Dish TV investor Presentation

Dish TV investor Presentation

Dish TV investor Presentation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Dish</strong> <strong>TV</strong> India Limited<br />

Investor <strong>Presentation</strong>

Disclaimer<br />

Some of the statements made in this presentation are forward-looking statements and are<br />

based on the current beliefs, assumptions, expectations, estimates, objectives and<br />

projections of the directors and management of <strong>Dish</strong> <strong>TV</strong> India Limited about its business<br />

and the industry and markets in which it operates.<br />

These forward-looking statements include, without limitation, statements relating to<br />

revenues and earnings. The words<br />

“believe”, “anticipate”, “expect”, “estimate”,“intend”, “project” and similar expressions<br />

are also intended to identify forward looking statements.<br />

These statements are not guarantees of future performance and are subject to<br />

risks, uncertainties and other factors, some of which are beyond the control of the<br />

Company and are difficult to predict. Consequently, actual results could differ materially<br />

from those expressed or forecast in the forward-looking statements as a result of, among<br />

other factors, changes in economic and market conditions, changes in the regulatory<br />

environment and other business and operational risks. <strong>Dish</strong> <strong>TV</strong> India Limited does not<br />

undertake to update these forward-looking statements to reflect events or circumstances<br />

that may arise after publication.<br />

2

About us<br />

• India’s pioneer DTH service provider; the only listed pure-play DTH company in<br />

the country.<br />

• Consistent market leader with 32% subscriber share currently.<br />

• Part of the:<br />

GROUP<br />

Having diverse presence across media, packaging, entertainment, technology<br />

enabled services, infrastructure development and education.<br />

India’s first and the country’s largest fully integrated media and entertainment<br />

conglomerate.<br />

• Promoted and led by Subhash Chandra, Chairman, Essel group of companies, a<br />

thought leader and a pioneer in most of his businesses.<br />

3

Indian DTH industry<br />

4

SUBSCRIBERS IN MN<br />

Journey so far<br />

25<br />

VOLUNTARY DIGILIZATION<br />

BY CABLE OPERATORS .<br />

DTH SUBS CROSS<br />

20 MN MARK<br />

20<br />

DTH SUBS BREACH THE 2MN<br />

MARK IN A 2 PLAYER MKT.<br />

15<br />

10<br />

5<br />

LAUNCH OF DTH SERVICE<br />

BY DISH <strong>TV</strong> IN SELECT<br />

MARKETS<br />

DISPUTE OVER CONTENT .<br />

SETTLEMENT BTW DISH & STAR<br />

DIGITIZATION<br />

TRIGGRED,<br />

CAS MADE<br />

MANDATORY IN<br />

SELECT<br />

PART OF METROS<br />

LAUNCH BY<br />

SUN DIRECT<br />

LAUNCH OF<br />

DTH SERVICE<br />

BY TATASKY<br />

DISPUTE WITH SUN <strong>TV</strong><br />

OVER CONTENT. SETTLED.<br />

DTH SUBSCRIBER<br />

BASE AT ~10 MN<br />

LAUNCH OF<br />

RELIANCE BIG <strong>TV</strong><br />

LAUNCH OF DTH<br />

SERVICE BY VIDEOCON<br />

LAUNCH OF DTH<br />

SERVICE BY AIRTEL<br />

0<br />

DISH Subscribers<br />

DTH Subscribers<br />

5

Million<br />

Opportunities galore!<br />

Key statistics:<br />

Total HHs<br />

232 mn.<br />

<strong>TV</strong> HHs<br />

136 mn.<br />

<strong>TV</strong> Penetration 59%<br />

C&S HHs<br />

105 mn.<br />

C&S Penetration (in <strong>TV</strong> HHs) 77%<br />

DTH Subs *<br />

27.5 mn.<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

73%<br />

77%<br />

81% 84% 86%<br />

88%<br />

238 241 243<br />

236<br />

229 233<br />

129 136 142 147 152 155<br />

130 136<br />

115 123<br />

94 105<br />

2008 2009 2010E 2011E 2012E 2013E<br />

Total HHs<br />

<strong>TV</strong> HHs<br />

C&S HHs<br />

C&S Penetration<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

• Increasing <strong>TV</strong> HHs; likely to be 155 million, 64% penetration, by 2013.<br />

Developed countries average penetration at more than 97%. China at 98%.<br />

• C&S penetration: huge opportunity, likely to be 88% by 2013.<br />

• DTH to be the key driver & direct beneficiary of increasing C&S households!<br />

Source: MPA 2009 report * Up to 31/10/10. (Source: market est.) C&S implies cable <strong>TV</strong> & DTH HHs<br />

6

DTH growth projections…<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

MPA 2009 FICCI Frames 2010<br />

37.8<br />

45<br />

34.1<br />

20.5% CAGR 2009-13 40 25% CAGR 2009-13<br />

29.5<br />

35<br />

30<br />

24.1<br />

30<br />

24<br />

17.9<br />

25<br />

11.1<br />

20 16<br />

15<br />

1.1<br />

3.6<br />

10<br />

5<br />

43<br />

39<br />

35<br />

0<br />

2006 2007 2008 2009 2010p 2011p 2012p 2013p<br />

2009 2010p 2011p 2012p 2013p 2014p<br />

DTH Sub. Base (mn.)<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

58.5% 61.2%<br />

63.9% 64.3% 63.9% 63.7% 63.5% 63.3% 63.2%<br />

12.0%<br />

1.0% 2.0% 4.0% 8.6% 13.1%<br />

0.4% 0.9%<br />

2.9%<br />

17.0% 21.0% 24.0%<br />

16.9% 20.0%<br />

26.0%<br />

28.0%<br />

22.4% 24.4%<br />

% Cable HHs to <strong>TV</strong> HHs % DTH HHs to <strong>TV</strong> HHs % DTH HHs to Pay <strong>TV</strong> HHs<br />

Source: MPA 2009<br />

Cable HHs include analogue & digital cable<br />

Pay <strong>TV</strong> includes Cable + DTH + IP<strong>TV</strong><br />

7

Outperformed !!<br />

MPA 2009 Report - Indian DTH subscribers to reach 24.1 mn. by the<br />

end of 2010 !<br />

FICCI Frames 2010 -“Total number of DTH subscribers to be added in<br />

2010 is expected to be ~ 8 million.”<br />

January – October 2010 – 9.0 million* DTH subscribers added<br />

taking industry size to 27.5 million!<br />

Festival quarter continues to surprise positively!<br />

* Source: <strong>Dish</strong> <strong>TV</strong> actual & Market Est.<br />

8

Outperformed !!<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

DTH industry scale-up<br />

Subscribers in Mn.<br />

1.5<br />

4.3<br />

10.3<br />

18.4<br />

27.5<br />

2006 2007 2008 2009 2010 - Upto<br />

October<br />

Source: <strong>Dish</strong><br />

<strong>TV</strong> actual &<br />

industry est.<br />

• DTH driving digitization & growth in pay-<strong>TV</strong> HHs.<br />

• DTH penetration already at ~ 26% of C&S HHs; ahead of estimates.<br />

• An estimated 60% of all new C&S subscribers up to 2018 expected to opt for a DTH connection.*<br />

• TRAI’s recent recommendations on digitization in the form of sunset clause to provide further impetus.<br />

With more than 2.5 mn. subscribers being added every quarter, India is poised to overtake<br />

the current leader (U.S), which currently adds ~ 1.5 mn. subscribers each year.<br />

9<br />

* Source: MPA report 2009

Digitizing with addressability<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

92%<br />

Cable subscription to broadcasers<br />

DTH subscription to broadcasters<br />

83%<br />

67%<br />

56% 53%<br />

51%<br />

44% 47% 49%<br />

33%<br />

17%<br />

8%<br />

2006 2007 2008 2009 2010 P 2011 P<br />

` mn.<br />

Subscription Revenue<br />

Cable Subscription to Broadcasters 2006 2007 2008 2009 2010P 2011P<br />

Subscription Income Paid (Digital + Analogue) 19750 23110 27545 30805 34535 39305<br />

Less: Carriage & Placement Received 5000 6000 12000 13000 13000 13300<br />

Net Subscription Paid 14750 17110 15545 17805 21535 26005<br />

DTH Subscription to Broadcasters<br />

Net Subscription Paid 1360 3415 7795 13905 19375 24925<br />

DTH continues to strengthen its relationship with broadcasters creating a win-win<br />

situation for both.<br />

Source: MPA 2009, FICCI 2010 &<br />

Mkt. estimates<br />

10

Key regulations<br />

Licensing<br />

• Total foreign investment limit of 49% (sub limit ceiling of 20% for FDI) *<br />

• Uplink centre to be in India<br />

• Set-top boxes to be BIS compliant<br />

• License fee at 10% of DTH revenues (favourable TDSAT Order received on 28/05/10 will result in<br />

license fee outflow at ~ 4%)<br />

• Initial license validity of 10 years; renewable thereafter<br />

Service<br />

quality<br />

• Subscribers can be offered STBs on Rent/Hire-Purchase/Sale<br />

• Mechanism to be in place for handling customer complaints & grievances<br />

Interconnect<br />

• Broadcasters have to provide content to all distribution platforms; pricing flexible<br />

• Prohibits broadcasters from seeking guarantee for minimum number of subscribers<br />

Reference<br />

interconnect<br />

• Pricing information on content of the broadcaster<br />

• Maximum 50% of non-CAS cable rates<br />

• A-la-carte offering to be allowed<br />

* As per TRAI‟s (Telecom Regulatory Authority of India) recommendation dated 30 th June, 2010 to the Ministry of I&B, Foreign Investment<br />

Limit for DTH is to be increased to 74%. The recommendation is yet to be approved.<br />

11

Recent regulatory initiatives<br />

Tariff Order<br />

for<br />

addressable<br />

systems<br />

• Broadcasters to mandatorily provide pay channels to digital service providers at a maximum of 35%<br />

of corresponding rates for non-addressable cable <strong>TV</strong> services *<br />

• Retail tariff under forbearance.<br />

Digitization<br />

TRAI recommendation on sunset date for analogue <strong>TV</strong> systems in India:<br />

• Phase I # - Four metros – by 31/03/2011. Phase II – Cities with 1 mn.+ population - by 31/12/2011<br />

• Phase III – Other urban areas – by 31/12/2012. Phase IV – Rest of India – by 31/12/2013.<br />

* Since challenged by Pay Broadcasters in TDSAT.<br />

# Phase I likely to miss deadline due to Common Wealth Games and state elections.<br />

12

<strong>Dish</strong> <strong>TV</strong> – market leader in DTH<br />

13

Business – basics<br />

• Direct-to-home distribution of <strong>TV</strong> channels up-linked from India by<br />

Broadcasters.<br />

• CPE installed on rent at consumer’s premises.<br />

• Inertia to pay for hardware equipment results in up-front subsidy on STBs.<br />

• Negative Working Capital cycle – subscription revenue collected in advance.<br />

• DTH revenue includes subscription and lease rentals.<br />

• Emerging revenue streams - Value-added-services, Movie –on-demand and<br />

Bandwidth charges.<br />

• Fixed content cost deals with most broadcasters; significant competitive<br />

advantage.<br />

• Growing subscriber base would bring operating leverage into play.<br />

14

Key strengths<br />

Brand<br />

Strong Brand presence and Brand recall.<br />

Market Leadership<br />

Largest subscriber base amongst all six players; currently at 32%.<br />

Carried and distributed by most third party dealers and distributors.<br />

Content<br />

Highest number; more than 250 channels & services and growing.<br />

Fixed content cost deal with most big broadcasters.<br />

Selling & Distribution Network<br />

Pan-India presence through 1400 distributors & ~55,000 dealers across 6600 towns<br />

Network managed by over 200 sales personnel. 8 Zonal and 19 Regional Offices.<br />

Advanced Infrastructure & Technology<br />

Sufficient capacity to broadcast increasing number of channels – currently 11 KU<br />

band transponders equivalent.<br />

‘DISH TRUHD’ with content tie-up with highest no. of HD channel broadcasters.<br />

15

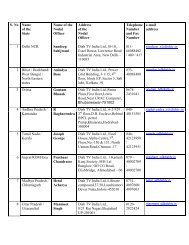

Select key management personnel<br />

Subhash Chandra<br />

Non Executive Chairman<br />

Jawahar Lal Goel<br />

Managing Director<br />

R.C. Venkateish<br />

CEO<br />

Salil Kapoor<br />

COO<br />

Rajeev Dalmia<br />

CFO<br />

Promoter – Essel Group of Companies. He is the<br />

pioneer of the Indian television industry and recipient<br />

of numerous honorary degrees, industry awards and<br />

civic honours. Profile - Chairman.pdf<br />

Mr. Goel is the MD of <strong>Dish</strong> <strong>TV</strong> since January ‘07 & has<br />

been instrumental in establishing it as India’s leading<br />

DTH company. He has also been actively involved in<br />

the expansion of the Essel Group and is an active<br />

member on the Board of various committees set up by<br />

MIB, Govt. of India for addressing critical matters<br />

relating to the industry. Profile - MD.pdf<br />

On-board since July ‘10, he was the MD-India & South<br />

Asia, ESPN Star Sports before that. An IIT, IIM<br />

Graduate, Venkateish has more than 27 years of<br />

experience & a successful track record in turning<br />

around businesses & re- defining business processes<br />

for winning brands like Oral-B, Nestle and Kelloggs.<br />

Profile - CEO.pdf<br />

Salil has a work experience of more than 18 years and<br />

has worked with various global corporations including<br />

Microsoft and Samsung. He is an MBA from Delhi<br />

University.<br />

A qualified Chartered Accountant, Rajeev has been<br />

leading the finance department since January, ‘07.<br />

16

<strong>Dish</strong> <strong>TV</strong> – now<br />

17

18<br />

<strong>Dish</strong> <strong>TV</strong> crossed the 9 million subscriber mark in November, ‘10 becoming the first DTH player in<br />

the country to achieve the landmark number so far.

Market leading share<br />

<strong>Dish</strong> <strong>TV</strong> continues to lead with the highest market share amongst all 6<br />

players<br />

18% 10%<br />

20%<br />

15%<br />

5%<br />

32%<br />

<strong>Dish</strong> <strong>TV</strong> Tata Sky Sun Direct<br />

Big <strong>TV</strong> Airtel Digital Videocon D2h<br />

Source: <strong>Dish</strong> <strong>TV</strong> actual & industry est.<br />

(31/10/10)<br />

19

Consistent leadership<br />

<strong>Dish</strong> <strong>TV</strong> – Increasing number of subscribers<br />

<strong>Dish</strong> <strong>TV</strong> - Market share on total subscriber base<br />

10<br />

8<br />

6<br />

4<br />

2<br />

3.9<br />

3.4<br />

4.7<br />

5.9<br />

5.5<br />

5.1<br />

5<br />

4.6<br />

4.3<br />

4<br />

6.9<br />

6.4<br />

5.7<br />

5.3<br />

8.7<br />

8.3<br />

7.5<br />

7.1<br />

6.8<br />

6.2<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

75%<br />

23<br />

20.7<br />

18.4<br />

42%<br />

11.1<br />

35% 33%<br />

6.4<br />

6.9<br />

3.6<br />

4.7<br />

2.7<br />

27.5<br />

26<br />

33% 32% 32%<br />

7.5 8.3 8.7<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0<br />

0<br />

0%<br />

Dec. '07 Dec. '08 Dec. '09 Mar. '10 June '10<br />

Sept.<br />

'10<br />

Oct. '10<br />

Total DTH Subscribers<br />

<strong>Dish</strong> <strong>TV</strong> Subscribers<br />

Gross Subscriber Base (mn.)<br />

Net Subscriber Base (mn.)<br />

<strong>Dish</strong> <strong>TV</strong> Market Share<br />

Source: <strong>Dish</strong> <strong>TV</strong><br />

Players with large and stable subscriber base to emerge as winners in the long run.<br />

<strong>Dish</strong> <strong>TV</strong> is well placed being the largest player in the DTH industry.<br />

20

`<br />

`<br />

Q1 FY 09<br />

Q1 FY 09<br />

Q2 FY 09<br />

Q2 FY 09<br />

Q3 FY 09<br />

Q3 FY 09<br />

Q4 FY 09<br />

Q4 FY 09<br />

Q1 FY 10<br />

Q1 FY 10<br />

Q2 FY 10<br />

Q2 FY 10<br />

Q3 FY 10<br />

2487 2635 2477 2383 2147 2083<br />

Q3 FY 10<br />

Q4 FY 10<br />

Q4 FY 10<br />

Q1 FY 11<br />

Q1 FY 11<br />

Q2 FY 11<br />

Q2 FY 11<br />

Key business metrics<br />

240<br />

Average Revenue Per User (ARPU)<br />

160<br />

164<br />

150 137 132<br />

142<br />

139 135 138 139 139<br />

80<br />

0<br />

• Increasing trend – rationalisation back!<br />

• Continuous efforts to evolve ARPU levels.<br />

Subscriber Acquisition Cost (SAC)<br />

3000<br />

2634 2601 2832 2505<br />

2000<br />

1000<br />

0<br />

• Focus on reducing subsidies.<br />

• Support coming in from growing<br />

incremental market share.<br />

Source: Company ARPU = (Subscription revenue + activation charges) / Avg. subscribers during the period; SAC = Subsidy on STB+80% of<br />

marketing expenses + Commission to dealers<br />

21

Driving up ARPUs – marketing initiatives<br />

Silver pack made dormant.<br />

Constant marketing initiatives to create better value proposition in higher ARPU packs.<br />

22

Driving up ARPUs – HD & VAS<br />

High Definition & Value Added Services seen as ARPU drivers in the long run.<br />

23

Financials<br />

24

` Mn<br />

` Mn.<br />

` Mn<br />

Q2 FY 09<br />

-874<br />

Q3 FY 09<br />

-389<br />

Q4 FY 09<br />

42<br />

Q1 FY 10<br />

157<br />

Q2 FY 10<br />

255<br />

134<br />

Q3 FY 10<br />

Q4 FY 10<br />

400<br />

Q1 FY 11<br />

322<br />

Q2 FY 11<br />

498<br />

Encouraging performance<br />

Operating Revenues - Annual<br />

EBITDA Margins - Annual<br />

12000<br />

10000<br />

8000<br />

6000<br />

4000<br />

2000<br />

FY 08-10 CAGR 62.0%<br />

4127<br />

1909<br />

7377<br />

10848<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

8.7%<br />

FY 07 FY 08 FY 09 FY 10<br />

-18.3%<br />

0<br />

FY 07 FY 08 FY 09 FY 10<br />

-80%<br />

-100%<br />

-97%<br />

-53%<br />

Operating Revenues - Quarterly<br />

EBITDA & EBITDA Margins - Quarterly<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

3261<br />

3032 3043<br />

2775<br />

2467 2575<br />

Q1 FY 10 Q2 FY10 Q3 FY10 Q4 FY10 Q1 FY 11 Q2 FY 11<br />

25<br />

600<br />

400<br />

200<br />

0<br />

-200<br />

-400<br />

-600<br />

-800<br />

-1000<br />

-50%<br />

-20%<br />

2%<br />

6.4%<br />

9.9%<br />

4.8%<br />

13.2% 10.6%<br />

15.3%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

-60%

Subs mn<br />

171<br />

202<br />

234<br />

319<br />

529<br />

540<br />

588<br />

971<br />

1023<br />

1086<br />

1150<br />

1298<br />

1437<br />

1638<br />

Fixed content cost driving margins<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

80%<br />

71% 71%<br />

73%<br />

70%<br />

70%<br />

61% 61% 59%<br />

60%<br />

58% 61% 60%<br />

54%<br />

57%<br />

54% 54%<br />

46%<br />

50%<br />

41%<br />

46% 46%<br />

40% 39% 39%<br />

43% 42% 39% 40%<br />

29%<br />

30%<br />

29% 27%<br />

30%<br />

20%<br />

10%<br />

420 502 646 755 804 867 929 670 881 925 986 1,001 1,060 1,062<br />

0%<br />

Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10<br />

Content Cost Contribution Content Cost (% Subs Revenue)<br />

26

Summary financials<br />

Quarter ended Sept '09 Dec '09 March '10 June '10 Sept '10<br />

Gross operating revenue 2575 2775 3032 3043 3261<br />

Expenditure 2344 2659 2683 2721 2763<br />

EBITDA 231 116 349 322 498<br />

Add: Other income 4 11 5 69 25<br />

Less: Depreciation 730 779 846 889 843<br />

EBIT -495 -652 -492 -498 -320<br />

Less: Financial expenses 66 110 106 133 131<br />

PBT -561 -762 -598 -631 -451<br />

Provision for tax 0 0 0 0 0<br />

PAT -561 -762 -598 -631 -451<br />

Operating Metrics Sept '09 Dec '09 March '10 June '10 Sept '10<br />

Subscribers added (mn.) 0.41 0.55 0.44 0.64 0.76<br />

SAC (Rs/subscriber) 2635 2477 2383 2147 2083<br />

ARPU (INR) 139 135 138 139 139<br />

** Flat QoQ revenue growth in June „10 due to discontinuation of HITS operations.<br />

Source: Company Financials. All figures in ` mn. except mentioned otherwise.<br />

27

Way forward<br />

28

Growth beyond just subscriber numbers<br />

Continuous<br />

focus on:<br />

Sustained<br />

product<br />

Customer care<br />

Expand<br />

customer<br />

base with<br />

Augmenting<br />

revenue<br />

contribution<br />

through<br />

innovative value<br />

added services<br />

innovation to<br />

retain<br />

subscribers and<br />

expand<br />

category<br />

Brand building<br />

Technology<br />

and<br />

Distribution<br />

focus on<br />

leadership<br />

29

Thank you<br />

30

Questions<br />

31