FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

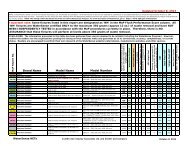

Modeling the Real Return Class<br />

• Different plan sponsor blueprints for the class reflect different preferences and skill sets:<br />

Source: PCA<br />

Examples <strong>of</strong> Approved Plan Sponsor “Blueprints”<br />

CalPERS<br />

Inflation-<br />

Linked<br />

OTPP<br />

Inflation-<br />

Linked<br />

WSIB<br />

Tangible<br />

Assets<br />

KPERS<br />

Real<br />

Return<br />

Hawaii<br />

Real<br />

Return<br />

Asset Class<br />

Subcomponents<br />

TIPS 20% 0% 0% 50% 50%<br />

TIMBER 20% 20% 30% 25% 50%<br />

INFRASTRCTR 30% 60% 50% 0% 0%<br />

COMMODITIES 30% 10% 0% 0% 0%<br />

OIL&GAS 0% 0% 10% 0% 0%<br />

AGRICULTURE 0% 10% 10% 0% 0%<br />

HEDGE FOF 0% 0% 0% 25% 0%<br />

TOTAL 100% 100% 100% 100% 100%<br />

• Wide variation <strong>of</strong> structures, reflecting unique plan sponsor characteristics<br />

• Typically, market-driven opportunities will cause actual fundings to deviate significantly from<br />

proposed structure for modeling purposes<br />

• Policies and guidelines for this class typically allow for ample investment latitude<br />

21<br />

21