i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

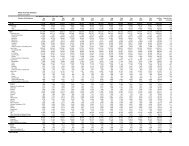

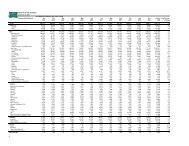

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

(i)<br />

Foreign exchange risk management<br />

STB has exposure to foreign currency risk from transactions denominated in foreign currencies arising from its normal<br />

course of operations and from its investment portfolio arising from securities denominated in foreign currencies. Where<br />

appropriate, STB may hedge these risks as they arise.<br />

At the reporting date, the carrying amounts of monetary assets and monetary liabilities denominated in significant foreign<br />

currencies other than STB’s functional currency are disclosed in the respective notes to the financial statements.<br />

Foreign currency sensitivity analysis has not been presented as management do not expect any reasonable possible<br />

changes in foreign currency exchange rates to have a significant impact on STB’s operations and cashflows.<br />

(ii)<br />

Interest rate risk management<br />

STB’s exposure to changes in interest rates relates primarily to investments in fixed income instruments and fixed deposits.<br />

Fixed income instruments are managed by external fund managers appointed by STB. It is STB’s policy to obtain the<br />

most favourable interest rate for its fixed deposits depending on the immediate cash requirements. Interest rate sensitivity<br />

analysis has not been presented as management do not expect any reasonable possible changes in interest rates to have<br />

a significant impact on STB’s operations and cash flows.<br />

(iii)<br />

Credit risk management<br />

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to STB.<br />

Cash and fixed deposits are placed with reputable financial institutions. Investments in financial instruments are managed<br />

by approved and reputable fund managers.<br />

Credit risks, or the risk of counterparties defaulting, are controlled by the application of regular monitoring procedures. The<br />

extent of STB’s credit exposure is represented by the aggregate balance of financial assets at the end of each reporting<br />

period.<br />

76