FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

FROM: Lisa Sorani, Manager of HR Employee Services LS -

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M E M O R A N D U M<br />

Date: April 29, 2013<br />

To:<br />

East Bay Municipal Utility District (EBMUD)<br />

From: Pension Consulting Alliance, Inc. (PCA) cc: Eric White – PCA<br />

Jeremy Thiessen – PCA<br />

RE:<br />

Barrow Hanley “Heightened Monitoring” Status Recommendation<br />

Summary<br />

PCA recommends that EBMUD place the Barrow, Hanley, Mewhinney & Strauss Large Cap<br />

Value (Barrow Hanley) account on heightened monitoring status to be closely monitored over<br />

the next 12 to 18 months. As <strong>of</strong> March 31, 2013, Barrow Hanley’s gross <strong>of</strong> fees trailing 12-<br />

month performance underperformed their benchmark, the Russell 1000 Value Index, by (5.6%),<br />

falling below EBMUD’s short-term 1 <strong>Manager</strong> Heightened Monitoring Criteria.<br />

Discussion<br />

EBMUD retained Barrow Hanley to manage approximately $109.3 million for the large cap value<br />

portion <strong>of</strong> its investment portfolio during the third quarter <strong>of</strong> 2005. EBMUD’s total exposure to the<br />

Barrow Hanley Large Cap Value account was approximately $152.4 million as <strong>of</strong> March 31, 2013.<br />

Over the past 1-year period Barrow Hanley has underperformed their benchmark, the Russell<br />

1000 Value Index, by (5.6%). Over the past 3- and 5-year periods Barrow Hanley has<br />

underperformed by (1.8%) and outperformed by 1.1% per annum, respectively. Since inception,<br />

Barrow Hanley has matched its benchmark with a 5.0% return.<br />

1 Short-term criteria: Underperformance greater than (3.5%) in a trailing 12-month period gross <strong>of</strong> fees.

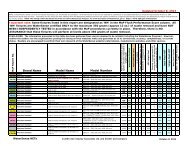

Barrow Hanley Large Cap Value<br />

Heightened Monitoring Status Recommendation<br />

Product and Organization Review Summary<br />

Reason for Update<br />

Failed Performance Criteria<br />

Organizational Changes<br />

Scheduled Watch Update<br />

Product<br />

Key people changes<br />

Changes to team structure/individuals roles<br />

Product client gain/losses<br />

Changes to the investment process<br />

Personnel turnover<br />

Level <strong>of</strong><br />

Concern^<br />

None<br />

None<br />

None<br />

None<br />

None<br />

Areas <strong>of</strong> Potential Impact<br />

Investment<br />

process<br />

(client Investment Performance<br />

portfolio) Team Track Record<br />

Team/<br />

Firm<br />

Culture<br />

Organization<br />

Ownership changes<br />

Key people changes<br />

Firm wide client gain/losses<br />

^None, low or high<br />

None<br />

None<br />

None<br />

Review and Recommendation History<br />

Date PCA Findings and Recommendation Board<br />

04/2013<br />

PCA recommends placing Barrow Hanley on Heightened Monitoring<br />

status due to performance. Next review in 12 to 18 months<br />

Pending<br />

Annualized Performance Results<br />

As <strong>of</strong> 03/31/2013<br />

Inception<br />

(12/31/05)<br />

Performance QTR YTD 1 Year 3 Years 5 Years<br />

Barrow Hanley 10.1 10.1 13.2 10.9 5.9 5.0<br />

Russell 1000 Value Index 12.3 12.3 18.8 12.7 4.8 5.0<br />

Difference -2.2 -2.2 -5.6 -1.8 1.1 0.0<br />

Peer Ranking^<br />

Barrow Hanley 82 82 80 65 40 61<br />

Russell 1000 Value Index 28 28 8 39 60 63<br />

Source: MPI<br />

^Peer rankings are based on gross <strong>of</strong> fee performance. Rankings: 1 = best and 100= worst<br />

2

Recent Investment Performance<br />

Barrow Hanley exhibits a consistently higher quality portfolio (high returns on equity, low leverage,<br />

sustained earnings) than the benchmark. This quality bias leads to a relative performance pattern<br />

wherein Barrow Hanley performs well during periods <strong>of</strong> volatility and market decline but tends to<br />

lag in strong up markets. Over time, this quality bias should lead to outperformance as a number<br />

<strong>of</strong> studies have shown higher quality stocks outperform lower quality stocks over the long term.<br />

When looking at quarterly excess performance relative to the Russell 1000 Value Index (see graph<br />

below), it is evident the portfolio’s excess returns have proven to be volatile. Since inception,<br />

Barrow Hanley has produced positive excess results relative to the Index in 13 <strong>of</strong> the 30 quarters<br />

(43% <strong>of</strong> the time). Strong excess performance in periods <strong>of</strong> market decline has helped Barrow<br />

Hanley over longer time periods.<br />

5<br />

4<br />

3<br />

Quarterly Excess Performance<br />

(Since Inception – 03/31/2013)<br />

Barrow<br />

Excess<br />

2<br />

Excess Return, %<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Mar-13<br />

On a risk-adjusted basis, since inception returns ending March 31, 2013, fall below those <strong>of</strong> the<br />

strategy’s median peer fund (see following graph). Over this 91-month period, the strategy<br />

produced an average annual return <strong>of</strong> 5.0%, while incurring a 16.4% annualized standard<br />

deviation. These results produced a 0.27 Sharpe ratio (a measure <strong>of</strong> return per unit <strong>of</strong> risk).<br />

3

10<br />

Risk / Return Performance Comparison<br />

(Since Inception Ending 03/31/2013)<br />

Large Value <strong>Manager</strong> Universe<br />

Barrow<br />

Russell 1000 Value<br />

Total Annualized Return, %<br />

8<br />

6<br />

4<br />

2<br />

Annualized Return, % Annualized StdDev, % Sharpe Ratio<br />

Barrow 5.04 16.39 0.27<br />

Russell 1000 Value 5.02 17.21 0.27<br />

Large Value <strong>Manager</strong> Universe Median 5.62 16.36 0.31<br />

0<br />

0 5 10 15 20 25 30 35<br />

Total Annualized StdDev, %<br />

The following exhibit shows Barrow Hanley’s cumulative performance versus the Russell 1000<br />

Value Index since inception. Since inception, the cumulative performance <strong>of</strong> Barrow Hanley has<br />

been in-line with its benchmark despite relatively strong performance surrounding the credit crisis.<br />

Cumulative Performance<br />

Inception – 03/31/2013<br />

150<br />

140<br />

Barrow<br />

Russell 1000 Value<br />

130<br />

120<br />

Growth <strong>of</strong> $100<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Aug-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 M ar-13<br />

4

Additional Considerations<br />

Barrow Hanley is a 75% owned subsidiary <strong>of</strong> Old Mutual investment adviser located in Dallas,<br />

Texas. <strong>Employee</strong>s own the remaining 25%.<br />

Capital Assets / Clients<br />

Firm-wide<br />

Large Cap Value Equity<br />

Assets<br />

Assets<br />

($ millions) Clients ($ millions) Clients<br />

2012-12 67,665 418 42,899 185<br />

2011-12 59,680 402 41,346 196<br />

2010-12 60,345 387 43,295 202<br />

2009-12 55,032 375 41,599 209<br />

Source: eVestment Alliance<br />

Barrow Hanley’s approach to the equity market is based on the underlying philosophy that<br />

markets are inefficient. These inefficiencies can best be exploited through adherence to a valueoriented<br />

investment process dedicated to the selection <strong>of</strong> securities on a bottom-up basis. The<br />

firm does not attempt to time the market or rotate in and out <strong>of</strong> broad market sectors, as it<br />

believes that it is difficult, if not impossible, to add incremental value on a consistent basis by<br />

market timing. They stay fully invested with a defensive, conservative orientation based on the<br />

belief that superior returns can be achieved while taking below average risks. The firm<br />

implements this strategy by constructing portfolios <strong>of</strong> individual stocks that reflect all three value<br />

characteristics; price/earnings and price/book ratios below the market and dividend yields above<br />

the market (S&P 500).<br />

Barrow Hanley’s history indicates that a strategy <strong>of</strong> emphasizing low price/book ratios and high<br />

dividend yields provides a measure <strong>of</strong> protection in down markets, as well as participation in<br />

improving economic cycles.<br />

The firm starts by looking at a stock’s price relative to its (1) current earnings level, (2) current<br />

tangible book value, and (3) stated dividend, identifying stocks with a low P/E, low price/book, and<br />

high yield. They then make five-year forecasts on ROE, book value, dividends and earnings per<br />

share. Each stock must be attractive on their Relative Return and Dividend Discount Models<br />

before it can be bought. Once purchased, securities are monitored through those two models.<br />

When a stock becomes fairly valued on either <strong>of</strong> the models, the liquidation process begins. The<br />

firm does not try to judge when the holding might reach a speculative level <strong>of</strong> overvaluation.<br />

5

M E M O R A N D U M<br />

Date: April 29, 2013<br />

To:<br />

East Bay Municipal Utility District (EBMUD)<br />

From: Pension Consulting Alliance, Inc. (PCA) cc: Eric White – PCA<br />

Jeremy Thiessen – PCA<br />

RE:<br />

INTECH Management Fee Recommendation<br />

Summary<br />

PCA has reached out to INTECH to discuss alternate fee arrangements for the large cap growth<br />

mandate they have with EBMUD. In response, INTECH has proposed a performance-based fee<br />

comprised <strong>of</strong> a low 5 basis point base fee with an incentive fee <strong>of</strong> 12.5% <strong>of</strong> excess performance.<br />

This compares favorably to their current 49.5 basis point flat fee. INTECH’s proposed fee schedule<br />

will more closely align INTECH’s compensation and their ability to add value. As such, PCA<br />

recommends that the Board accept the new management fee schedule proposal.<br />

Discussion<br />

In a recent meeting with INTECH, PCA requested that INTECH review their current management<br />

fee arrangement with EBMUD and potentially consider alternatives. PCA made this<br />

recommendation in light <strong>of</strong> the fact that INTECH has failed to add meaningful value over recent<br />

time periods. INTECH responded with an attractive performance-based option. The proposed<br />

annual management fee will consist <strong>of</strong> a 5 basis point base fee with an incentive fee <strong>of</strong> 12.5% <strong>of</strong><br />

excess performance.<br />

The objective is for EBMUD to pay a lower base management fee and then only pay additional<br />

fees if INTECH outperforms the benchmark. A maximum fee cap is also incorporated in the<br />

proposal which would impose a ceiling on the fees paid if INTECH were to significantly outperform<br />

the benchmark.<br />

The cost <strong>of</strong> the proposed fee schedule would match current fees when INTECH outperforms the<br />

benchmark by 3%. This was chosen because 3% relative outperformance is INTECH’s self-stated<br />

goal. As such, the new fee arrangement is superior to the current fee arrangement in any time<br />

period wherein INTECH outperforms by less than 3%. Inversely, the new fee arrangement would<br />

be inferior and more costly if INTECH outperforms by more than 3%. Under the proposed fee<br />

arrangement outperformance will be measured over a rolling 36-month period.

For example, as <strong>of</strong> the most recent quarter end, INTECH has outperformed its benchmark by 1.2%<br />

over the past 36-month period. This level <strong>of</strong> outperformance would earn INTECH a total fee <strong>of</strong><br />

approximately 20 basis points (5 bps base fee plus 15 bps incentive fee [1.2% outperformance<br />

times 12.5% incentive fee]): substantially less than the current flat base fee <strong>of</strong> 49.5 basis points. In<br />

dollar terms, this amounts to a savings <strong>of</strong> approximately $200,000 in this scenario (with the current<br />

fee structure, the annual fee is $327,000). For periods in which INTECH fails to outperform the<br />

benchmark, the total annual fee will be a mere 5 basis points, or $33,000.<br />

Attached is a document provided by INTECH illustrating the hypothetical fees given various levels<br />

<strong>of</strong> outperformance.<br />

2

INTECH Performance Fee Illustration *<br />

Fixed Fee Formula:<br />

0.495% on the 1st $100,000,000 Account market value (MV) = $66,000,000<br />

Base Fee $ = $33,000<br />

Avg. Fee % = 0.495% Performance Fee Terms:<br />

Avg. Fee $ = $326,700 Base Fee (BF) = 0.05%<br />

Participation Rate (PR) = 12.50%<br />

Maximum Fee (MF) = 0.90%<br />

Total Fee Calculations<br />

Gross Perf Total Excess TR<br />

Alpha Fee % Perf Fee $ Fee % Total Fee $ Net <strong>of</strong><br />

[ α ] [ α * PR ] [ α * PR * MV ] [ Perf + Base ] [ Perf + Base ] All Fees<br />

Minimum Fee 0.00% 0.0000% $0 0.0500% $33,000 -0.05%<br />

0.25% 0.0313% $20,625 0.0813% $53,625 0.17%<br />

0.50% 0.0625% $41,250 0.1125% $74,250 0.39%<br />

0.75% 0.0938% $61,875 0.1438% $94,875 0.61%<br />

1.00% 0.1250% $82,500 0.1750% $115,500 0.83%<br />

1.25% 0.1563% $103,125 0.2063% $136,125 1.04%<br />

1.50% 0.1875% $123,750 0.2375% $156,750 1.26%<br />

1.75% 0.2188% $144,375 0.2688% $177,375 1.48%<br />

2.00% 0.2500% $165,000 0.3000% $198,000 1.70%<br />

2.25% 0.2813% $185,625 0.3313% $218,625 1.92%<br />

2.50% 0.3125% $206,250 0.3625% $239,250 2.14%<br />

2.75% 0.3438% $226,875 0.3938% $259,875 2.36%<br />

3.00% 0.3750% $247,500 0.4250% $280,500 2.58%<br />

3.25% 0.4063% $268,125 0.4563% $301,125 2.79%<br />

3.50% 0.4375% $288,750 0.4875% $321,750 3.01%<br />

Fixed Fee Equivalance 3.56% 0.4450% $293,700 0.4950% $326,700 3.07%<br />

3.75% 0.4688% $309,375 0.5188% $342,375 3.23%<br />

4.00% 0.5000% $330,000 0.5500% $363,000 3.45%<br />

4.25% 0.5313% $350,625 0.5813% $383,625 3.67%<br />

4.50% 0.5625% $371,250 0.6125% $404,250 3.89%<br />

4.75% 0.5938% $391,875 0.6438% $424,875 4.11%<br />

5.00% 0.6250% $412,500 0.6750% $445,500 4.33%<br />

5.25% 0.6563% $433,125 0.7063% $466,125 4.54%<br />

5.50% 0.6875% $453,750 0.7375% $486,750 4.76%<br />

5.75% 0.7188% $474,375 0.7688% $507,375 4.98%<br />

6.00% 0.7500% $495,000 0.8000% $528,000 5.20%<br />

6.25% 0.7813% $515,625 0.8313% $548,625 5.42%<br />

6.50% 0.8125% $536,250 0.8625% $569,250 5.64%<br />

6.75% 0.8438% $556,875 0.8938% $589,875 5.86%<br />

Maximum Fee 6.80% 0.8500% $561,000 0.9000% $594,000 5.90%<br />

* Example calculations provided for illustrative purposes only. Only the Base Fee will be charged for the initial 3<br />

quarters under the performance fee arrangement. For the 4th and subsequent quarters, both the Base Fee and<br />

Performance Fee will be charged. The performance fee will be based upon the account's excess performance from the<br />

inception <strong>of</strong> the performance fee until its 3rd anniversary, at which point a rolling 3-year return will be utilized. The<br />

performance excess for the account will be calculated relative to the Benchmark Index in US dollars, although significant<br />

investment restrictions may require that a custom benchmark be used to calculate the excess performance for<br />

performance fee purposes. A document further describing INTECH’s standard performance fee methodology<br />

accompanies this illustration.

Q1 - 2013<br />

Preliminary<br />

Recent Investment Performance<br />

Quarter 1 Year 3 Year 5 Year 10 Year 20 Year<br />

Total Portfolio 6.3 10.4 10.2 5.6 8.7 8.1<br />

Policy Benchmark 6.4 11.1 10.0 5.3 8.9 8.2<br />

Excess Return -0.1 -0.7 0.2 0.3 -0.2 -0.1<br />

*Gross <strong>of</strong> Fees<br />

Portfolio Valuation as <strong>of</strong> March 31, 2013<br />

(in millions $)<br />

March 31, Dec. 31, Quarterly Percentage March 31, Annual Percentage<br />

2013 2012 Change Change* 2012 Change Change*<br />

EBMUD $1,109.2 $1,045.7 $63.5 6.1% $1,011.1 $98.1 9.7%<br />

*Percentage change in value due to both investment results and cash flows.<br />

1

Q1 - 2013<br />

Actual vs. Target Allocations<br />

Preliminary<br />

As <strong>of</strong> March 31, 2013<br />

Actual vs. Target Allocation<br />

Segment Actual $(000) Actual % Target %* Variance<br />

Total Portfolio 1,109,153 100% 100% ---<br />

Domestic Equity 599,471 54.0% 50.0% 4.0%<br />

International Equity 204,568 18.4% 20.0% -1.6%<br />

Fixed Income 239,489 21.6% 25.0% -3.4%<br />

Real Estate** 52,818 4.8% 5.0% -0.2%<br />

Cash 12,807 1.2% 0.0% 1.2%<br />

*2006 asset allocation policy targets.<br />

**RREEF performance results and allocation are lagged one-quarter.<br />

Actual Asset Allocation Comparison<br />

March 31, 2013<br />

FI<br />

22%<br />

December 31, 2012<br />

FI<br />

23%<br />

Dom Eq<br />

54%<br />

Cash<br />

1%<br />

RE<br />

5%<br />

Dom Eq<br />

52%<br />

Cash<br />

1%<br />

RE<br />

5%<br />

Intl Eq<br />

18%<br />

Intl Eq<br />

19%<br />

2

Q1 - 2013<br />

Preliminary<br />

Periods ending March 31, 2013<br />

(Gross <strong>of</strong> Fees)<br />

Asset Class Quarter 1 Year 3 Year 5 Year 10 Year 20 Year<br />

Total Portfolio 6.3 10.4 10.2 5.6 8.7 8.1<br />

Policy Benchmark^ 6.4 11.1 10.0 5.3 8.9 8.2<br />

Domestic Equity 10.2 13.0 12.6 6.4 9.1 8.3<br />

Russell 3000 (blend)* 11.1 14.6 13.0 6.3 9.6 9.2<br />

International Equity 3.2 8.4 6.3 1.1 11.2 ---<br />

MSCI ACWI x U.S.(blend)** 3.3 8.9 4.9 0.1 10.8 ---<br />

Fixed Income 0.4 6.0 7.3 6.8 5.7 6.7<br />

BC Universal (blend)*** 0.1 4.7 6.0 5.9 5.2 6.2<br />

Real Estate 5.7 12.5 17.2 -0.6 --- ---<br />

50/50 NCREIF/FTSE NAREIT All Equity**** 5.8 14.7 15.1 3.5 --- ---<br />

Cash 0.1 0.4 0.4 1.1 2.4 ---<br />

Citigroup T-bills 0.0 0.1 0.1 0.3 1.7 ---<br />

^Total Portfolio Benchmark consists <strong>of</strong> 50% Russell 3000 (blend), 20% MSCI ACWIxU.S. (blend), 25% Barclay’s Capital Universal (blend), 2.5% NCREIF (lagged), 2.5% FTSE<br />

NAREIT All Equity REITs index as <strong>of</strong> 11/1/11<br />

*Russell 3000 as <strong>of</strong> 10/1/05. Prior: 30% S&P500, 10% S&P400, 10% Russell 2000 (4/1/05-9/30/05); 33% S&P500, 10% S&P400, 10% Russell 2000 (9/1/98-3/31/05); 30% S&P500,<br />

15% Wilshire 5000 (4/1/96-8/31/98)<br />

**MSCI ACWIxU.S. as <strong>of</strong> 1/1/07; MSCI EAFE ND thru 12/31/06<br />

***BC Universal as <strong>of</strong> 1/1/08; BC Aggregate thru 12/31/07<br />

****50% NCREIF (lagged), 50% FTSE NAREIT All Equity REITs Index as <strong>of</strong> 11/1/11; NCREIF (lagged) thru 10/31/11<br />

3

Q1 - 2013<br />

<strong>Manager</strong> Performance (Gross <strong>of</strong> Fees)<br />

Preliminary<br />

Domestic Equity – Periods ending March 31, 2013<br />

<strong>Manager</strong><br />

Mkt Value<br />

($000)<br />

Asset Class<br />

Management<br />

Style<br />

Quarter 1 YR 3 YR 5 YR Estimated Annual<br />

Fee (bps) 1<br />

Current Monitoring<br />

Status<br />

Northern Trust Co. 266,346 Large Cap Core Passive 11.0 14.5 13.0 6.3 3 ---<br />

Russell 1000 Index --- --- --- 11.0 14.4 12.9 6.2 --- ---<br />

Intech 69,564 Large Cap Growth Active 8.7 10.8 14.3 7.1 50 ---<br />

T. Rowe Price 67,400 Large Cap Growth Active 7.9 8.4 13.2 8.1 49 ---<br />

Russell 1000 Growth Index --- --- --- 9.5 10.1 13.1 7.3 --- ---<br />

Barrow Hanley 152,416 Large Cap Value Active 10.1 13.2 10.9 5.9 32 ---<br />

Russell 1000 Value Index --- --- --- 12.3 18.8 12.7 4.8 --- ---<br />

Northern Trust Co. 18,612 Small Cap Growth Passive 13.2 14.9 15.0 --- 5 ---<br />

Russell 2000 Growth Index --- --- --- 13.2 14.5 14.7 --- --- ---<br />

Opus 25,133 Small Cap Value Active 11.5 13.6 12.1 8.1 67 2 Heightened<br />

Russell 2000 Value Index --- --- --- 11.6 18.1 12.1 7.3 --- ---<br />

International Equity – Periods ending March 31, 2013<br />

<strong>Manager</strong><br />

Mkt Value<br />

($000)<br />

Asset Class<br />

Management<br />

Style<br />

Quarter 1 YR 3 YR 5 YR Estimated Annual<br />

Fee (bps) 1<br />

Current Monitoring<br />

Status<br />

Franklin Templeton 3 100,102 ACWI x U.S. Active 3.3 12.1 5.7 0.3 58 ---<br />

Fisher Investments 104,466 ACWI x U.S. Active 3.1 5.1 6.6 1.8 66 ---<br />

MSCI ACWI x U.S. (blend)* --- --- --- 3.3 8.9 4.9 0.1 --- ---<br />

*As <strong>of</strong> January 1, 2007, the benchmark changed from MSCI EAFE to MSCI ACWI x U.S.<br />

1 Reviewed annually. Last reviewed June 30, 2012.<br />

2 The Estimated Annual Fee reported for Opus is based on the new management fee schedule approved by the Board at the November 2012 Board meeting.<br />

3 Franklin Templeton’s returns are reported net <strong>of</strong> fees. The Franklin Templeton institutional mutual fund account was liquidated in June 2011 and moved to a transition account which<br />

later funded the Franklin Templeton new separate account in the same month. The Q2-2011 return is an aggregate <strong>of</strong> the institutional mutual fund account, Franklin transition account,<br />

and new separate account.<br />

4

Q1 - 2013<br />

Preliminary<br />

Fixed Income – Periods ending March 31, 2013<br />

<strong>Manager</strong><br />

Mkt Value Asset Class Management Quarter 1 YR 3 YR 5 YR Estimated Annual Current Monitoring<br />

($000)<br />

Style<br />

Fee (bps) 4<br />

Status<br />

Western Asset Management 82,448 Core Plus Active 0.9 8.8 9.3 8.1 26 ---<br />

BC Universal (blend)* --- --- --- 0.1 4.7 6.0 5.9 --- ---<br />

CS McKee 157,041 Core Active 0.1 4.5 --- --- 20 ---<br />

BC Aggregate --- --- --- -0.1 3.8 --- --- --- ---<br />

*As <strong>of</strong> January 1, 2008, the benchmark changed from BC Aggregate to BC Universal.<br />

Real Estate – Periods ending March 31, 2013<br />

<strong>Manager</strong><br />

Mkt Value Asset Class Quarter 1 YR 3 YR 5 YR Estimated Annual Current Monitoring<br />

($000)<br />

Fee (bps) 4<br />

Status<br />

RREEF II* 21,075 Real Estate 3.4 12.4 15.6 -1.5 161 Heightened<br />

NCREIF* --- --- 2.5 10.5 12.6 2.1 --- ---<br />

Urdang 31,744 Real Estate 7.5 13.8 --- --- 27.5 bps + 15% on<br />

---<br />

excess returns<br />

FTSE NAREIT All Equity REITs --- --- 9.1 18.7 --- --- --- ---<br />

*Results are lagged one quarter.<br />

4 Reviewed annually. Last reviewed June 30, 2012.<br />

5

EBMUD FIXED INCOME DISCUSSION<br />

East Bay Municipal i Utility District<br />

i t<br />

May 2013

AGENDA ITEMS<br />

Section<br />

Tab<br />

Current Interest Rate Environment 1<br />

Looking Forward 2<br />

Investment Options 3<br />

Conclusions 4<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 2

SECTION 1<br />

THE CURRENT INTEREST RATE ENVIRONMENT<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion<br />

│ 3

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• Approximately 32 years ago on September 30, 1981, the 10-year Treasury reached its<br />

100-year peak <strong>of</strong> 15.8%<br />

• Since then interest rates have steadily fallen<br />

• Interest rates are now near all time lows at 1.7%<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

10-Year Treasury Yield<br />

Source: PCA, US Treasury<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 4

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• The gradual decline in interest rates over the past 30 years has acted as a wind at the back <strong>of</strong><br />

fixed income returns<br />

• Over this period the BC Aggregate has averaged an annualized 8.75% return per annum<br />

12 Month Rolling Performance<br />

35<br />

31.87<br />

Mar-81 - Mar-13<br />

BC Aggregate Bond<br />

30<br />

28.72 Total<br />

25<br />

%<br />

Total Return,<br />

20<br />

17.24<br />

15<br />

13.05<br />

9.86<br />

10<br />

5.30<br />

5<br />

12.34 12.91 13.29<br />

11.40<br />

11.99<br />

12.53<br />

11.69<br />

10.79<br />

873 8.73<br />

6.49<br />

4.89 5.16<br />

4.99 4.91<br />

2.37<br />

1.87<br />

7.69 7.71<br />

6.59 7.67<br />

5.35 5.40<br />

5.12<br />

3.77<br />

1.15 2.26 3.13<br />

0<br />

Mar-81 Mar-86 Mar-91 Mar-96 Mar-01 Mar-06 Mar-11 Mar-13<br />

Source: PCA, MPI<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 5

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• The declining i interest t rate environment has been very positive for Plan Sponsors<br />

• As interest rates fell and pushed up Fixed Income returns, the performance sacrifice for<br />

holding Fixed Income instead <strong>of</strong> more risky Stocks was relatively small<br />

• Over the past 20 years, Fixed Income has returned 6.1% while stocks have earned 8.5%<br />

o<br />

This resulted in a relatively small 2.4% performance sacrifice for holding considerably safer Fixed Income rather than<br />

Stocks<br />

• Using a 70% Stock / 30% Fixed Income allocation earned 7.78% per year over that time<br />

period<br />

• However, using the same 70/30 mix with today’s low 2% yield on Fixed Income results in an<br />

annual return <strong>of</strong> only 6.55%!<br />

• This creates a challenging environment for Plan Sponsors as most plans have higher actuarial<br />

assumed investment return assumptions<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 6

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• However, the problem posed by the low current yield on Fixed Income is not the only problem<br />

facing Plan Sponsors<br />

• Plan Sponsors also face the possibility <strong>of</strong> capital loss as interest rates start to rise<br />

• Why is this?<br />

o<br />

There is an inverse relationship between bond prices and interest rates<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 7

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• Lets look at an example:<br />

o You buy a bond with 11 years to maturity that yields 2% trading at par ($100)<br />

o<br />

o<br />

o<br />

o<br />

After a year, interest rates have gone up to 5% and you want to sell your bond<br />

Will you get $100 when you go to sell the bond? => No<br />

Why not? The buyer could just as easily buy a new identical 10 year bond yielding 5% and make<br />

more money over the life <strong>of</strong> the investment<br />

So for the buyer to be willing to buy your bond, your bond must allow him to make an equivalent<br />

amount <strong>of</strong> money as the identical 5% bond<br />

o How does this happen? => The price <strong>of</strong> your bond must go down<br />

o<br />

o<br />

In order for the two bonds to have identical returns over the next 10 years your bond must be sold at<br />

=> $76.83!<br />

You have a capital loss <strong>of</strong> 23% because <strong>of</strong> the increase in interest rates<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 8

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• Luckily there is a simple measure that we can use to estimate the change in Bond prices for<br />

given changes in interest rates => Duration<br />

• Duration measures the change in the price <strong>of</strong> a Bond given small parallel shifts in interest<br />

rates<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 9

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• The current interest rate environment has created an extremely asymmetric risk reward pr<strong>of</strong>ile<br />

o<br />

o<br />

The best outcome is getting your money back at maturity and earning a meager 2% interest along the<br />

way<br />

However, the potential downside during the tenure <strong>of</strong> the bond is enormous<br />

• The graph below shows the return distribution for a 10-year Treasury under different interest<br />

rate environments<br />

15%<br />

5%<br />

2%<br />

-5%<br />

% Change in<br />

Value<br />

-15%<br />

-25%<br />

-35%<br />

-45%<br />

‐7%<br />

‐15%<br />

‐22%<br />

‐28%<br />

‐34%<br />

‐39%<br />

-55%<br />

‐44%<br />

‐48%<br />

‐52% ‐55%<br />

-65%<br />

+0% +1% +2% +3% +4% +5% +6% +7% +8% +9% +10%<br />

Source: PCA, US Treasury<br />

% Change in Interest Rates<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 10

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• Historically there have been periods <strong>of</strong> moderate to severe losses from Fixed Income<br />

investments<br />

o Relatively small interest rate increases have led to significant capital losses<br />

Source: Welton Inv. Corp<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 11

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• Longest and most painful drawdown was in the period from 1954 to 1960 which featured a<br />

slow but steady rise in interest rates<br />

o<br />

During the period, interest rates only increased 1.8% but spanned 6 years <strong>of</strong> increasing rates resulting<br />

in a drawdown which continued over 8 years<br />

Source: Welton Inv. Corp<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 12

THE CURRENT INTEREST RATE ENVIRONMENT<br />

• So why was the 1954 to 1960 drawdown so severe? Why was a 15.3% capital loss with a 8+<br />

year drawdown period associated with an environment where interest rates went up slowly<br />

and by only 1.8%?<br />

• The answer is the low 2.85% starting interest rates <strong>of</strong> the period<br />

o<br />

o<br />

Return on Fixed Income is composed <strong>of</strong> two components: capital gain/loss and interest<br />

When interest rates are low there is less interest to <strong>of</strong>fset a portfolio capital loss as well as less money<br />

to reinvest at the higher interest rates<br />

• From the previous slides we can see that the slow grind from a low interest rate can be a<br />

more bearish environment for Fixed Income than a more volatile period with higher rates (late<br />

1970s & early 1980s)<br />

• The key lesson to remember is that a slow rise in interest rates from a low starting rate can be<br />

very harmful for a Fixed Income portfolio<br />

o<br />

Potentially eliminating any return from a Fixed Income portfolio for quite a long period <strong>of</strong> time<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 13

SECTION 2<br />

LOOKING FORWARD<br />

Source: Walt Disney<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion<br />

│ 14

LOOKING FORWARD: INTRODUCTION<br />

r<br />

• With Fixed Income exhibiting such pronounced asymmetry between risk and reward we must<br />

look ahead to how the current interest rate environment might unfold<br />

• While accurately forecasting the future <strong>of</strong> the economy and financial markets is <strong>of</strong>ten an<br />

exercise in futility we can gain some insight into the broad themes that may play out<br />

• Unfortunately there are relatively few positive scenarios for investing in Fixed Income at the<br />

current level <strong>of</strong> interest rates<br />

o<br />

While there are many scenarios that can produce markedly negative outcomes<br />

• WARNING: The following slides regrettably must divert slightly into Monetary and Fiscal<br />

Policy to get a full picture <strong>of</strong> what may lie ahead<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 15

LOOKING FORWARD: INTRODUCTION<br />

r<br />

• As we’ve already discussed d interest t rates are near all time lows<br />

• This outcome is the direct effect <strong>of</strong> the US Central Bank’s (Fed) policies<br />

• To combat the economic crisis <strong>of</strong> 2008 the Fed embarked on an unprecedented endeavor to<br />

lower interest rates to boost economic activity<br />

o December 2008 Fed set the Federal Funds Rate to 0-0.25%<br />

o<br />

November 2008 Fed began Quantitative Easing (QE1) buying $600 billion in MBS<br />

o November 2010 Fed began QE2 buying $600 billion in Treasuries<br />

o September 2012 Fed began QE3 buying an unlimited quantity <strong>of</strong> Treasuries and MBS at a rate <strong>of</strong> $85<br />

billion a month<br />

• These actions have swollen the Fed’s balance sheet from less than $1 trillion before the<br />

financial crisis to approximately $3.3 trillion today<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 16

LOOKING FORWARD: INTRODUCTION<br />

r<br />

• The Fed has grown its balance sheet at a rate <strong>of</strong> 30% per year since the crisis<br />

Current: $3.3T<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 17

LOOKING FORWARD: POSSIBLE OUTCOMES<br />

r<br />

• More recently the Fed has announced plans to keep interest t rates exceptionally low until at<br />

least 2015 and to continue to provide additional accommodation (QE) until economic growth<br />

accelerates<br />

• So what does this mean for Fixed Income investors?<br />

• Investors can expect low yields on Fixed Income investments for at least a couple years<br />

ahead.<br />

• This will continue to weigh on portfolio returns and continue to make it difficult for Plan<br />

Sponsors to reach their required investment return<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 18

POSSIBLE OUTCOMES: ‘BASE CASE’ SCENARIO<br />

r<br />

• Ideally, and by far the most positive, scenario on how the interest t rate environment evolves<br />

includes a relatively quick pick-up in economic growth which pulls down the unemployment<br />

rate<br />

• This would allow the Fed to discontinue its bond buying program and to eventually start<br />

raising interest rates at a slow-to-moderate pace. In addition, the Fed would slowly shrink its<br />

balance sheet as securities mature<br />

• In this ideal scenario, investors could position their portfolios so that bond maturities and<br />

interest are reinvested at the slightly higher rates <strong>of</strong>fsetting some <strong>of</strong> the capital loss<br />

• In this scenario, investors could hope to breakeven or experience a small loss over a<br />

moderate time period depending on how fast interest rates rise<br />

• We will consider this our “base case” and consider alternative scenarios with less optimistic<br />

outcomes<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 19

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Our first alternative ti scenario is one in which h growth does not accelerate as in the base case<br />

resulting in an environment <strong>of</strong> continued high unemployment<br />

• In this scenario, the Fed will likely keep interest rates low for a considerable period as well as<br />

continue to provide additional accommodation<br />

• This could cause two potentially problematic situations for investors/Plan Sponsors<br />

1. Prolonged period <strong>of</strong> low interest rates which places pressure on Plan Sponsors to meet their longterm<br />

assumed rate <strong>of</strong> return<br />

2. Alternatively, the continual printing <strong>of</strong> money may eventually spark inflation putting the Fed in an<br />

extremely difficult situation between supporting the economy through money printing or price stability<br />

through higher interest rates<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 20

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Our first alternative scenario characterized by slow growth and stubbornly high unemployment<br />

is lent credence by the thus far slow economic rebound after the financial crisis<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 21

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Thus far the Fed’s unprecedented d monetary policy has not sparked a large increase in the<br />

rate <strong>of</strong> inflation<br />

• Inflation has remained relatively muted with core inflation (ex volatile energy and food)<br />

remaining below 2%<br />

• Despite this, many economists are still worried that the seeds <strong>of</strong> future inflation are being<br />

sown today through the Fed’s easy money policy<br />

o<br />

o<br />

o<br />

They worry continuous printing <strong>of</strong> money will eventually lead to a marked decline in the dollar<br />

This would greatly increase the cost <strong>of</strong> imports but would also flow through to domestic goods due to<br />

the fact that a large percent <strong>of</strong> domestic goods use imports purchased internationally<br />

If inflation does start it would put the Fed in a particularly challenging position<br />

♦<br />

♦<br />

They could continue their accommodative process risking runaway inflation<br />

Or they could raise interest rates to slow inflation risking choking <strong>of</strong>f the nescient recovery<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 22

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 1<br />

r<br />

• Regardless <strong>of</strong> whether or not the prolonged period <strong>of</strong> low interest t rates and money printing<br />

actually creates higher rates <strong>of</strong> inflation, this alternative scenario would be extremely<br />

challenging for investors/Plan Sponsors<br />

• A prolonged period <strong>of</strong> near zero interest rates will make it exceedingly difficult for Plan<br />

Sponsors to meet their required investment return<br />

• Further complicating the situation is the knowledge that the continual money printing can lead<br />

to inflation<br />

o<br />

Many Plan Sponsors would likely look to alter their asset allocation to hedge this risk<br />

• Under this scenario, an investment in Fixed Income would have a highly asymmetric risk<br />

return pr<strong>of</strong>ile<br />

o<br />

o<br />

Investors would have to accept near zero rates <strong>of</strong> return<br />

While simultaneously, being exposed to the possibility that high inflation could severely damage their<br />

portfolio<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 23

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The next alternative ti scenario is similar il to the first but brings in the complicating role <strong>of</strong> fiscal<br />

policy and Government debt which will likely have a large impact on the future course <strong>of</strong><br />

interest rates<br />

• In reality this second scenario is really a series <strong>of</strong> multiple sub-scenarios comprised <strong>of</strong> similar<br />

themes<br />

• Before we can jump into the analysis <strong>of</strong> what the impact <strong>of</strong> these different sub-scenarios scenarios will<br />

be on interest rates and Fixed Income returns we must set the stage<br />

o<br />

Please excuse the quick journey through Government finances<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 24

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Government fiscal realities and Government debt<br />

o Over the last 20 years, Government expenditures have grown at an annual rate <strong>of</strong> 4.6%<br />

o Over the past 10 years, Government expenditures have grown at an annual rate <strong>of</strong> 5.1%<br />

o While over the same time periods, Government revenue (Taxes) grew at annual rate <strong>of</strong> 3.9% and<br />

32% 3.2% respectively<br />

Government Expenditures<br />

Government Revenue<br />

4,000,000<br />

3,500,000<br />

3,000,000<br />

2,500,000<br />

2,000,000<br />

1,500,000<br />

1,000,000<br />

500,000<br />

0<br />

4,000,000<br />

3,500,000<br />

3,000,000<br />

2,500,000<br />

2,000,000<br />

1,500,000<br />

1,000,000<br />

500,000<br />

0<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

Source: PCA, TreasuryDirect.gov<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 25

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Government fiscal realities and Government debt<br />

o<br />

o<br />

o<br />

o<br />

o<br />

The difference between Government expenditures (Spending) and Government revenue (Taxes) is the<br />

federal budget deficit<br />

The accumulation <strong>of</strong> deficits results in Government debt<br />

For perspective, the budget deficit in 2012 is equivalent to $9,398 per U.S. household<br />

Government debt has grown at a rate <strong>of</strong> 8.6% a year for the past 10 years<br />

For perspective, the Government debt amounts to approximately $150,000 per tax payer<br />

Deficit<br />

Total Debt<br />

1,600,000<br />

18,000,000<br />

1,400,000<br />

16,000,000<br />

1,200,000<br />

000<br />

1,000,000<br />

800,000<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

14,000,000<br />

12,000,000<br />

10,000,000<br />

8,000,000<br />

6,000,000<br />

4,000,000<br />

-200,000<br />

2,000,000<br />

-400,000<br />

0<br />

1 992<br />

1<br />

994<br />

1<br />

996<br />

1<br />

998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

1 992<br />

1<br />

994<br />

1<br />

996<br />

1<br />

998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

Source: PCA, TreasuryDirect.gov<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 26

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Government fiscal realities and Government debt<br />

o As <strong>of</strong> 4/23/2013, Government debt totaled $16,794,349,827,897.30<br />

o<br />

Of which 71% was held by the Public and 29% consisted <strong>of</strong> intergovernmental holdings (Social<br />

Security Trust Fund)<br />

o<br />

Of the 71% held by the public<br />

♦ Foreign holders account for 47% with both China and Japan holding over $1T<br />

♦ The Fed holds approximately 15%<br />

♦ The other 38% are held by US investors and institutions<br />

o<br />

The composition <strong>of</strong> the holders <strong>of</strong> Government debt may impact the evolution <strong>of</strong> interest rates<br />

♦<br />

♦<br />

The Fed and some US holders may be willing to accept exceedingly unfavorable terms on the debt<br />

given their specific policy or requirement<br />

On the other hand, some foreign holders and other US holders may respond to unfavorable terms by<br />

selling their securities<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 27

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Government fiscal realities and Government debt<br />

o<br />

o<br />

Despite the large increase in debt over the past 20 years ($4T to $16T) the interest owed by the<br />

Government on that debt has essentially not grown<br />

The annual interest cost to the Government has grown by a mere 1% a year over the past 20 years<br />

o Over this period, the weighted average interest rate on all Government debt fell from a high <strong>of</strong> 7% to a<br />

recent low <strong>of</strong> 2%<br />

o Over the entire period, the average interest rate was 5.2%<br />

Interest Cost<br />

Average Interest Rate<br />

$500,000<br />

8.00%<br />

$450,000<br />

$400,000 000<br />

$350,000<br />

$300,000<br />

7.00%<br />

6.00%<br />

5.00%<br />

$250,000<br />

4.00%<br />

$200,000<br />

$150,000<br />

$100,000<br />

$50,000<br />

3.00%<br />

2.00%<br />

1.00%<br />

$-<br />

0.00%<br />

1<br />

992<br />

1<br />

994<br />

1<br />

996<br />

1<br />

998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

992<br />

993<br />

994<br />

995<br />

996<br />

997<br />

998<br />

999<br />

1<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

Source: PCA, TreasuryDirect.gov<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 28

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Government fiscal realities and Government debt<br />

o<br />

o<br />

The Government borrows on a relatively short time frame => ~50% 3 years or less<br />

♦<br />

Short term nature means the Government must refinance its debts fairly regularly<br />

This will cause the average interest rate on Government debt to adjusts relatively quickly to changes<br />

in the interest t rates<br />

Maturity Pr<strong>of</strong>ile <strong>of</strong> Publically Held Debt<br />

Source: Treasury.gov<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 29

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The background provided over the past few slides lays out the foundation for concern over the<br />

future course <strong>of</strong> interest rates<br />

• Currently the cost to the Government to finance its debt (its debt servicing cost) has been<br />

relatively muted and unchanged over the past 20 years<br />

• This has been a boon for the Government as it has not had to pay the price for increased<br />

borrowing<br />

o<br />

o<br />

Imagine a credit card on which h the interest t rate declined d as the balance grows<br />

No wonder why politicians have been so liberal with their largesse<br />

• We are likely approaching a tipping point where the cost from the balance <strong>of</strong> outstanding debt<br />

starts t to outweigh the fall in average interest t rate<br />

o The average interest rate could continue to decline over the next year or two<br />

o But it can not fall too considerably lower from the weighted average rate <strong>of</strong> 2%<br />

• The average interest rate on Government debt will adjust relatively quickly to changes in<br />

interest rates due to the short-term nature <strong>of</strong> Government borrowing<br />

• What happens when this tipping point is reached?<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 30

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The chart below shows the income statement <strong>of</strong> the US Government for 2012<br />

o<br />

With spending as the left column and revenue on the right<br />

What happens<br />

when this starts<br />

to grow?<br />

Source: PCA, US Government Printing Office<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 31

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• So what happens when the cost <strong>of</strong> Government debt starts t to grow?<br />

• The obvious answers are:<br />

o<br />

o<br />

o<br />

The Government could raise revenue to cover the higher cost<br />

The Government could reduce spending on other goods/services to cover the higher cost<br />

♦<br />

Debt crowding out effect<br />

The Government increases borrowing to cover the higher cost<br />

♦<br />

Essentially paying for debt with more debt<br />

• The rate at which the cost to service Government debt rises and the method chosen to<br />

accommodate its rise will have large impacts on the future course <strong>of</strong> interest rates and the<br />

outcomes for Fixed Income holders<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 32

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Which h method chosen to accommodate the rise in the costs <strong>of</strong> servicing i the Government debt<br />

will have a meaningful impact on Fixed Income investors?<br />

• If the Government decides to raise revenue or cut spending to accommodate the rise in cost<br />

then there will likely be two competing forces on Fixed Income returns<br />

1. The spending cuts and higher taxes would likely lead to a slower economy, a slower economy usually<br />

pushes down interest rates which would temporarily boost Fixed Income returns<br />

2. On the other hand, higher taxes and reduced spending would likely force the Fed to remain<br />

accommodative for longer which would lower the long run return for Fixed Income investors<br />

• This process is compounded if the Government doesn’t have a balanced budget as the debt<br />

would continue to grow leading to an ever-increasing crowding out by debt<br />

• Taken to the limit, you can see how such a scenario would lead to an economy in a death<br />

spiral as austerity to cover the debt service slowly chokes <strong>of</strong>f the economy<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 33

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• If instead <strong>of</strong> deciding to raise revenue or cut expenses, the Government could decide to<br />

finance the cost by issuing more debt<br />

• This situation would compound much quicker than the previous one in which the Government<br />

enacted austerity to accommodate the debt service costs<br />

• Taken to the limit, it is easy to see how quickly this process can lead to a debt spiral<br />

Gov’t Debt<br />

I<br />

nterest<br />

Interest t<br />

Deficit<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 34

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• A combination <strong>of</strong> the two approaches can be witnessed in many Southern European countries<br />

• Greece, an extreme example, exhibited a typical debt spiral in which debt reaches a certain<br />

tipping point after which debt begets more debt<br />

o<br />

o<br />

o<br />

o<br />

In such a situation, debt servicing costs are financed by additional debt leading to higher debt<br />

servicing cost<br />

At some point this process becomes non-linear and the debt servicing cost explodes<br />

Along this process investors start viewing the debt more skeptically, raising the interest that must be<br />

paid on the debt => exacerbating the process<br />

This process can happen relatively slowly or rapidly (as it did in Greece)<br />

• On the other hand, Spain and Italy have chosen a path <strong>of</strong> austerity<br />

o<br />

o<br />

Deciding to cut spending and increase taxes to avoid increased borrowing<br />

However, this has had a huge impact on their economies as GDP has continued to fall and<br />

unemployment has continued to climb<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 35

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• While the US is in a far better situation than the countries in Southern Europe, some insights<br />

can be learned as the US enters a phase <strong>of</strong> increasing debt service cost<br />

• The dynamics <strong>of</strong> interest rates in Southern Europe and the outcomes on Fixed Income<br />

investments will provide valuable insights into the dynamics that could play out (likely with<br />

reduced severity) in the US<br />

• The chart below highlights just how quickly debt service costs can increase<br />

Debt =<br />

$16.8T<br />

Average<br />

Interest Rate<br />

Interest Cost<br />

($ Mil)<br />

% <strong>of</strong> Today’s<br />

Revenues<br />

Current 2.24% 376,498 15%<br />

3.00% 504,362 21%<br />

4.00% 672,483 28%<br />

20 Yr Avg 5.23% 879,302 36%<br />

6.00% 1,008,724 41%<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 36

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• While the US will likely l not face the same severity <strong>of</strong> issues as Southern Europe, the US does<br />

face considerable challenges ahead<br />

• The economy continues to grow at an moribund pace <strong>of</strong> less than 2%<br />

• The US has had four consecutive Trillion dollar plus deficits<br />

o<br />

While the deficit should fall under a Trillion dollars in 2013 it will remain in the high hundreds <strong>of</strong> Billions<br />

range<br />

• Unemployment has shown little improvement<br />

o<br />

While the <strong>of</strong>ficial unemployment rate has declined recently, labor force participation rate has continued<br />

to plunge<br />

• Entitlement programs have created a huge unfunded liability estimated by economists to be<br />

anywhere e from $50T to well over $100T<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 37

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The non-partisan Congressional Budget Office sees continued growth in Government Debt as<br />

entitlement programs expand as the population ages<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 38

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• The outcome for Fixed Income investors in this alternative ti scenario greatly depends d on the<br />

actions <strong>of</strong> the Government and the Fed<br />

• If the Government decides to accommodate the increase in debt service cost through<br />

austerity then investors may be in for a prolonged period <strong>of</strong> ultra-low interest rates<br />

o<br />

As mentioned, such an outcome would put extreme pressure on Plan Sponsors<br />

• If the Government chooses to accommodate the higher debt service cost with additional<br />

borrowings then investors face a more perilous situation<br />

o<br />

o<br />

o<br />

This method <strong>of</strong> accommodation creates a more unstable situation in which debt service costs grow<br />

more quickly<br />

In this scenario, investors’ risk tolerance plays an important role<br />

If investors become more adverse to holding the debt they may begin to sell their holdings or at least<br />

slow or stop their purchase <strong>of</strong> additional securities<br />

♦ This would drive up interest rates, possible quickly and in a disorderly fashion<br />

• In such a scenario, investors would face capital losses as interest rates rise<br />

o<br />

Such losses could be extremely high if the situation unfolds disorderly<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 39

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• Most observers comment that t the probability bilit <strong>of</strong> such a scenario playing out in the US is<br />

exceedingly unlikely<br />

o<br />

o<br />

One <strong>of</strong> the main reason people point to this unlikelihood is that the US controls its monetary supply<br />

In essence, if such a scenario began to play out the Fed could simply print additional money and<br />

purchase Government debt on the open market similarly il l to what they are doing with Quantitative<br />

Easing<br />

• However, such a scenario could lead to “Fed Capture”<br />

o<br />

o<br />

o<br />

o<br />

Fed Capture results when fiscal policy and the corresponding impact on the interest rate environment<br />

work together to force the Fed to act in a specific manner<br />

In such a scenario, monetary policy and the Fed essentially loses its independence<br />

Once this happens, the Fed’s mandate for price stability is sacrificed for interest rate stability and<br />

Government debt stability<br />

Historically, Central Bank Capture <strong>of</strong>ten proceeds bouts <strong>of</strong> inflation and currency decline and/or<br />

collapse<br />

♦ Central Bank Capture is a hallmark in studies <strong>of</strong> country default<br />

♦ Most countries prefer to default through currency devaluation and inflation versus reneging on debt<br />

♦ Reinhart and Rog<strong>of</strong>f point out in their book “This Time is Different” that inflation crises and exchange rate crises<br />

have traveled hand in hand in the overwhelming majority <strong>of</strong> [default] episodes across time and country<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 40

POSSIBLE OUTCOMES: ALTERNATIVE SCENARIO 2<br />

r<br />

• While it is easy to see how such a situation ti can get out <strong>of</strong> hand in severe cases, Fixed Income<br />

investors are still exposed to negative outcomes in more moderate situations<br />

o<br />

o<br />

o<br />

Any form <strong>of</strong> Fed Capture would be highly detrimental to investors even if it does not lead to a spiral <strong>of</strong><br />

hyperinflation<br />

Fixed Income investors rely on the price stability provided d by the Fed as part <strong>of</strong> its mandate<br />

Without price stability Fixed Income investors cannot make a sound judgment on the merits <strong>of</strong> a<br />

particular investment<br />

♦ Does the Bond provide adequate value greater than the foregone consumption today?<br />

♦<br />

If the investor can’t quantify their prospective purchasing power in future periods then it is impossible to estimate<br />

the value <strong>of</strong> an investment in the current period<br />

♦ Today’s low interest rate environment compounds the problem by reducing the margin <strong>of</strong> safety<br />

• In such a scenario, Fixed Income investors today can face multiple paths to sub-optimal<br />

outcomes<br />

o<br />

o<br />

Any swings in interest rates could cause material capital losses in today’s low rate environment<br />

Plan Sponsors, especially those with COLA agreements, are dangerously vulnerable to inflation<br />

increases<br />

♦<br />

The current 10-Year Treasury has a small negative real yield; if inflation increases, losses <strong>of</strong> real purchasing<br />

power would be substantial<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 41

LOOKING FORWARD: CONCLUSIONS<br />

r<br />

• Conclusions<br />

o<br />

o<br />

o<br />

o<br />

o<br />

It is important to reiterate that while the alternative scenarios presented are quite worrisome especially<br />

when taken to the limit case, these are not the most likely future path for interest rates<br />

Investors will want to plan for the likely l evolution <strong>of</strong> the current interest t rate environment to be<br />

relatively close to the base case<br />

However, it is important to see the possible alternative ways that the current environment could unfold<br />

over time<br />

The goal is for Plan Sponsors to identify the possible negative outcomes<br />

Think about situations in terms <strong>of</strong> what are the:<br />

♦<br />

♦<br />

♦<br />

Known-Knows: We know interest rates are at historic lows; interest will likely increase some point in the future;<br />

Fixed Income investors face capital losses in an increasing interest rate environment; Fixed Income will provide<br />

significantly lower returns going forward than they have in the past<br />

Known-Unknowns: What we don’t know is for how long interest rates will stay low; how fast they will increase;<br />

if inflation will rise; how the Government will react to increasing debt service costs; if the Fed will favor economic<br />

growth over price stability; if the Fed will favor price stability over interest rate stability<br />

Unknown-Unknowns: By definition we don’t know all the factors that may impact Fixed Income investors, in<br />

this case you have to use your imagination for thinking <strong>of</strong> scenarios that are seemingly improbable; for example,<br />

China deciding to let their currency free float which would no longer bind them to purchasing US Treasuries<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 42

SECTION 3<br />

INVESTMENT OPTIONS<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion<br />

│ 43

INVESTMENT OPTIONS<br />

r<br />

• In light <strong>of</strong> the preceding discussion i it is beneficial i to look at what other Plan Sponsors are<br />

doing in light <strong>of</strong> the current environment and what investment options can be put in place to<br />

mitigate some <strong>of</strong> the potential hazards <strong>of</strong> the current environment<br />

• Plan Sponsors have taken varied responses to the current environment<br />

o<br />

o<br />

o<br />

o<br />

Many Plan Sponsors are taking the long-term view, leaving their portfolios unaltered<br />

Others are implementing various tweaks to their asset allocation or to their fixed income composition<br />

Many Plan Sponsors are reducing their exposure to fixed income – namely foundations &<br />

endowments<br />

♦<br />

Princeton chose to move from Fixed Income into Cash<br />

Many Plan Sponsors are investing in High Yield debt, Bank Loans, and Opportunistic Credit<br />

• The main problem is how to implement these changes without increasing other risk within the<br />

portfolio<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 44

INVESTMENT OPTION 1<br />

r<br />

• Option 1: Do Nothing<br />

• By not altering either the strategic asset allocation or the composition <strong>of</strong> the Fixed Income<br />

portfolio the Plan Sponsor is sticking to the assumption that over time markets will normalize<br />

and a strong initial strategic asset allocation will meet the required return assumption<br />

• Benefits<br />

o<br />

o<br />

Known exposures – no exposure to new asset class (sub-asset class)<br />

Core Fixed Income would still do great in a deflationary environment (i.e., if risk-<strong>of</strong>f occurs in some<br />

dramatic fashion)<br />

• Drawbacks<br />

o Will not adapt to changing rate environment<br />

o Fixed Income returns are currently significantly lower than historical averages<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 45

INVESTMENT OPTION 2<br />

r<br />

• Option 2: Reallocate Away from Fixed Income<br />

• By moving a portion <strong>of</strong> the Fixed Income portfolio into other asset classes a Plan Sponsor can<br />

mitigate the negative impacts on Fixed Income investments<br />

o<br />

o<br />

However, doing so will expose the overall Plan portfolio to new risks or increase the risks already in<br />

the portfolio (if reallocating within current asset allocation)<br />

If the Plan reallocates to Cash rather than Fixed Income the Plan maintains the liquidity and stable<br />

value properties <strong>of</strong> Fixed Income with less exposure to a rising interest rate environment<br />

• Benefits<br />

o<br />

Reduces the potential headwinds facing Fixed Income<br />

• Drawbacks<br />

o<br />

o<br />

o<br />

Increases other risks in the portfolio<br />

Likely increase the overall portfolio risk level – can be mitigated through other portfolio reallocations<br />

While reallocating to Cash would lessen the exposure to rising interest rates, it would still produce<br />

minute returns if interest rates are held low for a long time<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 46

INVESTMENT OPTION 3<br />

r<br />

• Option 3: Reduce the Duration <strong>of</strong> the Fixed Income Portfolio (w/ current managers)<br />

• The duration <strong>of</strong> the overall Fixed Income portfolio can be reduced by either directing the<br />

investment mangers to lower their portfolio duration to a predetermined level or by hiring a<br />

derivatives overlay manager to reduce the duration through derivative contracts<br />

• Benefits<br />

o<br />

Reduces the duration risk<br />

o Maintains current investment managers<br />

• Drawbacks<br />

o Alters investment managers mandate – may not agree to changes<br />

o Only hedges against increases in interest rates – still exposed to potential long period <strong>of</strong> low rates<br />

o Overlay manager could be prohibitively expensive if hedging over long time periods<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 47

INVESTMENT OPTION 4<br />

r<br />

• Option 4: Alter Fixed Income Portfolio<br />

• By altering the composition <strong>of</strong> the Fixed Income portfolio a Plan Sponsor can move to address<br />

some <strong>of</strong> the challenges facing a traditional core Fixed Income manager in the current<br />

environment<br />

• We will look at 3 alternative methods for altering the composition <strong>of</strong> the Fixed Income portfolio<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 48

INVESTMENT OPTION 4-A<br />

r<br />

• Option 4 – A: Short-Term Lower-Quality<br />

• A portfolio composed <strong>of</strong> lower-quality investments that are short-term in nature can potentially<br />

mitigate some <strong>of</strong> the headwinds <strong>of</strong> the current interest rate environment. The lower-quality<br />

aspect allows the portfolio to earn a relatively high yield (4-6%) whereas the short-term nature<br />

limits the exposure to Duration risk (as well as default risk)<br />

• PCA has worked with a large Public Plan to implement a portfolio composed <strong>of</strong> 1/3 short-term term<br />

High Yield bonds, 1/3 Bank Loans, and 1/3 other short-term/floating rate instruments<br />

o<br />

o<br />

o<br />

Short-term High Yield benefits from the fact that securities with higher yields have less Duration risk;<br />

also, since they mature relatively soon there is less time for the business to deteriorate causing a<br />

default scenario.<br />

Bank loans have two great advantages: they have floating coupons and they are senior in the capital<br />

structure – since 1997 the S&P/<strong>LS</strong>TA Bank Loan Index has only lost money in one year (2008)<br />

The other category allows the investment manager to find value in other market segments depending<br />

on the manager’s expertise<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 49

INVESTMENT OPTION 4-A<br />

r<br />

• Option 4 – A: Short-Term Lower-Quality (Continued)<br />

• Benefits<br />

o<br />

o<br />

o<br />

o<br />

Increases the yield on the Fixed Income portfolio<br />

Short-term and floating rate nature provides protection in a rising rate environment<br />

Likely increases returns in low interest rate environment<br />

Short-term and senior nature <strong>of</strong> investments limits default risk<br />

• Drawbacks<br />

o Increases the credit risk <strong>of</strong> the overall Fixed Income portfolio<br />

o Exhibits increased “equity like” risk exposure in periods <strong>of</strong> market turmoil<br />

o High Yield and Bank Loans are expensive relative to history<br />

♦ Many investors have already moved into the space seeking yield<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 50

INVESTMENT OPTION 4-B<br />

r<br />

• Option 4 – B: Private Credit<br />

• Private Credit are investments in credit-related assets that are not publically traded<br />

o<br />

This can include loans to middle market firms, distressed debt, mezzanine loans, etc.<br />

• Due to the investments being private there is considerable illiquidity for the assets<br />

o<br />

This has benefits and drawbacks<br />

♦<br />

The major drawback is that t the funds that t do these type <strong>of</strong> investments t have private structures t (PE)<br />

♦ The rationale for this is the money has to be invested in a illiquid security or workout situation which dictates<br />

reduced access to the capital by Plan Sponsors<br />

♦ Fund-<strong>of</strong>-funds exist allowing for greater diversification<br />

• Relative to publically traded debt securities, private credit remains relatively cheap<br />

o<br />

Main reason for this is the illiquidity premium<br />

♦<br />

♦<br />

Many Plan Sponsors experienced predicaments during the credit crisis due to large illiquid investments; this<br />

greatly reduced their appetite for illiquid investments<br />

As a net inflow plan, EBMUD should not have any major liquidity needs for many years ahead<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 51

INVESTMENT OPTION 4-B<br />

r<br />

• Option 4 – B: Private Credit (Continued)<br />

• Benefits<br />

o<br />

Limited exposure to interest rates – return generated through Credit not Duration<br />

o High expected return (8-10%)<br />

o Relatively inexpensive compared to publically traded High Yield debt<br />

o Significantly better risk return pr<strong>of</strong>iles than publically traded High Yield debt<br />

♦<br />

Superior position in capital structure, stronger credit covenants, ability to do workouts<br />

• Drawbacks<br />

o Illiquidity – funds <strong>of</strong>ten have 4-8 year lock-ups<br />

o Pi Private fund structure<br />

t<br />

o High management fees – base and incentive<br />

o Much higher risk investment than traditional core fixed income<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 52

INVESTMENT OPTION 4-C<br />

r<br />

• Option 4 – C: Barbell llApproach<br />

• This option simply includes an allocation to either option A or B paired with a high-quality<br />

short-term mandate<br />

• By having both features, the overall credit quality <strong>of</strong> the bond portfolio does not change as<br />

materially – less effect on overall bond portfolio<br />

• The goal is to increase the return during the period <strong>of</strong> low interest rates through the “risk”<br />

portion <strong>of</strong> the barbell yet maintain credit quality through the “safe” side <strong>of</strong> the barbell<br />

• Since both portions <strong>of</strong> the barbell are short-term in nature the portfolio is less exposed to<br />

interest rate increases<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 53

INVESTMENT OPTION 4-C<br />

r<br />

• Option 4 – C: Barbell llApproach (continued)<br />

• Benefits<br />

o<br />

o<br />

o<br />

Less reduction in credit quality compared to option A or B<br />

Reduced exposure to rising interest rates<br />

Higher return than traditional fixed income<br />

• Drawbacks<br />

o<br />

o<br />

Reduced return potential due to safe side <strong>of</strong> the barbell<br />

High Yield and Bank Loans are relatively expensive<br />

Pension Consulting Alliance, Inc. ││ EBMUD Fixed Income Discussion │ 54

CONCLUSIONS<br />

r<br />

• Interest t rates are near all time lows as a result <strong>of</strong> unprecedented d actions taken by the Fed<br />

• Plan Sponsors face an extremely challenging situation<br />

o<br />

o<br />

o<br />

o<br />

o<br />

Low Bond yields make it exceedingly difficult to meet their actuarial return assumptions without<br />

t<br />

significantly altering the composition <strong>of</strong> their portfolio<br />

Compounding the problem is the fact that traditional Fixed Income benchmarks are highly weighted in<br />

Government backed debt – proportion is growing ***<br />

The base case for the evolution <strong>of</strong> the interest rate environment is not overwhelmingly positive - we<br />

can see from 1954 that small increases in interest rates over long time periods can be exceedingly<br />

detrimental to Fixed Income portfolios<br />

Despite the lackluster base case, alternative ti scenarios exist with far greater downside for Fixed<br />

Income investors<br />