A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

It’s an idea, but is it business? A <strong>guide</strong> <strong>to</strong> <strong>third</strong> sec<strong>to</strong>r <strong>trading</strong><br />

1: Getting<br />

started<br />

2: First steps 3: Business<br />

planning<br />

4: Legal and<br />

governance<br />

5: Funding<br />

and<br />

resourcing<br />

6: Financial<br />

controls<br />

7: Managing<br />

growth<br />

8: Management<br />

and<br />

governance<br />

9: Social<br />

enterprise<br />

10: Sources<br />

of support<br />

• The parent charity’s name can be included in the name of<br />

the <strong>trading</strong> subsidiary, so long as this does not give the false<br />

impression. It is acceptable <strong>to</strong> use a form of name like: “[charity<br />

name] Sales Company Ltd” for the subsidiary.<br />

• Company law restricts the use of the words “charity” and<br />

“charitable” in the name of any company, and they should only<br />

be used in the title of the subsidiary if they form part of the<br />

parent charity’s name.<br />

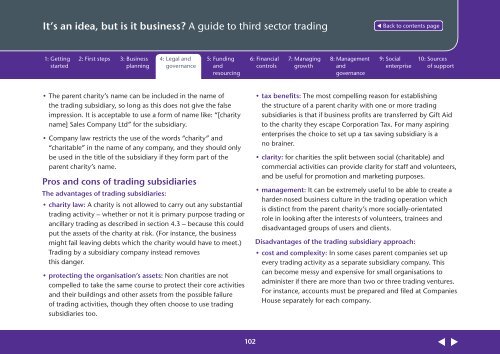

Pros and cons of <strong>trading</strong> subsidiaries<br />

The advantages of <strong>trading</strong> subsidiaries:<br />

• charity law: A charity is not allowed <strong>to</strong> carry out any substantial<br />

<strong>trading</strong> activity – whether or not it is primary purpose <strong>trading</strong> or<br />

ancillary <strong>trading</strong> as described in section 4.3 – because this could<br />

put the assets of the charity at risk. (For instance, the business<br />

might fail leaving debts which the charity would have <strong>to</strong> meet.)<br />

Trading by a subsidiary company instead removes<br />

this danger.<br />

• protecting the organisation’s assets: Non charities are not<br />

compelled <strong>to</strong> take the same course <strong>to</strong> protect their core activities<br />

and their buildings and other assets from the possible failure<br />

of <strong>trading</strong> activities, though they often choose <strong>to</strong> use <strong>trading</strong><br />

subsidiaries <strong>to</strong>o.<br />

• tax benefits: The most compelling reason for establishing<br />

the structure of a parent charity with one or more <strong>trading</strong><br />

subsidiaries is that if business profits are transferred by Gift Aid<br />

<strong>to</strong> the charity they escape Corporation Tax. For many aspiring<br />

enterprises the choice <strong>to</strong> set up a tax saving subsidiary is a<br />

no brainer.<br />

• clarity: for charities the split between social (charitable) and<br />

commercial activities can provide clarity for staff and volunteers,<br />

and be useful for promotion and marketing purposes.<br />

• management: It can be extremely useful <strong>to</strong> be able <strong>to</strong> create a<br />

harder-nosed business culture in the <strong>trading</strong> operation which<br />

is distinct from the parent charity’s more socially-orientated<br />

role in looking after the interests of volunteers, trainees and<br />

disadvantaged groups of users and clients.<br />

Disadvantages of the <strong>trading</strong> subsidiary approach:<br />

• cost and complexity: In some cases parent companies set up<br />

every <strong>trading</strong> activity as a separate subsidiary company. This<br />

can become messy and expensive for small organisations <strong>to</strong><br />

administer if there are more than two or three <strong>trading</strong> ventures.<br />

For instance, accounts must be prepared and filed at Companies<br />

House separately for each company.<br />

102