i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

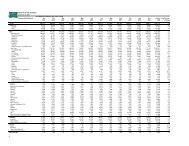

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

(k)<br />

GOVERNMENT GRANTS<br />

Government grants are not recognised until there is reasonable assurance that STB will comply with the conditions<br />

attaching to them and the grants will be received. Government grants whose primary condition is that STB should purchase,<br />

construct or otherwise acquire non-current assets are recognised as deferred income in the statement of financial position<br />

and transferred to income or expenses on a systematic and rational basis over the useful lives of the related assets.<br />

Other government grants are recognised as income over the periods necessary to match them with the costs for which<br />

they are intended to compensate, on a systematic basis. Government grants that are receivable as compensation for<br />

expenses or losses already incurred or for the purpose of giving immediate financial support to STB with no future related<br />

costs are recognised in income or expenses in the period in which they become receivable.<br />

(l)<br />

TRUST AND AGENCY FUNDS<br />

Trust and agency funds are set up to account for funds held in trust where STB is not the owner and beneficiary of the<br />

funds received from the Government and other organisation. The receipts and expenditure in respect of agency funds<br />

are taken directly to the funds accounts and the net assets relating to the funds are shown as a separate line item in the<br />

statement of financial position. Trust and agency funds are accounted for on the cash basis.<br />

STB administers the funds on behalf of the holders of these funds. Upon dissolution of these funds, the remaining monies<br />

in these funds shall be returned to the owners of the funds.<br />

(m) DEFERRED LONG-TERM LEASE INCOME<br />

Premiums received in advance from long-term leases are credited to a deferred long-term lease income account and are<br />

credited to the income or expense on a straight-line basis over the period of the leases.<br />

(n)<br />

INCOME RECOGNITION<br />

Revenue is recognised to the extent that it is probable that the economic benefits will flow to STB and the revenue can be<br />

reliably measured. The following specific recognition criteria must also be met before revenue is recognised:<br />

Funding from Government<br />

Funding from supervisory ministry is based on a percentage of trade receipts and recognised on an accrual basis.<br />

Events-related revenue<br />

Events-related revenue is recognised when the events are completed.<br />

Lease income<br />

Lease income is accounted for in accordance with the accounting policy for leases as detailed in Note 2(c) above.<br />

72