Download - Siemens Pakistan

Download - Siemens Pakistan

Download - Siemens Pakistan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

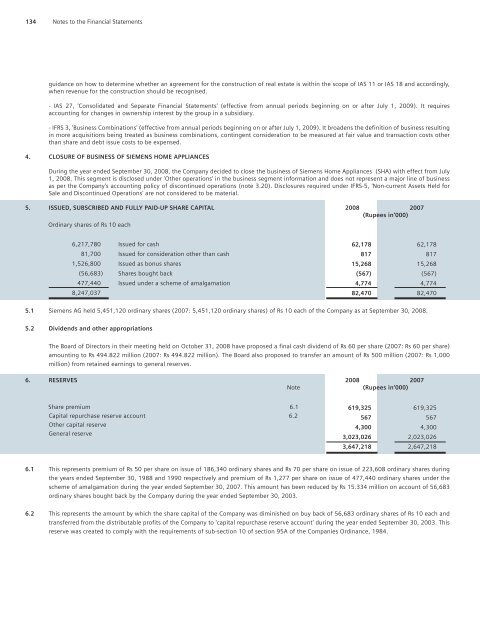

134 Notes to the Financial Statements<br />

guidance on how to determine whether an agreement for the construction of real estate is within the scope of IAS 11 or IAS 18 and accordingly,<br />

when revenue for the construction should be recognised.<br />

- IAS 27, 'Consolidated and Separate Financial Statements' (effective from annual periods beginning on or after July 1, 2009). It requires<br />

accounting for changes in ownership interest by the group in a subsidiary.<br />

- IFRS 3, 'Business Combinations' (effective from annual periods beginning on or after July 1, 2009). It broadens the definition of business resulting<br />

in more acquisitions being treated as business combinations, contingent consideration to be measured at fair value and transaction costs other<br />

than share and debt issue costs to be expensed.<br />

4. CLOSURE OF BUSINESS OF SIEMENS HOME APPLIANCES<br />

During the year ended September 30, 2008, the Company decided to close the business of <strong>Siemens</strong> Home Appliances (SHA) with effect from July<br />

1, 2008. This segment is disclosed under 'Other operations' in the business segment information and does not represent a major line of business<br />

as per the Company's accounting policy of discontinued operations (note 3.20). Disclosures required under IFRS-5, 'Non-current Assets Held for<br />

Sale and Discontinued Operations' are not considered to be material.<br />

5. ISSUED, SUBSCRIBED AND FULLY PAID-UP SHARE CAPITAL 2008 2007<br />

(Rupees in‘000)<br />

Ordinary shares of Rs 10 each<br />

6,217,780 Issued for cash<br />

81,700 Issued for consideration other than cash<br />

1,526,800 Issued as bonus shares<br />

(56,683) Shares bought back<br />

477,440 Issued under a scheme of amalgamation<br />

8,247,037<br />

62,178<br />

817<br />

15,268<br />

(567)<br />

4,774<br />

82,470<br />

62,178<br />

817<br />

15,268<br />

(567)<br />

4,774<br />

82,470<br />

5.1 <strong>Siemens</strong> AG held 5,451,120 ordinary shares (2007: 5,451,120 ordinary shares) of Rs 10 each of the Company as at September 30, 2008.<br />

5.2 Dividends and other appropriations<br />

The Board of Directors in their meeting held on October 31, 2008 have proposed a final cash dividend of Rs 60 per share (2007: Rs 60 per share)<br />

amounting to Rs 494.822 million (2007: Rs 494.822 million). The Board also proposed to transfer an amount of Rs 500 million (2007: Rs 1,000<br />

million) from retained earnings to general reserves.<br />

6. RESERVES 2008 2007<br />

Note<br />

(Rupees in‘000)<br />

Share premium 6.1<br />

Capital repurchase reserve account 6.2<br />

Other capital reserve<br />

General reserve<br />

619,325<br />

567<br />

4,300<br />

3,023,026<br />

3,647,218<br />

619,325<br />

567<br />

4,300<br />

2,023,026<br />

2,647,218<br />

6.1 This represents premium of Rs 50 per share on issue of 186,340 ordinary shares and Rs 70 per share on issue of 223,608 ordinary shares during<br />

the years ended September 30, 1988 and 1990 respectively and premium of Rs 1,277 per share on issue of 477,440 ordinary shares under the<br />

scheme of amalgamation during the year ended September 30, 2007. This amount has been reduced by Rs 15.334 million on account of 56,683<br />

ordinary shares bought back by the Company during the year ended September 30, 2003.<br />

6.2 This represents the amount by which the share capital of the Company was diminished on buy back of 56,683 ordinary shares of Rs 10 each and<br />

transferred from the distributable profits of the Company to 'capital repurchase reserve account' during the year ended September 30, 2003. This<br />

reserve was created to comply with the requirements of sub-section 10 of section 95A of the Companies Ordinance, 1984.