FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

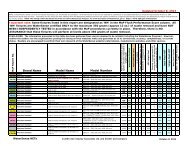

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• While it is easy to see how such a situation ti can get out <strong>of</strong> hand in severe cases, Fixed Income<br />

investors are still exposed to negative outcomes in more moderate situations<br />

o<br />

o<br />

o<br />

Any form <strong>of</strong> Fed Capture would be highly detrimental to investors even if it does not lead to a spiral <strong>of</strong><br />

hyperinflation<br />

Fixed Income investors rely on the price stability provided d by the Fed as part <strong>of</strong> its mandate<br />

Without price stability Fixed Income investors cannot make a sound judgment on the merits <strong>of</strong> a<br />

particular investment<br />

♦ Does the Bond provide adequate value greater than the foregone consumption today?<br />

♦<br />

If the investor can’t quantify their prospective purchasing power in future periods then it is impossible to estimate<br />

the value <strong>of</strong> an investment in the current period<br />

♦ Today’s low interest rate environment compounds the problem by reducing the margin <strong>of</strong> safety<br />

• In such a scenario, Fixed Income investors today can face multiple paths to sub-optimal<br />

outcomes<br />

o<br />

o<br />

Any swings in interest rates could cause material capital losses in today’s low rate environment<br />

Plan Sponsors, especially those with COLA agreements, are dangerously vulnerable to inflation<br />

increases<br />

♦<br />

The current 10-Year Treasury has a small negative real yield; if inflation increases, losses <strong>of</strong> real purchasing<br />

power would be substantial<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 41