FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

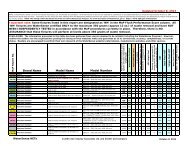

INVESTMENT OPTION 4-B<br />

r<br />

• Option 4 – B: Private Credit<br />

• Private Credit are investments in credit-related assets that are not publically traded<br />

o<br />

This can include loans to middle market firms, distressed debt, mezzanine loans, etc.<br />

• Due to the investments being private there is considerable illiquidity for the assets<br />

o<br />

This has benefits and drawbacks<br />

♦<br />

The major drawback is that t the funds that t do these type <strong>of</strong> investments t have private structures t (PE)<br />

♦ The rationale for this is the money has to be invested in a illiquid security or workout situation which dictates<br />

reduced access to the capital by Plan Sponsors<br />

♦ Fund-<strong>of</strong>-funds exist allowing for greater diversification<br />

• Relative to publically traded debt securities, private credit remains relatively cheap<br />

o<br />

Main reason for this is the illiquidity premium<br />

♦<br />

♦<br />

Many Plan Sponsors experienced predicaments during the credit crisis due to large illiquid investments; this<br />

greatly reduced their appetite for illiquid investments<br />

As a net inflow plan, EBMUD should not have any major liquidity needs for many years ahead<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 51