A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

A guide to third sector trading - WCVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

It’s an idea, but is it business? A <strong>guide</strong> <strong>to</strong> <strong>third</strong> sec<strong>to</strong>r <strong>trading</strong><br />

1: Getting<br />

started<br />

2: First steps 3: Business<br />

planning<br />

4: Legal and<br />

governance<br />

5: Funding<br />

and<br />

resourcing<br />

6: Financial<br />

controls<br />

7: Managing<br />

growth<br />

8: Management<br />

and<br />

governance<br />

9: Social<br />

enterprise<br />

10: Sources<br />

of support<br />

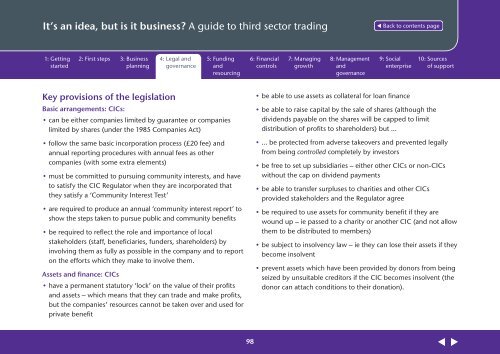

Key provisions of the legislation<br />

Basic arrangements: CICs:<br />

• can be either companies limited by guarantee or companies<br />

limited by shares (under the 1985 Companies Act)<br />

• follow the same basic incorporation process (£20 fee) and<br />

annual reporting procedures with annual fees as other<br />

companies (with some extra elements)<br />

• must be committed <strong>to</strong> pursuing community interests, and have<br />

<strong>to</strong> satisfy the CIC Regula<strong>to</strong>r when they are incorporated that<br />

they satisfy a ‘Community Interest Test’<br />

• are required <strong>to</strong> produce an annual ‘community interest report’ <strong>to</strong><br />

show the steps taken <strong>to</strong> pursue public and community benefits<br />

• be required <strong>to</strong> reflect the role and importance of local<br />

stakeholders (staff, beneficiaries, funders, shareholders) by<br />

involving them as fully as possible in the company and <strong>to</strong> report<br />

on the efforts which they make <strong>to</strong> involve them.<br />

Assets and finance: CICs<br />

• have a permanent statu<strong>to</strong>ry ‘lock’ on the value of their profits<br />

and assets – which means that they can trade and make profits,<br />

but the companies’ resources cannot be taken over and used for<br />

private benefit<br />

• be able <strong>to</strong> use assets as collateral for loan finance<br />

• be able <strong>to</strong> raise capital by the sale of shares (although the<br />

dividends payable on the shares will be capped <strong>to</strong> limit<br />

distribution of profits <strong>to</strong> shareholders) but …<br />

• … be protected from adverse takeovers and prevented legally<br />

from being controlled completely by inves<strong>to</strong>rs<br />

• be free <strong>to</strong> set up subsidiaries – either other CICs or non-CICs<br />

without the cap on dividend payments<br />

• be able <strong>to</strong> transfer surpluses <strong>to</strong> charities and other CICs<br />

provided stakeholders and the Regula<strong>to</strong>r agree<br />

• be required <strong>to</strong> use assets for community benefit if they are<br />

wound up – ie passed <strong>to</strong> a charity or another CIC (and not allow<br />

them <strong>to</strong> be distributed <strong>to</strong> members)<br />

• be subject <strong>to</strong> insolvency law – ie they can lose their assets if they<br />

become insolvent<br />

• prevent assets which have been provided by donors from being<br />

seized by unsuitable credi<strong>to</strong>rs if the CIC becomes insolvent (the<br />

donor can attach conditions <strong>to</strong> their donation).<br />

98