OJSC Oil Company Rosneft Consolidated Financial Statements

OJSC Oil Company Rosneft Consolidated Financial Statements

OJSC Oil Company Rosneft Consolidated Financial Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>OJSC</strong> <strong>Oil</strong> <strong>Company</strong> <strong>Rosneft</strong><br />

Notes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)<br />

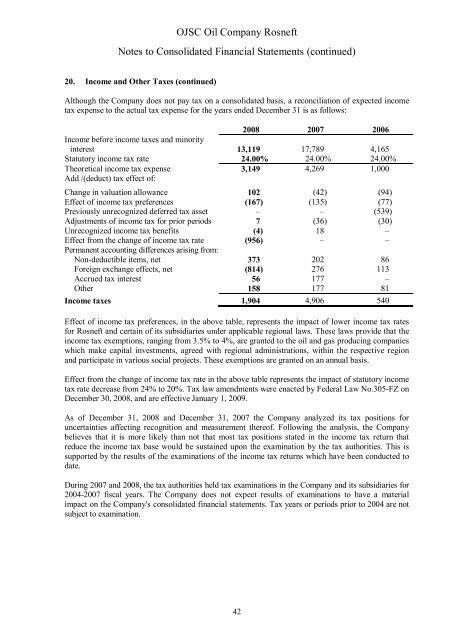

20. Income and Other Taxes (continued)<br />

Although the <strong>Company</strong> does not pay tax on a consolidated basis, a reconciliation of expected income<br />

tax expense to the actual tax expense for the years ended December 31 is as follows:<br />

2008 2007 2006<br />

Income before income taxes and minority<br />

interest 13,119 17,789 4,165<br />

Statutory income tax rate 24.00% 24.00% 24.00%<br />

Theoretical income tax expense 3,149 4,269 1,000<br />

Add /(deduct) tax effect of:<br />

Change in valuation allowance 102 (42) (94)<br />

Effect of income tax preferences (167) (135) (77)<br />

Previously unrecognized deferred tax asset – – (539)<br />

Adjustments of income tax for prior periods 7 (36) (30)<br />

Unrecognized income tax benefits (4) 18 –<br />

Effect from the change of income tax rate (956) – –<br />

Permanent accounting differences arising from:<br />

Non-deductible items, net 373 202 86<br />

Foreign exchange effects, net (814) 276 113<br />

Accrued tax interest 56 177 –<br />

Other 158 177 81<br />

Income taxes 1,904 4,906 540<br />

Effect of income tax preferences, in the above table, represents the impact of lower income tax rates<br />

for <strong>Rosneft</strong> and certain of its subsidiaries under applicable regional laws. These laws provide that the<br />

income tax exemptions, ranging from 3.5% to 4%, are granted to the oil and gas producing companies<br />

which make capital investments, agreed with regional administrations, within the respective region<br />

and participate in various social projects. These exemptions are granted on an annual basis.<br />

Effect from the change of income tax rate in the above table represents the impact of statutory income<br />

tax rate decrease from 24% to 20%. Tax law amendments were enacted by Federal Law No.305-FZ on<br />

December 30, 2008, and are effective January 1, 2009.<br />

As of December 31, 2008 and December 31, 2007 the <strong>Company</strong> analyzed its tax positions for<br />

uncertainties affecting recognition and measurement thereof. Following the analysis, the <strong>Company</strong><br />

believes that it is more likely than not that most tax positions stated in the income tax return that<br />

reduce the income tax base would be sustained upon the examination by the tax authorities. This is<br />

supported by the results of the examinations of the income tax returns which have been conducted to<br />

date.<br />

During 2007 and 2008, the tax authorities held tax examinations in the <strong>Company</strong> and its subsidiaries for<br />

2004-2007 fiscal years. The <strong>Company</strong> does not expect results of examinations to have a material<br />

impact on the <strong>Company</strong>'s consolidated financial statements. Tax years or periods prior to 2004 are not<br />

subject to examination.<br />

42