OJSC Oil Company Rosneft Consolidated Financial Statements

OJSC Oil Company Rosneft Consolidated Financial Statements

OJSC Oil Company Rosneft Consolidated Financial Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>OJSC</strong> <strong>Oil</strong> <strong>Company</strong> <strong>Rosneft</strong><br />

Notes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)<br />

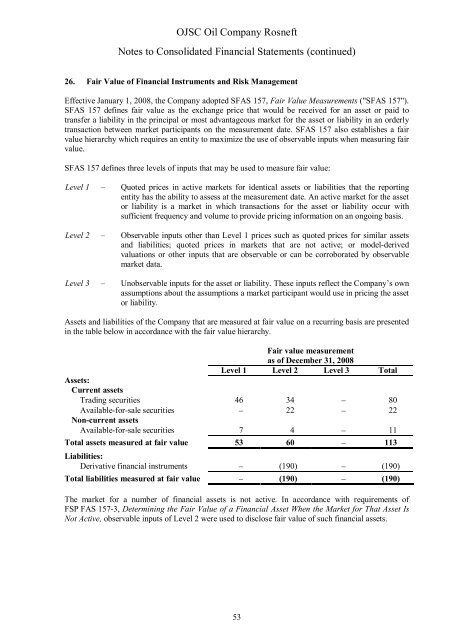

26. Fair Value of <strong>Financial</strong> Instruments and Risk Management<br />

Effective January 1, 2008, the <strong>Company</strong> adopted SFAS 157, Fair Value Measurements ("SFAS 157").<br />

SFAS 157 defines fair value as the exchange price that would be received for an asset or paid to<br />

transfer a liability in the principal or most advantageous market for the asset or liability in an orderly<br />

transaction between market participants on the measurement date. SFAS 157 also establishes a fair<br />

value hierarchy which requires an entity to maximize the use of observable inputs when measuring fair<br />

value.<br />

SFAS 157 defines three levels of inputs that may be used to measure fair value:<br />

Level 1 – Quoted prices in active markets for identical assets or liabilities that the reporting<br />

entity has the ability to assess at the measurement date. An active market for the asset<br />

or liability is a market in which transactions for the asset or liability occur with<br />

sufficient frequency and volume to provide pricing information on an ongoing basis.<br />

Level 2 – Observable inputs other than Level 1 prices such as quoted prices for similar assets<br />

and liabilities; quoted prices in markets that are not active; or model-derived<br />

valuations or other inputs that are observable or can be corroborated by observable<br />

market data.<br />

Level 3 – Unobservable inputs for the asset or liability. These inputs reflect the <strong>Company</strong>’s own<br />

assumptions about the assumptions a market participant would use in pricing the asset<br />

or liability.<br />

Assets and liabilities of the <strong>Company</strong> that are measured at fair value on a recurring basis are presented<br />

in the table below in accordance with the fair value hierarchy.<br />

Fair value measurement<br />

as of December 31, 2008<br />

Level 1 Level 2 Level 3 Total<br />

Assets:<br />

Current assets<br />

Trading securities 46 34 − 80<br />

Available-for-sale securities − 22 − 22<br />

Non-current assets<br />

Available-for-sale securities 7 4 − 11<br />

Total assets measured at fair value 53 60 − 113<br />

Liabilities:<br />

Derivative financial instruments − (190) − (190)<br />

Total liabilities measured at fair value − (190) − (190)<br />

The market for a number of financial assets is not active. In accordance with requirements of<br />

FSP FAS 157-3, Determining the Fair Value of a <strong>Financial</strong> Asset When the Market for That Asset Is<br />

Not Active, observable inputs of Level 2 were used to disclose fair value of such financial assets.<br />

53