FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

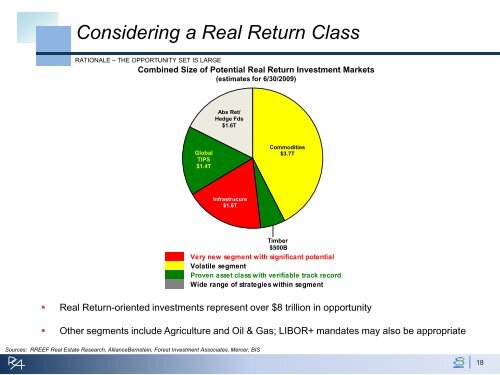

Considering a Real Return Class<br />

RATIONALE – THE OPPORTUNITY SET IS LARGE<br />

Combined Size <strong>of</strong> Potential Real Return Investment Markets<br />

(estimates for 6/30/2009)<br />

Abs Ret/<br />

Hedge Fds<br />

$1.6T<br />

Global<br />

TIPS<br />

$1.4T<br />

Commodities<br />

$3.7T<br />

Infrastrucure<br />

$1.6T<br />

Timber<br />

$500B<br />

Very new segment with significant potential<br />

Volatile segment<br />

Proven asset class with verifiable track record<br />

Wide range <strong>of</strong> strategies within segment<br />

• Real Return-oriented investments represent over $8 trillion in opportunity<br />

• Other segments include Agriculture and Oil & Gas; LIBOR+ mandates may also be appropriate<br />

Sources: RREEF Real Estate Research, AllianceBernstein, Forest Investment Associates, Mercer, BIS<br />

18<br />

18