FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Additional Considerations<br />

Barrow Hanley is a 75% owned subsidiary <strong>of</strong> Old Mutual investment adviser located in Dallas,<br />

Texas. <strong>Employee</strong>s own the remaining 25%.<br />

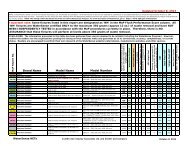

Capital Assets / Clients<br />

Firm-wide<br />

Large Cap Value Equity<br />

Assets<br />

Assets<br />

($ millions) Clients ($ millions) Clients<br />

2012-12 67,665 418 42,899 185<br />

2011-12 59,680 402 41,346 196<br />

2010-12 60,345 387 43,295 202<br />

2009-12 55,032 375 41,599 209<br />

Source: eVestment Alliance<br />

Barrow Hanley’s approach to the equity market is based on the underlying philosophy that<br />

markets are inefficient. These inefficiencies can best be exploited through adherence to a valueoriented<br />

investment process dedicated to the selection <strong>of</strong> securities on a bottom-up basis. The<br />

firm does not attempt to time the market or rotate in and out <strong>of</strong> broad market sectors, as it<br />

believes that it is difficult, if not impossible, to add incremental value on a consistent basis by<br />

market timing. They stay fully invested with a defensive, conservative orientation based on the<br />

belief that superior returns can be achieved while taking below average risks. The firm<br />

implements this strategy by constructing portfolios <strong>of</strong> individual stocks that reflect all three value<br />

characteristics; price/earnings and price/book ratios below the market and dividend yields above<br />

the market (S&P 500).<br />

Barrow Hanley’s history indicates that a strategy <strong>of</strong> emphasizing low price/book ratios and high<br />

dividend yields provides a measure <strong>of</strong> protection in down markets, as well as participation in<br />

improving economic cycles.<br />

The firm starts by looking at a stock’s price relative to its (1) current earnings level, (2) current<br />

tangible book value, and (3) stated dividend, identifying stocks with a low P/E, low price/book, and<br />

high yield. They then make five-year forecasts on ROE, book value, dividends and earnings per<br />

share. Each stock must be attractive on their Relative Return and Dividend Discount Models<br />

before it can be bought. Once purchased, securities are monitored through those two models.<br />

When a stock becomes fairly valued on either <strong>of</strong> the models, the liquidation process begins. The<br />

firm does not try to judge when the holding might reach a speculative level <strong>of</strong> overvaluation.<br />

5