Notes to the Financial Statements - Swissco Holdings Limited

Notes to the Financial Statements - Swissco Holdings Limited Notes to the Financial Statements - Swissco Holdings Limited

Notes to the Financial Statements For the financial year ended 31 December 2009 2. Significant accounting policies (continued) 2.20 Dividends to Company’s shareholders Dividends to Company’s shareholders are recognised when the dividends are approved for payment. 2.21 Non-current assets held for sale Non-current assets held for sale are carried at the lower of carrying amount and fair value less costs to sell if their carrying amount is recovered principally through a sale transaction rather than through continuing use. The assets are not depreciated or amortised while they are classified as held for sale. Any impairment loss on initial classification and subsequent measurement is recognised in profit or loss. Any subsequent increase in fair value less costs to sell (not exceeding the accumulated impairment loss that has been previously recognised) is recognised in profit or loss. 2.22 Financial guarantees The Company has issued corporate guarantees to banks for borrowings of its subsidiaries and an associated company. These guarantees are financial guarantees as they require the Company to reimburse the banks if the borrowing entities fail to make principal or interest payments when due in accordance with the terms of their borrowings. Financial guarantees are initially recognised at their fair values (if material) plus transaction costs in the Company’s balance sheet. Financial guarantees are subsequently amortised to profit or loss over the period of the borrowings, unless it is probable that the Company will reimburse the bank for an amount higher than the unamortised amount. In this case, the financial guarantees shall be carried at the expected amount payable to the bank in the Company’s balance sheet. Intragroup transactions are eliminated on consolidation. 2.23 Government grants Grants from the government are recognised as a receivable at their fair value when there is reasonable assurance that the grant will be received and the Group will comply with all the attached conditions. Government grants receivable are recognised as income over the periods necessary to match them with the related costs which they are intended to compensate, on a systematic basis. Government grants relating to expenses are shown separately as other income. Swissco International Limited Annual Report 2009 52

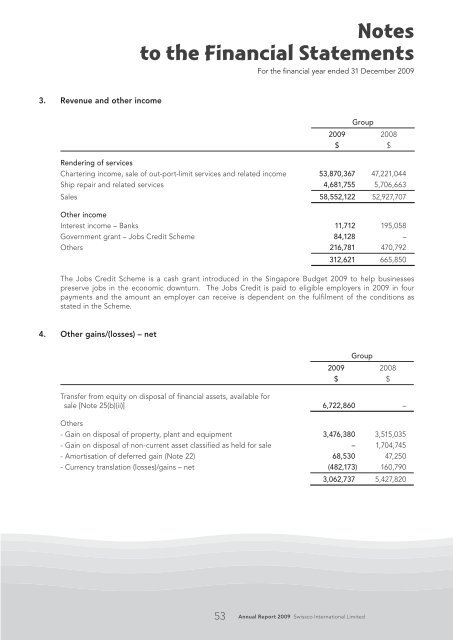

Notes to the Financial Statements For the financial year ended 31 December 2009 3. Revenue and other income Group 2009 2008 $ $ Rendering of services Chartering income, sale of out-port-limit services and related income 53,870,367 47,221,044 Ship repair and related services 4,681,755 5,706,663 Sales 58,552,122 52,927,707 Other income Interest income – Banks 11,712 195,058 Government grant – Jobs Credit Scheme 84,128 – Others 216,781 470,792 312,621 665,850 The Jobs Credit Scheme is a cash grant introduced in the Singapore Budget 2009 to help businesses preserve jobs in the economic downturn. The Jobs Credit is paid to eligible employers in 2009 in four payments and the amount an employer can receive is dependent on the fulfilment of the conditions as stated in the Scheme. 4. Other gains/(losses) – net Group 2009 2008 $ $ Transfer from equity on disposal of financial assets, available for sale [Note 25(b)(ii)] 6,722,860 – Others - Gain on disposal of property, plant and equipment 3,476,380 3,515,035 - Gain on disposal of non-current asset classified as held for sale – 1,704,745 - Amortisation of deferred gain (Note 22) 68,530 47,250 - Currency translation (losses)/gains – net (482,173) 160,790 3,062,737 5,427,820 53 Annual Report 2009 Swissco International Limited

- Page 3 and 4: Corporate Profile Swissco Internati

- Page 5 and 6: Ship Repair and Maintenance Small t

- Page 7 and 8: Financial Summary FY2009 FY2008 FY2

- Page 9 and 10: Chairman’s Statement Dividend The

- Page 11 and 12: ENTRY INTO ACCOMMODATION WORK BOAT

- Page 13 and 14: Fleet Composition Our fleet has gro

- Page 15 and 16: Operations Review Our vessels AHT B

- Page 17 and 18: SW Marine (M) Sdn Bhd 49% PT Swissc

- Page 19 and 20: Board of Directors Mr Phillip Chan

- Page 21 and 22: Key Management Mr Sam Kwai Hoong Ch

- Page 23 and 24: Corporate Governance Report Swissco

- Page 25 and 26: Corporate Governance Report The NC

- Page 27 and 28: Corporate Governance Report Executi

- Page 29 and 30: Corporate Governance Report The Aud

- Page 31 and 32: Directors' Report For the financial

- Page 33 and 34: Directors' Report For the financial

- Page 35 and 36: Directors' Report For the financial

- Page 37 and 38: Statement by Directors For the fina

- Page 39 and 40: Consolidated Statement of Comprehen

- Page 41 and 42: Consolidated Statement of Changes i

- Page 43 and 44: Notes to the Financial Statements F

- Page 45 and 46: Notes to the Financial Statements F

- Page 47 and 48: Notes to the Financial Statements F

- Page 49 and 50: Notes to the Financial Statements F

- Page 51 and 52: Notes to the Financial Statements F

- Page 53: Notes to the Financial Statements F

- Page 57 and 58: Notes to the Financial Statements F

- Page 59 and 60: Notes to the Financial Statements F

- Page 61 and 62: Notes to the Financial Statements F

- Page 63 and 64: Notes to the Financial Statements F

- Page 65 and 66: Notes to the Financial Statements F

- Page 67 and 68: Notes to the Financial Statements F

- Page 69 and 70: Notes to the Financial Statements F

- Page 71 and 72: Notes to the Financial Statements F

- Page 73 and 74: Notes to the Financial Statements F

- Page 75 and 76: Notes to the Financial Statements F

- Page 77 and 78: Notes to the Financial Statements F

- Page 79 and 80: Notes to the Financial Statements F

- Page 81 and 82: Notes to the Financial Statements F

- Page 83 and 84: Notes to the Financial Statements F

- Page 85 and 86: Notes to the Financial Statements F

- Page 87 and 88: Statistics of Shareholdings As at 1

- Page 89 and 90: Notice of Sixth Annual General Meet

- Page 91 and 92: Notice of Sixth Annual General Meet

- Page 93 and 94: NOTES 1. A member entitled to atten

<strong>Notes</strong><br />

<strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong><br />

For <strong>the</strong> financial year ended 31 December 2009<br />

3. Revenue and o<strong>the</strong>r income<br />

Group<br />

2009 2008<br />

$ $<br />

Rendering of services<br />

Chartering income, sale of out-port-limit services and related income 53,870,367 47,221,044<br />

Ship repair and related services 4,681,755 5,706,663<br />

Sales 58,552,122 52,927,707<br />

O<strong>the</strong>r income<br />

Interest income – Banks 11,712 195,058<br />

Government grant – Jobs Credit Scheme 84,128 –<br />

O<strong>the</strong>rs 216,781 470,792<br />

312,621 665,850<br />

The Jobs Credit Scheme is a cash grant introduced in <strong>the</strong> Singapore Budget 2009 <strong>to</strong> help businesses<br />

preserve jobs in <strong>the</strong> economic downturn. The Jobs Credit is paid <strong>to</strong> eligible employers in 2009 in four<br />

payments and <strong>the</strong> amount an employer can receive is dependent on <strong>the</strong> fulfilment of <strong>the</strong> conditions as<br />

stated in <strong>the</strong> Scheme.<br />

4. O<strong>the</strong>r gains/(losses) – net<br />

Group<br />

2009 2008<br />

$ $<br />

Transfer from equity on disposal of financial assets, available for<br />

sale [Note 25(b)(ii)] 6,722,860 –<br />

O<strong>the</strong>rs<br />

- Gain on disposal of property, plant and equipment 3,476,380 3,515,035<br />

- Gain on disposal of non-current asset classified as held for sale – 1,704,745<br />

- Amortisation of deferred gain (Note 22) 68,530 47,250<br />

- Currency translation (losses)/gains – net (482,173) 160,790<br />

3,062,737 5,427,820<br />

53 Annual Report 2009 <strong>Swissco</strong> International <strong>Limited</strong>