FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

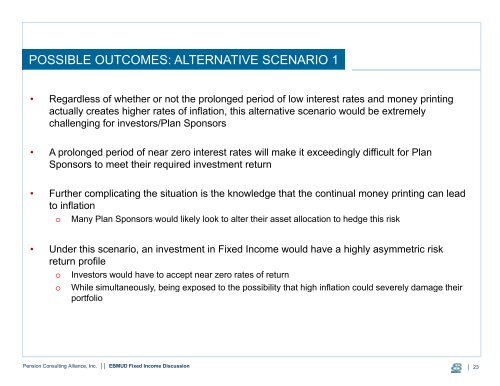

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Regardless <strong>of</strong> whether or not the prolonged period <strong>of</strong> low interest t rates and money printing<br />

actually creates higher rates <strong>of</strong> inflation, this alternative scenario would be extremely<br />

challenging for investors/Plan Sponsors<br />

• A prolonged period <strong>of</strong> near zero interest rates will make it exceedingly difficult for Plan<br />

Sponsors to meet their required investment return<br />

• Further complicating the situation is the knowledge that the continual money printing can lead<br />

to inflation<br />

o<br />

Many Plan Sponsors would likely look to alter their asset allocation to hedge this risk<br />

• Under this scenario, an investment in Fixed Income would have a highly asymmetric risk<br />

return pr<strong>of</strong>ile<br />

o<br />

o<br />

Investors would have to accept near zero rates <strong>of</strong> return<br />

While simultaneously, being exposed to the possibility that high inflation could severely damage their<br />

portfolio<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 23