download - Contra Costa County Bar Association

download - Contra Costa County Bar Association

download - Contra Costa County Bar Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

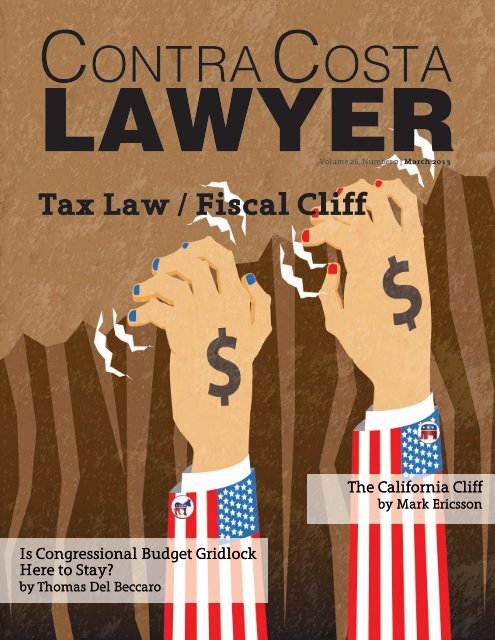

<strong>Contra</strong> <strong>Costa</strong><br />

LAWYER<br />

Volume 26, Number 2 | March 2013<br />

Tax Law / Fiscal Cliff<br />

The California Cliff<br />

by Mark Ericsson<br />

Is Congressional Budget Gridlock<br />

Here to Stay?<br />

by Thomas Del Beccaro<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 1

Perry A. Novak<br />

Senior Vice President - Investments<br />

UBS Financial Services, Inc.<br />

2185 N. California Blvd., Suite 400<br />

Walnut Creek, CA 94596<br />

(925) 746-0245<br />

perry.novak@ubs.com<br />

ubs.com/team/thenovakgroup<br />

You know there are more questions you should be asking, but<br />

you're not sure what they are.<br />

You want to stop procrastinating and make a decision,<br />

but you don't feel well enough informed.<br />

You know where you want to be,<br />

but you don't have a plan that will get you there.<br />

That's where we come in.<br />

The Novak Group at UBS Financial Services, Inc.<br />

Providing wealth planning and asset management services to affluent<br />

families, business owners and professionals since 1983.<br />

Trusted advice, caring support, prudent financial solutions.<br />

2<br />

MARCH 2013

TED AND HIS<br />

CALIFORNIA FORMS<br />

WERE INSEPARABLE.<br />

LIGHTEN YOUR LOAD WITH<br />

WESTLAW FORM BUILDER.<br />

Westlaw® Form Builder can take your California forms from tedious<br />

to streamlined, from time-consuming to cost-effective. This online<br />

document assembly tool delivers continually updated official and<br />

lawyer-tested forms from Witkin, Judicial Council of California, and<br />

other trusted sources, plus state-of-the-art automation to build them.<br />

No-charge linking to WestlawNext®, too! Embrace the future with<br />

Westlaw Form Builder.<br />

For more information, call 1-800-759-5418 or visit<br />

legalsolutions.com/formbuilder.<br />

© 2013 Thomson Reuters L-374258/2-13<br />

Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters.<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 3

4<br />

MARCH 2013

2013 BOARD OF DIRECTORS<br />

Jay Chafetz President<br />

Stephen Steinberg President-Elect<br />

Candice Stoddard Secretary<br />

Nick Casper Treasurer<br />

Audrey Gee Ex Officio<br />

Richard Alexander<br />

Philip Andersen<br />

Dean <strong>Bar</strong>bieri<br />

Amanda Bevins<br />

Oliver Bray<br />

Denae Hildebrand Budde<br />

CCCBA EXECUTIVE DIRECTOR<br />

Lisa Reep | 925.288.2555 | lgreep@cccba.org<br />

CCCBA main office 925.686.6900 | www.cccba.org<br />

Jennifer Comages<br />

Membership Coordinator<br />

Emily Day<br />

Systems Administrator and<br />

Fee Arbitration Coordinator<br />

Dawnell Blaylock<br />

Communications<br />

Coordinator<br />

Mary Carey<br />

Alison Chandler<br />

Elva Harding<br />

Peter Hass<br />

Reneé Livingston<br />

James Wu<br />

CONTRA COSTA LAWYER<br />

CO-EDITORS EDITORIAL BOARD<br />

Harvey Sohnen<br />

925.258.9300<br />

Nicole Mills<br />

925.351.3171<br />

BOARD LIAISON<br />

Candice Stoddard<br />

925.942.5100<br />

COURT LIAISON<br />

Kiri Torre<br />

925.957.5607<br />

PRINTING<br />

Steven’s Printing<br />

925.681.1774<br />

PHOTOGRAPHER<br />

Moya Fotografx<br />

510.847.8523<br />

Theresa Hurley<br />

Associate Executive Director<br />

<strong>Bar</strong>bara Arsedo<br />

LRIS Coordinator<br />

Mark Ericsson<br />

925.930.6000<br />

Matthew Guichard<br />

925.459.8440<br />

Elva Harding<br />

925.215.4577<br />

Patricia Kelly<br />

925.258.9300<br />

Craig Nevin<br />

925.930.6016<br />

David Pearson<br />

925.287.0051<br />

Stephen Steinberg<br />

925.385.0644<br />

Marlene Weinstein<br />

925.942.5100<br />

James Wu<br />

925.658.0300<br />

The <strong>Contra</strong> <strong>Costa</strong> Lawyer (ISSN 1063-4444) is published 12 times a<br />

year - 6 times online-only - by the <strong>Contra</strong> <strong>Costa</strong> <strong>County</strong> <strong>Bar</strong> <strong>Association</strong><br />

(CCCBA), 2300 Clayton Road, Suite 520, Concord, CA 94520. Annual<br />

subscription of $25 is included in the membership dues. Periodical<br />

postage paid at Concord, CA. POSTMASTER: send address change<br />

to the <strong>Contra</strong> <strong>Costa</strong> Lawyer, 2300 Clayton Road, Suite 520, Concord,<br />

CA 94520. The Lawyer welcomes and encourages articles and letters<br />

from readers. Please send them to contracostalawyer@cccba.org.<br />

The CCCBA reserves the right to edit articles and letters sent in<br />

for publication. All editorial material, including editorial comment,<br />

appearing herein represents the views of the respective authors and<br />

does not necessarily carry the endorsement of the CCCBA or the<br />

Board of Directors. Likewise, the publication of any advertisement<br />

is not to be construed as an endorsement of the product or service<br />

offered unless it is specifically stated in the ad that there is such<br />

approval or endorsement.<br />

<strong>Contra</strong> <strong>Costa</strong><br />

LAWYER<br />

Volume 26 Number 2 | March 2013<br />

FEATURES<br />

DEPARTMENTS<br />

6 INSIDE | by Mark Ericsson<br />

7 PRESIDENT’S MESSAGE | by Jay Chafetz<br />

19 CENTER | Annual Officer Installation<br />

Introducing Judge Judy Johnson and Commissioner Anita Santos<br />

Judicial Demeanor Training | Women’s Section Powerlunch<br />

Meet Your Local Judges, Family and Juvenile<br />

30 COFFEE TALK<br />

How do you fix the congressional process?<br />

32 INNS OF COURT | by Matthew Talbot<br />

34 CLASSIFIEDS<br />

35 CALENDAR<br />

The official publication of the<br />

IS CONGRESSIONAL BUDGET GRIDLOCK<br />

HERE TO STAY?<br />

by Thomas Del Beccaro<br />

THE CALIFORNIA CLIFF<br />

by Mark Ericsson<br />

ELEMENTS OF ATRA<br />

by G. Scott Haislet<br />

B A R<br />

A S S O C I A T I O N<br />

8<br />

11<br />

12<br />

BUSINESS TAX PROVISIONS OF ATRA 2012<br />

15<br />

by George Cabot<br />

IRS RETURN PREPARER REGS DERAILED<br />

by Warren Peterson<br />

DOMESTIC PARTNER COVERAGE RIGHTS<br />

UNDER THE CALIFORNIA INSURANCE<br />

EQUALITY ACT<br />

by Ralph L. Jacobson<br />

THE POPULATION CLIFF<br />

by Perry A. Novak<br />

17<br />

26<br />

28<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 5

inside<br />

My dad always said, “Spare me exciting<br />

times.” By April first, the country will or<br />

will not have survived four near-death<br />

experiences. We have already survived<br />

the fiscal cliff with last minute legislation entitled the<br />

American Taxpayer Relief Act of 2012 (ATRA). Both parties<br />

grumble that the other side won. The Democrats got<br />

higher taxes on the rich while holding the Bush cuts on<br />

the not so rich. The Republicans did not lose their pressure<br />

points – the coming battles over the debt ceiling,<br />

sequestration and the budget. The rest of the Americas<br />

grumbled over the unmitigated gall of Congress to call<br />

the act “The American...”<br />

First, Congress will take up an increase in the debt ceiling.<br />

This week, the House passed a three-month extension.<br />

It was anticipated that the ceiling would have to<br />

be raised sometime in February. Now it looks like it may<br />

be sometime in May.<br />

The President has said he won’t negotiate over the<br />

debt ceiling. He argues that Congress passed the spending<br />

bills and it is up to them to increase the debt ceiling.<br />

In so doing, he has rejected the idea of coining a platinum<br />

one-trillion-dollar coin or raising the ceiling by fiat<br />

under the 14th Amendment, theories that would skirt<br />

the debt ceiling issue. The Republicans say they won’t<br />

raise the debt ceiling until they get spending cuts sufficient<br />

to cover the debt increase. Experts claim that a failure<br />

to raise the debt ceiling would end the world as we<br />

know it and would certainly change the way the world<br />

views us. Please spare me these exciting times.<br />

Second up is the fight over the sequester, a result of a<br />

Congress that could not come to a compromise on the<br />

debt ceiling increase last time around. To resolve the<br />

gridlock, Congress passed spending cuts in 2011 so onerous<br />

to both parties that a compromise seemed guaranteed<br />

before the January 31, 2013, effective date. A gridlocked<br />

Congress could not reach a compromise before<br />

2013 and the ATRA extended the effective date to March<br />

first, expecting that they can still reach a compromise.<br />

Einstein defined insanity as doing the same thing over<br />

and over again and expecting a different result. Enough<br />

said.<br />

Finally we face congressional confirmation of a budget.<br />

Don’t forget that Newt Gingrich shut down the government<br />

by blocking the passage of a budget. Just this<br />

week the House passed an act mandating that senators<br />

and representatives must pass a budget by April 15th to<br />

get paid. The Senate has been unwilling to pass a budget<br />

these last three years. Maybe this is the impetus needed.<br />

Mark Ericsson<br />

Guest Editor<br />

In this issue, we looked around for someone that<br />

could answer the question “How do we fix the congressional<br />

process?” and posed the question to the chair of<br />

the California Republican Party, soon to publish a book<br />

on the subject. We also asked Perry Novak to scare us<br />

with facts about the upcoming demographic changes<br />

in our society. In our feature article, Scott Haislet explains<br />

the American Taxpayer Relief Act in detail. In a<br />

companion piece, we look at the impact when you combine<br />

the effects of ATRA with California tax rates. George<br />

Cabot reviews the corporate landscape and the debate<br />

over lowering our internationally high tax rates. Ralph<br />

Jacobson brings us up to date on the rights of domestic<br />

partners under insurance policies. Warren Peterson<br />

warns us that tax preparers no longer must be registered<br />

with the IRS.<br />

I’m afraid to say that these are going to be very exciting<br />

times. My father must be turning over in his grave.<br />

One last thought: Is it a coincidence that there is no<br />

ethics credits being given in this issue? s<br />

Mark Ericsson is a partner in the tax and business<br />

firm of Youngman & Ericsson, has served as the 2006<br />

president of the <strong>Bar</strong> <strong>Association</strong> and is currently the<br />

chair of the Taxation Section. He has written over 30<br />

articles on tax and business issues.<br />

6<br />

MARCH 2013

CCCBA - It’s Your Organization<br />

president’s message<br />

By the time this reaches<br />

print, our organization will<br />

already have had its Installation<br />

Luncheon, where the<br />

new officers, directors and section<br />

leaders of the <strong>Contra</strong> <strong>Costa</strong> <strong>County</strong><br />

<strong>Bar</strong> <strong>Association</strong> are installed in<br />

their positions.<br />

I know that I will have seen only<br />

a few of you there. I regret that this<br />

year especially, because those of<br />

you who did not attend missed a<br />

fascinating interview with our most<br />

recent appointee to the California<br />

Supreme Court, Goodwin Liu. Happily,<br />

that interview was videotaped<br />

and is available for viewing on our<br />

website. It is well worth watching.<br />

The Installation Luncheon is regularly<br />

attended by judges, CCCBA<br />

presidents, officers, and past presidents,<br />

CCCBA directors, and CCCBA<br />

section leaders. I often feel that after<br />

we have given recognition to all of<br />

these luminaries, there is no one left<br />

in the audience whose name has<br />

not been mentioned. We are an organization<br />

of 1,700 members. About<br />

125 of them usually attend the Installation<br />

Luncheon.<br />

Times have changed for our <strong>Bar</strong><br />

<strong>Association</strong>. Before the early 1990s,<br />

when the State <strong>Bar</strong> first adopted<br />

mandatory continuing legal education,<br />

our <strong>Bar</strong> <strong>Association</strong> largely interacted<br />

with its members through<br />

a few well-attended bar-wide functions<br />

each year. After this change,<br />

our sections began to offer education<br />

credits at their programs and<br />

over the years most members of<br />

the <strong>Bar</strong> <strong>Association</strong> now have contact<br />

with the <strong>Association</strong> mainly<br />

through the sections.<br />

The Conservatorship, Guardianship,<br />

Probate & Trust Section has<br />

over 200 members. They had their<br />

annual luncheon a week after that<br />

of the <strong>Bar</strong> <strong>Association</strong> as a whole,<br />

and had even greater attendance<br />

than we had at the Installation<br />

Luncheon—and the people attending<br />

each function were largely different.<br />

The Family Law Section is<br />

also a large and active one with regular<br />

monthly programs, also very<br />

well attended. CCCBA is the umbrella<br />

organization that sponsors these<br />

sections, helps them advertise their<br />

programs, provides administrative<br />

and accounting support, and supplies<br />

the nonprofit corporation that<br />

lets them furnish their valuable<br />

networking and educational services<br />

to our members. So the mother organization<br />

is vitally important to all<br />

of our members even though many<br />

of them never attend anything<br />

more than events sponsored by the<br />

sections. We are the heart and lungs<br />

that let the body get where it’s going.<br />

Your board of directors has tried<br />

to be responsive to these changed<br />

times. Over the last several years,<br />

we have made changes that reflect<br />

our perception of the different<br />

things that you, our members, want<br />

and need from us. We dropped a second<br />

annual event called the State of<br />

the Court Address when attendance<br />

began to fall off. The event, in the<br />

current tough economic times for<br />

our state, ended up being just a depressing<br />

yearly recap of all the bad<br />

news about the budget cuts to the<br />

court system. We continually brainstorm<br />

about new programs that we<br />

might offer you or about possible<br />

changes to streamline and make<br />

more relevant the programs that we<br />

already offer.<br />

Unfortunately, we have little<br />

data to guide us. We do not have<br />

organization-wide elections to become<br />

officers of the CCCBA. The information<br />

we get about your likes<br />

Jay Chafetz<br />

CCCBA Board President<br />

and dislikes is fragmentary and anecdotal<br />

at best.<br />

So as I go about my duties this<br />

year, I want to make sure that each<br />

of you knows I have an open door<br />

policy. If there is a concern that you<br />

have about our organization or an<br />

idea you want to propose about<br />

how to make it better, please feel<br />

free to email or call me.<br />

Later this month, we are going to<br />

send you a survey. We will do our<br />

best to make it easy and quick to<br />

complete. Please participate in it.<br />

We want to serve you, and we can<br />

only know how to serve you if you<br />

tell us what you want.<br />

This is your organization, not<br />

mine or that of the other members<br />

of the board of directors. Do not<br />

think of it as something apart from<br />

you or, as it is tempting to think<br />

about government, something you<br />

have no control over and cannot<br />

change. I and the other directors<br />

are here to serve the organization,<br />

but even more importantly, to serve<br />

you. Take control of your organization.<br />

Tell us what you want it to be.<br />

And be sure to let us know how we<br />

are doing. s<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 7

The United States national debt<br />

is higher at $16.5 trillion than the<br />

overall size of the U.S. economy.<br />

In 2012, America faced a so-called<br />

“fiscal cliff” that wasn’t resolved so<br />

much as it was put off to another<br />

day. We also know that the U.S. Senate<br />

has not passed a budget in four<br />

years.<br />

Is this the new normal for America?<br />

Or is there some solution to this political<br />

budgetary gridlock? In plain<br />

truth, while lack of leadership in<br />

congress is a problem, so much of<br />

America is either dependent on the<br />

federal government or doing business<br />

with the federal government,<br />

that the divisions in congress and<br />

America we see today are likely<br />

here to stay.<br />

As I detail in my upcoming book,<br />

The Divided Era, the partisanship<br />

Is Congressional Budget<br />

Gridlock Here to Stay?<br />

by Thomas Del Beccaro<br />

Chairman, California Republican Party<br />

The United States national<br />

debt is higher at $16.5 trillion<br />

than the overall size of<br />

the U.S. economy. In 2012,<br />

America faced a so-called “fiscal<br />

cliff” that wasn’t resolved so much<br />

as it was put off to another day. We<br />

also know that the U.S. Senate has<br />

not passed a budget in four years.<br />

Is this the new normal for America?<br />

Or is there some solution to this<br />

political budgetary gridlock? While<br />

lack of leadership in Congress is a<br />

problem, so much of America is either<br />

dependent on the federal government<br />

or doing business with the<br />

federal government, that the divisions<br />

in Congress and America we<br />

see today are likely here to stay.<br />

As I detail in my upcoming book,<br />

“The Divided Era,” the partisanship<br />

of today is different than at any time<br />

in our history. In the past, we have<br />

had very partisan eras featuring<br />

very difficult issues. The most divisive<br />

era in our history, the Civil War<br />

and Reconstruction Period, saw us<br />

decide issues with guns more than<br />

ballots. You cannot get more partisan<br />

than that.<br />

The adoption of the Constitution<br />

saw a political party do battle with<br />

its anti-party: Federalists versus Anti-Federalists.<br />

Imagine today if the<br />

two parties were called Democrats<br />

and Anti-Democrats or Republicans<br />

and Anti-Republicans.<br />

Now, however, we face a potentially<br />

more intractable problem.<br />

While the Civil War was a larger<br />

and more deadly issue, and while<br />

the adoption of the Constitution<br />

proved to be more than just a philosophical<br />

political fight for the ages,<br />

they both involved what I describe<br />

as closed-end issues.<br />

We adopted the Constitution,<br />

and while Hamilton and Jefferson<br />

fought about its meaning, just as<br />

some do today, the issue was resolved.<br />

We have a Constitution and<br />

we don’t have Articles of Confederation.<br />

That issue was capable of being<br />

decided once and for all. Similarly,<br />

we fought a Civil War and we are<br />

now one nation.<br />

Today, we face a different problem.<br />

When the Civil War ended,<br />

and even up to the year 1900, total<br />

government expenditures were less<br />

than 7 percent of the U.S. economy.<br />

Today, total government expenditures,<br />

from local government all the<br />

way to the federal government, are<br />

a staggering 33 percent.<br />

First, that means our governments<br />

are spending a lot more<br />

money. Predictably, we have the<br />

usual fights over the proper scope of<br />

government. Today, however, the<br />

number and fervor of those fights<br />

is growing right along with the size<br />

of the federal budget, which has<br />

grown over 300 percent in the last<br />

30 years. While this fight is not new,<br />

it is a growing problem.<br />

Second, our growing deficits, tax<br />

burdens and troubled economy are<br />

fostering an unprecedented competition<br />

between those seeking<br />

funding for current government op-<br />

8<br />

MARCH 2013

erations and those concerned with<br />

government pensions. Closely related<br />

to that are also: (1) the growing<br />

competition between public employee<br />

unions and taxpayers, and<br />

(2) the fights for taxes and funding<br />

between the states and the federal<br />

government over federal programs<br />

like ObamaCare.<br />

Third, and this is a critical point,<br />

the fact that our governments now<br />

represent one-third of the economy<br />

also means that our governments<br />

are doing more things than they<br />

have ever before – and by a wide<br />

factor. Those governments doing<br />

many more things lead to unprecedented<br />

partisanship that is at the<br />

crux of gridlock today.<br />

Simply put - a government that<br />

does but 100 things will find far<br />

fewer partisans than a government<br />

that does 1,000 things. Today, our<br />

governments all combined do $5<br />

trillion worth of things each year<br />

and we have many more partisans<br />

than our founders could ever imagine.<br />

As a result, we also have an unprecedented<br />

competition among<br />

those seeking government benefits,<br />

preferences and spoils doled out<br />

at all levels of our state, local and<br />

federal governments. Businesses,<br />

citizens, lobbyists, charities, government<br />

contractors and more compete<br />

for those spoils. Indeed, many businesses<br />

seemingly compete as much<br />

in the halls of our governments as<br />

they do in the marketplace. Many<br />

times, they can gain greater victories<br />

from government than they can<br />

in the marketplace.<br />

All of this adds up to the fact that<br />

the number of people doing business<br />

with our governments or dependent<br />

on them dwarfs the number<br />

of those people at any previous<br />

time in our history. The result of this<br />

new, “my piece of the pie partisanship”<br />

is people less driven by ideology<br />

and more driven by self-interest.<br />

Further, we see greater divisions<br />

among Americans and greater pressure<br />

to deliver the goods on the focal<br />

point of all of these competitions<br />

- our elected officials.<br />

Worse yet, the source of the current<br />

gridlock is not subject to any<br />

one close-end decision. To the contrary,<br />

our federal government is doing<br />

thousands of things which no<br />

single vote, war or legislative act<br />

“Simply put - a government that does but 100 things will find far fewer<br />

partisans than a government that does 1,000 things.”<br />

could resolve. As a result, we are<br />

likely to face division and gridlock<br />

for decades to come.<br />

Some choose to blame hyperpartisans<br />

in the major parties – and<br />

now the Tea Party – for our current<br />

gridlock. Partisans, however, are<br />

present in every age. For instance,<br />

Samuel Adams was considered incendiary<br />

as he sought revolutionary<br />

change in Boston. He was the<br />

leader of a mob and far more partisan<br />

than anyone in modern politics.<br />

He was essential, however, to our<br />

founding and the freedom that has<br />

spread across the world. Continuing<br />

the thought, John Adams stated<br />

outright that the Revolution would<br />

be attributed to another highly<br />

partisan writer of the age, Thomas<br />

Paine.<br />

Youngman & Ericsson, LLP<br />

1981 North Broadway • Suite 300<br />

Walnut Creek, CA 94596<br />

The point is that for anyone to<br />

blame partisans is to blame the<br />

symptom, not the cause. It is human<br />

nature for people with so<br />

much at stake to be highly partisan.<br />

As lawyers, we should be no more<br />

surprised at their fervor than at the<br />

fervor of our clients whose cases<br />

mean their fortune to them, if not<br />

more.<br />

In short, we should stop blaming<br />

the participants and start focusing<br />

on the dynamic, which brings them<br />

to the fray. They are acting in their<br />

self-interest or for their personal<br />

ambition. The rules of the game accentuate<br />

their ambition and their<br />

natures. Should one company sit<br />

at home while another seeks an<br />

advantage in Congress? Should we<br />

really expect people being taxed to<br />

the point of moving not be vocal?<br />

California has lost over 4.5 million<br />

taxpayers since 1998, mostly to low<br />

tax states. We shouldn’t any more<br />

blame them than to blame our clients<br />

for filing lawsuits for their<br />

claims.<br />

So what are we to do? First, and<br />

this will be the hardest, we need<br />

to understand that there is no example<br />

in history of a government<br />

lasting as comparatively large as<br />

ours. Part of the story of Rome and<br />

Greece at their heights is bureaucratic<br />

breakdown and class warfare<br />

over stagnant economies and divisive<br />

tax schemes. It is not a story<br />

of governments getting their fiscal<br />

house in order.<br />

As such, we need to understand<br />

Estate Litigation Lawyers.<br />

www.youngman.com (925) 930-6000<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 9

Budget Gridlock,<br />

cont. from page 9<br />

that growing government will lead<br />

to more division, not less. Each time<br />

we add to the size of government,<br />

we add to this unprecedented partisanship<br />

and potential for gridlock.<br />

We simply must stop looking<br />

to government for every happenstance<br />

or to resolve every inequity<br />

on the globe.<br />

Second, we need leaders that<br />

have the ability to focus voters on<br />

a common goal more than to divide<br />

their constituents. Reagan and Kennedy<br />

focused Americans on grand<br />

goals like restoring the economy<br />

and strengthening of our foreign<br />

policy goals. In both cases, Reagan<br />

and Kennedy relied as much on the<br />

private sector as on public sector activity.<br />

Both used tax cuts for all Americans,<br />

which bound people to their<br />

common presidential goal of reviving<br />

the economy. Kennedy challenged<br />

us to go to the moon and<br />

to join the Peace Corps. Reagan set<br />

a national goal for transcending<br />

communism. Those goals did not<br />

exclude any American from participating<br />

in their achievement. By creating<br />

goals for all Americans, goals<br />

that relied on private initiative, it<br />

made it easier for them to bring people<br />

together.<br />

Finally, as long as we have a tax<br />

system that pits one class of Americans<br />

against another, like our federal<br />

system, we can expect growing<br />

division. Taxing half of Americans<br />

and not the other half is the very<br />

nature of division. If we moved to<br />

a consumption-based tax system<br />

like many thriving states, we could<br />

minimize our divisions and grow<br />

the economy and revenues – all of<br />

IS PLEASED TO ANNOUNCE THAT<br />

IS PLEASED ARMAND TO ANNOUNCE M. ESTRADA THAT<br />

HAS RYAN JOINED W. LOCKHART THE FIRM AS<br />

OF COUNSEL<br />

HAS JOINED THE FIRM<br />

Mr. Estrada’s practice will continue to focus on business<br />

transactions,<br />

Mr. Lockhart<br />

intellectual<br />

focuses<br />

property<br />

his practice<br />

consulting<br />

in estate<br />

and licensing,<br />

construction, real property matters and related litigation.<br />

planning, wealth transfer planning, estate and gift<br />

Mr. Estrada provides arbitration and mediation services.<br />

tax planning, trust administration and probate.<br />

___________________<br />

The Firm continues to concentrate on business,<br />

employment, estate and tax planning,<br />

The Firm continues to concentrate on<br />

real estate and related litigation matters.<br />

business, employment, estate and tax planning,<br />

real estate and related litigation matters.<br />

1333 N. California Boulevard, Suite 350<br />

Walnut Creek, California 94596<br />

Telephone: 925.944.9700<br />

Facsimile: 925.944.9701<br />

www.bpbsllp.com<br />

1333 N. California Boulevard, Suite 350<br />

Walnut Creek, California 94596<br />

Telephone: 925.944.9700<br />

Facsimile: 925.944.9701<br />

www.bpbsllp.com<br />

that would lead to less gridlock.<br />

Those are long-term changes we<br />

need to make as a society. In the<br />

short term, it will take an extraordinary<br />

president or Speaker of the<br />

House to forge a consensus around<br />

a new national goal to break the<br />

current deadlock. The number of<br />

divisions present today in The Divided<br />

Era, however unfortunately,<br />

are not likely to simply go away. s<br />

10<br />

MARCH 2013

The California Cliff<br />

by Mark Ericsson<br />

California, the state that takes<br />

a backseat to no one, has<br />

certainly taken a backseat<br />

in the fiscal cliff debate.<br />

While all eyes were glued to the TV<br />

to watch the fight over how much<br />

the federal tax would bite the rich,<br />

California passed Proposition 30<br />

which raised California’s top tax<br />

rates nearly one and a half times as<br />

great as our federal counterpart, and<br />

we did it retroactively to the start of<br />

2012.<br />

Let’s look first at the rates we voted<br />

in by way of the proposition. The<br />

increases in California rates start<br />

at lower levels than the federal increases.<br />

For a single person, the top<br />

rate for those with incomes under<br />

one million dollars, formerly 9.3<br />

percent, increases to 10.3 percent at<br />

a taxable income of $250,000, 11.3<br />

percent at $300,000 and 12.3 percent<br />

at $500,000. The existing 1 percent<br />

surcharge kicks in at $1,000,000 taxing<br />

income in excess of $1,000,000<br />

at 13.3 percent. For married couples,<br />

the increases come at twice the income<br />

levels as for the single taxpayer.<br />

While the increase in the top<br />

rate nationally was an increase of<br />

13 percent over the 2012 rate, the increase<br />

in California was 32 percent<br />

over 2011, remembering the state<br />

increase was retroactive.<br />

For Californians with taxable incomes<br />

over $250,000, the news in<br />

California is not good. When you<br />

add in the effects of the alternative<br />

minimum tax, the ObamaCare investment<br />

tax and California capital<br />

gains policy, you can get some scary<br />

results. The alternative minimum<br />

tax was passed some 30 years ago<br />

to prevent high-income taxpayers<br />

from sheltering their incomes from<br />

tax. To calculate the tax, you first<br />

calculate your normal tax. You then<br />

calculate the tax without the shelter<br />

items to create a broader base<br />

and apply a lower rate. You pay the<br />

higher of the tax calculated by the<br />

two methods.<br />

One of the shelter items is state income<br />

tax. You do not get to deduct<br />

state income tax when calculating<br />

your alternative minimum tax. Taxpayers<br />

in states with high income<br />

tax rates like New York and California<br />

often get no tax benefit federally<br />

from paying state tax. Therefore, the<br />

two taxes are often additive. The<br />

combined tax rate for a single person<br />

with taxable income above $250,000<br />

is 45.2 percent; above $300,000 it is<br />

46.2 percent; above $400,000, it is<br />

50.8 percent, above $500,000, it is<br />

51.8 percent; and above $1,000,000,<br />

it is 52.8 percent.<br />

We then have the ObamaCare<br />

investment tax of 3.8 percent on investment<br />

income. All investment<br />

income over $200,000 for individuals<br />

and $250,000 for families is taxed<br />

at 3.8 percent. If you sell your house<br />

for a profit, you will certainly be<br />

subject to this tax. A lot of income is<br />

going to be taxed at 56.6 percent.<br />

Most disruptive is that in California,<br />

we don’t give any break for<br />

capital gains. The theory is that the<br />

California rates aren’t high enough<br />

to drive taxpayers out of the state.<br />

Thus someone with a capital gain<br />

from the sale of property or a business<br />

can incur a 12.3 percent rate on<br />

gains above $500,000 in addition to<br />

the 23.8 percent federal rate.<br />

I have a client who is going to<br />

sell his company for $150,000,000.<br />

He has asked me for instruction<br />

on how to cut his ties to this state.<br />

With 13 percent of his capital gain<br />

being taken by California, he sees<br />

no advantage in living in this state<br />

in a time where mobility is the big<br />

new thing. He will pay no tax if he<br />

moves to Nevada or Texas. The governor’s<br />

balanced budget assumes<br />

that no one is going to leave the<br />

state. Multiply the $18,500,000 in<br />

taxes the state is going to lose from<br />

this one taxpayer by the hundreds<br />

of others leaving and the budget<br />

loses its glamour.<br />

It is often noted that tax rates<br />

were much higher during the prosperous<br />

years of the Eisenhower administration.<br />

However, society is<br />

much more mobile now and work<br />

forces are much more competitive.<br />

Relocation is no longer a burden.<br />

Not only does California have<br />

America’s highest income tax rates,<br />

California has the nation’s highest<br />

sales tax rate, with counties that are<br />

looking to the more profitable real<br />

estate sectors to extract property tax<br />

and cities that are increasingly enforcing<br />

once lax gross receipts tax<br />

ordinances.<br />

One has to wonder why California<br />

needs the most pervasive tax<br />

regime by far of any state in the nation.<br />

s<br />

Mark Ericsson is a partner in the<br />

tax and business firm of Youngman<br />

& Ericsson, has served as the<br />

2006 president of the <strong>Bar</strong> <strong>Association</strong><br />

and is currently the chair of<br />

the Taxation Section. He has written<br />

over 30 articles on tax and business<br />

issues.<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 11

Elements of ATRA<br />

The American Taxpayer Relief<br />

Act (ATRA) became law<br />

on January 2, 2013.<br />

ATRA: (1) repealed the<br />

sunset of the Economic Growth<br />

and Tax Relief Reconciliation Act<br />

of 2001 (EGTRRA); (2) increased tax<br />

rate; (3) increased the capital gains<br />

rate; (4) re-introduced the “stealth”<br />

taxes by reduction of itemized deductions<br />

and personal exemptions;<br />

(5) created “permanent” alternative<br />

minimum tax relief; and (6) extended<br />

estate and gift tax exemptions<br />

established in 2010.<br />

ATRA relief retained some of the<br />

Bush-era tax policies and avoided<br />

government spending cuts, although<br />

resolution of the debt ceiling<br />

question has only been deferred.<br />

ATRA was a compromise. The<br />

administration wanted higher tax<br />

rates on incomes of at least $250,000<br />

(citing those successful families and<br />

individuals as “rich”), while Republicans<br />

resisted higher rates. The definition<br />

of rich settled at singles making<br />

over $400,000, and $450,000 for<br />

married joint filers.<br />

Repeal of EGTRRA<br />

Sunset<br />

EGTRRA provided significant tax<br />

breaks from 2001 through 2012, particularly<br />

in the area of capital gain<br />

rates, estate taxes and gift taxes.<br />

EGTRRA was scheduled to sunset<br />

after 2010, meaning that we would<br />

return to higher tax rates in effect<br />

before 2001. Both sides agreed to defer<br />

the EGTRRA sunset at the end of<br />

2010 to December 31, 2012, at which<br />

time the government would face its<br />

self-imposed fiscal cliff.<br />

When the dust settled, both sides<br />

claimed victory when they made<br />

by G. Scott Haislet<br />

EGTRRA permanent under ATRA,<br />

with no possibility of sunset in the<br />

future.<br />

Income Tax Rates<br />

ATRA retained existing 10 percent,<br />

15 percent, 25 percent, 28 percent,<br />

33 percent and 35 percent rates<br />

that prevailed pre-ATRA. Absent<br />

ATRA, these rates would have been<br />

materially higher.<br />

ATRA added a 39.6 percent rate for<br />

income above the applicable threshold<br />

of $400,000 for single taxpayers,<br />

$450,000 for married joint filers and<br />

$425,000 for heads of household.<br />

The applicable threshold will be<br />

adjusted annually for inflation.<br />

The tax brackets on which income<br />

is taxed at 10 percent, 15 percent, 25<br />

percent, 28 percent, 33 percent and<br />

35 percent will be adjusted annually<br />

for inflation. These favorable<br />

policies retain the “bracket creep”<br />

avoidance policy dating from the<br />

1980s.<br />

Capital Gain Rates<br />

ATRA retained the zero percent<br />

and 15 percent long-term capital<br />

gain rates. That means zero percent<br />

capital gain rate will apply to gains<br />

that would otherwise be subject to<br />

10 percent or 15 percent ordinary<br />

rate; 15 percent will apply to gains<br />

that would otherwise be subject to<br />

25 percent, 28 percent, 33 percent or<br />

35 percent ordinary rate.<br />

ATRA imposes a 20 percent longterm<br />

capital gain rate on income<br />

above the applicable threshold (e.g.,<br />

above $450,000 for married joint filers<br />

and $400,000 for singles). That<br />

means that 20 percent capital gain<br />

rate will apply to gains that would<br />

otherwise by subject to the 39.6 percent<br />

ordinary rate.<br />

For example, it will be possible<br />

for a gain to be taxed partially at 15<br />

percent and partially at 20 percent.<br />

Long-term capital gain rates will apply<br />

to gains on sales of capital assets<br />

and on “qualified” dividends. A dividend<br />

is qualified if taxpayer holds<br />

the stock at least 61 days during the<br />

121-day period that begins 60 days<br />

before the stock goes ex-dividend.<br />

Note: a new 3.8 percent tax will<br />

apply to net investment income<br />

(interest, dividends, gains, etc.) for<br />

those with “modified” adjusted gross<br />

income of $200,000, and $250,000 for<br />

married joint filers; that tax began<br />

January 1, 2013, under federal tax<br />

code section 1411, which was adopted<br />

by Congress in 2010. Thus, top<br />

federal long-term capital gain rates<br />

are effectively 23.8 percent.<br />

12<br />

MARCH 2013

ATRA also retained the 25 percent<br />

rate on “unrecaptured section 1250<br />

gain,” which is taxpayer’s accumulated<br />

depreciation on real estate. Example:<br />

taxpayer buys commercial<br />

property for $1 million in 2005; taxpayer<br />

sells the property for $1.2 million<br />

on February 1, 2013, at which<br />

date accumulated depreciation<br />

was $100,000. Taxpayer will pay tax<br />

at applicable capital gain rate on<br />

$200,000 ($1.2 million minus $1 million<br />

purchase price) and pay 25 percent<br />

on $100,000 unrecaptured section<br />

1250 gain. Taxpayer will avoid<br />

both the capital gain tax and 1250<br />

gain tax in the event of a successful<br />

1031 exchange. The new 3.8 percent<br />

tax will apply to the unrecaptured<br />

section 1250 gain.<br />

Stealth Increases<br />

Without increasing tax rates,<br />

taxes increased during the Clinton<br />

administration by reducing deductions<br />

for personal exemptions and<br />

certain itemized deductions. EG-<br />

TRRA reduced those stealth tax increases<br />

in 2005-2008 and eliminated<br />

them from 2009-2012. Thus, for 2012,<br />

each individual was entitled to a<br />

personal exemption of $3,800 irrespective<br />

of income. A married couple<br />

without children would save<br />

$7,600 in taxable income. A married<br />

couple with two dependents would<br />

save $15,800 in taxable income.<br />

Under ATRA beginning in 2013,<br />

personal exemptions are phased<br />

out for adjusted gross income (AGI)<br />

over $250,000, and $300,000 for married<br />

joint filers. Beginning in 2013,<br />

itemized deductions for mortgage<br />

interest, taxes, charity, and miscellaneous<br />

deductions will be reduced<br />

for single taxpayers with AGI over<br />

$250,000, and $300,000 for married<br />

joint filers. The reduction of itemized<br />

deductions is 3 percent times<br />

that sum above applicable AGI.<br />

Alternative Minimum<br />

Tax (AMT)<br />

AMT is an alternative taxation<br />

system. Each individual taxpayer<br />

computes his income tax under the<br />

“regular” and “alternative” systems,<br />

paying the higher of the two. The<br />

regular system is AGI minus itemized<br />

deductions, minus personal exemptions,<br />

the result being taxable<br />

income subject to the tax rates discussed<br />

above.<br />

The AMT system is AGI, modified<br />

for certain items, minus itemized<br />

deductions (except that deductions<br />

for taxes and miscellaneous deductions<br />

are not permissible under<br />

AMT), the result being alternative<br />

taxable income subject to 26 percent<br />

or 28 percent rates. Note: many Californians<br />

fall into AMT because of<br />

high state income taxes.<br />

A relatively large personal exemption<br />

frees most taxpayers from<br />

AMT concern. The higher the personal<br />

AMT exemption, the more<br />

likely a person would not be subject<br />

to AMT. The previous permanent<br />

AMT exemptions were $45,000 for<br />

married joint filers and $33,750 for<br />

singles.<br />

Beginning with EGTRRA, the<br />

exemptions were temporarily increased<br />

with an AMT “patch”; laws<br />

Morrill Law Firm<br />

1333 N. California Blvd., Ste 620 • Walnut Creek, CA 94596<br />

Phone 925.322.8615 • Fax 925.357.3151<br />

Will & Trust Litigation<br />

Financial Elder Abuse<br />

Conservatorships<br />

General Civil Litigation<br />

Probate & Civil Appeals<br />

Mediation<br />

Joseph Morrill<br />

Andrew R. Verriere<br />

Nicole Morrill<br />

Paralegal<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 13

Elements,<br />

cont. from page 13<br />

enacted every one to two years after<br />

2001 to provide for relatively higher<br />

levels of AMT exemptions.<br />

ATRA has eliminated the need<br />

for future patches by adopting permanently<br />

higher AMT exemptions:<br />

$78,750 for married joint filers and<br />

$50,600 for singles.<br />

Estate and Gift Taxes<br />

Estate taxes are levied on a decedent’s<br />

assets valued at date of death.<br />

Tax law permits a person to transfer a<br />

sum of property and money to heirs<br />

or other individuals. The limit has<br />

varied over the years. The limit was<br />

$675,000 before EGTRRA, increased<br />

to $1 million under EGTRRA with<br />

additional increases until reaching<br />

$3.5 million in 2009. There was no<br />

limit for persons dying in 2010 (i.e.,<br />

taxpayers died tax-free).<br />

Example: an unmarried person<br />

died in 2009 with net estate of $7.5<br />

million with no prior gifts. The sum<br />

of $4 million would have been<br />

taxed ($7.5 million net estate minus<br />

$3.5 million exemption). The $4 million<br />

is the decedent’s taxable estate.<br />

EGTRRA was supposed to sunset<br />

at December 31, 2010. Congress<br />

extended EGTRRA, implementing<br />

a $5 million tax-free transfer limit<br />

applied for 2011 and 2012, again<br />

subject to expire after 2012. ATRA<br />

extended the $5 million limit permanently,<br />

with inflation adjustment<br />

after 2011.<br />

Thus, the limit for persons dying<br />

in 2012 was $5.12 million, and is<br />

$5.25 million for persons dying in<br />

2013. The top estate tax rate in 2011<br />

and 2012 was 35 percent. ATRA increased<br />

that rate to 40 percent.<br />

That means, for example, that a<br />

single person dying in 2013 with<br />

$7.25 million net estate will incur<br />

$800,000 estate taxes, which is $7.25<br />

million minus $5.25 million, or $2<br />

million, times the 40 percent top estate<br />

tax rate. This example assumes<br />

that the decedent had made no gifts<br />

prior to death that would have reduced<br />

the lifetime exemption limit.<br />

Gift and estate taxes were “unified”<br />

in 2011 and 2012 and remain<br />

so under ATRA, meaning that a donor’s<br />

gifts during life or after death<br />

count against the lifetime exempt<br />

limit. Therefore, some donors give<br />

money and property to their heirs<br />

during their life up to a lifetime limit<br />

($5.25 million in 2013), because:<br />

(1) of concern that the government<br />

may reduce the limit in future, and<br />

(2) any appreciation on today’s gifts<br />

escape tax at the donor’s death.<br />

effectiveness<br />

While ATRA makes the $5 million<br />

limit permanent, nothing involving<br />

tax legislation is ever really permanent<br />

inside of the beltway, and<br />

that applies to all the permanent<br />

changes noted above. Thus, clients<br />

should consider inter vivos gifts to<br />

exhaust the lifetime gift exclusion<br />

in case it disappears. s<br />

G. Scott Haislet is a CPA and tax attorney<br />

in Lafayette. He is a certified<br />

specialist in taxation law, Board of<br />

Legal Specialization of California<br />

<strong>Bar</strong>. His practice includes tax planning,<br />

preparation, controversies,<br />

real estate matters, estate planning,<br />

and 1031 exchanges. He may be<br />

reached at (925) 283-1031 or scott@<br />

goscott.com.<br />

Palmer Madden has conducted more than<br />

1,000 mediations since 1981. One jurisdiction<br />

reported that he has over a 90% settlement rate.<br />

experience<br />

His 25 years of experience as a trial attorney gives<br />

him an understanding about clients that has proven<br />

time and again to be critical in tough cases.<br />

efficiency<br />

He does not carry the overhead of other<br />

mediation firms (no administrative fees) -<br />

which means the price is always right!<br />

palmer brown madden<br />

925.838.8593 | WWW.ADRSERVICES.COM<br />

Over 25 years’ experience as an ADR neutral<br />

14<br />

MARCH 2013

Business Tax Provisions of ATRA 2012<br />

An extension of targeted incentives, but needed<br />

corporate tax reform must wait…<br />

When have budgetary<br />

and tax machinations<br />

in Washington<br />

generated so fertile a<br />

phrase, one so conducive to corny<br />

metaphor and other colorful figures<br />

of speech? I pledge in writing this<br />

article to avoid the use of the phrase<br />

“fiscal cliff.” Oops, I just did. Well,<br />

never again…<br />

The purpose of this article is to discuss<br />

those provisions of the American<br />

Taxpayer Relief Act of 2012 1 (the<br />

Act) of particular interest to business.<br />

The Act extends a variety of<br />

tax incentives for business, including<br />

15-year depreciation and bonus<br />

depreciation on certain property<br />

and Section 179 expensing (essentially<br />

100 percent depreciation on<br />

certain assets up to $500,000, subject<br />

to certain limitations). In addition,<br />

two very interesting corporate incentives<br />

were made retroactively<br />

applicable to 2012 and extended<br />

through the end of 2013. These are<br />

described and discussed in the first<br />

two sections below. The final section<br />

explores proposals for the corporate<br />

tax reform which are being<br />

seriously discussed in Washington,<br />

but which were not addressed in<br />

the Act.<br />

Qualified Small Business<br />

Stock<br />

In the June 2011 edition of CC<br />

Lawyer, this author reported on an<br />

economic stimulus provision relating<br />

to small business stock. See<br />

“Gains from Investments in Small<br />

Business Stock Acquired During<br />

2011 May Be Tax Free” [CC Lawyer<br />

June 2011]. Section 1202 of the<br />

tax code generally provides a 50<br />

percent exclusion of gain from the<br />

sale of “qualified small business<br />

stock.” Measures enacted in 2009<br />

and 2010 increased the exclusion to<br />

100 percent temporarily and thus<br />

allowed an investor to effectively<br />

pay zero percent tax on gains from<br />

QSBS purchased prior to the end of<br />

2011 and held for at least five years<br />

before sale. QSBS is defined in Section<br />

1202 as stock in a C corporation<br />

that: (1) has no more than $50 million<br />

in gross assets, and (2) engages<br />

in the active conduct of a qualified<br />

trade or business. 2 For a detailed description<br />

of the other qualifications<br />

and limitations of Section 1202, see<br />

“Gains.” California adopted the analogue<br />

of Section 1202 in 1993, allowing<br />

a 50 percent exclusion of gain<br />

for QSBS, but restricted eligibility to<br />

California businesses. California did<br />

not follow the federal lead in offering<br />

a temporary 100 percent exclusion.<br />

The Act extends the effective zero<br />

percent tax rate on capital gains<br />

from the sale of QSBS through the<br />

end of 2013. It provides a 100 percent<br />

exclusion of eligible gain received<br />

by an individual taxpayer<br />

from the sale of QSBS acquired after<br />

September 7, 2010, and before January<br />

1, 2014, and held for more than<br />

five years. In addition, gain from<br />

QSBS is excluded for alternative<br />

minimum tax purposes. Note that<br />

the Act has retroactive application<br />

to 2012. The exclusion had expired<br />

at the end of 2011. The Act both extends<br />

the exclusion through the end<br />

of the 2013 but also retroactively applies<br />

it to QSBS acquired in 2012. Absent<br />

another extension, beginning<br />

by George Cabot<br />

January 1, 2014, QSBS will again be<br />

eligible for only a 50 percent exclusion<br />

and the excluded gain will be<br />

a tax preference item for alternative<br />

minimum tax purposes.<br />

That is the good news. The bad<br />

news is that California’s 50 percent<br />

exclusion has recently been found<br />

to be unconstitutional by the Court<br />

of Appeals in Cutler v. Franchise<br />

Tax Board, (2012) 208 Cal. App. 4th<br />

1247, which held that the provision<br />

violates the U.S. Constitution by<br />

discriminating in favor of California<br />

businesses. That means that QSBS<br />

qualifying for partial or full exclusion<br />

for federal income tax purposes<br />

will still be subject to California income<br />

tax at rates up to 13.3 percent<br />

(capital gains are not eligible for<br />

preferential tax rates in California).<br />

Taxpayers who relied upon this exclusion<br />

in prior tax periods that are<br />

not closed by the statute of limitations<br />

are required to amend their<br />

returns and recompute their taxable<br />

income without the exclusion.<br />

From a planning perspective, the<br />

temporary 100 percent exclusion<br />

for QSBS makes the C corporation<br />

an interesting alternative to passthrough<br />

entities (LLCs and S corporations)<br />

for start-ups. In addition,<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 15

Provisions,<br />

cont. from page 15<br />

existing LLCs and S corporations<br />

may want to explore conversion to<br />

C corporation status prior to the end<br />

of 2013. Will the exclusion be extended<br />

beyond 2013 or made applicable<br />

for California income tax purposes?<br />

There is certainly reason to<br />

hope so, given that the economy is<br />

likely to remain very sluggish well<br />

beyond 2013 or even return to recession<br />

as a result of the anti-growth<br />

policies currently being pursued in<br />

Sacramento and Washington.<br />

S Corporation: Built-in<br />

Gains Relief Provision<br />

C corporations can gain the benefit<br />

of a single level of taxation by converting<br />

to S corporations. However,<br />

converted S corporations remain<br />

subject to tax on built-in gains on<br />

assets that existed at the time of<br />

conversion. If the S corporation disposes<br />

of any BIG assets during the<br />

10-year period following conversion,<br />

the realized built-in gains are<br />

taxed at the highest C corporation<br />

tax rate, currently 35 percent. As a<br />

result of economic stimulus legislation<br />

in 2009 and 2010, the holding<br />

period for BIG assets was reduced.<br />

For tax years beginning in 2009 and<br />

2010, the holding period was seven<br />

years. For tax years beginning in<br />

2011, the holding period was five<br />

years, meaning that in 2011 an S<br />

corporation could sell BIG assets<br />

held as little as five years without<br />

being subject to BIG tax.<br />

Like the relief provision for QSBS<br />

discussed above, this S corporation<br />

relief provision expired at the end<br />

of 2011. However, ARTA 2012 extended<br />

the five-year holding period<br />

through the end of 2013 and made it<br />

retroactively applicable to 2012.<br />

What Wasn’t in ATRA<br />

2012 (but may be on<br />

the horizon):<br />

The U.S. corporate tax system has<br />

grown increasingly out of sync with<br />

the corporate tax structures in other<br />

developed countries. The U.S. currently<br />

taxes corporate income at a<br />

top rate of 35 percent - the highest<br />

among advanced world economies.<br />

The average is closer to 25 percent<br />

in most of the developed world.<br />

Moreover, most of the other developed<br />

countries have a territorial tax<br />

system, under which a company<br />

is taxed only on income generated<br />

domestically. The U.S., on the<br />

other hand, taxes a corporation on<br />

its worldwide income. Tax credits<br />

are available for taxes paid in a foreign<br />

jurisdiction, but if those taxes<br />

are imposed at a lower rate (which<br />

will usually be the case) the U.S.<br />

corporation effectively pays the<br />

higher U.S. tax rate. U.S. taxation of<br />

foreign earnings can be delayed by<br />

keeping the earnings inside foreign<br />

subsidiaries, but the earnings will<br />

be subject to U.S. taxation when<br />

repatriated to the U.S. According to<br />

J.P. Morgan, U.S. companies control<br />

$1.7 trillion in foreign earnings held<br />

outside the U.S., a portion of which<br />

would doubtless be repatriated and<br />

used for investment in the U.S. but<br />

for the disincentives in the current<br />

corporate tax system.<br />

There is an emerging consensus<br />

on both sides of the political aisle<br />

that the U.S. corporate tax system<br />

needs to be reformed to make it<br />

more competitive. President Obama<br />

has at least paid lip service to the<br />

notion in the presidential debates<br />

last fall. Proposals for legislative<br />

reforms are being actively debated,<br />

and the impetus for taking action is<br />

strong given the serious imbalance<br />

between the U.S. corporate tax system<br />

and that of our major trading<br />

partners.<br />

The outcome of reform proposals<br />

is far from certain, but what would<br />

be the implications of a reduction in<br />

top U.S. corporate tax rates to something<br />

in the 25 percent ballpark? A<br />

top corporate rate significantly below<br />

the individual rate, currently<br />

39.6 percent, will reduce the tax<br />

incentive for forming pass-through<br />

entities (LLCs and S corporations).<br />

There was a time in the past when<br />

a similar dynamic prevailed. For example,<br />

in the 1960s and 70s the top<br />

individual rate was 70 percent, but<br />

the top corporate rate was 35 percent.<br />

In those times it was not uncommon<br />

for closely held businesses<br />

to operate as C corporations. It was<br />

even common to hold real estate in<br />

C corporations – something that is<br />

considered the height of lunacy today.<br />

Nonetheless, if we again see a<br />

significant rate differential, it may<br />

be “back to the future.”<br />

Even without legislative reform,<br />

the temporary extension of the<br />

100 percent exclusion for QSBS discussed<br />

above gives the C corporation<br />

a comparative advantage in<br />

some situations through the end<br />

of 2013, and maybe later if it is extended.<br />

s<br />

1<br />

P.L. 112-240, signed by the President on<br />

January 3, 2013.<br />

2<br />

The definition of “qualified trade or business”<br />

excludes investment companies,<br />

professional services and consulting,<br />

banking, insurance and other financial<br />

services, farming, oil & gas or mineral extraction,<br />

and the hotel, motel or restaurant<br />

business.<br />

George S. Cabot is a Partner at<br />

PremierCounsel LLP, with offices<br />

in San Francisco and Lafayette.<br />

George is a Certified Tax Specialist<br />

with a business transactional practice<br />

focusing on structuring business<br />

entities, M&A and entity level<br />

tax planning.<br />

Win A $100 GIFT CARD!<br />

We will be sending out a<br />

member survey via email this<br />

month and would greatly appreciate<br />

your feedback. When<br />

you receive it, please complete<br />

the survey for a chance to win<br />

a $100 gift card to the store<br />

or restaurant of your choice!<br />

16<br />

MARCH 2013

IRS Return Preparer Regs Derailed<br />

by Warren Peterson<br />

On January 18, 2013, the<br />

United States District<br />

Court for the District of Columbia<br />

decided Loving v.<br />

Internal Revenue Service, 1 derailed<br />

the IRS’ efforts to regulate hundreds<br />

of thousands of tax return preparers<br />

who are not attorneys, CPAs or<br />

enrolled agents with the IRS (hereinafter<br />

“unenrolled preparer”). The<br />

IRS had promulgated regulations<br />

that required unenrolled preparers<br />

to register with the IRS, pass a<br />

qualifying exam, pay an annual<br />

application fee and take 15 hours of<br />

continuing education each year.<br />

Three unenrolled preparers<br />

brought suit to enjoin the regulations.<br />

In an opinion issued just in<br />

time to throw things into a turmoil<br />

for this tax season, the District Court<br />

granted summary judgment to the<br />

plaintiffs finding that the IRS did<br />

not have the statutory authority to<br />

regulate unenrolled preparers.<br />

The IRS’ effort to regulate unenrolled<br />

preparers was prompted by<br />

Youngman & Ericsson, LLP<br />

1981 North Broadway • Suite 300<br />

Walnut Creek, CA 94596<br />

Tax Lawyers.<br />

www.youngman.com (925) 930-6000<br />

the increasing importance of third<br />

parties and tax preparation software<br />

in the preparation of tax returns.<br />

In 2007 and 2008, over 80 percent<br />

of federal individual income tax<br />

returns were prepared by paid tax<br />

preparers or by taxpayers using tax<br />

preparation software. The IRS has<br />

estimated that there may be 1.2 million<br />

paid preparers. 2<br />

Organizations such as the IRS National<br />

Taxpayer Advocate 3 and the<br />

Treasury Inspector General for Tax<br />

Administration (TIGTA) 4 have each<br />

identified errors and omissions in<br />

the preparation of tax returns by<br />

both unenrolled preparers and national<br />

tax preparation chains. Many<br />

critics argued that the wide-open<br />

nature of the industry makes it difficult<br />

to ensure minimum competence<br />

and ethical standards for unenrolled<br />

preparers. 5<br />

The IRS has been focusing on<br />

this issue since June 2009, when the<br />

Commissioner of the IRS, Douglas<br />

Shulman, initiated the Return Preparer<br />

Review. The IRS solicited input<br />

from the public which led to the<br />

following recommendations:<br />

1. Mandatory tax return preparer<br />

registration.<br />

2. Mandatory competency examinations<br />

for unenrolled preparers.<br />

3. Required continuing professional<br />

education for unenrolled<br />

preparers.<br />

4. Extension to unenrolled preparers<br />

of the ethical standards established<br />

by Treasury Department<br />

Circular 230. 6<br />

The IRS implemented these recommendations<br />

by adopting regulations.<br />

The system was to go into full<br />

effect as of the beginning of 2013.<br />

The IRS reported that 88 percent<br />

of those expressing an opinion favored<br />

registration of unenrolled<br />

preparers. Those who addressed<br />

the issues of minimum education<br />

and testing requirements were 90<br />

percent in favor of such requirements.<br />

7 At the same time, others did<br />

not favor the direction the IRS was<br />

taking on regulation of unenrolled<br />

preparers. There were objections to<br />

the costs and burden the regulatory<br />

regime would place on return preparers,<br />

with the costs likely being<br />

passed onto taxpayers. 8<br />

This opposition to the new regulatory<br />

requirements prompted the<br />

filing of Loving. The District Court<br />

determined that the key question<br />

was whether tax return preparers<br />

are ‘representatives’ who ‘practice’<br />

before the IRS” (Loving, p. 9). The<br />

court considered the meaning of<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 17

IRS Return,<br />

cont. from page 17<br />

statutory language about “presenting<br />

their cases” and concluded that<br />

normal usage of the term would not<br />

include the tax return preparation<br />

activities of unenrolled preparers,<br />

striking down the regulations.<br />

The IRS will file an appeal by early<br />

March 2013. 9 s<br />

1<br />

https://ecf.dcd.uscourts.gov/cgi-bin/<br />

show_public_doc?2012cv0385-22<br />

2<br />

AICPA Tax Advisor, Regulation of Tax Return<br />

Preparers, May 1, 2011.<br />

3<br />

National Taxpayer Advocate, 2009 Annual<br />

Report to Congress, Vol. 1 (December<br />

31, 2009).<br />

4<br />

TIGTA, Inadequate Data on Paid Preparers<br />

Impedes Effective Oversight (2009-40-<br />

098), (July 14, 2009).<br />

5<br />

IRS Return Preparers Review, December<br />

2009, pp. 24-30.<br />

6<br />

Supra, pp. 3-4.<br />

Roger F. Allen<br />

510.832-7770<br />

Ericksen, Arbuthnot<br />

155 Grand Avenue, Suite 1050<br />

Oakland, CA 94612<br />

rallen@ericksenarbuthnot.com<br />

Northern California<br />

Mediator / Arbitrator<br />

16 years as Mediator<br />

25 years as Arbitrator<br />

33 years in Civil Practice<br />

• Training includes Mediation Course at<br />

Pepperdine University 1995<br />

• Serving on Kaiser Medical Malpractice<br />

Neutral Arbitrators Panel<br />

• Settlement Commissioner, Alameda and<br />

<strong>Contra</strong> <strong>Costa</strong> Counties<br />

• Experienced in all areas of Tort Litigation,<br />

including injury, property damage, fire loss,<br />

malpractice, construction defect<br />

7<br />

Supra, p. 2.<br />

8<br />

Supra, p. 32.<br />

9<br />

www.irs.gov/uac/IRS-Statement-on-<br />

Court-Ruling-Related-to-Return-Preparers<br />

Warren R. Peterson, a Danville<br />

sole practitioner, has been practicing<br />

law in one form or another<br />

for several years. He is a graduate<br />

of New York University School of<br />

Law and holds an M.S. in Taxation<br />

from California State University<br />

East Bay. Warren has extensive experience<br />

in various areas of corporate<br />

law and was employed as<br />

a Revenue Agent by the Internal<br />

Revenue Service. He is presently<br />

concentrating his practice in the<br />

area of tax conflicts, defending taxpayers<br />

in disputes with federal and<br />

California state tax authorities.<br />

— WANTED —<br />

Conservatorships<br />

think<br />

Matt Toth<br />

as in<br />

Pedder, Hesseltine,<br />

Walker & Toth, LLP<br />

oldest partnership in <strong>Contra</strong> <strong>Costa</strong> <strong>County</strong><br />

(since 1955)<br />

p 925.283-6816 • f 925.283-3683<br />

3445 Golden Gate Way, P.O. Box 479<br />

Lafayette, CA 94549-0479<br />

AV Martindale-Hubbell<br />

David B. Pastor<br />

GET INVOLVED<br />

Learn more about the CCCBA,<br />

its sections,<br />

committees,<br />

and upcoming<br />

events at<br />

www.cccba.org<br />

ConServAtorShiPS<br />

ProBAteS<br />

CriMinAl DefenSe<br />

• Free Consultation •<br />

Law Offices of<br />

DAviD B. PAStor<br />

CCCBA MeMBer<br />

SinCe 1977<br />

www.davidbpastor.com<br />

1280 Boulevard Way, Suite 212 • Walnut Creek, CA 94595<br />

925-932-3346 • david@davidbpastor.com<br />

18<br />

MARCH 2013

Annual Officer<br />

Installation<br />

January 25, 2013<br />

The Honorable <strong>Bar</strong>ry P. Goode administering the oath<br />

Fireside Chat with the Honorable<br />

Goodwin Liu<br />

Board of Directors and Section<br />

Leaders taking the oath<br />

CCCBA 2012 President<br />

Audrey Gee<br />

CCCBA 2013 Board President Jay<br />

Chafetz presenting Richard Frankel<br />

with a plaque honoring his many<br />

years of volunteer service to the CCCBA<br />

Photos courtesy of Michael Moya,<br />

MOYA fotografx | ArType Studio<br />

www.moyafotografx.com<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 19

Meet Your New Judge:<br />

Judy Johnson<br />

Administration of the oath by the Honorable<br />

Thelton E. Henderson<br />

Presentation of the judicial robe by<br />

Delores Fontenberry and Maxine Johnson<br />

CCCBA Board President Jay Chafetz presenting the gavel<br />

JUDY JOHNSON was inducted on February 1, 2013. She<br />

has been named as one of 20 “Women Leaders in Law” by The<br />

Recorder in 2011. Last year she came out of retirement and accepted<br />

an appointment by Governor Brown to the <strong>Contra</strong> <strong>Costa</strong><br />

<strong>County</strong> Superior Court.<br />

The Honorable Diana Becton, Starr Babcock, Esq.<br />

and the Honorable Teri L. Jackson<br />

After graduating from King Hall School of Law at UC Davis,<br />

Judy became a legal aid attorney in Oakland, and soon after<br />

was appointed as Assistant District Attorney for the city and<br />

county of San Francisco. In 2000, Judy took the position as the<br />

State <strong>Bar</strong>’s executive director and served for 11 years, the longest<br />

that the position has been held in California history.<br />

Judy is also extensively involved in community affairs as the<br />

elected board president for the California Consumer Protection<br />

Foundation.<br />

The Honorable Willie Lewis Brown Jr.<br />

20<br />

MARCH 2013

Meet Your New<br />

Commissioner:<br />

ANITA SANTOS is excited to<br />

be the new child support commissioner.<br />

Prior to her appointment,<br />

Anita had a private practice in Solano<br />

<strong>County</strong> as a sole practitioner in<br />

family law since 2008.<br />

After graduating from UC Berkeley,<br />

Anita attended Hastings College<br />

of the Law in San Francisco. In<br />

1994, she began her career as a police<br />

officer in Concord. She moved<br />

on to become a deputy district attorney<br />

in <strong>Contra</strong> <strong>Costa</strong> <strong>County</strong> from<br />

1997 through 2008.<br />

Anita has been married to her<br />

husband, Mitch Celaya, for 17 years.<br />

Mitch is chief of police in Calistoga.<br />

They have four children: JC, 23 years<br />

old, Nile, 16 years old, Mateo, 12<br />

years old and four-year-old Lanissa.<br />

Anita Santos<br />

CONTRA COSTA COUNTY BAR ASSOCIATION CONTRA COSTA LAWYER 21

Judicial Demeanor<br />

Training<br />

In January, CCCBA members responded to the call from the CCC<br />

Superior Court for Pro Tem Judges. Participants in the Judicial<br />

Demeanor training classes learned about appropriate bench<br />

conduct, demeanor and decorum. Discussing potential scenarios<br />

led to much laughter among participants!<br />

The Honorable Jill Fannin and the<br />

Honorable Theresa Canepa<br />

Joscelyn Jones Torru and Helen Peters<br />

Katherine Wenger<br />

Women’s Section<br />

January 16, 2013<br />

Powerlunch<br />

Nicole Mills and Robin Krutzsch<br />

Margaret Grover, Michelle Thimesch,<br />

Ericka Ackeret and Michelle McGrath<br />

Lubna Jahangiri, Victoria Robinson Smith<br />

and Marta Vanegas<br />

22<br />

MARCH 2013

Meet Your Local Judges,<br />

Family and Juvenile<br />

February 7, 2013<br />

Andy Ross introducing the judges<br />