i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

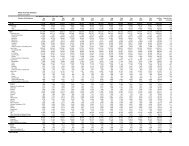

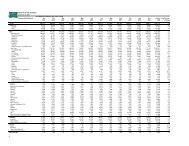

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

(i)<br />

With effect from financial year 2009/<strong>2010</strong>, Statutory <strong>Board</strong>s are to participate in the Centralised Liquidity Management by the AGD under AGD Circular 4/2009.<br />

Deposits, which are interest- bearing, are centrally managed by AGD and are available to the statutory board upon request and earns interest at the average rate<br />

of 0.56% (2009/<strong>2010</strong> : 0.64%) per annum.<br />

(ii)<br />

Short-term fixed deposits are made for varying periods of up to 365 days (2009/<strong>2010</strong> : 4 days to 365 days) depending on the immediate cash requirements<br />

of STB, and earn interest at the average deposit rates of 0.67% (2009/<strong>2010</strong> : 0.03% to 1.975%) per annum. The fixed deposits mature within 5 months<br />

(2009/<strong>2010</strong> : within 6 months) from the end of the respective reporting periods and are easily convertible to cash upon request by STB.<br />

The cash and cash equivalents are sustainably denominated in the functional currency of STB.<br />

12 RECEIVABLES AND PREPAYMENTS<br />

<strong>2010</strong>/<strong>2011</strong> 2009/<strong>2010</strong><br />

$’000 $’000<br />

Deposits 1,798 2,091<br />

Short-term loan (i) - 26,399<br />

Prepayments 1,626 2,018<br />

Other receivables 10,247 12,141<br />

13,671 42,649<br />

Less: Allowance for doubtful receivables (448) (379)<br />

13,223 42,270<br />

(i)<br />

The short-term loan was granted to a Statutory <strong>Board</strong> in <strong>Singapore</strong>. It was secured by a deed of charge over a cargo of artefacts owned by a whollyowned<br />

subsidiary of the borrower and non-interest bearing. Under the terms of the loan agreement, subject to the mutual agreement between STB and the<br />

borrower, the repayment of the loan would be by way of cash or the transfer of all rights, title and benefits to the cargo of artefacts and the related intellectual<br />

property rights in lieu of cash. The loan was non-interest bearing, repayable upon a demand made by STB by giving notice to the borrower of not less than<br />

90 business days.<br />

During the current financial year, STB received the repayment of the loan by way of the transfer of all rights, title and benefits to the cargo of artefacts and<br />

the related intellectual property rights in lieu of cash. Accordingly, the artefacts were recognised as heritage materials on the statement of financial position.<br />

Movement in the allowance for doubtful debts:<br />

<strong>2010</strong>/<strong>2011</strong> 2009/<strong>2010</strong><br />

$’000 $’000<br />

Balance at beginning of year 379 376<br />

Charge to income or expense 69 3<br />

Balance at the end of year 448 379<br />

The receivables and prepayments are sustainably denominated in the functional currency of STB.<br />

83