FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

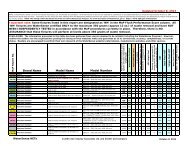

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Thus far the Fed’s unprecedented d monetary policy has not sparked a large increase in the<br />

rate <strong>of</strong> inflation<br />

• Inflation has remained relatively muted with core inflation (ex volatile energy and food)<br />

remaining below 2%<br />

• Despite this, many economists are still worried that the seeds <strong>of</strong> future inflation are being<br />

sown today through the Fed’s easy money policy<br />

o<br />

o<br />

o<br />

They worry continuous printing <strong>of</strong> money will eventually lead to a marked decline in the dollar<br />

This would greatly increase the cost <strong>of</strong> imports but would also flow through to domestic goods due to<br />

the fact that a large percent <strong>of</strong> domestic goods use imports purchased internationally<br />

If inflation does start it would put the Fed in a particularly challenging position<br />

♦<br />

♦<br />

They could continue their accommodative process risking runaway inflation<br />

Or they could raise interest rates to slow inflation risking choking <strong>of</strong>f the nescient recovery<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 22