FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

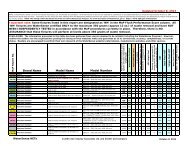

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• The declining i interest t rate environment has been very positive for Plan Sponsors<br />

• As interest rates fell and pushed up Fixed Income returns, the performance sacrifice for<br />

holding Fixed Income instead <strong>of</strong> more risky Stocks was relatively small<br />

• Over the past 20 years, Fixed Income has returned 6.1% while stocks have earned 8.5%<br />

o<br />

This resulted in a relatively small 2.4% performance sacrifice for holding considerably safer Fixed Income rather than<br />

Stocks<br />

• Using a 70% Stock / 30% Fixed Income allocation earned 7.78% per year over that time<br />

period<br />

• However, using the same 70/30 mix with today’s low 2% yield on Fixed Income results in an<br />

annual return <strong>of</strong> only 6.55%!<br />

• This creates a challenging environment for Plan Sponsors as most plans have higher actuarial<br />

assumed investment return assumptions<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 6