i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

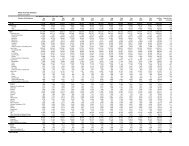

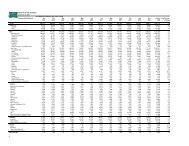

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

(h)<br />

IMPAIRMENT OF NON-FINANCIAL ASSETS<br />

At the end of each reporting period, STB reviews the carrying amounts of its assets to determine whether there is any<br />

indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the<br />

asset is estimated in order to determine the extent of the impairment loss (if any). Where it is not possible to estimate the<br />

recoverable amount of an individual asset, STB estimates the recoverable amount of the cash-generating unit to which the<br />

asset belongs.<br />

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated<br />

future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments<br />

of the time value of money and the risks specific to the asset.<br />

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying<br />

amount of the asset (or cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognised<br />

immediately in income or expense.<br />

Where an impairment loss is subsequently reversed, the carrying amount of the asset (or cash-generating unit) is increased<br />

to the revised estimate of its recoverable amount, but only to the extent that the increased carrying amount does not<br />

exceed the carrying amount that would have been determined had no impairment loss been recognised for the asset (or<br />

cash-generating unit) in prior years. A reversal of an impairment loss is recognised immediately in income or expense.<br />

(i)<br />

PROVISIONS<br />

Provisions are recognised when STB has a present obligation (legal or constructive) as a result of a past event, it is probable<br />

that STB will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation.<br />

The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation<br />

at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. Where a<br />

provision is measured using the cash flows estimated to settle the present obligation, its carrying amount is the present<br />

value of those cash flows.<br />

When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party,<br />

the receivable is recognised as an asset if it is virtually certain that reimbursement will be received and the amount of the<br />

receivable can be measured reliably.<br />

(j)<br />

SHARE CAPITAL<br />

Pursuant to the Financial Circular Minute (“FCM”) No. 26/2008 on Capital Management Framework (“CMF”), equity<br />

injection from the Government is recorded as share capital.<br />

71