Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMIC PARTNERSHIP AGREEMENTS<br />

By Antony Kung'u<br />

Background<br />

A special trade relationship has existed between the European Union<br />

(EU) and African Caribbean and Pacific group (ACP) of countries since<br />

1975 when the first Lome Convention was signed. Under the Lome<br />

Conventions, the ACP countries enjoyed unilateral trade preferences<br />

into the EU market. The Fourth Lome Convention was replaced by<br />

the Cotonou Agreement in 2000, which extends the unilateral trade<br />

preferences up to December 2007. Thereafter, the parties are dutybound<br />

to negotiate and conclude World Trade Organisation (WTO)<br />

compatible reciprocal trade agreements, the Economic Partnership<br />

Agreements (EPAs), at the beginning of 2008.<br />

The EPAs are touted as the new co-operative framework under the<br />

Cotonou Agreement and are expected to adopt an integrated approach<br />

based on partnership and promoting co-operation, multilateral trade<br />

and political dialogue between the EU and the ACP countries. The key<br />

features of EPAs are their reciprocity and non-discriminatory nature.<br />

They involve the removal of all trade preferences which have been<br />

established between the EU and the ACP countries since 1975 as well<br />

as the progressive removal of trade barriers between the partners. The<br />

EPAs are open to all developing countries thereby effectively bringing<br />

down the curtain on the ACP group as the main development partner<br />

of the EU.<br />

Regional Blocs<br />

Previously, the EU negotiated with all ACP countries as a bloc. However,<br />

for EPAs’ negotiations, the EU has split the ACP countries into trading<br />

blocs, arguably undermining their solidarity, negotiating power and<br />

political power thus weakening their overall bargaining power. The<br />

ACP countries have formed six regional configurations or groupings<br />

through which to negotiate EPAs with the EU, some of which arethe<br />

Southern Africa Development Community (SADC), the Eastern<br />

and Southern Africa group (ESA), the Caribbean Community and the<br />

Economic Community of West Africa (ECOWAS). Kenya belongs to the<br />

ESA configuration.<br />

Effects of EPAs on ACP Countries<br />

Although the EPAs are aimed at supporting the on-going processes<br />

of economic integration and gradual liberalisation of trade between<br />

ACP countries and the EU, some very legitimate concerns have been<br />

raised on their effects on the ACP countries. The EU has chosen to<br />

negotiate the agreements under strict WTO rules that govern reciprocal<br />

free trade agreements (FTAs), requiring ACP countries to open their<br />

markets to "substantially all" EU imports over a limited period of time.<br />

The 10-year period given by EU to ACP countries to open their markets<br />

to substantially all trade is not adequate for the latter to develop their<br />

productive capacities and strengthen their competitiveness prior to<br />

the potential influx of EU products into the ACP markets. Inequalities<br />

resulting from the different levels of development between the EU<br />

and ACP countries make reciprocity untenable. The ACP countries also<br />

face a gargantuan task in their zeal to break into EU markets already<br />

dominated by long established, well loved and highly patronised<br />

European brands. Local producers lacking distinctive capabilities will<br />

not survive the potential onslaught to be waged by cheap imports<br />

from the EU. Furthermore, the EU is bound to apply stringent rules of<br />

origin (ROO) on imports from ACP countries, thus introducing technical<br />

barriers to market access.<br />

MABATINEWS<br />

Profiling lines at CGL Mariakani<br />

By Gabriel Olukwo<br />

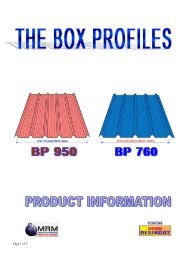

As part of its modernization and<br />

equipment u<strong>pg</strong>rading program in line<br />

with the developments in technology,<br />

<strong>MRM</strong> has installed and commissioned three<br />

profiling lines at the finishing department of<br />

the Continuous Galvanizing Line at Mariakani.<br />

Profiler 1 was commissioned in July 2004,<br />

while profilers 2 and 3 were commissioned<br />

in October 2006. These lines have replaced<br />

shearing lines and barrel corrugators. The<br />

profiling lines produce galvanized and<br />

aluminium-zinc coated corrugated standard<br />

profile sheets. These profiling lines and<br />

their layout are in line with Gemba Kaizen<br />

principles of lean manufacturing. Material<br />

and crane movement have been greatly<br />

reduced. Three processes have been<br />

combined into one. The order execution time<br />

has been reduced and the products from<br />

these lines do not have any variations. The<br />

profiling lines are far much superior to barrel<br />

corrugators in many ways. A higher range of<br />

materials can be processed on profilers. They<br />

can accommodate 0.20mm to 0.30mm thick<br />

material with minimum adjustments. Sheets<br />

of various lengths are produced ranging from<br />

a few centimetres to over 10 metres length<br />

to meet customer requirement. The<br />

profiling lines also produce sheets with<br />

uniform profiles. These profilers are highly<br />

automated with minimal setting time and<br />

once correct settings have been achieved, the<br />

profilers run automatically producing scratch<br />

free sheets. Since profiling lines combine<br />

three processes, (shearing, handling and<br />

corrugation), rejections are fewer and orders<br />

can be executed exactly as per requirements.<br />

Profiling lines occupy less space and do not<br />

require storage for cut plain sheets. Each<br />

Profiling line is manned by only five persons<br />

compared to 11 persons in barrel corrugators<br />

(three at shearing and eight at corrugator).<br />

Production cost of profiling lines is lower than<br />

that of lines with barrel corrugators because<br />

less manpower is utilised and less power is<br />

consumed. The profiling lines have a very<br />

high safety level as the operation position<br />

is far from moving parts and there is no<br />

manual feeding of sheets into the profiler. The<br />

operation is thus less tiresome resulting to<br />

decreased human errors as a result of fatigue.<br />

The noise levels at profiling lines are very low<br />

hence operators are not required to wear ear<br />

plugs or muffs.<br />

Conversely, barrel corrugators<br />

process only one gauge and a<br />

maximum sheet length of 3.7 metres. As<br />

the production process entails shearing,<br />

transfers and finally corrugation the rejection<br />

level is high because of the independent<br />

multiple processes involved. Continuous<br />

manual feeding leads to over dependency on<br />

humans. These lines are prone to accidents<br />

because of multiple handling of products,<br />

operation is near to moving parts and their<br />

inherent prolonged human fatigue. Lines<br />

with barrel corrugators occupy a lot of floor<br />

to accommodate the shearing lines, extra<br />

storage space for work in process plain sheets<br />

and the barrel corrugators. The noise levels at<br />

barrel corrugators are high and the operators<br />

must wear ear plugs or muffs for hearing<br />

protection.<br />

M A B A T I N E W S 15