i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

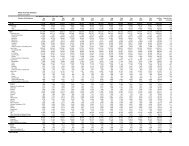

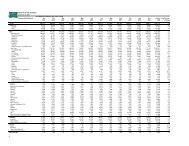

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

Dividend income<br />

Dividend income is recognised when STB’s right to receive payment is established.<br />

Interest income<br />

Interest income is accrued on a time-proportion basis, by reference to the principal outstanding and at the effective interest<br />

rate applicable.<br />

(o)<br />

EMPLOYEE BENEFITS<br />

Defined contribution plans<br />

Payments to defined contribution retirement benefit plans are charged as an expense as they fall due. Payments made to<br />

state-managed retirement benefit schemes, such as the <strong>Singapore</strong> Central Provident Fund, are dealt with as payments to<br />

defined contribution plans where STB’s obligations under the plans are equivalent to those arising in a defined contribution<br />

retirement benefit plan.<br />

Employee leave entitlement<br />

Employee entitlements to annual leave are recognised as a liability when they accrue to employees. The estimated liability<br />

for leave is recognised for services rendered by employees up to the end of the reporting period.<br />

(p)<br />

CONTRIBUTION TO CONSOLIDATED FUND<br />

Under Section 13(1)(e) and the First Schedule of the <strong>Singapore</strong> Income Tax Act, Chapter 134, the income of STB is exempt<br />

from income tax.<br />

In lieu of income tax, STB is required to make contribution to the Government Consolidated Fund in accordance with the<br />

Statutory Corporations (Contributions to Consolidated Fund) Act, Chapter 319A. The provision is based on the guidelines<br />

specified by the Ministry of Finance. It is computed based on the net surplus of STB for each of the financial year<br />

(adjusted for any accumulated deficits brought forward from prior years) at the prevailing corporate tax rate for the Year of<br />

Assessment. Contribution to consolidated fund is provided for on an accrual basis.<br />

73