FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

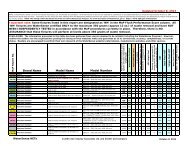

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The background provided over the past few slides lays out the foundation for concern over the<br />

future course <strong>of</strong> interest rates<br />

• Currently the cost to the Government to finance its debt (its debt servicing cost) has been<br />

relatively muted and unchanged over the past 20 years<br />

• This has been a boon for the Government as it has not had to pay the price for increased<br />

borrowing<br />

o<br />

o<br />

Imagine a credit card on which h the interest t rate declined d as the balance grows<br />

No wonder why politicians have been so liberal with their largesse<br />

• We are likely approaching a tipping point where the cost from the balance <strong>of</strong> outstanding debt<br />

starts t to outweigh the fall in average interest t rate<br />

o The average interest rate could continue to decline over the next year or two<br />

o But it can not fall too considerably lower from the weighted average rate <strong>of</strong> 2%<br />

• The average interest rate on Government debt will adjust relatively quickly to changes in<br />

interest rates due to the short-term nature <strong>of</strong> Government borrowing<br />

• What happens when this tipping point is reached?<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 30