Annual Report on Form 20-F 2008 - Petrobras

Annual Report on Form 20-F 2008 - Petrobras

Annual Report on Form 20-F 2008 - Petrobras

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Pre-salt reservoir<br />

<str<strong>on</strong>g>Annual</str<strong>on</strong>g> <str<strong>on</strong>g>Report</str<strong>on</strong>g> <strong>on</strong><br />

<strong>Form</strong> <strong>20</strong>-F <strong>20</strong>08

Commissi<strong>on</strong>FileNumber00115106<br />

PetróleoBrasileiroS.A.—PETROBRAS<br />

(Exactnameofregistrantasspecifiedinitscharter)<br />

BrazilianPetroleumCorporati<strong>on</strong>—<strong>Petrobras</strong><br />

(Translati<strong>on</strong>ofregistrant'snameintoEnglish)<br />

TheFederativeRepublicofBrazil<br />

(Jurisdicti<strong>on</strong>ofincorporati<strong>on</strong>ororganizati<strong>on</strong>)<br />

<br />

AvenidaRepúblicadoChile,65<br />

<strong>20</strong>031912–RiodeJaneiro–RJ<br />

Brazil<br />

(Addressofprincipalexecutiveoffices)<br />

AlmirGuilhermeBarbassa<br />

(5521)3224<strong>20</strong>40–barbassa@petrobras.com.br<br />

AvenidaRepúblicadoChile,65–23 rd Floor<br />

<strong>20</strong>031912–RiodeJaneiro–RJ<br />

Brazil<br />

UNITEDSTATESSECURITIESANDEXCHANGECOMMISSION<br />

WASHINGTON,D.C.<strong>20</strong>549<br />

FORM<strong>20</strong>F<br />

ANNUALREPORT<br />

PURSUANTTOSECTION13OR15(d)<br />

OFTHESECURITIESEXCHANGEACTOF1934<br />

forthefiscalyearendedDecember31,<strong>20</strong>08<br />

Commissi<strong>on</strong>FileNumber:00133121<br />

<strong>Petrobras</strong>Internati<strong>on</strong>alFinanceCompany<br />

(Exactnameofregistrantasspecifiedinitscharter)<br />

<br />

CaymanIsland<br />

(Jurisdicti<strong>on</strong>ofincorporati<strong>on</strong>ororganizati<strong>on</strong>)<br />

<br />

HarbourPlace<br />

103SouthChurchStreet,4thfloor<br />

P.O.Box1034GT—BWI<br />

GeorgeTown,GrandCaymanCaymanIslands<br />

(Addressofprincipalexecutiveoffices)<br />

SérvioTúliodaRosaTinoco<br />

(5521)32241410–ttinoco@petrobras.com.br<br />

AvenidaRepúblicadoChile,65–3 rd Floor<br />

<strong>20</strong>031912–RiodeJaneiro–RJ<br />

Brazil<br />

(Name,teleph<strong>on</strong>e,emailand/orfacsimilenumberandaddressofcompany<br />

c<strong>on</strong>tactpers<strong>on</strong>)<br />

(Name,teleph<strong>on</strong>e,emailand/orfacsimilenumberandaddressofcompany<br />

c<strong>on</strong>tactpers<strong>on</strong>)<br />

SecuritiesregisteredortoberegisteredpursuanttoSecti<strong>on</strong>12(b)oftheAct:<br />

Titleofeachclass: Nameofeachexchange<strong>on</strong>whichregistered: <br />

<strong>Petrobras</strong>Comm<strong>on</strong>Shares,withoutparvalue<br />

NewYorkStockExchange*<br />

<strong>Petrobras</strong>AmericanDepositaryShares,orADSs<br />

NewYorkStockExchange<br />

(evidencedbyAmericanDepositaryReceipts,orADRs),<br />

eachrepresenting2Comm<strong>on</strong>Shares<br />

<strong>Petrobras</strong>PreferredShares,withoutparvalue*<br />

NewYorkStockExchange*<br />

<strong>Petrobras</strong>AmericanDepositaryShares<br />

NewYorkStockExchange<br />

(asevidencedbyAmericanDepositaryReceipts),<br />

eachrepresenting2PreferredShares<br />

6.125%GlobalNotesdue<strong>20</strong>16,issuedbyPifCo<br />

NewYorkStockExchange<br />

5.875%GlobalNotesdue<strong>20</strong>18,issuedbyPifCo<br />

NewYorkStockExchange<br />

7.875%GlobalNotesdue<strong>20</strong>19,issuedbyPifCo<br />

NewYorkStockExchange<br />

*Notfortrading,but<strong>on</strong>lyinc<strong>on</strong>necti<strong>on</strong>withtheregistrati<strong>on</strong>ofAmericanDepositarySharespursuanttotherequirementsoftheNewYorkStockExchange.<br />

SecuritiesregisteredortoberegisteredpursuanttoSecti<strong>on</strong>12(g)oftheAct:N<strong>on</strong>e<br />

Securitiesforwhichthereisareportingobligati<strong>on</strong>pursuanttoSecti<strong>on</strong>15(d)oftheAct:<br />

Titleofeachclass:<br />

9.750%SeniorNotesdue<strong>20</strong>11,issuedbyPifCo<br />

9.125%GlobalNotesdue<strong>20</strong>13,issuedbyPifCo<br />

7.75%GlobalNotesdue<strong>20</strong>14,issuedbyPifCo<br />

8.375%GlobalNotesdue<strong>20</strong>18,issuedbyPifCo<br />

Thenumberofoutstandingsharesofeachclassofstockof<strong>Petrobras</strong>andPifCoasofDecember31,<strong>20</strong>08was:<br />

5,073,347,344<strong>Petrobras</strong>Comm<strong>on</strong>Shares,withoutparvalue<br />

3,700,729,396<strong>Petrobras</strong>PreferredShares,withoutparvalue<br />

300,050,000PifCoComm<strong>on</strong>Shares,atparvalueU.S.$1pershare.<br />

Indicatebycheckmarkiftheregistrantisawellknownseas<strong>on</strong>edissuer,asdefinedbyRule405oftheSecuritiesAct.<br />

YesNo<br />

Ifthisreportisanannualortransiti<strong>on</strong>alreport,indicatebycheckmarkiftheregistrantisnotrequiredtofilereportspursuanttosecti<strong>on</strong>13or15(d)oftheSecurities<br />

ExchangeActof1934.<br />

YesNo<br />

Indicatebycheckmarkwhethertheregistrant(1) hasfiledallreportsrequiredtobefiledbySecti<strong>on</strong>13or15(d)oftheSecuritiesExchangeActof1934duringthe<br />

preceding12m<strong>on</strong>ths(orforsuchshorterperiodthattheregistrantwasrequiredtofilesuchreports),and(2)hasbeensubjecttosuchfilingrequirementsforthepast90<br />

days.<br />

YesNo<br />

Indicate by check mark whether the registrant has submitted electr<strong>on</strong>ically and posted <strong>on</strong> its corporate Web site, if any, every Interactive Data File required to be<br />

submittedandpostedpursuanttoRule405ofRegulati<strong>on</strong>ST(§232.405ofthischapter)duringthepreceding12m<strong>on</strong>ths(orforsuchshorterperiodthattheregistrant<br />

wasrequiredtosubmitandpostsuchfiles).N/A<br />

YesNo<br />

Indicatebycheckmarkwhethertheregistrantisalargeacceleratedfiler,anacceleratedfiler,oran<strong>on</strong>acceleratedfiler.Seedefiniti<strong>on</strong>of“acceleratedfiler”inRule12b<br />

2oftheExchangeAct.(Check<strong>on</strong>e):<br />

Largeacceleratedfiler[<strong>Petrobras</strong>]AcceleratedfilerN<strong>on</strong>acceleratedfiler[PifCo]<br />

Indicatebycheckmarkwhichbasisofaccountingtheregistranthasusedtopreparethefinancialstatementsincludedinthisfiling:<br />

U.S.GAAP Internati<strong>on</strong>alFinancial<str<strong>on</strong>g>Report</str<strong>on</strong>g>ingStandardsasissuedbytheInternati<strong>on</strong>alAccountingStandardsBoard Other<br />

If“Other”hasbeencheckedinresp<strong>on</strong>setothepreviousquesti<strong>on</strong>,indicatebycheckmarkwhichfinancialstatementitemtheregistranthaselectedtofollow.<br />

Item17Item18<br />

Ifthisisanannualreport,indicatebycheckmarkwhethertheregistrantisashellcompany(asdefinedinRule12b2oftheExchangeAct).<br />

YesNo

TABLEOFCONTENTS<br />

Page<br />

ForwardLookingStatements..................................................................................................................................1<br />

GlossaryofPetroleumIndustryTerms....................................................................................................................3<br />

C<strong>on</strong>versi<strong>on</strong>Table....................................................................................................................................................5<br />

Abbreviati<strong>on</strong>s.........................................................................................................................................................6<br />

Presentati<strong>on</strong>ofFinancialInformati<strong>on</strong>.....................................................................................................................7<br />

<strong>Petrobras</strong>....................................................................................................................................7<br />

PifCo...........................................................................................................................................7<br />

RecentDevelopments ............................................................................................................................................8<br />

Presentati<strong>on</strong>ofInformati<strong>on</strong>C<strong>on</strong>cerningReserves ..................................................................................................8<br />

PARTI<br />

Item1. IdentityofDirectors,SeniorManagementandAdvisers...............................................................9<br />

Item2.<br />

Item3.<br />

Item4.<br />

Item4A.<br />

Item5.<br />

OfferStatisticsandExpectedTimetable.......................................................................................9<br />

KeyInformati<strong>on</strong> ..........................................................................................................................9<br />

SelectedFinancialData ...............................................................................................................9<br />

ExchangeRates......................................................................................................................... 12<br />

RiskFactors............................................................................................................................... 13<br />

RisksRelatingtoOurOperati<strong>on</strong>s ............................................................................................... 13<br />

RisksRelatingtoPifCo............................................................................................................... 17<br />

RisksRelatingtoOurRelati<strong>on</strong>shipwiththeBrazilianGovernment ............................................. 18<br />

RisksRelatingtoBrazil............................................................................................................... 18<br />

RisksRelatingtoOurEquityandDebtSecurities........................................................................ <strong>20</strong><br />

Informati<strong>on</strong><strong>on</strong>theCompany .................................................................................................... 23<br />

HistoryandDevelopment.......................................................................................................... 23<br />

OverviewoftheGroup.............................................................................................................. 24<br />

Explorati<strong>on</strong>andProducti<strong>on</strong>....................................................................................................... 27<br />

Supply(Downstream–Brazil).................................................................................................... 35<br />

Distributi<strong>on</strong>............................................................................................................................... 42<br />

GasandEnergy(Gas,PowerandRenewables—Brazil)............................................................... 43<br />

Internati<strong>on</strong>al............................................................................................................................. 52<br />

Informati<strong>on</strong><strong>on</strong>PifCo................................................................................................................. 58<br />

Organizati<strong>on</strong>alStructure ........................................................................................................... 60<br />

Property,PlantsandEquipment................................................................................................ 62<br />

Regulati<strong>on</strong>oftheOilandGasIndustryinBrazil.......................................................................... 62<br />

Health,SafetyandEnvir<strong>on</strong>mentalInitiatives.............................................................................. 64<br />

Insurance.................................................................................................................................. 66<br />

UnresolvedStaffComments...................................................................................................... 66<br />

OperatingandFinancialReviewandProspects.......................................................................... 66<br />

Management'sDiscussi<strong>on</strong>andAnalysisof<strong>Petrobras</strong>'FinancialC<strong>on</strong>diti<strong>on</strong>andResultsof<br />

Operati<strong>on</strong>s................................................................................................................................ 66<br />

Overview .................................................................................................................................. 66<br />

SalesVolumesandPrices .......................................................................................................... 67<br />

EffectofTaxes<strong>on</strong>OurIncome................................................................................................... 68<br />

Inflati<strong>on</strong>andExchangeRateVariati<strong>on</strong> ....................................................................................... 68<br />

ResultsofOperati<strong>on</strong>s................................................................................................................ 69<br />

ResultsofOperati<strong>on</strong>s—<strong>20</strong>08comparedto<strong>20</strong>07........................................................................ 70<br />

ResultsofOperati<strong>on</strong>s—<strong>20</strong>07comparedto<strong>20</strong>06........................................................................ 76<br />

Additi<strong>on</strong>alBusinessSegmentInformati<strong>on</strong> ................................................................................. 83<br />

Management'sDiscussi<strong>on</strong>andAnalysisofPifCo’sFinancialC<strong>on</strong>diti<strong>on</strong>andResultsofOperati<strong>on</strong>s84<br />

Overview .................................................................................................................................. 84<br />

PurchasesandSalesofCrudeOilandOilProducts..................................................................... 84<br />

<br />

<br />

i

Item6.<br />

Item7.<br />

Item8.<br />

Item9.<br />

Item10.<br />

Item11.<br />

Item12.<br />

Item13.<br />

Item14.<br />

Item15.<br />

<br />

<br />

ResultsofOperati<strong>on</strong>s—<strong>20</strong>08comparedto<strong>20</strong>07........................................................................ 84<br />

ResultsofOperati<strong>on</strong>s—<strong>20</strong>07comparedto<strong>20</strong>06........................................................................ 85<br />

LiquidityandCapitalResources................................................................................................. 86<br />

<strong>Petrobras</strong>.................................................................................................................................. 86<br />

PifCo......................................................................................................................................... 89<br />

C<strong>on</strong>tractualObligati<strong>on</strong>s............................................................................................................. 94<br />

<strong>Petrobras</strong>.................................................................................................................................. 94<br />

PifCo......................................................................................................................................... 94<br />

CriticalAccountingPoliciesandEstimates ................................................................................. 94<br />

ImpactofNewAccountingStandards........................................................................................ 98<br />

ResearchandDevelopment..................................................................................................... 100<br />

Trends .................................................................................................................................... 100<br />

Directors,SeniorManagementandEmployees........................................................................ 102<br />

DirectorsandSeniorManagement.......................................................................................... 102<br />

Compensati<strong>on</strong>......................................................................................................................... 108<br />

ShareOwnership..................................................................................................................... 108<br />

FiscalCouncil .......................................................................................................................... 108<br />

<strong>Petrobras</strong>AuditCommittee..................................................................................................... 109<br />

OtherAdvisoryCommittees .................................................................................................... 110<br />

<strong>Petrobras</strong>Ombudsman ........................................................................................................... 110<br />

PifCoAdvisoryCommittees ..................................................................................................... 110<br />

EmployeesandLaborRelati<strong>on</strong>s............................................................................................... 110<br />

MajorShareholdersandRelatedPartyTransacti<strong>on</strong>s................................................................ 112<br />

MajorShareholders................................................................................................................. 112<br />

<strong>Petrobras</strong>RelatedPartyTransacti<strong>on</strong>s...................................................................................... 113<br />

PifCoRelatedPartyTransacti<strong>on</strong>s............................................................................................. 114<br />

FinancialInformati<strong>on</strong> .............................................................................................................. 116<br />

<strong>Petrobras</strong>C<strong>on</strong>solidatedStatementsandOtherFinancialInformati<strong>on</strong> ...................................... 116<br />

PifCoC<strong>on</strong>solidatedStatementsandOtherFinancialInformati<strong>on</strong> ............................................. 116<br />

LegalProceedings ................................................................................................................... 116<br />

DividendDistributi<strong>on</strong> .............................................................................................................. 1<strong>20</strong><br />

TheOfferandListing............................................................................................................... 121<br />

<strong>Petrobras</strong>................................................................................................................................ 121<br />

PifCo....................................................................................................................................... 122<br />

Additi<strong>on</strong>alInformati<strong>on</strong>............................................................................................................ 123<br />

MemorandumandArticlesofIncorporati<strong>on</strong>of<strong>Petrobras</strong>........................................................ 123<br />

Restricti<strong>on</strong>s<strong>on</strong>N<strong>on</strong>BrazilianHolders...................................................................................... 130<br />

TransferofC<strong>on</strong>trol.................................................................................................................. 130<br />

DisclosureofShareholderOwnership...................................................................................... 130<br />

MemorandumandArticlesofAssociati<strong>on</strong>ofPifCo .................................................................. 131<br />

MaterialC<strong>on</strong>tracts .................................................................................................................. 134<br />

<strong>Petrobras</strong>ExchangeC<strong>on</strong>trols................................................................................................... 134<br />

Taxati<strong>on</strong>RelatingtoOurADSsandComm<strong>on</strong>andPreferredShares.......................................... 135<br />

Taxati<strong>on</strong>RelatingtoPifCo'sNotes........................................................................................... 142<br />

Documents<strong>on</strong>Display............................................................................................................. 145<br />

QualitativeandQuantitativeDisclosuresaboutMarketRisk .................................................... 145<br />

<strong>Petrobras</strong>................................................................................................................................ 145<br />

PifCo....................................................................................................................................... 148<br />

Descripti<strong>on</strong>ofSecuritiesotherthanEquitySecurities.............................................................. 150<br />

PARTII<br />

Defaults,DividendArrearagesandDelinquencies.................................................................... 150<br />

MaterialModificati<strong>on</strong>stotheRightsofSecurityHoldersandUseofProceeds ......................... 150<br />

C<strong>on</strong>trolsandProcedures......................................................................................................... 150<br />

ii

Item16A.<br />

Item16B.<br />

Item16C.<br />

Item16D.<br />

Item16E.<br />

Item16F.<br />

Item16G.<br />

Evaluati<strong>on</strong>ofDisclosureC<strong>on</strong>trolsandProcedures ................................................................... 150<br />

Management's<str<strong>on</strong>g>Report</str<strong>on</strong>g><strong>on</strong>InternalC<strong>on</strong>trolOverFinancial<str<strong>on</strong>g>Report</str<strong>on</strong>g>ing........................................ 150<br />

ChangesinInternalC<strong>on</strong>trols.................................................................................................... 151<br />

AuditCommitteeFinancialExpert ........................................................................................... 151<br />

CodeofEthics......................................................................................................................... 151<br />

PrincipalAccountantFeesandServices ................................................................................... 152<br />

AuditandN<strong>on</strong>AuditFees ....................................................................................................... 152<br />

AuditCommitteeApprovalPoliciesandProcedures................................................................. 153<br />

Exempti<strong>on</strong>sfromtheListingStandardsforAuditCommittees.................................................. 153<br />

PurchasesofEquitySecuritiesbytheIssuerandAffiliatedPurchasers ..................................... 153<br />

ChangeinRegistrant’sCertifyingAccountant .......................................................................... 153<br />

CorporateGovernance............................................................................................................ 154<br />

PARTIII<br />

FinancialStatements............................................................................................................... 156<br />

FinancialStatements............................................................................................................... 156<br />

Item17.<br />

Item18.<br />

Item19 Exhibits................................................................................................................................... 157<br />

Signatures.......................................................................................................................................................... 162<br />

Signatures.......................................................................................................................................................... 163<br />

<br />

<br />

<br />

iii

FORWARDLOOKINGSTATEMENTS<br />

Many statements made in this annual<br />

report are forwardlooking statements within the<br />

meaning of Secti<strong>on</strong> 27A of the Securities Act of<br />

1933,asamended(SecuritiesAct),andSecti<strong>on</strong>21E<br />

oftheSecuritiesExchangeActof1934,asamended<br />

(ExchangeAct),thatarenotbased<strong>on</strong>historicalfacts<br />

and arenot assurances of future results.Many of<br />

the forwardlooking statements c<strong>on</strong>tained in this<br />

annual report may be identified by the use of<br />

forwardlookingwords,suchas“believe,”“expect,”<br />

“anticipate,” “should,” “planned,” “estimate” and<br />

“potential,”am<strong>on</strong>gothers.Wehavemadeforward<br />

looking statements that address, am<strong>on</strong>g other<br />

things,our:<br />

<br />

our ability to find, acquire or gain<br />

access to additi<strong>on</strong>al reserves and to<br />

successfullydevelopourcurrent<strong>on</strong>es;<br />

uncertainties inherent in making<br />

estimates of our oil and gas reserves<br />

including recently discovered oil and<br />

gasreserves;<br />

<br />

<br />

competiti<strong>on</strong>;<br />

technicaldifficultiesintheoperati<strong>on</strong>of<br />

our equipment and the provisi<strong>on</strong> of<br />

ourservices;<br />

<br />

regi<strong>on</strong>al marketing and expansi<strong>on</strong><br />

strategy;<br />

<br />

changes in, or failure to comply with,<br />

lawsorregulati<strong>on</strong>s;<br />

drilling and other explorati<strong>on</strong><br />

activities;<br />

<br />

importandexportactivities;<br />

projected and targeted capital<br />

expenditures and other costs,<br />

commitmentsandrevenues;<br />

<br />

liquidity;and<br />

<br />

<br />

<br />

receiptofgovernmentalapprovalsand<br />

licenses;<br />

internati<strong>on</strong>al and Brazilian political,<br />

ec<strong>on</strong>omic and social developments;<br />

military operati<strong>on</strong>s, acts of terrorism<br />

orsabotage,warsorembargoes;<br />

the cost and availability of adequate<br />

insurancecoverage;and<br />

<br />

development of additi<strong>on</strong>al revenue<br />

sources.<br />

<br />

other factors discussed below under<br />

“RiskFactors.”<br />

Because these forwardlooking statements<br />

involverisksanduncertainties,thereareimportant<br />

factors that could cause actual results to differ<br />

materiallyfromthoseexpressedorimpliedbythese<br />

forwardlookingstatements.Thesefactorsinclude,<br />

am<strong>on</strong>gotherthings:<br />

<br />

ourabilitytoobtainfinancing;<br />

general ec<strong>on</strong>omic and business<br />

c<strong>on</strong>diti<strong>on</strong>s, including crude oil and<br />

other commodity prices, refining<br />

marginsandprevailingexchangerates;<br />

<br />

global ec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s and the<br />

currentglobalcreditcrisis;<br />

These statements are not guarantees of<br />

futureperformanceandaresubjecttocertainrisks,<br />

uncertainties and assumpti<strong>on</strong>s that are difficult to<br />

predict.Therefore, our actual results could differ<br />

materially from those expressed or forecast in any<br />

forwardlooking statements as a result of a variety<br />

offactors,includingthosein“RiskFactors”setforth<br />

below.<br />

All forwardlooking statements are<br />

expressly qualified in their entirety by this<br />

cauti<strong>on</strong>ary statement, and you should not place<br />

reliance <strong>on</strong> any forwardlooking statement<br />

c<strong>on</strong>tained inthis annual report.We undertake no<br />

obligati<strong>on</strong>topubliclyupdateorreviseanyforward<br />

looking statements, whether as a result of new<br />

informati<strong>on</strong> or future events or for any other<br />

reas<strong>on</strong>.<br />

<br />

<br />

1

Thecrudeoilandnaturalgasreservedata<br />

presented or described in this annual report are<br />

<strong>on</strong>lyestimatesandouractualproducti<strong>on</strong>,revenues<br />

andexpenditureswithrespecttoourreservesmay<br />

materiallydifferfromtheseestimates.<br />

This is the annual report of both Petróleo<br />

Brasileiro S.A.—PETROBRAS (<strong>Petrobras</strong>) and its<br />

direct wholly owned Cayman Islands subsidiary,<br />

<strong>Petrobras</strong> Internati<strong>on</strong>al Finance Company (PifCo).<br />

PifCo's operati<strong>on</strong>s, which c<strong>on</strong>sist principally of<br />

purchases and sales of crude oil and oil products,<br />

aredescribedinfurtherdetailbelow.<br />

<br />

Unlessthec<strong>on</strong>textotherwiserequires,the<br />

terms “<strong>Petrobras</strong>,” “we,” “us,” and “our” refer to<br />

Petróleo Brasileiro S.A.—PETROBRAS and its<br />

c<strong>on</strong>solidated subsidiaries and special purpose<br />

companies, including <strong>Petrobras</strong> Internati<strong>on</strong>al<br />

Finance Company. The term “PifCo” refers to<br />

<strong>Petrobras</strong> Internati<strong>on</strong>al Finance Company and its<br />

subsidiaries.<br />

<br />

<br />

<br />

2

GLOSSARYOFPETROLEUMINDUSTRYTERMS<br />

Unlessthec<strong>on</strong>textindicatesotherwise,thefollowingtermshavethemeaningsshownbelow:<br />

ANP.......................................... The Agência Naci<strong>on</strong>al de Petróleo, Gás Natural e Biocombustíveis (Nati<strong>on</strong>al<br />

Petroleum, Natural Gas and Biofuels Agency), or ANP, is the federal agency that<br />

regulatestheoil,naturalgasandrenewablefuelsindustryinBrazil.<br />

Barrels...................................... Barrelsofcrudeoil.<br />

BSW......................................... Basicsedimentandwater,ameasurementofthewaterandsedimentc<strong>on</strong>tentof<br />

flowingcrudeoil.<br />

Catalyticcracking ..................... Aprocessbywhichhydrocarb<strong>on</strong>moleculesarebrokendown(cracked)intolighter<br />

fracti<strong>on</strong>sbytheacti<strong>on</strong>ofacatalyst.<br />

Coker ....................................... Avesselinwhichbitumeniscrackedintoitsfracti<strong>on</strong>s.<br />

C<strong>on</strong>densate.............................. Light hydrocarb<strong>on</strong> substances produced with natural gas, which c<strong>on</strong>dense into<br />

liquidatnormaltemperaturesandpressures.<br />

Deepwater .............................. Between300and1,500meters(984and4,921feet)deep.<br />

Distillati<strong>on</strong>................................ A process by which liquids are separated or refined by vaporizati<strong>on</strong> followed by<br />

c<strong>on</strong>densati<strong>on</strong>.<br />

EWT ......................................... Extendedwelltest<br />

FPSO ........................................ FloatingProducti<strong>on</strong>,StorageandOffloadingUnit.<br />

FPU .......................................... FloatingProducti<strong>on</strong>Unit.<br />

FSO .......................................... FloatingStorageandOffloadingUnit.<br />

FSRU ........................................ FloatingStorageandRegasificati<strong>on</strong>Unit,avesselthatreceivesliquefiednaturalgas<br />

andc<strong>on</strong>vertsitintogassuitableforuseortransmissi<strong>on</strong>bypipeline.<br />

Heavycrudeoil......................... CrudeoilwithAPIdensitylessthanorequalto22°.<br />

Intermediatecrudeoil.............. CrudeoilwithAPIdensityhigherthan22°andlessthanorequalto31°.<br />

Lightcrudeoil........................... CrudeoilwithAPIdensityhigherthan31°.<br />

LNG.......................................... Liquefiednaturalgas.<br />

LPG .......................................... Liquefied petroleum gas, which is a mixture of saturated and unsaturated<br />

hydrocarb<strong>on</strong>s,withuptofivecarb<strong>on</strong>atoms,usedasdomesticfuel.<br />

NGLs ........................................ Naturalgasliquids,whicharelighthydrocarb<strong>on</strong>substancesproducedwithnatural<br />

gas,whichc<strong>on</strong>denseintoliquidatnormaltemperaturesandpressures.<br />

Oil............................................ Crudeoil,includingNGLsandc<strong>on</strong>densates.<br />

<br />

<br />

3

Presaltreservoir...................... A geological formati<strong>on</strong> c<strong>on</strong>taining oil or natural gas deposits located beneath an<br />

evaporiticlayer.<br />

Provedreserves........................ Proved oil and gasreserves are the estimated quantities ofcrude oil, natural gas<br />

and natural gas liquids that geological and engineering data dem<strong>on</strong>strate with<br />

reas<strong>on</strong>ablecertaintyarerecoverableinfutureyearsfromknownreservoirsunder<br />

existingec<strong>on</strong>omicandoperatingc<strong>on</strong>diti<strong>on</strong>s,i.e.,pricesandcostsasofthedatethe<br />

estimate is made. Prices include c<strong>on</strong>siderati<strong>on</strong> of changes in existing prices<br />

provided<strong>on</strong>lybyc<strong>on</strong>tractualarrangements,butnotescalati<strong>on</strong>sbasedup<strong>on</strong>future<br />

c<strong>on</strong>diti<strong>on</strong>s.<br />

Proveddevelopedreserves....... Proved developed reserves are reserves that can be expected to be recovered<br />

throughexistingwellswithexistingequipmentandoperatingmethods.Additi<strong>on</strong>al<br />

oil and gas expected to be obtained through the applicati<strong>on</strong> of fluid injecti<strong>on</strong> or<br />

other improved recovery techniques for supplementing the natural forces and<br />

mechanismsofprimaryrecoveryareincludedas“proveddevelopedreserves”<strong>on</strong>ly<br />

after testing by a pilot project or after the operati<strong>on</strong> of aninstalled program has<br />

c<strong>on</strong>firmedthroughproducti<strong>on</strong>resp<strong>on</strong>sethatincreasedrecoverywillbeachieved.<br />

Provedundevelopedreserves... Provedundevelopedreservesarereservesthatareexpectedtoberecoveredfrom<br />

new wells <strong>on</strong> undrilled acreage, or from existing wells where a relatively major<br />

expenditureisrequiredforrecompleti<strong>on</strong>,butd<strong>on</strong>otincludereservesattributable<br />

to any acreage for which an applicati<strong>on</strong> of fluid injecti<strong>on</strong> or other improved<br />

recovery technique is c<strong>on</strong>templated, unless such techniques have been proved<br />

effective by actual tests in the area and in the same reservoir. Reserves <strong>on</strong><br />

undrilled acreage are limited to those undrilled units offsetting productive units<br />

thatarereas<strong>on</strong>ablycertainofproducti<strong>on</strong>whendrilled.Provedreservesforother<br />

undrilledunitsareclaimed<strong>on</strong>lywhereitisdem<strong>on</strong>stratedwithcertaintythatthere<br />

isc<strong>on</strong>tinuityofproducti<strong>on</strong>fromtheexistingproductiveformati<strong>on</strong>.<br />

SS............................................. Semisubmersibleunit.<br />

Ultradeepwater...................... Over1,500meters(4,921feet)deep.<br />

<br />

<br />

<br />

4

CONVERSIONTABLE<br />

1acre = 0.0040km 2 <br />

1barrel = 42U.S.gall<strong>on</strong>s = Approximately0.13tofoil<br />

1boe = 1barrelofcrudeoilequivalent = 6,000cfofnaturalgas<br />

1m 3 ofnaturalgas = 35.315cf = 0.0059boe<br />

1km = 0.6214miles <br />

1km 2 = 247acres <br />

1meter = 3.2808feet <br />

1tofcrudeoil = 1,000kilogramsofcrudeoil = Approximately7.5barrelsofcrudeoil(assuming<br />

anatmosphericpressureindexgravityof37°<br />

API)<br />

<br />

<br />

5

ABBREVIATIONS<br />

bbl ......................... Barrels<br />

bn .......................... Billi<strong>on</strong>(thousandmilli<strong>on</strong>)<br />

bnbbl ..................... Billi<strong>on</strong>barrels<br />

bncf........................ Billi<strong>on</strong>cubicfeet<br />

bnm 3 ...................... Billi<strong>on</strong>cubicmeters<br />

boe ........................ Barrelsofoilequivalent<br />

bbl/d...................... Barrelsperday<br />

cf............................ Cubicfeet<br />

GOM ...................... GulfofMexico<br />

GW......................... Gigawatts<br />

GWh....................... Onegigawattofpowersuppliedordemandedfor<strong>on</strong>ehour<br />

km.......................... Kilometer<br />

km 2 ........................ Squarekilometers<br />

m 3 .......................... Cubicmeter<br />

mbbl ...................... Thousandbarrels<br />

mbbl/d................... Thousandbarrelsperday<br />

mboe ..................... Thousandbarrelsofoilequivalent<br />

mboe/d.................. Thousandbarrelsofoilequivalentperday<br />

mcf ........................ Thousandcubicfeet<br />

mcf/d..................... Thousandcubicfeetperday<br />

mm 3 ....................... Thousandcubicmeters<br />

mm 3 /d.................... Thousandcubicmetersperday<br />

mmbbl ................... Milli<strong>on</strong>barrels<br />

mmbbl/d................ Milli<strong>on</strong>barrelsperday<br />

mmboe .................. Milli<strong>on</strong>barrelsofoilequivalent<br />

mmboe/d............... Milli<strong>on</strong>barrelsofoilequivalentperday<br />

mmcf ..................... Milli<strong>on</strong>cubicfeet<br />

mmcf/d.................. Milli<strong>on</strong>cubicfeetperday<br />

mmm 3 .................... Milli<strong>on</strong>cubicmeters<br />

mmm 3 /d ................ Milli<strong>on</strong>cubicmetersperday<br />

mmt/y.................... Milli<strong>on</strong>metrict<strong>on</strong>speryear<br />

MW........................ Megawatts<br />

MWavg .................. Amountofenergy(inMWh)dividedbythetime(inhours)inwhichsuchenergyisproduced<br />

orc<strong>on</strong>sumed<br />

MWh...................... Onemegawattofpowersuppliedordemandedfor<strong>on</strong>ehour<br />

P$ .......................... Argentinepesos<br />

R$ .......................... Brazilianreais<br />

t............................. Metrict<strong>on</strong><br />

tcf .......................... Trilli<strong>on</strong>cubicfeet<br />

U.S.$ ...................... UnitedStatesdollars<br />

/d........................... Perday<br />

/y ........................... Peryear<br />

<br />

<br />

<br />

6

In this annualreport, references to“real,”<br />

“reais”or“R$”aretoBrazilianreaisandreferences<br />

to“U.S.dollars”or“U.S.$”aretotheUnitedStates<br />

dollars. Certain figures included in this annual<br />

reporthave been subjectto rounding adjustments;<br />

accordingly,figuresshownastotalsincertaintables<br />

may notbe anexact arithmetic aggregati<strong>on</strong> of the<br />

figuresthatprecedethem.<br />

<strong>Petrobras</strong><br />

The audited c<strong>on</strong>solidated financial<br />

statements of <strong>Petrobras</strong> and our c<strong>on</strong>solidated<br />

subsidiariesasofDecember31,<strong>20</strong>08and<strong>20</strong>07,and<br />

for each of the three years in the period ended<br />

December 31, <strong>20</strong>08, and the accompanying notes,<br />

c<strong>on</strong>tainedinthisannualreporthavebeenpresented<br />

inU.S.dollarsandpreparedinaccordancewithU.S.<br />

generally accepted accounting principles, or U.S.<br />

GAAP.SeeItem5.“OperatingandFinancialReview<br />

and Prospects” and Note 2(a) to our audited<br />

c<strong>on</strong>solidatedfinancialstatements.Wealsopublish<br />

financialstatementsinBrazilinreaisinaccordance<br />

withtheaccountingprinciplesrequiredbyLawNo.<br />

6404/76, as amended, or Brazilian Corporate Law<br />

and the regulati<strong>on</strong>s promulgated by the Comissão<br />

de Valores Mobiliários (Brazilian Securities<br />

Commissi<strong>on</strong>,ortheCVM),orBrazilianGAAP,which<br />

differsinsignificantrespectsfromU.S.GAAP.<br />

Certainprioryearamountsfor<strong>20</strong>07,<strong>20</strong>06,<br />

<strong>20</strong>05and<strong>20</strong>04havebeenreclassifiedtoc<strong>on</strong>formto<br />

current year presentati<strong>on</strong> standards. These<br />

reclassificati<strong>on</strong>shadnoimpact<strong>on</strong>ournetincome.<br />

PRESENTATIONOFFINANCIALINFORMATION<br />

Unlessthec<strong>on</strong>textotherwiseindicates:<br />

<br />

historicaldatac<strong>on</strong>tainedinthisannual<br />

reportthatwerenotderivedfromthe<br />

audited c<strong>on</strong>solidated financial<br />

statementshavebeentranslatedfrom<br />

reais<strong>on</strong>asimilarbasis;<br />

forwardlooking amounts, including<br />

estimated future capital expenditures,<br />

have all been based <strong>on</strong> our <strong>Petrobras</strong><br />

<strong>20</strong><strong>20</strong> Strategic Plan, which covers the<br />

periodfrom<strong>20</strong>08to<strong>20</strong><strong>20</strong>,and<strong>on</strong>our<br />

<strong>20</strong>09<strong>20</strong>13 Business Plan, and have<br />

beenprojected<strong>on</strong>ac<strong>on</strong>stantbasisand<br />

have been translated from reais in<br />

<strong>20</strong>09 at an estimated average<br />

exchange rate of R$2.10 to U.S.$1.00,<br />

and future calculati<strong>on</strong>s involving an<br />

assumed price of crude oil have been<br />

calculatedusingaBrentcrudeoilprice<br />

ofU.S.$58perbarrelfor<strong>20</strong>09,U.S.$61<br />

per barrel for <strong>20</strong>10, U.S.$72 for <strong>20</strong>11,<br />

U.S.$74 for <strong>20</strong>12 and U.S.$68 per<br />

barrel for <strong>20</strong>13, adjusted for our<br />

qualityandlocati<strong>on</strong>differences,unless<br />

otherwisestated;and<br />

<br />

estimated future capital expenditures<br />

are based <strong>on</strong> the most recently<br />

budgeted amounts, which may not<br />

have been adjusted to reflect all<br />

factorsthatcouldaffectsuchamounts.<br />

Our functi<strong>on</strong>al currency is the Brazilian<br />

real.As described more fully in Note 2(a) to our<br />

audited c<strong>on</strong>solidated financial statements, the U.S.<br />

dollar amounts as of the dates and for the periods<br />

presented in our audited c<strong>on</strong>solidated financial<br />

statements have been recalculated or translated<br />

from the real amounts in accordance with the<br />

criteria set forth in Statement of Financial<br />

AccountingStandardsNo.52,orSFAS52,oftheU.S.<br />

Financial Accounting Standards Board, FASB.U.S.<br />

dollaramountspresentedinthisannualreporthave<br />

been translated from reais at the periodend<br />

exchange rate for balance sheet items and the<br />

average exchangerate prevailing during the period<br />

forincomestatementandcashflowitems.<br />

PifCo<br />

PifCo's functi<strong>on</strong>al currency is the U.S.<br />

dollar.SubstantiallyallofPifCo'ssalesaremadein<br />

U.S.dollarsandallofitsdebtisdenominatedinU.S.<br />

dollars. Accordingly, PifCo's audited c<strong>on</strong>solidated<br />

financial statements as of December 31, <strong>20</strong>08 and<br />

<strong>20</strong>07,andforeachofthethreeyearsintheperiod<br />

ended December 31, <strong>20</strong>08, and the accompanying<br />

notes c<strong>on</strong>tained in this annual report have been<br />

presented in U.S. dollars and prepared in<br />

accordance with U.S. GAAP and include PifCo's<br />

wholly owned subsidiaries: <strong>Petrobras</strong> Europe<br />

Limited, <strong>Petrobras</strong> Finance Limited, Bear Insurance<br />

Company Limited (BEAR) and <strong>Petrobras</strong> Singapore<br />

PrivateLimited.<br />

<br />

<br />

7

Since December 31, <strong>20</strong>08, PifCo has<br />

incurredU.S.$1,500milli<strong>on</strong>ofindebtednessthrough<br />

the issuance of notes in the internati<strong>on</strong>al capital<br />

market and U.S.$4,000 milli<strong>on</strong> of indebtedness<br />

through various credit facilities. See Item 5.<br />

“Operating and Financial Review and Prospects—<br />

Liquidity and Capital Resources—PifCo—L<strong>on</strong>gTerm<br />

IndebtednessIncurredafterDecember31,<strong>20</strong>08.”<br />

The estimates of our proved reserves of<br />

crudeoilandnaturalgasasofDecember31,<strong>20</strong>08,<br />

includedinthisannualreporthavebeencalculated<br />

according to the technical definiti<strong>on</strong>s required by<br />

theU.S.SecuritiesandExchangeCommissi<strong>on</strong>,orthe<br />

SEC. DeGolyer and MacNaught<strong>on</strong> provided<br />

estimatesofmostofournetdomesticreservesasof<br />

December 31, <strong>20</strong>08.All reserve estimates involve<br />

some degree of uncertainty. See Item 3. “Key<br />

Informati<strong>on</strong>—Risk Factors—Risks Relating to Our<br />

Operati<strong>on</strong>s”foradescripti<strong>on</strong>oftherisksrelatingto<br />

ourreservesandourreserveestimates.<br />

We also file oil and gas reserve estimates<br />

with governmental authorities in most of the<br />

countries in which we operate. On January 15,<br />

<strong>20</strong>09,wefiledreserveestimatesforBrazilwiththe<br />

ANP, in accordance with Brazilian rules and<br />

regulati<strong>on</strong>s,totaling11.9billi<strong>on</strong>barrelsofcrudeoil<br />

and c<strong>on</strong>densate and 12.7 trilli<strong>on</strong> cubic feet of<br />

naturalgas.Thereserveestimateswefiledwiththe<br />

ANP and those provided herein differ by<br />

approximately27%.Thisdifferenceisdueto(i)the<br />

ANPrequirementthatweestimateprovedreserves<br />

through the technical aband<strong>on</strong>ment of producti<strong>on</strong><br />

wells, as opposed to limiting reserve estimates to<br />

the life of our c<strong>on</strong>cessi<strong>on</strong> c<strong>on</strong>tracts as required by<br />

Rule 410 of Regulati<strong>on</strong> SX and (ii) different<br />

technical criteria for booking proved reserves,<br />

including the use of 3D seismic data to establish<br />

<br />

RECENTDEVELOPMENTS<br />

PRESENTATIONOFINFORMATIONCONCERNINGRESERVES<br />

On May 19, <strong>20</strong>09, we c<strong>on</strong>cluded<br />

negotiati<strong>on</strong>s with China Development Bank for a<br />

bilateralloanintheamountofU.S.$10billi<strong>on</strong>.The<br />

loanwillhaveatenorof10yearsandtheproceeds<br />

willbeusedtofinanceour<strong>20</strong>09<strong>20</strong>13BusinessPlan<br />

andtofinancetheacquisiti<strong>on</strong>ofgoodsandservices<br />

fromChinesecompanies.<br />

provedreservesinBrazilandtheuseofaverageoil<br />

prices as opposed to yearend prices to determine<br />

theec<strong>on</strong>omicproducibilityofreservesinBrazil.<br />

We also file reserve estimates from our<br />

internati<strong>on</strong>aloperati<strong>on</strong>swithvariousgovernmental<br />

agencies under the guidelines of the Society of<br />

PetroleumEngineers,orSPE.Theaggregatereserve<br />

estimates from ourinternati<strong>on</strong>al operati<strong>on</strong>s, under<br />

SPEguidelines,amountedto0.497billi<strong>on</strong>barrelsof<br />

crude oil and NGLs and 2,967 billi<strong>on</strong> cubic feet of<br />

natural gas, which is approximately 8.24% higher<br />

than the reserve estimates calculated under<br />

Regulati<strong>on</strong>SX,asprovidedherein.Thisdifference<br />

occurs because, unlike Regulati<strong>on</strong> SX, the SPE's<br />

technical guidelines allow for the booking of our<br />

reserves in Nigeria based <strong>on</strong> certain oil recovery<br />

techniques, such as fluid injecti<strong>on</strong>, based <strong>on</strong><br />

analogousfields.<br />

In December <strong>20</strong>08, the SEC adopted<br />

revisi<strong>on</strong>stoitsoilandgasreportingrulesinorderto<br />

modernize and update the oil and gas disclosure<br />

requirements. The changes bring the reporting<br />

guidance up to date with advances made in the<br />

industry around oil and gas reserves<br />

determinati<strong>on</strong>s.Wearestudyingtheimpactofthe<br />

newSECguidelinesforreportingofouroilandgas<br />

provedreserves.ThenewSECguidelineshavenot<br />

g<strong>on</strong>e into effect and have not been used in the<br />

determinati<strong>on</strong> of reserves for yearend <strong>20</strong>08.<br />

<br />

<br />

8

PARTI<br />

Item1.<br />

IdentityofDirectors,SeniorManagementandAdvisers<br />

Notapplicable.<br />

Item2.<br />

OfferStatisticsandExpectedTimetable<br />

Notapplicable.<br />

Item3.<br />

KeyInformati<strong>on</strong><br />

SelectedFinancialData<br />

<strong>Petrobras</strong><br />

The following tables set forth our selected c<strong>on</strong>solidated financial data, presented in U.S. dollars and<br />

preparedinaccordancewithU.S.GAAP.ThedataforeachofthefiveyearsintheperiodendedDecember31,<br />

<strong>20</strong>08 has been derived from our audited c<strong>on</strong>solidated financial statements, which were audited by KPMG<br />

AuditoresIndependentesfortheyearsendedDecember31,<strong>20</strong>08,<strong>20</strong>07and<strong>20</strong>06andbyErnst&YoungAuditores<br />

IndependentesS/SforeachoftheyearsendedDecember31,<strong>20</strong>05and<strong>20</strong>04.Theinformati<strong>on</strong>belowshouldbe<br />

read in c<strong>on</strong>juncti<strong>on</strong> with, and is qualified in its entirety by reference to, our audited c<strong>on</strong>solidated financial<br />

statementsandtheaccompanyingnotesandItem5.“OperatingandFinancialReviewandProspects.”<br />

Certainprioryearamountsfor<strong>20</strong>07,<strong>20</strong>06,<strong>20</strong>05and<strong>20</strong>04havebeenreclassifiedtoc<strong>on</strong>formtocurrent<br />

yearpresentati<strong>on</strong>standards.Thesereclassificati<strong>on</strong>shadnoimpact<strong>on</strong>ournetincome.<br />

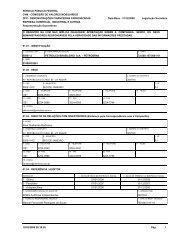

BALANCESHEETDATA—PETROBRAS<br />

<br />

AsofDecember31,<br />

<strong>20</strong>08 <strong>20</strong>07 <strong>20</strong>06 <strong>20</strong>05 <strong>20</strong>04<br />

<br />

(U.S.$milli<strong>on</strong>)<br />

Assets: <br />

Totalcurrentassets................................................................................... 26,758 29,140 30,955 25,784 19,426<br />

Property,plantandequipment,net ........................................................ 84,719 84,282 58,897 45,9<strong>20</strong> 37,0<strong>20</strong><br />

Investmentsinn<strong>on</strong>c<strong>on</strong>solidatedcompaniesandotherinvestments .. 3,198 5,112 3,262 1,810 1,862<br />

Totaln<strong>on</strong>currentassets ........................................................................... 11,0<strong>20</strong> 11,181 5,566 5,124 4,774<br />

Totalassets....................................................................................... 125,695 129,715 98,680 78,638 63,082<br />

Liabilitiesandshareholders'equity: <br />

Totalcurrentliabilities.............................................................................. 24,756 24,468 21,976 18,161 13,328<br />

Totall<strong>on</strong>gtermliabilities(1) ..................................................................... 22,340 25,588 19,929 14,983 14,226<br />

L<strong>on</strong>gtermdebt(2) .................................................................................... 16,031 12,148 10,510 11,503 12,145<br />

Totalliabilities ................................................................................. 63,127 62,<strong>20</strong>4 52,415 44,647 39,699<br />

Minorityinterest ....................................................................................... 659 2,332 1,966 1,074 877<br />

Shareholders'equity <br />

Sharesauthorizedandissued: <br />

Preferredshare..................................................................................... 15,106 8,6<strong>20</strong> 7,718 4,772 4,772<br />

Comm<strong>on</strong>share...................................................................................... 21,088 12,196 10,959 6,929 6,929<br />

Capitalreserveandothercomprehensiveincome 25,715 44,363 25,622 21,216 10,805<br />

Totalshareholders'equity ........................................................................ 61,909 65,179 44,299 32,917 22,506<br />

Totalliabilitiesandshareholders'equity ....................................... 125,695 129,715 98,680 78,638 63,082<br />

<br />

(1)<br />

(2)<br />

Excludesl<strong>on</strong>gtermdebt.<br />

Excludescurrentporti<strong>on</strong>ofl<strong>on</strong>gtermdebt.<br />

<br />

<br />

9

INCOMESTATEMENTDATA—PETROBRAS<br />

<br />

FortheYearEndedDecember31,<br />

<strong>20</strong>08 <strong>20</strong>07 <strong>20</strong>06 <strong>20</strong>05 <strong>20</strong>04<br />

<br />

(U.S.$milli<strong>on</strong>,exceptforshareandpersharedata)<br />

<br />

<br />

Netoperatingrevenues ..................................... 118,257 87,735 72,347 56,324 38,428<br />

Operatingincome............................................... 25,294 <strong>20</strong>,451 19,844 15,085 9,711<br />

Netincomefortheyear(1) ................................ 18,879 13,138 12,826 10,344 6,190<br />

Weightedaveragenumberofshares<br />

<br />

outstanding:(2)<br />

Comm<strong>on</strong>......................................................... 5,073,347,344 5,073,347,344 5,073,347,344 5,073,347,344 5,073,347,344<br />

Preferred ........................................................ 3,700,729,396 3,700,729,396 3,699,806,288 3,698,956,056 3,698,956,056<br />

Operatingincomeper:(2) <br />

Comm<strong>on</strong>andPreferredShares .................... 2.88 2.33 2.26 1.72 1.11<br />

Comm<strong>on</strong>andPreferredADS(3) .................... 5.76 4.66 4.52 3.44 2.22<br />

Basicanddilutedearningsper:(1)(2) <br />

Comm<strong>on</strong>andPreferredShares .................... 2.15 1.50 1.46 1.18 0.71<br />

Comm<strong>on</strong>andPreferredADS(3) .................... 4.30 3.00 2.92 2.36 1.42<br />

Cashdividendsper:(2)(4) <br />

Comm<strong>on</strong>andPreferredshares .................... 0.47 0.35 0.42 0.34 0.21<br />

Comm<strong>on</strong>andPreferredADS(3) .................... 0.94 0.70 0.84 0.68 0.42<br />

<br />

(1) Ournetincomerepresentsourincomefromc<strong>on</strong>tinuingoperati<strong>on</strong>s.<br />

(2) Wecarriedoutatwofor<strong>on</strong>estocksplit<strong>on</strong>April25,<strong>20</strong>08.Shareandpershareamountsforallperiodsgiveeffecttothestocksplit.<br />

(3) Wecarriedoutafourfor<strong>on</strong>ereversestocksplitinJuly<strong>20</strong>07thatchangedtheratioofunderlyingsharestoAmericanDepositaryShares<br />

fromfoursharesforeachADStotwosharesforeachADS.Pershareamountsforallperiodsgiveeffecttothestocksplit.<br />

(4) Representsdividendspaidduringtheyear.<br />

<br />

<br />

10

PifCo<br />

ThefollowingtablessetforthPifCo'sselectedc<strong>on</strong>solidatedfinancialdata,presentedinU.S.dollarsand<br />

preparedinaccordancewithU.S.GAAP.ThedataforeachofthefiveyearsintheperiodendedDecember31,<br />

<strong>20</strong>08 have been derived from PifCo's auditedc<strong>on</strong>solidated financial statements, which were audited byKPMG<br />

Auditores Independentes for the years ended December 31, <strong>20</strong>08, <strong>20</strong>07 and <strong>20</strong>06, and by Ernst & Young<br />

AuditoresIndependentesS/SforeachoftheyearsendedDecember31,<strong>20</strong>05and<strong>20</strong>04.Theinformati<strong>on</strong>below<br />

shouldbereadinc<strong>on</strong>juncti<strong>on</strong>with,andisqualifiedinitsentiretybyreferenceto,PifCo'sauditedc<strong>on</strong>solidated<br />

financialstatementsandtheaccompanyingnotesandItem5.“OperatingandFinancialReviewandProspects.”<br />

BALANCESHEETDATA—PifCo<br />

<br />

FortheYearEndedDecember31,<br />

<strong>20</strong>08 <strong>20</strong>07 <strong>20</strong>06 <strong>20</strong>05 <strong>20</strong>04<br />

<br />

(U.S.$milli<strong>on</strong>)<br />

Assets: <br />

Totalcurrentassets........................................................................ 30,383 28,002 19,241 13,242 11,057<br />

Propertyandequipment,net........................................................ 2 1 1 — —<br />

Totalotherassets ........................................................................... 2,918 4,867 2,079 3,507 3,613<br />

Totalassets ................................................................................ 33,303 32,870 21,321 16,749 14,670<br />

<br />

Liabilitiesandstockholder'sequity: <br />

Totalcurrentliabilities................................................................... 28,012 27,686 9,264 7,098 4,929<br />

Totall<strong>on</strong>gtermliabilities(1) .......................................................... — — 7,442 3,734 3,553<br />

L<strong>on</strong>gtermdebt(2) ......................................................................... 5,884 5,187 4,640 5,909 6,152<br />

Totalliabilities............................................................................ 33,896 32,873 21,346 16,741 14,634<br />

Totalstockholder's(deficit)equity ............................................... (593) (3) (25) 8 36<br />

Totalliabilitiesandstockholder'sequity ................................. 33,303 32,870 21,321 16,749 14,670<br />

<br />

(1)<br />

(2)<br />

<br />

Excludesl<strong>on</strong>gtermdebt.<br />

Excludescurrentporti<strong>on</strong>ofl<strong>on</strong>gtermdebt.<br />

INCOMESTATEMENTDATA—PifCo<br />

<br />

FortheYearEndedDecember31,<br />

<strong>20</strong>08 <strong>20</strong>07 <strong>20</strong>06 <strong>20</strong>05 <strong>20</strong>04<br />

<br />

(U.S.$milli<strong>on</strong>)<br />

Netoperatingrevenue................................................................... 42,443 26,732 22,070 17,136 12,356<br />

Operating(loss)income................................................................. (927) 127 (38) (13) <strong>20</strong><br />

Net(loss)incomefortheyear....................................................... (772) 29 (211) (28) (59)<br />

<br />

<br />

<br />

11

ExchangeRates<br />

<br />

Subject to certain procedures and specific<br />

regulatoryprovisi<strong>on</strong>s,therearenolimitati<strong>on</strong>stothe<br />

purchase and sale of foreign currency and the<br />

internati<strong>on</strong>al transfer of reais as l<strong>on</strong>g as the<br />

underlying transacti<strong>on</strong> is valid.Foreign currencies<br />

may<strong>on</strong>lybepurchasedthroughfinancialinstituti<strong>on</strong>s<br />

domiciledinBrazilandauthorizedtooperateinthe<br />

exchangemarket.We cannot predict whether the<br />

Central Bank or the Brazilian government will<br />

c<strong>on</strong>tinuetolettherealfloatfreelyorwillintervene<br />

in the exchange rate market through a currency<br />

bandsystemorotherwise.<br />

<br />

The real appreciated 8.1% in <strong>20</strong>04 against<br />

theU.S.dollarandc<strong>on</strong>tinuedtoappreciate11.8%in<br />

<strong>20</strong>05,8.7%in<strong>20</strong>06and17.2%in<strong>20</strong>07and10.1%in<br />

thefirsthalfof<strong>20</strong>08.Beginninginthesec<strong>on</strong>dhalf<br />

of <strong>20</strong>08, the real greatly depreciated against the<br />

U.S.dollar.Therealdepreciated31.9%againstthe<br />

U.S.dollarin<strong>20</strong>08.AsofMay<strong>20</strong>,<strong>20</strong>09,therealhas<br />

appreciatedtoR$2.0<strong>20</strong>perU.S.$1.00,representing<br />

an appreciati<strong>on</strong> of approximately 13.6% in <strong>20</strong>09<br />

yeartodate.Therealmaydepreciateorappreciate<br />

substantially in the future.See “—Risk Factors—<br />

RisksRelatingtoBrazil.”<br />

<br />

Thefollowingtableprovidesinformati<strong>on</strong><strong>on</strong>thesellingexchangerate,expressedinreaisperU.S.dollar<br />

(R$/U.S.$),fortheperiodsindicated.ThetableusesthecommercialsellingratepriortoMarch14,<strong>20</strong>05.<br />

<br />

<br />

(R$/U.S.$)<br />

High Low Average(1) PeriodEnd<br />

YearendedDecember31,<br />

<br />

<strong>20</strong>08 ....................................................................................................... 2.500 1.559 1.836 2.337<br />

<strong>20</strong>07 ....................................................................................................... 2.156 1.733 1.947 1.771<br />

<strong>20</strong>06 ....................................................................................................... 2.371 2.059 2.175 2.138<br />

<strong>20</strong>05 ....................................................................................................... 2.762 2.163 2.435 2.341<br />

<strong>20</strong>04 ....................................................................................................... 3.<strong>20</strong>5 2.654 2.926 2.654<br />

M<strong>on</strong>th:<br />

<br />

December<strong>20</strong>08..................................................................................... 2.500 2.337 2.398 2.337<br />

January<strong>20</strong>09.......................................................................................... 2.380 2.189 2.313 2.316<br />

February<strong>20</strong>09 ....................................................................................... 2.392 2.245 2.3<strong>20</strong> 2.378<br />

March<strong>20</strong>09............................................................................................ 2.422 2.238 2.313 2.315<br />

April<strong>20</strong>09............................................................................................... 2.290 2.170 2.<strong>20</strong>2 2.178<br />

May<strong>20</strong>09(throughMay<strong>20</strong>,<strong>20</strong>09) ...................................................... 2.178 2.0<strong>20</strong> 2.098 2.0<strong>20</strong><br />

<br />

Source:CentralBankofBrazil<br />

(1)<br />

<str<strong>on</strong>g>Annual</str<strong>on</strong>g>averageexchangeratesrepresenttheaverageofthem<strong>on</strong>thendexchangeratesduringtherelevantperiod.M<strong>on</strong>thlyaverage<br />

exchangeratesrepresenttheaverageoftheexchangeratesatthecloseoftrading<strong>on</strong>eachbusinessdayduringsuchperiod.<br />

Brazilianlawprovidesthat,wheneverthere<br />

is a serious imbalance in Brazil's balance of<br />

paymentsorthereareseriousreas<strong>on</strong>stoforeseea<br />

serious imbalance, temporary restricti<strong>on</strong>s may be<br />

imposed <strong>on</strong> remittances of foreign capital abroad.<br />

See“—RiskFactors—RisksRelatingtoBrazil.”<br />

<br />

<br />

12

RisksRelatingtoOurOperati<strong>on</strong>s<br />

Substantial or extended declines and volatility in<br />

the internati<strong>on</strong>al prices of crude oil, oil products<br />

and natural gas may have a material adverse<br />

effect<strong>on</strong>ourincome<br />

The majority of our revenue is derived<br />

primarily from sales of crude oil and oil products<br />

and,toalesserextent,naturalgas.Wed<strong>on</strong>ot,and<br />

will not, have c<strong>on</strong>trol over the factors affecting<br />

internati<strong>on</strong>al prices for crude oil, oil products and<br />

natural gas.The average price of Brent crude, an<br />

internati<strong>on</strong>al benchmark oil, was approximately<br />

U.S.$96.99 per barrel for <strong>20</strong>08, U.S.$72.52 per<br />

barrelfor<strong>20</strong>07andU.S.$65.14perbarrelfor<strong>20</strong>06,<br />

and the price of Brent crude was U.S.$41.76 per<br />

barrel<strong>on</strong>April30,<strong>20</strong>09.Changesincrudeoilprices<br />

typicallyresultin changes in prices for oil products<br />

andnaturalgas.<br />

RISKFACTORS<br />

internati<strong>on</strong>al crude oil prices may have a material<br />

adverseeffect<strong>on</strong>ourbusiness,resultsofoperati<strong>on</strong>s<br />

andfinancialc<strong>on</strong>diti<strong>on</strong>,andthevalueofourproved<br />

reserves.Significantdecreasesinthepriceofcrude<br />

oilmaycauseustoreduceoralterthetimingofour<br />

capitalexpenditures,andthiscouldadverselyaffect<br />

our producti<strong>on</strong> forecasts in the medium term and<br />

ourreserveestimatesinthefuture.Inadditi<strong>on</strong>,our<br />

pricing policy in Brazil is intended to be at parity<br />

with internati<strong>on</strong>al product prices over the l<strong>on</strong>g<br />

term. In general we do not adjust our prices for<br />

diesel,gasolineandLPGduringperiodsofvolatility<br />

in the internati<strong>on</strong>al markets.As a result, material<br />

rapid or sustained increases in the internati<strong>on</strong>al<br />

price of crude oil and oil products may result in<br />

reduced downstream margins for us, and we may<br />

notrealizeallthegainsthatourcompetitorsrealize<br />

inperiodsofhigherinternati<strong>on</strong>alprices.<br />

Historically, internati<strong>on</strong>al prices for crude<br />

oil, oil products and natural gas have fluctuated<br />

widely as a result of many factors.These factors<br />

include:<br />

<br />

<br />

<br />

global and regi<strong>on</strong>al ec<strong>on</strong>omic and<br />

geopolitical developments in crude oil<br />

producing regi<strong>on</strong>s, particularly in the<br />

MiddleEast;<br />

the ability of the Organizati<strong>on</strong> of<br />

Petroleum Exporting Countries (OPEC)<br />

to set and maintain crude oil<br />

producti<strong>on</strong>levelsanddefendprices;<br />

globalandregi<strong>on</strong>alsupplyanddemand<br />

for crude oil, oil products and natural<br />

gas;<br />

competiti<strong>on</strong> from other energy<br />

sources;<br />

<br />

<br />

domestic and foreign government<br />

regulati<strong>on</strong>s;and<br />

weatherc<strong>on</strong>diti<strong>on</strong>s.<br />

Volatility and uncertainty in internati<strong>on</strong>al<br />

pricesforcrudeoil,oilproductsandnaturalgasmay<br />

c<strong>on</strong>tinue. Substantial or extended declines in<br />

Our ability to achieve our l<strong>on</strong>gterm growth<br />

objectives depends <strong>on</strong> our ability to discover<br />

additi<strong>on</strong>alreservesandsuccessfullydevelopthem,<br />

and failure to do so could prevent us from<br />

achieving our l<strong>on</strong>gterm goals for growth in<br />

producti<strong>on</strong>.<br />

Ourabilitytoachieveourl<strong>on</strong>gtermgrowth<br />

objectives,includingthosedefinedinour<strong>20</strong>09<strong>20</strong>13<br />

BusinessPlan, ishighly dependent up<strong>on</strong> our ability<br />

to obtain new c<strong>on</strong>cessi<strong>on</strong>s through new bidding<br />

rounds and discover additi<strong>on</strong>al reserves, as well as<br />

to successfully develop our existing reserves.We<br />

will need to make substantial investments to<br />

achieve the growth targets set forth in our <strong>20</strong>09<br />

<strong>20</strong>13 Business Plan and we cannot assure you we<br />

willbeabletoraisetherequiredcapital.<br />

Further, our competitive advantage in<br />

bidding rounds for new c<strong>on</strong>cessi<strong>on</strong>s in Brazil has<br />

diminished over the years as a result of the<br />

increased competiti<strong>on</strong> in the oil and gas sector in<br />

Brazil.Inadditi<strong>on</strong>,ourexplorati<strong>on</strong>activitiesexpose<br />

ustotheinherentrisksofdrilling,includingtherisk<br />

that we will not discover commercially productive<br />

crude oil or natural gas reserves. The costs of<br />

drilling wells are often uncertain, and numerous<br />

factors bey<strong>on</strong>d our c<strong>on</strong>trol (such as unexpected<br />

drilling c<strong>on</strong>diti<strong>on</strong>s, equipment failures or accidents,<br />

andshortagesordelaysintheavailabilityofdrilling<br />

rigs and the delivery of equipment) may cause<br />

<br />

<br />

13

drilling operati<strong>on</strong>s to be curtailed, delayed or<br />

cancelled.Theserisksareheightenedwhenwedrill<br />

in deep and ultradeep water. Deep and ultra<br />

deepwater drilling represented approximately 35%<br />

oftheexploratorywellswedrilledin<strong>20</strong>08.<br />

Unless we c<strong>on</strong>duct successful explorati<strong>on</strong><br />

and development activities or acquire properties<br />

c<strong>on</strong>tainingprovedreserves,orboth,andareableto<br />

raise the necessary capital to fund these activities,<br />

our proved reserves will decline as reserves are<br />

extracted.If we fail to gain access to additi<strong>on</strong>al<br />

reserves we may not achieve our goals for<br />

producti<strong>on</strong> growth for <strong>20</strong>09 through <strong>20</strong>13 and our<br />

resultsofoperati<strong>on</strong>sandfinancialc<strong>on</strong>diti<strong>on</strong>maybe<br />

adverselyaffected.<br />

The current global financial crisis and uncertain<br />

ec<strong>on</strong>omicenvir<strong>on</strong>menthaveledtoloweroilprices<br />

that, if sustained, may reduce our cash flow and<br />

make it difficult for us to achieve our growth<br />

objectives as defined in our <strong>20</strong>09<strong>20</strong>13 Business<br />

Plan.<br />

The current global financial crisis and<br />

uncertain ec<strong>on</strong>omic envir<strong>on</strong>ment that worsened in<br />

the sec<strong>on</strong>d half of <strong>20</strong>08 have led to a worldwide<br />

decrease in demand for oil products.As a result,<br />

pricesforoilproductshavefallenandourcashflows<br />

havebeenreduced.Ifoilpricesremainlow,wemay<br />

be required to revise our growth objectives,<br />

particularly in light of substantial decreases in the<br />

availability of credit in the capital markets. The<br />

global financial and ec<strong>on</strong>omic situati<strong>on</strong> may also<br />

haveanegativeimpact<strong>on</strong>thirdpartieswithwhom<br />

we do, or may do, business.Any of these factors<br />

may affect our results of operati<strong>on</strong>s, financial<br />

c<strong>on</strong>diti<strong>on</strong>andliquidity.<br />

Wed<strong>on</strong>otownanyofthecrudeoilandnaturalgas<br />

reservesinBrazil.<br />

A guaranteed source of crude oil and<br />

natural gas reserves is essential to an oil and gas<br />

company's sustained producti<strong>on</strong> and generati<strong>on</strong> of<br />

income. Under Brazilian law, the Brazilian<br />

government owns all crude oil and natural gas<br />

reserves in Brazil and the c<strong>on</strong>cessi<strong>on</strong>aire owns the<br />

oil and gas it produces.We possess the exclusive<br />

right to develop our reserves pursuant to<br />

c<strong>on</strong>cessi<strong>on</strong> agreements awarded to us by the<br />

Braziliangovernmentandweownthehydrocarb<strong>on</strong>s<br />

we produce under the c<strong>on</strong>cessi<strong>on</strong> agreements, but<br />

if the Brazilian government were to restrict or<br />

prevent us from exploiting these crude oil and<br />

naturalgasreserves,ourabilitytogenerateincome<br />

wouldbeadverselyaffected.<br />

Our crude oil and natural gas reserve estimates<br />

involve some degree of uncertainty, which could<br />

adverselyaffectourabilitytogenerateincome.<br />

The proved crude oil and natural gas<br />

reserves set forth in this annual report are our<br />

estimated quantities of crude oil, natural gas and<br />

natural gas liquids that geological and engineering<br />

data dem<strong>on</strong>strate with reas<strong>on</strong>able certainty to be<br />

recoverable from known reservoirs under existing<br />

ec<strong>on</strong>omicandoperatingc<strong>on</strong>diti<strong>on</strong>s(i.e.,pricesand<br />

costs as of the date the estimate is made).Our<br />

proveddevelopedcrudeoilandnaturalgasreserves<br />

arereserves that can be expected to be recovered<br />

through existing wells with existing equipment and<br />

operating methods. There are uncertainties in<br />

estimating quantities of provedreservesrelated to<br />

prevailingcrudeoilandnaturalgaspricesapplicable<br />

to our producti<strong>on</strong>, which may lead us to make<br />

revisi<strong>on</strong>s to our reserve estimates. Downward<br />

revisi<strong>on</strong>s in our reserve estimates could lead to<br />

lower future producti<strong>on</strong>, which could have an<br />

adverse effect <strong>on</strong> our results of operati<strong>on</strong>s and<br />

financialc<strong>on</strong>diti<strong>on</strong>.<br />

We may not have sufficient resources to support<br />

future explorati<strong>on</strong>, producti<strong>on</strong> and development<br />

activities in our newly discovered presalt<br />

reservoirs.<br />

Exploitingouroilandgasdiscoveriesinthe<br />

presaltreservoirswillrequiresubstantialadditi<strong>on</strong>al<br />

amounts of capital, human resources and a broad<br />

rangeofoffshoreoilservices.Aprimaryoperati<strong>on</strong>al<br />