Tourism Sector Performance Report for Q3 2011 - Singapore ...

Tourism Sector Performance Report for Q3 2011 - Singapore ...

Tourism Sector Performance Report for Q3 2011 - Singapore ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5/1/2012<br />

TOURISM SECTOR PERFORMANCE<br />

HIGHLIGHTS<br />

1. <strong>Tourism</strong> Receipts<br />

• <strong>Tourism</strong> Receipts (TR) <strong>for</strong> Quarter Three (<strong>Q3</strong>) <strong>2011</strong> were estimated at S$6<br />

billion, registering a 12% year-on-year growth.<br />

• All TR components <strong>for</strong> <strong>Q3</strong> <strong>2011</strong> saw year-on-year growth.<br />

2. International Visitor Arrivals<br />

• International Visitor Arrivals (IVA) <strong>for</strong> <strong>Q3</strong> <strong>2011</strong> stood at close to 3.5 million,<br />

representing a 15% year-on-year growth.<br />

3. Hotel Industry<br />

• Gazetted hotel room revenue <strong>for</strong> <strong>Q3</strong> <strong>2011</strong> came in at an estimated S$0.7<br />

billion, representing an 18% year-on-year growth.<br />

• Robust per<strong>for</strong>mance in Average Room Rate (ARR) and Average Occupancy Rate<br />

(AOR) resulted in a 16% growth in Revenue Per Available Room (RevPAR).<br />

Note to Editors:<br />

This quarterly report provides a summary of key statistics on tourism receipts, international<br />

visitor arrivals and gazetted hotels. The analysis in this report is based on data from a variety of<br />

sources, including Disembarkation/Embarkation cards, the Overseas Visitors Survey (OVS) and<br />

the monthly hotel returns from gazetted hotels. Data derived from the OVS are subject to<br />

sampling error. Users are advised to exercise discretion when drawing any conclusions or<br />

inferences, or taking any action, based on the data.<br />

A downloadable version of this report is also available at:<br />

http://app.stb.gov.sg/asp/new/new02a.asp?id=3<br />

Monthly International Visitor Arrival and Hotel statistics are available at:<br />

https://app.stb.gov.sg/asp/tou/tou02.asp#VS

1. <strong>Tourism</strong> Receipts<br />

QUARTER THREE <strong>2011</strong> PERFORMANCE 1<br />

<strong>Tourism</strong> Receipts (TR) <strong>for</strong> Quarter Three (<strong>Q3</strong>) <strong>2011</strong> were estimated at S$6 billion, registering a<br />

12% year-on-year growth. All TR components saw year-on-year growth.<br />

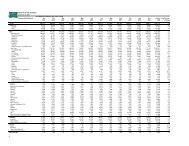

<strong>Tourism</strong> Receipts by Major Components, <strong>Q3</strong> <strong>2011</strong><br />

<strong>Tourism</strong> Receipts: S$6 billion (+12% vs <strong>Q3</strong> 2010)<br />

% Change<br />

vs 2010<br />

% Share<br />

19%<br />

Shopping<br />

1,188<br />

20%<br />

13%<br />

Accommodation<br />

1,114<br />

19%<br />

17%<br />

Food & Beverage<br />

585<br />

10%<br />

9%<br />

Sightseeing & Entertainment<br />

(including Gaming)<br />

1,448<br />

24%<br />

7%<br />

Other TR Components<br />

1,591<br />

27%<br />

S$ Millions - 500 1,000 1,500 2,000<br />

Source: Disembarkation/Embarkation Cards and Overseas Visitor Survey<br />

- Sightseeing & Entertainment includes entrance fees to attractions and nightspots, expenditure on day-tours, leisure events and entertainment at the Integrated Resorts.<br />

- Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and trans it visitors.<br />

Chart 1: <strong>Tourism</strong> Receipts by Major Components, <strong>Q3</strong> <strong>2011</strong><br />

Excluding Sightseeing & Entertainment expenditure, Indonesia (S$781 million), P R China (S$603<br />

million), Australia (S$296 million), India (S$296 million) and Japan (S$232 million) were<br />

<strong>Singapore</strong>’s top five TR generating markets <strong>for</strong> <strong>Q3</strong> <strong>2011</strong>.<br />

All top 10 markets registered year-on-year growth in <strong>Q3</strong>, except USA (-14%) which saw a<br />

continuing decline in business traffic. India (+41%) was the top growth market in terms of TR,<br />

boosted by a strong increase in business traffic in <strong>Q3</strong>. Significant TR increases were also<br />

registered <strong>for</strong> Japan (36%), Philippines (34%) and P R China (31%), primarily due to an increase<br />

in leisure traffic and shopping expenditure.<br />

<strong>Tourism</strong> Receipts by Major Components, Top 10 Markets, <strong>Q3</strong> <strong>2011</strong><br />

<strong>Tourism</strong> Receipts: S$6 billion (+12% vs <strong>Q3</strong> 2010)<br />

% Change<br />

vs 2010<br />

Shopping Accommodation Food & Beverage Other TR Components<br />

<strong>2011</strong> TR*<br />

(S$ mil)<br />

13%<br />

Overall<br />

27%<br />

25%<br />

13%<br />

36%<br />

4,477<br />

6%<br />

Indonesia<br />

28%<br />

17%<br />

9%<br />

46%<br />

781<br />

31%<br />

P R China<br />

53%<br />

14%<br />

7%<br />

25%<br />

603<br />

1%<br />

Australia<br />

18%<br />

23%<br />

13%<br />

46%<br />

296<br />

41%<br />

India<br />

19%<br />

35%<br />

17%<br />

30%<br />

296<br />

36%<br />

Japan<br />

17%<br />

30%<br />

13%<br />

40%<br />

232<br />

14%<br />

Malaysia<br />

29%<br />

27%<br />

10%<br />

34%<br />

220<br />

34%<br />

Philippines<br />

21%<br />

35%<br />

17%<br />

27%<br />

201<br />

-14%<br />

USA<br />

8%<br />

40%<br />

20%<br />

31%<br />

164<br />

6%<br />

UK<br />

10%<br />

26%<br />

15%<br />

49%<br />

153<br />

6%<br />

Hong Kong SAR<br />

18%<br />

32%<br />

18%<br />

32%<br />

148<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

Expenditure is estimated from Overseas Visitor Survey.<br />

Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and transit visitors.<br />

*Sightseeing & entertainment has been excluded in the country analysis due to commercial sensitivity of in<strong>for</strong>mation.<br />

Chart 2: <strong>Tourism</strong> Receipts by Major Components, Top 10 Markets, <strong>Q3</strong> <strong>2011</strong>

1. <strong>Tourism</strong> Receipts<br />

JANUARY TO SEPTEMBER <strong>2011</strong> PERFORMANCE 1<br />

<strong>Tourism</strong> Receipts (TR) <strong>for</strong> January to September <strong>2011</strong> were estimated at S$17 billion,<br />

registering a 22% year-on-year growth.<br />

% Change<br />

vs 2010<br />

<strong>Tourism</strong> Receipts by Major Components, January-September <strong>2011</strong><br />

<strong>Tourism</strong> Receipts: S$17 billion (+22% vs Jan-Sep 2010)<br />

Q1 Q2 <strong>Q3</strong><br />

% Share<br />

13%<br />

Shopping<br />

1,043<br />

1,048<br />

1,188<br />

20%<br />

21%<br />

Accommodation<br />

1,034<br />

1,081<br />

1,114<br />

19%<br />

21%<br />

Food & Beverage<br />

546<br />

544<br />

585<br />

10%<br />

56%<br />

Sightseeing & Entertainment<br />

(including Gaming)<br />

1,344<br />

1,283<br />

1,448<br />

25%<br />

6%<br />

Other TR Components<br />

1,360<br />

1,360<br />

1,591<br />

26%<br />

S$ Millions - 1,000 2,000 3,000 4,000 5,000<br />

Source: Disembarkation/Embarkation Cards and Overseas Visitor Survey<br />

- Sightseeing & Entertainment includes entrance fees to attractions and nightspots, expenditure on day-tours, leisure events and entertainment at the Integrated Resorts.<br />

- Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and trans it visitors.<br />

Chart 3: <strong>Tourism</strong> Receipts by Major Components, January-September <strong>2011</strong><br />

Excluding Sightseeing & Entertainment expenditure, Indonesia (S$2,114 million), P R China<br />

(S$1,579 million), Australia (S$818 million), India (S$808 million) and Malaysia (S$635 million)<br />

were <strong>Singapore</strong>’s top five TR generating markets <strong>for</strong> January to September <strong>2011</strong>.<br />

<strong>Tourism</strong> Receipts by Major Components, Top 10 Markets, January to September <strong>2011</strong><br />

<strong>Tourism</strong> Receipts: S$17 billion (+22% vs Jan-Sep 2010)<br />

% Change<br />

vs 2010<br />

Shopping Accommodation Food & Beverage Other TR Components<br />

<strong>2011</strong> TR*<br />

(S$ mil)<br />

13%<br />

Overall<br />

26%<br />

26%<br />

13%<br />

35%<br />

12,495<br />

8%<br />

Indonesia<br />

30%<br />

16%<br />

9%<br />

45%<br />

2,114<br />

28%<br />

P R China<br />

50%<br />

17%<br />

8%<br />

25%<br />

1,579<br />

8%<br />

Australia<br />

17%<br />

25%<br />

14%<br />

43%<br />

818<br />

20%<br />

India<br />

22%<br />

32%<br />

15%<br />

30%<br />

808<br />

19%<br />

Malaysia<br />

31%<br />

25%<br />

11%<br />

33%<br />

635<br />

39%<br />

Philippines<br />

23%<br />

36%<br />

19%<br />

23%<br />

628<br />

30%<br />

Japan<br />

17%<br />

31%<br />

13%<br />

39%<br />

589<br />

-3%<br />

USA<br />

10%<br />

40%<br />

19%<br />

30%<br />

478<br />

14%<br />

Hong Kong SAR<br />

16%<br />

34%<br />

18%<br />

31%<br />

430<br />

8%<br />

Thailand<br />

23%<br />

36%<br />

16%<br />

25%<br />

425<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

Expenditure is estimated from Overseas Visitor Survey.<br />

Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and transit visitors.<br />

*Sightseeing & entertainment has been excluded in the country analysis due to commercial sensitivity of in<strong>for</strong>mation.<br />

Chart 4: <strong>Tourism</strong> Receipts by Major Components, Top 10 Markets, January-September <strong>2011</strong><br />

Asia’s share of TR continues to grow, as western markets such as USA and UK, affected by poor<br />

economic conditions, showed a decline in their respective shares of TR.<br />

1<br />

All <strong>Tourism</strong> Receipts estimates are correct as at 12 December <strong>2011</strong>.

IVA<br />

2. International Visitor Arrivals<br />

QUARTER THREE <strong>2011</strong> PERFORMANCE<br />

International Visitor Arrivals (IVA) <strong>for</strong> <strong>Q3</strong> stood at close to 3.5 million, representing a 15% yearon-year<br />

growth. IVA <strong>for</strong> July <strong>2011</strong> was the highest ever recorded thus far <strong>for</strong> any single month.<br />

August and September have the highest recorded IVA <strong>for</strong> the respective months.<br />

1,400,000<br />

1,200,000<br />

1,000,000<br />

800,000<br />

International Visitor Arrivals, January to September <strong>2011</strong><br />

Jan-Sep <strong>2011</strong>: 9.8 million (+15% vs Jan-Sep 2010)<br />

JANUARY TO SEPTMBER<br />

<strong>2011</strong> PERFORMANCE<br />

• IVA: over 9.8 million<br />

(+15%)<br />

600,000<br />

400,000<br />

200,000<br />

-<br />

JAN FEB MAR APR MAY JUN JUL AUG SEP<br />

IVA <strong>2011</strong> 1,055,908 990,107 1,071,916 1,103,065 1,054,018 1,079,959 1,273,846 1,178,429 1,033,608<br />

IVA 2010 908,495 857,387 928,903 939,013 946,676 951,032 1,095,047 996,899 947,585<br />

% Change 16% 15% 15% 17% 11% 14% 16% 18% 9%<br />

Chart 5: International Visitor Arrivals, January-September <strong>2011</strong><br />

JANUARY TO SEPTEMBER <strong>2011</strong> PERFORMANCE<br />

Indonesia (1,925,000), P R China (1,230,000), Malaysia (817,000), Australia (717,000) and India<br />

(641,000) were <strong>Singapore</strong>'s top five international visitor-generating markets <strong>for</strong> the period of<br />

January to September <strong>2011</strong> 2 . These markets accounted <strong>for</strong> 54% of total IVA <strong>for</strong> the period.<br />

P R China (+39%) and the Philippines (+30%) registered the highest percentage growth out of<br />

the top 15 markets <strong>for</strong> the period of January to September <strong>2011</strong>.<br />

International Visitor Arrivals, Top 15 Markets, January to September <strong>2011</strong><br />

% Chg vs. 10 Jan-Sep <strong>2011</strong>: 9.8 million (+15% vs Jan-Sep 2010)<br />

+14 Indonesia<br />

1,925<br />

+39 P R China<br />

1,230<br />

+13<br />

+10<br />

+6<br />

Malaysia<br />

Australia<br />

India<br />

817<br />

717<br />

641<br />

+30<br />

+23<br />

+25<br />

+16<br />

+6<br />

-3<br />

+14<br />

+3<br />

+25<br />

+4<br />

Philippines<br />

Japan<br />

Hong Kong SAR<br />

Thailand<br />

USA<br />

UK<br />

South Korea<br />

Vietnam<br />

Taiwan<br />

Germany<br />

505<br />

475<br />

366<br />

351<br />

331<br />

330<br />

319<br />

259<br />

190<br />

157<br />

'000s<br />

0 500 1000 1500 2000 2500<br />

Source: Disembarkation/Embarkation cards<br />

Chart 6: International Visitor Arrivals, Top 15 Markets, January-September <strong>2011</strong><br />

2<br />

Statistics on top international visitor-generating markets <strong>for</strong> <strong>Q3</strong> can be found here: https://app.stb.gov.sg/asp/tou/tou0201.asp

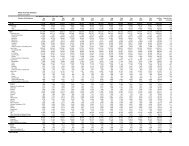

3. Hotel Industry<br />

QUARTER THREE <strong>2011</strong> PERFORMANCE<br />

Gazetted hotel room revenue <strong>for</strong> <strong>Q3</strong> <strong>2011</strong> came in at an estimated S$0.7 billion, representing<br />

an 18% year-on-year growth.<br />

July <strong>2011</strong> posted a record high AOR as IVA reached an all-time peak. With continued increase<br />

in IVA as a result of F1 and the accompanying events of the Grand Prix Season <strong>Singapore</strong> among<br />

others, September <strong>2011</strong> registered the highest REVPAR ever recorded.<br />

<strong>2011</strong> 2010<br />

ARR<br />

($)<br />

AOR<br />

(%)<br />

RevPAR<br />

($)<br />

ARR<br />

($)<br />

AOR<br />

(%)<br />

RevPAR<br />

($)<br />

January 227 82 187 189 81 153<br />

February 229 83 190 200 80 161<br />

March 240 87 208 206 89 182<br />

April 239 86 205 213 86 183<br />

May 244 85 207 214 87 185<br />

June 250 88 221 222 89 197<br />

July 245 94 229 215 88 190<br />

August 239 85 203 225 83 186<br />

September 271 87 235 243 81 197<br />

Table 1: ARR, AOR & RevPAR, January to September 2010 & <strong>2011</strong><br />

QUARTER THREE <strong>2011</strong> PERFORMANCE – ACROSS HOTEL TIERS<br />

Average Room Rate (ARR 3 ) stood at S$251 in <strong>Q3</strong> <strong>2011</strong>, a year-on-year increase of 11%. Room<br />

rates <strong>for</strong> all hotel tiers increased, with the Upscale tier posting the highest growth rate at 11%.<br />

Average Occupancy Rate (AOR 4 ) reached 88% in <strong>Q3</strong> <strong>2011</strong>.<br />

JANUARY TO<br />

SEPTEMBER <strong>2011</strong><br />

PERFORMANCE<br />

• Gazetted hotel<br />

room revenue:<br />

S$1.9 billion<br />

(+31%)<br />

• Highest AOR: July<br />

• Highest ARR and<br />

RevPAR:<br />

September<br />

Robust per<strong>for</strong>mance in ARR and AOR resulted in a 16% growth in Revenue Per Available Room<br />

(RevPAR 5 ), which stood at S$222 in <strong>Q3</strong> <strong>2011</strong>. The Upscale tier was the top per<strong>for</strong>mer in terms<br />

of RevPAR growth.<br />

<strong>Q3</strong> <strong>2011</strong><br />

ARR AOR RevPAR<br />

$ %∆ % %∆ $ %∆<br />

OVERALL 251 11% 88 4% pt 222 16%<br />

LUXURY 404 9% 82 4% pt 330 15%<br />

UPSCALE 282 11% 90 7% pt 255 20%<br />

MID-TIER 191 8% 88 1% pt 168 9%<br />

ECONOMY 112 3% 86 0% pt 97 2%<br />

Table 2: ARR, AOR and RevPAR, <strong>Q3</strong> <strong>2011</strong><br />

3<br />

Standard AOR = [Gross lettings (Room Nights) / Available room nights] x 100<br />

4<br />

Standard AOR = [Gross lettings (Room Nights) / Available room nights] x 100<br />

5<br />

RevPAR = AOR x ARR

Note:<br />

The hotel tiering system is a reference system developed by the <strong>Singapore</strong> <strong>Tourism</strong> Board (STB) to categorise the<br />

different hotels in <strong>Singapore</strong> into tiers based on a combination of factors that include average room rates, location<br />

and product characteristics.<br />

Figures <strong>for</strong> the hotel industry are preliminary estimates, based on returns as at 26 November <strong>2011</strong>. The current<br />

hotel tiers published are based on the hotels’ per<strong>for</strong>mance in 2010. The response rate across the tiers may vary.<br />

Luxury - Includes hotels in the luxury segment and are predominantly in prime locations and/or in historical<br />

buildings<br />

Upscale - Includes hotels in the upscale segment and are generally in prime locations or hotels with boutique<br />

positioning in prime or distinctive locations<br />

Mid-Tier - Includes hotels in the mid-tier segment and are primarily located in prime commercial zones or<br />

immediately outlying areas<br />

Economy - Includes hotels in the budget segment and are generally located in outlying areas

For more in<strong>for</strong>mation, please contact:<br />

Siti Nurhidayati (Ms)<br />

Communications Division<br />

<strong>Singapore</strong> <strong>Tourism</strong> Board<br />

Tel: +65 6831 3416<br />

Email: siti_nurhidayati@stb.gov.sg<br />

Or the STB Media Hotline at +65 9011 2071