i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

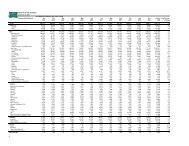

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

Depreciation of property, plant and equipment and investment properties<br />

The cost of property, plant and equipment and investment properties are depreciated on a straight-line basis over their useful<br />

lives. STB estimates the useful lives of these property, plant and equipment and investment properties to be within 3 to 99 years,<br />

based on the lease period for leasehold properties and estimated useful lives of the assets. The carrying amounts are disclosed<br />

in Note 7 and 8 of the financial statements. Changes in the expected level of usage, technological developments and economic<br />

condition could impact the economic useful lives and the residual values of these assets, therefore future depreciation charges<br />

could be revised.<br />

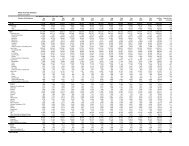

4 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL RISKS MANAGEMENT<br />

(a)<br />

Categories of financial instruments<br />

The following table sets out the financial instruments:<br />

<strong>2010</strong>/<strong>2011</strong> 2009/<strong>2010</strong><br />

$’000 $’000<br />

Financial assets<br />

At fair value through profit or loss (Note 13) 28,560 24,337<br />

Loans and receivables (including cash and cash equivalent) 243,022 186,885<br />

Available-for-sale investments 2,000 2,000<br />

Total 273,582 213,222<br />

Financial liability<br />

Amortised cost 101,246 82,860<br />

Derivative financial instruments at fair value 24 112<br />

Total 101,270 82,972<br />

(b)<br />

Financial risk management policies and objectives<br />

STB, in its normal course of operations, is exposed to market risk (including foreign exchange risk and interest rate risk),<br />

credit risk and liquidity risk. While STB does not hold or issue derivative financial instruments for trading purposes, STB<br />

may use such instruments for risk management purposes. STB has written policies and guidelines, which set out its<br />

general risk management philosophy.<br />

75