FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

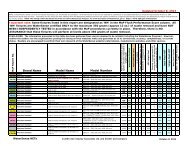

INVESTMENT OPTION 4-B<br />

r<br />

• Option 4 – B: Private Credit (Continued)<br />

• Benefits<br />

o<br />

Limited exposure to interest rates – return generated through Credit not Duration<br />

o High expected return (8-10%)<br />

o Relatively inexpensive compared to publically traded High Yield debt<br />

o Significantly better risk return pr<strong>of</strong>iles than publically traded High Yield debt<br />

♦<br />

Superior position in capital structure, stronger credit covenants, ability to do workouts<br />

• Drawbacks<br />

o Illiquidity – funds <strong>of</strong>ten have 4-8 year lock-ups<br />

o Pi Private fund structure<br />

t<br />

o High management fees – base and incentive<br />

o Much higher risk investment than traditional core fixed income<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 52