Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Fortis</strong> <strong>Funds</strong> (<strong>Nederland</strong>) N.V. Condensed Interim Report 2009<br />

30 June 2009 UNAUDITED<br />

2.2 Accounting policies<br />

The same principles are used for the valuation of the assets and liabilities and determination of<br />

results as in the financial statements for the year ended 31 December 2008.<br />

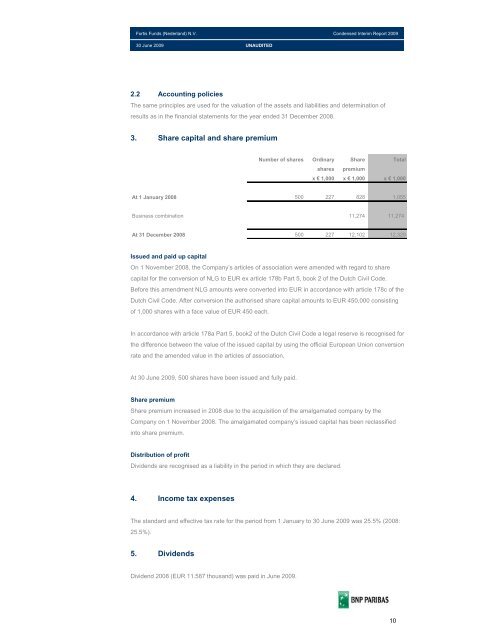

3. Share capital and share premium<br />

Number of shares Ordinary Share Total<br />

shares premium<br />

x € 1,000 x € 1,000 x € 1,000<br />

At 1 January 2008 500 227 828 1,055<br />

Business combination 11,274 11,274<br />

At 31 December 2008 500 227 12,102 12,329<br />

Issued and paid up capital<br />

On 1 November 2008, the Company’s articles of association were amended with regard to share<br />

capital for the conversion of NLG to EUR ex article 178b Part 5, book 2 of the Dutch Civil Code.<br />

Before this amendment NLG amounts were converted into EUR in accordance with article 178c of the<br />

Dutch Civil Code. After conversion the authorised share capital amounts to EUR 450,000 consisting<br />

of 1,000 shares with a face value of EUR 450 each.<br />

In accordance with article 178a Part 5, book2 of the Dutch Civil Code a legal reserve is recognised for<br />

the difference between the value of the issued capital by using the official European Union conversion<br />

rate and the amended value in the articles of association.<br />

At 30 June 2009, 500 shares have been issued and fully paid.<br />

Share premium<br />

Share premium increased in 2008 due to the acquisition of the amalgamated company by the<br />

Company on 1 November 2008. The amalgamated company’s issued capital has been reclassified<br />

into share premium.<br />

Distribution of profit<br />

Dividends are recognised as a liability in the period in which they are declared.<br />

4. Income tax expenses<br />

The standard and effective tax rate for the period from 1 January to 30 June 2009 was 25.5% (2008:<br />

25.5%).<br />

5. Dividends<br />

Dividend 2008 (EUR 11.587 thousand) was paid in June 2009.<br />

10