A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

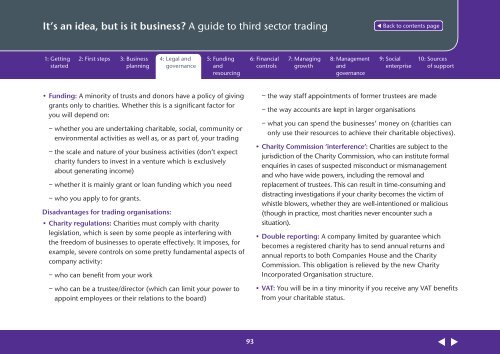

It’s an idea, but is it business? A <strong>guide</strong> <strong>to</strong> <strong>third</strong> sec<strong>to</strong>r <strong>trading</strong><br />

1: Getting<br />

started<br />

2: First steps 3: Business<br />

planning<br />

4: Legal and<br />

governance<br />

5: Funding<br />

and<br />

resourcing<br />

6: Financial<br />

controls<br />

7: Managing<br />

growth<br />

8: Management<br />

and<br />

governance<br />

9: Social<br />

enterprise<br />

10: Sources<br />

of support<br />

• Funding: A minority of trusts and donors have a policy of giving<br />

grants only <strong>to</strong> charities. Whether this is a significant fac<strong>to</strong>r for<br />

you will depend on:<br />

− whether you are undertaking charitable, social, community or<br />

environmental activities as well as, or as part of, your <strong>trading</strong><br />

− the scale and nature of your business activities (don’t expect<br />

charity funders <strong>to</strong> invest in a venture which is exclusively<br />

about generating income)<br />

− whether it is mainly grant or loan funding which you need<br />

− who you apply <strong>to</strong> for grants.<br />

Disadvantages for <strong>trading</strong> organisations:<br />

• Charity regulations: Charities must comply with charity<br />

legislation, which is seen by some people as interfering with<br />

the freedom of businesses <strong>to</strong> operate effectively. It imposes, for<br />

example, severe controls on some pretty fundamental aspects of<br />

company activity:<br />

− who can benefit from your work<br />

− who can be a trustee/direc<strong>to</strong>r (which can limit your power <strong>to</strong><br />

appoint employees or their relations <strong>to</strong> the board)<br />

− the way staff appointments of former trustees are made<br />

− the way accounts are kept in larger organisations<br />

− what you can spend the businesses’ money on (charities can<br />

only use their resources <strong>to</strong> achieve their charitable objectives).<br />

• Charity Commission ‘interference’: Charities are subject <strong>to</strong> the<br />

jurisdiction of the Charity Commission, who can institute formal<br />

enquiries in cases of suspected misconduct or mismanagement<br />

and who have wide powers, including the removal and<br />

replacement of trustees. This can result in time-consuming and<br />

distracting investigations if your charity becomes the victim of<br />

whistle blowers, whether they are well-intentioned or malicious<br />

(though in practice, most charities never encounter such a<br />

situation).<br />

• Double reporting: A company limited by guarantee which<br />

becomes a registered charity has <strong>to</strong> send annual returns and<br />

annual reports <strong>to</strong> both Companies House and the Charity<br />

Commission. This obligation is relieved by the new Charity<br />

Incorporated Organisation structure.<br />

• VAT: You will be in a tiny minority if you receive any VAT benefits<br />

from your charitable status.<br />

93