FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

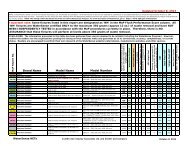

POSSIBLE OUTCOMES: ‘BASE CASE’ SCENARIO<br />

r<br />

• Ideally, and by far the most positive, scenario on how the interest t rate environment evolves<br />

includes a relatively quick pick-up in economic growth which pulls down the unemployment<br />

rate<br />

• This would allow the Fed to discontinue its bond buying program and to eventually start<br />

raising interest rates at a slow-to-moderate pace. In addition, the Fed would slowly shrink its<br />

balance sheet as securities mature<br />

• In this ideal scenario, investors could position their portfolios so that bond maturities and<br />

interest are reinvested at the slightly higher rates <strong>of</strong>fsetting some <strong>of</strong> the capital loss<br />

• In this scenario, investors could hope to breakeven or experience a small loss over a<br />

moderate time period depending on how fast interest rates rise<br />

• We will consider this our “base case” and consider alternative scenarios with less optimistic<br />

outcomes<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 19