i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

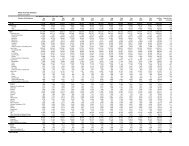

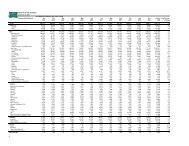

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

STB as lessor<br />

Amounts due from lessees under finance leases are recorded as receivables at the amount of STB’s net investment in the<br />

leases. Finance lease income is allocated to accounting periods so as to reflect a constant periodic rate of return on STB’s<br />

net investment outstanding in respect of the leases.<br />

Rental income from operating leases is recognised on a straight-line basis over the term of the relevant lease unless<br />

another systematic basis is more representative of the time pattern in which use benefit derived from the leased asset is<br />

diminished. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount<br />

of the leased asset and recognised on a straight-line basis over the lease term.<br />

STB as lessee<br />

Rentals payable under operating leases are charged to income or expense on a straight-line basis over the term of the<br />

relevant lease unless another systematic basis is more representative of the time pattern in which economic benefits from<br />

the leased asset are consumed. Contingent rentals arising under operating leases are recognised as an expense in the<br />

period in which they are incurred.<br />

In the event that lease incentives are received to enter into operating leases, such incentives are recognised as a liability.<br />

The aggregate benefit of incentives is recognised as a reduction of rental expense on a straight-line basis, except where<br />

another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are<br />

consumed.<br />

(d)<br />

PROPERTY, PLANT AND EQUIPMENT<br />

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses.<br />

Depreciation of property, plant and equipment begins when the asset is available for use and is calculated using the<br />

straight-line method to allocate their depreciable amounts over their expected useful lives as follows:<br />

Leasehold land – Over the lease periods of 99 years<br />

Buildings – 25 years<br />

Building improvements – 5 years<br />

Furniture, fittings and equipment – 3 to 5 years<br />

Motor vehicles – 5 years<br />

Electrical installation and air-conditioners – 7 years<br />

<strong>Tourism</strong> assets – 3 to 10 years<br />

Capital work-in-progress included in property, plant and equipment is not depreciated as these assets are not available for<br />

use. Fully depreciated assets still in use are retained in the financial statements.<br />

69