Dish TV investor Presentation

Dish TV investor Presentation

Dish TV investor Presentation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Dish</strong> <strong>TV</strong> India Limited<br />

Investor <strong>Presentation</strong>

Disclaimer<br />

Some of the statements made in this presentation are forward-looking statements and are<br />

based on the current beliefs, assumptions, expectations, estimates, objectives and<br />

projections of the directors and management of <strong>Dish</strong> <strong>TV</strong> India Limited about its business<br />

and the industry and markets in which it operates.<br />

These forward-looking statements include, without limitation, statements relating to<br />

revenues and earnings. The words<br />

“believe”, “anticipate”, “expect”, “estimate”,“intend”, “project” and similar expressions<br />

are also intended to identify forward looking statements.<br />

These statements are not guarantees of future performance and are subject to<br />

risks, uncertainties and other factors, some of which are beyond the control of the<br />

Company and are difficult to predict. Consequently, actual results could differ materially<br />

from those expressed or forecast in the forward-looking statements as a result of, among<br />

other factors, changes in economic and market conditions, changes in the regulatory<br />

environment and other business and operational risks. <strong>Dish</strong> <strong>TV</strong> India Limited does not<br />

undertake to update these forward-looking statements to reflect events or circumstances<br />

that may arise after publication.<br />

2

About us<br />

• India’s pioneer DTH service provider; the only listed pure-play DTH company in<br />

the country.<br />

• Consistent market leader with 32% subscriber share currently.<br />

• Part of the:<br />

GROUP<br />

Having diverse presence across media, packaging, entertainment, technology<br />

enabled services, infrastructure development and education.<br />

India’s first and the country’s largest fully integrated media and entertainment<br />

conglomerate.<br />

• Promoted and led by Subhash Chandra, Chairman, Essel group of companies, a<br />

thought leader and a pioneer in most of his businesses.<br />

3

Indian DTH industry<br />

4

SUBSCRIBERS IN MN<br />

Journey so far<br />

25<br />

VOLUNTARY DIGILIZATION<br />

BY CABLE OPERATORS .<br />

DTH SUBS CROSS<br />

20 MN MARK<br />

20<br />

DTH SUBS BREACH THE 2MN<br />

MARK IN A 2 PLAYER MKT.<br />

15<br />

10<br />

5<br />

LAUNCH OF DTH SERVICE<br />

BY DISH <strong>TV</strong> IN SELECT<br />

MARKETS<br />

DISPUTE OVER CONTENT .<br />

SETTLEMENT BTW DISH & STAR<br />

DIGITIZATION<br />

TRIGGRED,<br />

CAS MADE<br />

MANDATORY IN<br />

SELECT<br />

PART OF METROS<br />

LAUNCH BY<br />

SUN DIRECT<br />

LAUNCH OF<br />

DTH SERVICE<br />

BY TATASKY<br />

DISPUTE WITH SUN <strong>TV</strong><br />

OVER CONTENT. SETTLED.<br />

DTH SUBSCRIBER<br />

BASE AT ~10 MN<br />

LAUNCH OF<br />

RELIANCE BIG <strong>TV</strong><br />

LAUNCH OF DTH<br />

SERVICE BY VIDEOCON<br />

LAUNCH OF DTH<br />

SERVICE BY AIRTEL<br />

0<br />

DISH Subscribers<br />

DTH Subscribers<br />

5

Million<br />

Opportunities galore!<br />

Key statistics:<br />

Total HHs<br />

232 mn.<br />

<strong>TV</strong> HHs<br />

136 mn.<br />

<strong>TV</strong> Penetration 59%<br />

C&S HHs<br />

105 mn.<br />

C&S Penetration (in <strong>TV</strong> HHs) 77%<br />

DTH Subs *<br />

27.5 mn.<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

73%<br />

77%<br />

81% 84% 86%<br />

88%<br />

238 241 243<br />

236<br />

229 233<br />

129 136 142 147 152 155<br />

130 136<br />

115 123<br />

94 105<br />

2008 2009 2010E 2011E 2012E 2013E<br />

Total HHs<br />

<strong>TV</strong> HHs<br />

C&S HHs<br />

C&S Penetration<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

• Increasing <strong>TV</strong> HHs; likely to be 155 million, 64% penetration, by 2013.<br />

Developed countries average penetration at more than 97%. China at 98%.<br />

• C&S penetration: huge opportunity, likely to be 88% by 2013.<br />

• DTH to be the key driver & direct beneficiary of increasing C&S households!<br />

Source: MPA 2009 report * Up to 31/10/10. (Source: market est.) C&S implies cable <strong>TV</strong> & DTH HHs<br />

6

DTH growth projections…<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

MPA 2009 FICCI Frames 2010<br />

37.8<br />

45<br />

34.1<br />

20.5% CAGR 2009-13 40 25% CAGR 2009-13<br />

29.5<br />

35<br />

30<br />

24.1<br />

30<br />

24<br />

17.9<br />

25<br />

11.1<br />

20 16<br />

15<br />

1.1<br />

3.6<br />

10<br />

5<br />

43<br />

39<br />

35<br />

0<br />

2006 2007 2008 2009 2010p 2011p 2012p 2013p<br />

2009 2010p 2011p 2012p 2013p 2014p<br />

DTH Sub. Base (mn.)<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

58.5% 61.2%<br />

63.9% 64.3% 63.9% 63.7% 63.5% 63.3% 63.2%<br />

12.0%<br />

1.0% 2.0% 4.0% 8.6% 13.1%<br />

0.4% 0.9%<br />

2.9%<br />

17.0% 21.0% 24.0%<br />

16.9% 20.0%<br />

26.0%<br />

28.0%<br />

22.4% 24.4%<br />

% Cable HHs to <strong>TV</strong> HHs % DTH HHs to <strong>TV</strong> HHs % DTH HHs to Pay <strong>TV</strong> HHs<br />

Source: MPA 2009<br />

Cable HHs include analogue & digital cable<br />

Pay <strong>TV</strong> includes Cable + DTH + IP<strong>TV</strong><br />

7

Outperformed !!<br />

MPA 2009 Report - Indian DTH subscribers to reach 24.1 mn. by the<br />

end of 2010 !<br />

FICCI Frames 2010 -“Total number of DTH subscribers to be added in<br />

2010 is expected to be ~ 8 million.”<br />

January – October 2010 – 9.0 million* DTH subscribers added<br />

taking industry size to 27.5 million!<br />

Festival quarter continues to surprise positively!<br />

* Source: <strong>Dish</strong> <strong>TV</strong> actual & Market Est.<br />

8

Outperformed !!<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

DTH industry scale-up<br />

Subscribers in Mn.<br />

1.5<br />

4.3<br />

10.3<br />

18.4<br />

27.5<br />

2006 2007 2008 2009 2010 - Upto<br />

October<br />

Source: <strong>Dish</strong><br />

<strong>TV</strong> actual &<br />

industry est.<br />

• DTH driving digitization & growth in pay-<strong>TV</strong> HHs.<br />

• DTH penetration already at ~ 26% of C&S HHs; ahead of estimates.<br />

• An estimated 60% of all new C&S subscribers up to 2018 expected to opt for a DTH connection.*<br />

• TRAI’s recent recommendations on digitization in the form of sunset clause to provide further impetus.<br />

With more than 2.5 mn. subscribers being added every quarter, India is poised to overtake<br />

the current leader (U.S), which currently adds ~ 1.5 mn. subscribers each year.<br />

9<br />

* Source: MPA report 2009

Digitizing with addressability<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

92%<br />

Cable subscription to broadcasers<br />

DTH subscription to broadcasters<br />

83%<br />

67%<br />

56% 53%<br />

51%<br />

44% 47% 49%<br />

33%<br />

17%<br />

8%<br />

2006 2007 2008 2009 2010 P 2011 P<br />

` mn.<br />

Subscription Revenue<br />

Cable Subscription to Broadcasters 2006 2007 2008 2009 2010P 2011P<br />

Subscription Income Paid (Digital + Analogue) 19750 23110 27545 30805 34535 39305<br />

Less: Carriage & Placement Received 5000 6000 12000 13000 13000 13300<br />

Net Subscription Paid 14750 17110 15545 17805 21535 26005<br />

DTH Subscription to Broadcasters<br />

Net Subscription Paid 1360 3415 7795 13905 19375 24925<br />

DTH continues to strengthen its relationship with broadcasters creating a win-win<br />

situation for both.<br />

Source: MPA 2009, FICCI 2010 &<br />

Mkt. estimates<br />

10

Key regulations<br />

Licensing<br />

• Total foreign investment limit of 49% (sub limit ceiling of 20% for FDI) *<br />

• Uplink centre to be in India<br />

• Set-top boxes to be BIS compliant<br />

• License fee at 10% of DTH revenues (favourable TDSAT Order received on 28/05/10 will result in<br />

license fee outflow at ~ 4%)<br />

• Initial license validity of 10 years; renewable thereafter<br />

Service<br />

quality<br />

• Subscribers can be offered STBs on Rent/Hire-Purchase/Sale<br />

• Mechanism to be in place for handling customer complaints & grievances<br />

Interconnect<br />

• Broadcasters have to provide content to all distribution platforms; pricing flexible<br />

• Prohibits broadcasters from seeking guarantee for minimum number of subscribers<br />

Reference<br />

interconnect<br />

• Pricing information on content of the broadcaster<br />

• Maximum 50% of non-CAS cable rates<br />

• A-la-carte offering to be allowed<br />

* As per TRAI‟s (Telecom Regulatory Authority of India) recommendation dated 30 th June, 2010 to the Ministry of I&B, Foreign Investment<br />

Limit for DTH is to be increased to 74%. The recommendation is yet to be approved.<br />

11

Recent regulatory initiatives<br />

Tariff Order<br />

for<br />

addressable<br />

systems<br />

• Broadcasters to mandatorily provide pay channels to digital service providers at a maximum of 35%<br />

of corresponding rates for non-addressable cable <strong>TV</strong> services *<br />

• Retail tariff under forbearance.<br />

Digitization<br />

TRAI recommendation on sunset date for analogue <strong>TV</strong> systems in India:<br />

• Phase I # - Four metros – by 31/03/2011. Phase II – Cities with 1 mn.+ population - by 31/12/2011<br />

• Phase III – Other urban areas – by 31/12/2012. Phase IV – Rest of India – by 31/12/2013.<br />

* Since challenged by Pay Broadcasters in TDSAT.<br />

# Phase I likely to miss deadline due to Common Wealth Games and state elections.<br />

12

<strong>Dish</strong> <strong>TV</strong> – market leader in DTH<br />

13

Business – basics<br />

• Direct-to-home distribution of <strong>TV</strong> channels up-linked from India by<br />

Broadcasters.<br />

• CPE installed on rent at consumer’s premises.<br />

• Inertia to pay for hardware equipment results in up-front subsidy on STBs.<br />

• Negative Working Capital cycle – subscription revenue collected in advance.<br />

• DTH revenue includes subscription and lease rentals.<br />

• Emerging revenue streams - Value-added-services, Movie –on-demand and<br />

Bandwidth charges.<br />

• Fixed content cost deals with most broadcasters; significant competitive<br />

advantage.<br />

• Growing subscriber base would bring operating leverage into play.<br />

14

Key strengths<br />

Brand<br />

Strong Brand presence and Brand recall.<br />

Market Leadership<br />

Largest subscriber base amongst all six players; currently at 32%.<br />

Carried and distributed by most third party dealers and distributors.<br />

Content<br />

Highest number; more than 250 channels & services and growing.<br />

Fixed content cost deal with most big broadcasters.<br />

Selling & Distribution Network<br />

Pan-India presence through 1400 distributors & ~55,000 dealers across 6600 towns<br />

Network managed by over 200 sales personnel. 8 Zonal and 19 Regional Offices.<br />

Advanced Infrastructure & Technology<br />

Sufficient capacity to broadcast increasing number of channels – currently 11 KU<br />

band transponders equivalent.<br />

‘DISH TRUHD’ with content tie-up with highest no. of HD channel broadcasters.<br />

15

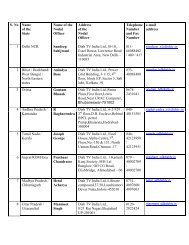

Select key management personnel<br />

Subhash Chandra<br />

Non Executive Chairman<br />

Jawahar Lal Goel<br />

Managing Director<br />

R.C. Venkateish<br />

CEO<br />

Salil Kapoor<br />

COO<br />

Rajeev Dalmia<br />

CFO<br />

Promoter – Essel Group of Companies. He is the<br />

pioneer of the Indian television industry and recipient<br />

of numerous honorary degrees, industry awards and<br />

civic honours. Profile - Chairman.pdf<br />

Mr. Goel is the MD of <strong>Dish</strong> <strong>TV</strong> since January ‘07 & has<br />

been instrumental in establishing it as India’s leading<br />

DTH company. He has also been actively involved in<br />

the expansion of the Essel Group and is an active<br />

member on the Board of various committees set up by<br />

MIB, Govt. of India for addressing critical matters<br />

relating to the industry. Profile - MD.pdf<br />

On-board since July ‘10, he was the MD-India & South<br />

Asia, ESPN Star Sports before that. An IIT, IIM<br />

Graduate, Venkateish has more than 27 years of<br />

experience & a successful track record in turning<br />

around businesses & re- defining business processes<br />

for winning brands like Oral-B, Nestle and Kelloggs.<br />

Profile - CEO.pdf<br />

Salil has a work experience of more than 18 years and<br />

has worked with various global corporations including<br />

Microsoft and Samsung. He is an MBA from Delhi<br />

University.<br />

A qualified Chartered Accountant, Rajeev has been<br />

leading the finance department since January, ‘07.<br />

16

<strong>Dish</strong> <strong>TV</strong> – now<br />

17

18<br />

<strong>Dish</strong> <strong>TV</strong> crossed the 9 million subscriber mark in November, ‘10 becoming the first DTH player in<br />

the country to achieve the landmark number so far.

Market leading share<br />

<strong>Dish</strong> <strong>TV</strong> continues to lead with the highest market share amongst all 6<br />

players<br />

18% 10%<br />

20%<br />

15%<br />

5%<br />

32%<br />

<strong>Dish</strong> <strong>TV</strong> Tata Sky Sun Direct<br />

Big <strong>TV</strong> Airtel Digital Videocon D2h<br />

Source: <strong>Dish</strong> <strong>TV</strong> actual & industry est.<br />

(31/10/10)<br />

19

Consistent leadership<br />

<strong>Dish</strong> <strong>TV</strong> – Increasing number of subscribers<br />

<strong>Dish</strong> <strong>TV</strong> - Market share on total subscriber base<br />

10<br />

8<br />

6<br />

4<br />

2<br />

3.9<br />

3.4<br />

4.7<br />

5.9<br />

5.5<br />

5.1<br />

5<br />

4.6<br />

4.3<br />

4<br />

6.9<br />

6.4<br />

5.7<br />

5.3<br />

8.7<br />

8.3<br />

7.5<br />

7.1<br />

6.8<br />

6.2<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

75%<br />

23<br />

20.7<br />

18.4<br />

42%<br />

11.1<br />

35% 33%<br />

6.4<br />

6.9<br />

3.6<br />

4.7<br />

2.7<br />

27.5<br />

26<br />

33% 32% 32%<br />

7.5 8.3 8.7<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

0<br />

0%<br />

Dec. '07 Dec. '08 Dec. '09 Mar. '10 June '10<br />

Sept.<br />

'10<br />

Oct. '10<br />

Total DTH Subscribers<br />

<strong>Dish</strong> <strong>TV</strong> Subscribers<br />

Gross Subscriber Base (mn.)<br />

Net Subscriber Base (mn.)<br />

<strong>Dish</strong> <strong>TV</strong> Market Share<br />

Source: <strong>Dish</strong> <strong>TV</strong><br />

Players with large and stable subscriber base to emerge as winners in the long run.<br />

<strong>Dish</strong> <strong>TV</strong> is well placed being the largest player in the DTH industry.<br />

20

`<br />

`<br />

Q1 FY 09<br />

Q1 FY 09<br />

Q2 FY 09<br />

Q2 FY 09<br />

Q3 FY 09<br />

Q3 FY 09<br />

Q4 FY 09<br />

Q4 FY 09<br />

Q1 FY 10<br />

Q1 FY 10<br />

Q2 FY 10<br />

Q2 FY 10<br />

Q3 FY 10<br />

2487 2635 2477 2383 2147 2083<br />

Q3 FY 10<br />

Q4 FY 10<br />

Q4 FY 10<br />

Q1 FY 11<br />

Q1 FY 11<br />

Q2 FY 11<br />

Q2 FY 11<br />

Key business metrics<br />

240<br />

Average Revenue Per User (ARPU)<br />

160<br />

164<br />

150 137 132<br />

142<br />

139 135 138 139 139<br />

80<br />

0<br />

• Increasing trend – rationalisation back!<br />

• Continuous efforts to evolve ARPU levels.<br />

Subscriber Acquisition Cost (SAC)<br />

3000<br />

2634 2601 2832 2505<br />

2000<br />

1000<br />

0<br />

• Focus on reducing subsidies.<br />

• Support coming in from growing<br />

incremental market share.<br />

Source: Company ARPU = (Subscription revenue + activation charges) / Avg. subscribers during the period; SAC = Subsidy on STB+80% of<br />

marketing expenses + Commission to dealers<br />

21

Driving up ARPUs – marketing initiatives<br />

Silver pack made dormant.<br />

Constant marketing initiatives to create better value proposition in higher ARPU packs.<br />

22

Driving up ARPUs – HD & VAS<br />

High Definition & Value Added Services seen as ARPU drivers in the long run.<br />

23

Financials<br />

24

` Mn<br />

` Mn.<br />

` Mn<br />

Q2 FY 09<br />

-874<br />

Q3 FY 09<br />

-389<br />

Q4 FY 09<br />

42<br />

Q1 FY 10<br />

157<br />

Q2 FY 10<br />

255<br />

134<br />

Q3 FY 10<br />

Q4 FY 10<br />

400<br />

Q1 FY 11<br />

322<br />

Q2 FY 11<br />

498<br />

Encouraging performance<br />

Operating Revenues - Annual<br />

EBITDA Margins - Annual<br />

12000<br />

10000<br />

8000<br />

6000<br />

4000<br />

2000<br />

FY 08-10 CAGR 62.0%<br />

4127<br />

1909<br />

7377<br />

10848<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

8.7%<br />

FY 07 FY 08 FY 09 FY 10<br />

-18.3%<br />

0<br />

FY 07 FY 08 FY 09 FY 10<br />

-80%<br />

-100%<br />

-97%<br />

-53%<br />

Operating Revenues - Quarterly<br />

EBITDA & EBITDA Margins - Quarterly<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

3261<br />

3032 3043<br />

2775<br />

2467 2575<br />

Q1 FY 10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY 11 Q2 FY 11<br />

25<br />

600<br />

400<br />

200<br />

0<br />

-200<br />

-400<br />

-600<br />

-800<br />

-1000<br />

-50%<br />

-20%<br />

2%<br />

6.4%<br />

9.9%<br />

4.8%<br />

13.2% 10.6%<br />

15.3%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

-60%

Subs mn<br />

171<br />

202<br />

234<br />

319<br />

529<br />

540<br />

588<br />

971<br />

1023<br />

1086<br />

1150<br />

1298<br />

1437<br />

1638<br />

Fixed content cost driving margins<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

80%<br />

71% 71%<br />

73%<br />

70%<br />

70%<br />

61% 61% 59%<br />

60%<br />

58% 61% 60%<br />

54%<br />

57%<br />

54% 54%<br />

46%<br />

50%<br />

41%<br />

46% 46%<br />

40% 39% 39%<br />

43% 42% 39% 40%<br />

29%<br />

30%<br />

29% 27%<br />

30%<br />

20%<br />

10%<br />

420 502 646 755 804 867 929 670 881 925 986 1,001 1,060 1,062<br />

0%<br />

Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10<br />

Content Cost Contribution Content Cost (% Subs Revenue)<br />

26

Summary financials<br />

Quarter ended Sept '09 Dec '09 March '10 June '10 Sept '10<br />

Gross operating revenue 2575 2775 3032 3043 3261<br />

Expenditure 2344 2659 2683 2721 2763<br />

EBITDA 231 116 349 322 498<br />

Add: Other income 4 11 5 69 25<br />

Less: Depreciation 730 779 846 889 843<br />

EBIT -495 -652 -492 -498 -320<br />

Less: Financial expenses 66 110 106 133 131<br />

PBT -561 -762 -598 -631 -451<br />

Provision for tax 0 0 0 0 0<br />

PAT -561 -762 -598 -631 -451<br />

Operating Metrics Sept '09 Dec '09 March '10 June '10 Sept '10<br />

Subscribers added (mn.) 0.41 0.55 0.44 0.64 0.76<br />

SAC (Rs/subscriber) 2635 2477 2383 2147 2083<br />

ARPU (INR) 139 135 138 139 139<br />

** Flat QoQ revenue growth in June „10 due to discontinuation of HITS operations.<br />

Source: Company Financials. All figures in ` mn. except mentioned otherwise.<br />

27

Way forward<br />

28

Growth beyond just subscriber numbers<br />

Continuous<br />

focus on:<br />

Sustained<br />

product<br />

Customer care<br />

Expand<br />

customer<br />

base with<br />

Augmenting<br />

revenue<br />

contribution<br />

through<br />

innovative value<br />

added services<br />

innovation to<br />

retain<br />

subscribers and<br />

expand<br />

category<br />

Brand building<br />

Technology<br />

and<br />

Distribution<br />

focus on<br />

leadership<br />

29

Thank you<br />

30

Questions<br />

31