 18.4 17.5 0.0 0.0 - 0.0 17.5 0.9 5.3<br />

180-222 Lonsdale Street, Melbourne^ 22.3 - (0.0) - 0.1 22.2 21.7 - 0.0 - 0.1 21.7 0.5 2.3<br />

2 Southbank Boulevard, Melbourne^ 14.8 0.2 0.6 - 0.0 14.0 13.7 0.1 0.6 - 0.0 13.0 1.0 7.8<br />

Western Australia<br />

46 Colin Street, West Perth^ 3.4 - 0.1 - 0.1 3.2 2.6 - 0.0 - - 2.6 0.6 21.6<br />

1 Mill Street, Perth 7 - - - - - - 2.1 - 0.0 - - 2.1 (2.1) n.a.<br />

5 Mill Street, Perth 7 - - - - - - 1.7 0.0 0.0 - - 1.7 (1.7) n.a.<br />

58 Mounts Bay Road, Perth^ 8.0 0.1 0.1 - - 7.9 7.9 0.0 0.1 - - 7.8 0.1 1.4<br />

197 St Georges Terrace, Perth 7 0.1 - - - - 0.1 5.1 - 0.0 - 0.1 5.0 (4.9) n.a.<br />

Total 251.5 3.9 13.4 0.0 2.4 231.8 237.3 4.5 14.0 - 2.3 216.5 15.4 7.1<br />

Distribution income from investments in associates<br />

Grosvenor Place Holdings Trust ^ 16.9 0.3 1.7 - 0.3 14.5 17.6 0.3 1.6 - 0.1 15.7 (1.2) (7.4)<br />

Kent Street Trust 2 4.6 0.4 0.9 0.0 0.1 3.2 5.8 0.3 0.5 - 0.1 5.0 (1.8) n.a.<br />

Site 6 Homebush Bay Trust ^ 2.7 - - - - 2.7 2.6 - 0.0 - - 2.6 0.1 2.9<br />

Site 7 Homebush Bay Trust ^ 3.7 - - - - 3.7 3.7 - 0.0 - - 3.7 (0.0) (0.0)<br />

Total 27.8 0.7 2.6 0.0 0.4 24.1 29.7 0.6 2.0 - 0.2 26.9 (2.9) (10.6)<br />

GRAND TOTAL 279.3 4.6 16.0 0.0 2.8 255.9 267.0 5.1 16.0 - 2.5 243.4 12.5 5.1<br />

Like-for-like total 8 218.8 214.5 4.3 2.0<br />

^ Indicates properties held throughout the period 1 July 2011 to 30 June 2013 (excluding 5 Martin Place, Sydney, 145 Ann Street, Brisbane and 201 Kent Street, Sydney).<br />

1. In October 2011, the Fund sold its interest in 259 George Street, Sydney.<br />

2. On 10 April 2013, the Fund acquired the remaining 50% interest in the Kent Street Trust. It has been determined that the Fund’s 100% holding represents control. As such, the Kent Street Trust was fully consolidated from this date.<br />

3. In June 2012, the Fund sold a 50% interest in 5 Martin Place, Sydney.<br />

4. The development of 145 Ann Street, Brisbane completed in November 2012.<br />

5. In June 2012, the Fund acquired a 100% interest in 10 Eagle Street, Brisbane.<br />

6. In June 2013, the Fund sold its interest in 45 Pirie Street, Adelaide.<br />

7. In December 2011, the Fund sold its interest in 1 and 5 Mill Street, Perth and 197 St Georges Terrace, Perth.<br />

8. Only includes investments as indicated by ^ above.

Commonwealth Property Office Fund<br />

Valuation information by property<br />

As at 30 June 2013<br />

CPA<br />

share<br />

Valuation<br />

Discount<br />

rate 1<br />

Terminal<br />

yield<br />

Capitalisation<br />

rate<br />

Property % Company date $m % % %<br />

Australian Capital Territory<br />

Finlay Crisp Centre, Canberra<br />

- Allara House 100 JLL Jun-13 21.0 10.00 9.50 9.25<br />

- Customs House 100 JLL Jun 13 31.5 10.00 9.50 9.25<br />

- Nara Centre 100 JLL Jun 13 25.0 9.75 9.25 8.75<br />

New South Wales<br />

60 Castlereagh Street, Sydney 100 JLL Mar-13 247.5 9.00 7.25 7.00<br />

2 and 4 Dawn Fraser Avenue,<br />

Sydney Olympic Park 50 CBRE Dec-12 83.7 9.50 8.25 8.00<br />

36 George Street, Burwood 100 m3 Mar-13 52.0 9.25 8.75 8.75<br />

101 George Street, Parramatta 100 JLL Jun 13 93.0 9.25 8.25 8.00<br />

150 George Street, Parramatta 100 CBRE Sep 12 99.5 9.50 8.75 8.50<br />

225 George Street, Sydney 25 CI Dec-12 271.3 8.75 6.75 6.50<br />

201Kent Street, Sydney 50 KF Dec-12 156.0 9.00 7.50 7.38<br />

14 Lee Street, Sydney 100 Sav Sep 12 70.0 9.50 8.50 8.00<br />

5 Martin Place, Sydney 2 50 KF Jun-13 52.5<br />

201 Miller Street, North Sydney 100 Sav Sep 12 71.0 9.75 9.00 8.50<br />

56 Pitt Street, Sydney 100 KF Dec-12 166.0 9.00 7.25 7.25<br />

175 Pitt Street, Sydney<br />

- Tower 100 CI Jun-13 182.0 8.75 7.38 7.25<br />

- Retail 100 CI Jun-13 63.5 9.00 7.00 6.88<br />

10 Shelley Street, Sydney 50 Sav Jun-13 108.0 9.00 7.50 7.00<br />

Queensland<br />

145 Ann Street, Brisbane 100 KF Dec-12 218.0 9.25 7.68 7.53<br />

10 Eagle Street, Brisbane 100 CI Mar-13 204.0 9.00 7.50 7.50<br />

South Australia<br />

108 North Terrace, Adelaide 100 JLL Sep-12 73.8 10.00 8.75 8.50<br />

11 Waymouth Street, Adelaide 100 KF Sep-12 154.0 9.50 8.50 8.25<br />

Victoria<br />

385 Bourke Street, Melbourne<br />

- Tower 100 CBRE Dec-12 237.0 9.25 7.75 7.50<br />

- Galleria 100 CBRE Dec-12 61.5 9.50 7.75 7.50<br />

655 Collins Street, Melbourne 100 Sav Jun-13 100.0 9.25 7.25 7.00<br />

750 Collins Street, Docklands 100 m3 Jun-13 240.0 9.00 7.50 7.50<br />

180-222 Lonsdale Street, Melbourne<br />

- 180 Lonsdale Street, Melbourne 50 JLL Mar-13 101.0 9.00 7.75 7.50<br />

- 222 Lonsdale Street, Melbourne 50 JLL Mar-13 40.5 9.25 7.75 7.50<br />

- QV Retail Centre, Melbourne 50 JLL Mar-13 116.5 9.00 7.50 7.25<br />

- QV Centre car park, Melbourne 50 JLL Mar-13 33.8 10.25 8.00 7.75<br />

- QV Creche, Melbourne 100 JLL Mar-13 3.9 9.00<br />

2 Southbank Boulevard, Melbourne 50 CI Mar-13 183.0 9.00 7.25 7.25<br />

Western Australia<br />

46 Colin Street, West Perth 100 Sav Jun-13 44.0 10.50 10.00 9.75<br />

58 Mounts Bay Road, Perth 50 KF Dec-12 103.0 9.75 8.25 8.00<br />

Total portfolio weighted average rates 9.17 7.72 7.55<br />

Note<br />

1. Used to calculate discounted cash flow valuation over 10 years.<br />

Valuation company legend<br />

CBRE CB Richard Ellis<br />

CI<br />

Colliers International<br />

JLL<br />

Jones Lang LaSalle<br />

KF<br />

Knight Frank<br />

m3<br />

m3 Property<br />

SAV<br />

Savills

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> <strong>4E</strong> - Reconciliation of book values by property ($m)<br />

For the year ended 30 June 2013<br />

Book value<br />

as at<br />

30-Jun-12<br />

Acquisitions/<br />

(Divestments) Capex<br />

Leasing fees and<br />

incentives paid<br />

Amortisation of fitout<br />

incentives,<br />

cash incentives<br />

and leasing<br />

comissions<br />

Amortisation of rent<br />

free incentives<br />

Straight-lining<br />

revenue<br />

Independent<br />

revaluation<br />

changes<br />

Property<br />

Australian Capital Territory<br />

Finlay Crisp Centre, Canberra 90.7 - 1.2 - (0.5) (0.7) (0.1) (13.2) 0.1 77.5<br />

New South Wales<br />

60 Castlereagh Street, Sydney 243.8 - 1.2 4.5 (1.2) (0.5) 0.4 0.0 (0.4) 247.8<br />

36 George Street, Burwood 54.0 - 0.2 1.4 (0.5) (0.6) (0.0) (2.4) 0.0 52.1<br />

101 George Street, Parramatta 92.0 - 0.2 0.1 (1.7) (0.1) (0.1) 2.6 0.1 93.0<br />

150 George Street, Parramatta 98.8 - 0.5 - (1.4) (0.0) (0.4) 1.0 0.4 98.9<br />

201 Kent Street, Sydney 1 - 159.7 0.4 0.7 (0.2) (0.2) (0.0) 0.0 0.0 160.4<br />

14 Lee Street, Sydney 71.6 - 0.2 - (0.1) - 0.1 (1.6) (0.1) 70.1<br />

5 Martin Place, Sydney 40.0 - 19.4 - - - - (6.9) - 52.5<br />

201 Miller Street, North Sydney 69.5 - 2.4 1.7 (0.5) (0.1) 0.2 1.0 (0.2) 74.1<br />

56 Pitt Street, Sydney 159.5 - 2.7 2.2 (1.0) (0.2) 0.1 5.5 (0.1) 168.7<br />

175 Pitt Street, Sydney 240.0 - 0.5 3.8 (3.8) (0.7) 1.3 5.6 (1.3) 245.5<br />

10 Shelley Street, Sydney 137.9 - 0.2 0.0 (0.0) - (0.7) (30.1) 0.7 108.0<br />

Site 4B, Sydney Olympic Park 2 3.6 (4.6) 0.1 - - - - 0.9 - -<br />

Queensland<br />

145 Ann Street, Brisbane 165.1 - 52.3 3.1 (0.2) (0.0) 2.4 1.5 (2.4) 221.8<br />

10 Eagle Street, Brisbane 205.9 - 7.9 2.0 (0.1) (0.1) 1.3 (6.0) (1.3) 209.5<br />

South Australia<br />

108 North Terrace, Adelaide 76.5 - 0.1 - - - (1.0) (2.8) 1.0 73.8<br />

45 Pirie Street, Adelaide 3 85.7 (86.3) 1.4 2.6 (0.7) (0.3) 0.1 (2.4) (0.1) 0.0<br />

11 Waymouth Street, Adelaide 151.1 - 0.9 0.3 (0.0) (0.0) (0.1) 2.7 0.1 155.0<br />

Victoria<br />

385 Bourke Street, Melbourne 311.3 - 10.3 0.1 (2.9) (0.1) 0.0 (16.1) (0.0) 302.6<br />

655 Collins Street, Melbourne 96.8 - 0.2 - - - 0.0 3.0 (0.0) 100.0<br />

750 Collins Street, Melbourne 224.5 - 0.7 (0.2) - 0.0 1.5 15.0 (1.5) 240.0<br />

180-222 Lonsdale Street, Melbourne 285.8 - 2.2 0.2 (0.1) - 0.6 8.3 (0.6) 296.4<br />

2 Southbank Boulevard, Melbourne 182.2 - 0.0 0.8 (0.6) (0.2) (0.7) 0.6 0.7 182.9<br />

AIFRS<br />

revaluation<br />

changes<br />

Book value<br />

as at<br />

30-Jun-13

Commonwealth Property Office Fund<br />

<strong>Appendix</strong> <strong>4E</strong> - Reconciliation of book values by property ($m)<br />

For the year ended 30 June 2013<br />

Book value<br />

as at<br />

30-Jun-12<br />

Acquisitions/<br />

(Divestments) Capex<br />

Leasing fees and<br />

incentives paid<br />

Amortisation of fitout<br />

incentives,<br />

cash incentives<br />

and leasing<br />

comissions<br />

Amortisation of rent<br />

free incentives<br />

Straight-lining<br />

revenue<br />

Independent<br />

revaluation<br />

changes<br />

Property<br />

Western Australia<br />

46 Colin Street, West Perth 43.5 - 0.6 1.5 (0.2) - (0.2) (1.4) 0.2 44.0<br />

58 Mounts Bay Road, Perth 100.0 - 0.0 - (0.1) (0.1) 1.3 3.1 (1.3) 102.9<br />

Total 3,229.8 68.8 105.8 24.9 (15.8) (3.9) 6.0 (32.1) (6.0) 3,377.5<br />

<strong>Investments</strong> in associates<br />

AIFRS<br />

revaluation<br />

changes<br />

Book value<br />

as at<br />

30-Jun-13<br />

Grosvenor Place Holdings Trust 4 273.1 4.7 - - - - - (2.8) - 275.1<br />

Kent Street Trust 1 85.3 (85.2) - - - - - (0.1) - 0.0<br />

Site 6 Homebush Bay Trust 5 35.0 0.1 - - - - - 0.6 - 35.6<br />

Site 7 Homebush Bay Trust 6 47.5 0.4 - - - - - 0.3 - 48.2<br />

Total 440.9 (80.0) - - - - - (2.0) - 358.9<br />

GRAND TOTAL 3,670.7 (11.2) 105.8 24.9 (15.8) (3.9) 6.0 (34.1) (6.0) 3,736.4<br />

1. On 10 April 2013, the Fund acquired the remaining 50% interest in the Kent Street Trust. It has been determined that the Fund’s 100% holding represents control. As such, the Kent Street Trust was fully consolidated from this date.<br />

2. On 21 December 2012, the Fund sold its interest in Site 4B, Sydney Olympic Park for $4.7 million excluding selling costs.<br />

3. On 12 June 2013, the Fund sold its interest in 45 Pirie Street, Adelaide for $87.0 million excluding selling costs.<br />

4. The Fund indirectly owns 25% of 225 George Street, Sydney via units in Grosvenor Place Holdings Trust. The Fund's equity accounted investment includes its share of the non-property assets and liabilities of the Grosvenor Place Holdings Trust.<br />

5. The Fund indirectly owns 50% of 4 Dawn Fraser Avenue, Sydney Olympic Park via units in Site 6 Homebush Bay Trust. The Fund's equity accounted investment includes its share of the non-property assets and liabilities of Site 6 Homebush Bay Trust.<br />

6. The Fund indirectly owns 50% of 2 Dawn Fraser Avenue, Sydney Olympic Park via units in Site 7 Homebush Bay Trust. The Fund's equity accounted investment includes its share of the non-property assets and liabilities of Site 7 Homebush Bay Trust.

Commonwealth Property Office Fund<br />

Debt summary<br />

As at 30 June 2013<br />

Key debt statistics Debt maturity profile $m 7<br />

Total borrowings 1 $948.9m<br />

Borrowings as a proportion of total assets 2 25.2%<br />

FY14<br />

Weighted average interest rate (including margins and line fees) 5.6%<br />

FY15 200<br />

Weighted average debt maturity 3.9 years<br />

Portion of debt hedged 3 95.9%<br />

Weighted average interest rate on hedged debt (excluding margins and fees) 3 5.1%<br />

Weighted average maturity of hedged debt 3 4.0 years<br />

Credit rating Short term Long term<br />

- Moody's P-2 A3<br />

- Standard & Poor's A-2 A- Sources of debt 7<br />

FY16<br />

FY17<br />

FY18<br />

FY19<br />

Beyond<br />

151<br />

200<br />

300<br />

210<br />

200<br />

33<br />

Debt position as at 30 June 2013<br />

Facility size Drawn Undrawn<br />

Type Maturity $m $m $m<br />

Bank debt facility Jun-15 200.0 - 200.0<br />

Bank debt facility Apr-18 300.0 55.0 245.0<br />

Short term notes Jul/Aug-13 100.0 100.0 -<br />

Medium term notes Mar-16 200.0 200.0 -<br />

Medium term notes Dec-19 185.0 185.0 -<br />

Medium term notes Dec-22 25.0 25.0 -<br />

Convertible notes 4 Dec-16 200.0 200.0 -<br />

US Private Placement 5 Dec-15 150.6 150.6 -<br />

US Private Placement 5 Dec 17 33.3 33.3 - Hedge maturity profile for the financial years ended 3<br />

32%<br />

14%<br />

15%<br />

39%<br />

1,393.9 948.9 445.0<br />

Less short term notes 6 1,000<br />

Jul/Aug-13 (100.0) - (100.0)<br />

Total 1,293.9 948.9 345.0 800<br />

Notes:<br />

600<br />

1. Borrowings is the amount of debt drawn as per Note 11 of the Financial Report equal to $931.9 million,<br />

adjusted for the value of cross currency swaps of $17.0 million liability.<br />

400<br />

2. Total assets exclude the fair value of derivative financial instruments of $2.2 million.<br />

3. Including all fixed-rate debt.<br />

200<br />

4. Convertible note investors have a put option on 11 December 2014.<br />

0<br />

5. Converted to AUD at AUD/USD 0.7505.<br />

6. As the Fund’s same day funding facility was in place to provide liquidity support to maturing<br />

2014 2015 2016 2017 2018 2019<br />

short-term notes, the capacity of the facilities is reduced by the total amount of short-term notes issued.<br />

Key: Face v alue of hedges ($m) (LHS) Weighted average interest rate on hedge debt (RHS)<br />

7. Excludes short term notes maturing in FY14 which are backed by bank debt facilities.<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%

Asset summaries<br />

CPA<br />

Asset summaries<br />

24 <br />

5 Martin Place, Sydney

145 ANN STREET, BRISBANE<br />

385 BOURKE STREET, MELBOURNE<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

ownership<br />

100%<br />

Grade<br />

A<br />

<br />

Date<br />

acquired<br />

<br />

CPA<br />

ownership<br />

100%<br />

Grade<br />

A<br />

<br />

<br />

<br />

FY14 ><br />

<br />

FY14 ><br />

32.2%<br />

FY15<br />

0.0%<br />

FY15<br />

2.5%<br />

FY16<br />

0.0%<br />

FY16<br />

10.4%<br />

FY17<br />

0.0%<br />

FY17<br />

10.5%<br />

FY18<br />

12.4%<br />

FY18<br />

21.1%<br />

BEYOND<br />

87.6%<br />

BEYOND<br />

23.3%<br />

145 Ann Street Brisbane, QLD<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

^<br />

<br />

^<br />

<br />

<br />

<br />

385 Bourke Street Melbourne, VIC

Asset summaries<br />

60 CASTLEREAGH STREET, SYDNEY<br />

46 COLIN STREET, WEST PERTH<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

Date<br />

CPA<br />

ownership Grade <br />

ownership Grade<br />

100% A 100% A<br />

Perth<br />

<br />

<br />

FY14 ><br />

38.7%<br />

FY14 ><br />

0.0%<br />

FY15<br />

5.6%<br />

FY15<br />

0.0%<br />

FY16<br />

0.0%<br />

FY16<br />

0.0%<br />

FY17<br />

10.2%<br />

FY17<br />

0.0%<br />

FY18<br />

6.2%<br />

FY18<br />

100%<br />

BEYOND<br />

39.3%<br />

BEYOND<br />

0.0%<br />

60 Castlereagh Street Sydney, NSW<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

46 Colin Street West Perth, WA

655 COLLINS STREET, MELBOURNE<br />

750 COLLINS STREET, MELBOURNE<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

ownership<br />

100%<br />

Grade<br />

A<br />

<br />

Date<br />

<br />

<br />

CPA<br />

ownership<br />

100%<br />

Grade<br />

A<br />

<br />

<br />

FY14 ><br />

0.0%<br />

FY14 ><br />

2.1%<br />

FY15<br />

0.0%<br />

FY15<br />

0.0%<br />

FY16<br />

0.0%<br />

FY16<br />

1.9%<br />

FY17<br />

0.0%<br />

FY17<br />

0.5%<br />

FY18<br />

0.0%<br />

FY18<br />

2.4%<br />

BEYOND<br />

100%<br />

BEYOND<br />

93.1%<br />

655 Collins Street Melbourne, VIC<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

750 Collins Street Melbourne, VIC

Asset summaries<br />

2 AND 4 DAWN FRASER AVENUE, SYDNEY OLYMPIC PARK<br />

SHOPPING 10 EAGLE STREET, CENTREBRISBANE<br />

<br />

<br />

<br />

railway station.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

Date<br />

CPA<br />

ownership Grade <br />

ownership Grade<br />

<br />

A<br />

<br />

<br />

100%<br />

A<br />

<br />

<br />

FY14 ><br />

8.2%<br />

FY14 ><br />

17.1%<br />

FY15<br />

0.0%<br />

FY15<br />

21.7%<br />

FY16<br />

0.5%<br />

FY16<br />

18.1%<br />

FY17<br />

0.0%<br />

FY17<br />

16.3%<br />

FY18<br />

53.1%<br />

FY18<br />

5.1%<br />

BEYOND<br />

38.2%<br />

BEYOND<br />

21.6%<br />

2 and 4 Dawn Fraser Avenue Sydney Olympic Park, NSW<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

^<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

10 Eagle Street Brisbane, QLD

FINLAY CRISP CENTRE, CANBERRA<br />

36 GEORGE STREET, BURWOOD<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

ownership<br />

100%<br />

Grade<br />

<br />

<br />

Date<br />

<br />

<br />

CPA<br />

ownership<br />

100% A<br />

Grade<br />

<br />

<br />

FY14 ><br />

0%<br />