FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

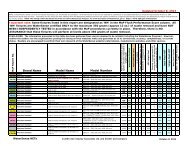

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Which h method chosen to accommodate the rise in the costs <strong>of</strong> servicing i the Government debt<br />

will have a meaningful impact on Fixed Income investors?<br />

• If the Government decides to raise revenue or cut spending to accommodate the rise in cost<br />

then there will likely be two competing forces on Fixed Income returns<br />

1. The spending cuts and higher taxes would likely lead to a slower economy, a slower economy usually<br />

pushes down interest rates which would temporarily boost Fixed Income returns<br />

2. On the other hand, higher taxes and reduced spending would likely force the Fed to remain<br />

accommodative for longer which would lower the long run return for Fixed Income investors<br />

• This process is compounded if the Government doesn’t have a balanced budget as the debt<br />

would continue to grow leading to an ever-increasing crowding out by debt<br />

• Taken to the limit, you can see how such a scenario would lead to an economy in a death<br />

spiral as austerity to cover the debt service slowly chokes <strong>of</strong>f the economy<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 33