i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

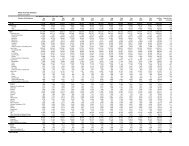

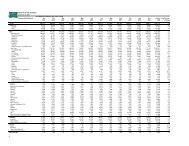

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

(iv)<br />

Liquidity risk<br />

STB monitors and maintains a level of cash and cash equivalents deemed adequate to finance its’ operations. The<br />

investment portfolio comprises mainly of quoted debt securities with resale markets to ensure portfolio liquidity.<br />

STB has non-derivative financial assets as shown on the statement of financial position under financial assets under fund<br />

management which are substantially managed externally by professional fund managers. The non-derivative financial<br />

assets comprise investments in debt securities which are mainly quoted (as disclosed under Note 13). The non-derivative<br />

financial assets may be liquidated readily when required.<br />

STB does not have a significant exposure to liquidity risk as at the end of each reporting periods.<br />

(v)<br />

Fair values of financial assets and financial liabilities<br />

The carrying amounts of financial assets and financial liabilities as reported in the financial statements approximate their<br />

respective fair values due to the relatively short-term maturity of these financial instruments.<br />

The fair values of financial assets and financial liabilities are determined as follows:<br />

• the fair value of financial assets and financial liabilities with standard terms and conditions and traded on active liquid<br />

markets are determined with reference to quoted market prices; and<br />

• Unquoted investment whose fair value cannot be reliably measured by alternative valuation methods are carried at<br />

cost less any impairment losses.<br />

STB classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in<br />

making the measurements. The fair value hierarchy has the following levels:<br />

(a) quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1);<br />

(b)<br />

inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e.<br />

as prices) or indirectly (i.e. derived from prices) (Level 2); and<br />

(c) inputs for the asset or liability that are not based on observable market data (unobservable inputs) (Level 3).<br />

77